Alberta

Have Alberta’s Skilled Workers had Enough?

The Canadian oil and gas industry suffered another blow on Sunday, October 25, when Cenovus Energy Inc. announced a $3.8 billion merger with 82-year old Canadian oil and gas company, Husky Energy. Headquartered in Calgary, Alberta, Husky is projected to lose up to 25% of its workforce as a result of the merger, approximately 2,150 jobs – mainly in Calgary.

The news, which fell on Alberta’s increasingly restless population of unemployed workers and struggling families, many of whom believe Alberta has been left out in the cold for far too long already, has fueled ongoing discussions of a provincial brain drain.

Simply put, brain drain is defined as “the departure of educated or professional people from one country, economic sector or field, usually for better pay or living conditions”. Recent statistics show this concept is rapidly gaining traction in Alberta as residents seek to escape the increasingly grim economic landscape to pursue opportunities elsewhere, beyond the provincial borders.

As Canada’s largest producer of oil and natural gas, Alberta is no stranger to the boom and bust nature of the industry, experiencing cyclical periods of economic prosperity influenced by global conditions followed by detrimental crashes and ensuing hard times. Prior to this year, Alberta experienced a major economic crash in 2015, with the Canadian oil and gas industry suffering a $91 billion loss in revenue and layoffs reaching 35,000 workers in Alberta alone (1).

In the last 5 years, countless Albertans have struggled to regain their footing on shaky economic and political grounds, suffering substantial losses and insecurity. In this setting, the catastrophic impacts of the global COVID-19 pandemic, coupled with pipeline delays and ongoing cuts in the Canadian oil and gas sector have left many Albertans with the feeling of being kicked while already down.

According to the Government of Alberta Economic Dashboard, the price of oil for many Alberta oil producers fell 36.6% from September 2019, averaging $28.43 USD per barrel in September 2020, according to the Western Canada Select (WCS) price. The coinciding unemployment rate in Alberta was 11.7% in September 2020, down from its 15.5% spike in May 2020, but still 6.6% higher than in September 2019 (2).

According to the Government of Alberta Economic Dashboard, the price of oil for many Alberta oil producers fell 36.6% from September 2019, averaging $28.43 USD per barrel in September 2020, according to the Western Canada Select (WCS) price. The coinciding unemployment rate in Alberta was 11.7% in September 2020, down from its 15.5% spike in May 2020, but still 6.6% higher than in September 2019 (2).

At this point, it seems a number of Albertans have simply had enough. According to The Alberta Annual Population Report 2019/20, “Alberta’s interprovincial migration patterns are heavily influenced by the economic conditions in the province, and as the economy cooled, the province experienced net outflows.” The report shows that 2,733 residents left Alberta between April and June 2020.

The loss of another 2,150 oil and gas jobs as a result of the Cenovus merger comes as a disappointing yet predictable defeat for industry workers who have remained “down on their luck” for many years in Alberta. Effectively decimating industries worldwide, the pandemic has also successfully pulled the rug from beneath Alberta’s shaky footing, tanking oil and gas once more and leaving countless skilled workers with nowhere to go but out.

For more stories, visit Todayville Calgary.

Alberta

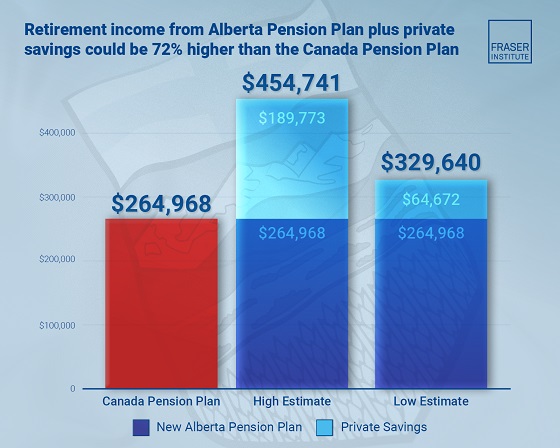

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

COVID-1924 hours ago

COVID-1924 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal