Crime

Red Deer RCMP recent arrests include stolen vehicles, break and enters and drug charges

Red Deer RCMP continue their focus on repeat offenders as part of the Pinpoint Crime Reduction Strategy, with numerous recent arrests involving stolen vehicles, illicit drugs, shoplifting, break and enters in progress, and the arrests of multiple individuals found to be breaching probation, parole and court-imposed conditions.

September 16

At 4 pm on September 16, RCMP responded to a report of a stolen SUV at a 67 Street business. RCMP located the SUV and arrested the three occupants as they exited the business. The female, who had been identified as the driver, gave police a false name but her identity was soon confirmed. RCMP seized identity documents and what is believed to be methamphetamine.

At the time of her arrest, 25 year old Madison Coutre was wanted on warrants for assault, failing comply, and failing to attend court. She now faces the following additional charges:

- Possession of stolen property under $5,000

- Possession of identity documents

- Resist/ obstruct peace officer

- Breach of recognizance X 5

- Possession of Schedule I substance

The two male passengers, 43 year old Marty Roy and 33 year old Kleedis Lagrelle, were both arrested on outstanding warrants out of Calgary. The vehicle was reported stolen out of Red Deer on September 15 during a garage break and enter; the vehicle keys and a wallet containing cash and bank cards were stolen from the garage.

September 14

Around noon on September 14, RCMP responded to a report of suspicious activity in downtown Red Deer and located 35 year old Amanda Hadiken, who was wanted on nine outstanding warrants for theft (X 2), fail to comply with an undertaking or conditions (X 4), fail to appear in court (X 2) and breach of conditions. A court date has not yet been set.

September 13

Shortly before 3 am on September 13, RCMP responded to a report of a break and enter in progress at a downtown business; RCMP located the suspect nearby and arrested him without incident.

34 year old Steven Hubley faces a charge of breaking, entering and committing.

September 12

At 4 am on September 12, RCMP on foot patrol in downtown Red Deer located a suspect who was wanted on a warrant for assault. In the course of his arrest, RCMP seized pills and what is believed to be fentanyl.

In addition to his warrant, 46 year old Wessam Haimour faces two charges of possession of a controlled substance.

September 11

At 7 am on September 11, RCMP responded to a report of a suspicious vehicle parked in a residential area in Oriole Park and located a man and a woman occupying a stolen vehicle that contained a number of stolen items, including electronics and identification documents.

39 year old Jason Gregory was wanted on warrants out of Strathcona area and Edmonton at the time of his arrest; he now faces charges of illegal possession or trafficking in government documents and possession of stolen property under $5,000 X 2

September 10

Shortly before 5 pm on September 10, RCMP responded to a report of shoplifting in progress at a south Red Deer store. The suspect was gone when police arrived, but was quickly identified through surveillance. RCMP located the suspect on September 11 and arrested him without incident.

27 year old Hayden William Smith faces charges of theft under $5,000, failure to comply with undertaking and failure to comply with probation.

September 10

At 1:30 pm on September 10, RCMP on patrol in downtown Red Deer conducted a traffic stop and located a woman who was wanted on 10 outstanding warrants out of Edmonton for fail to attend court (X 6), assault, obstruct/ resist peace officer, identity fraud and theft under $5,000. At the time of her arrest, she was in possession of stolen identification documents.

In addition to her warrants, 28 year old Adut Garang faces a charge of illegal possession or trafficking in government documents.

Banks

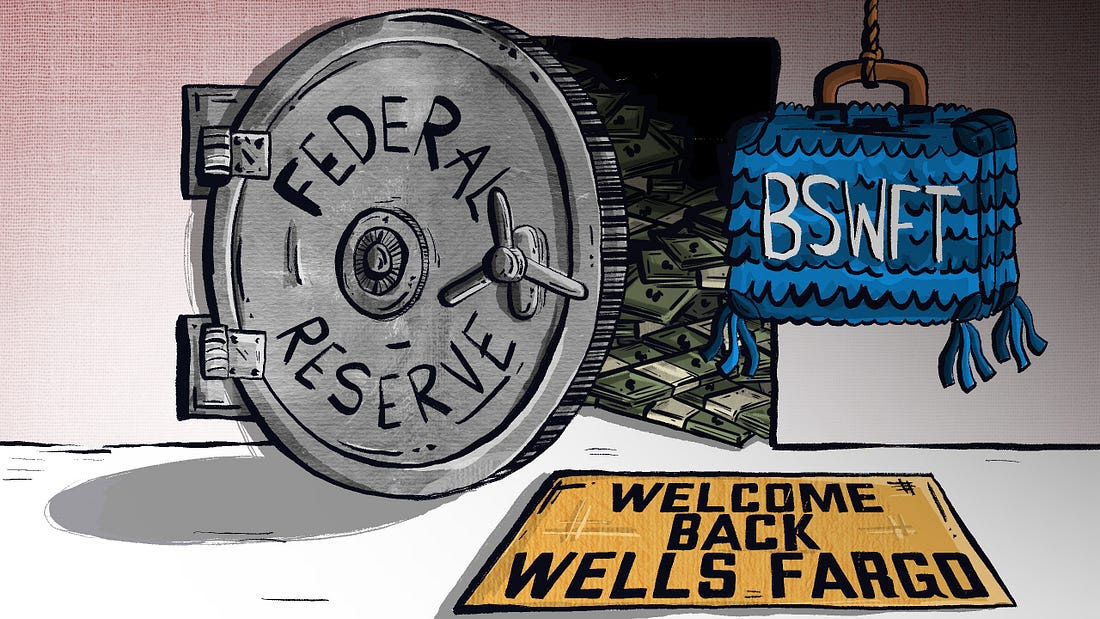

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

Crime

Bryan Kohberger avoids death penalty in brutal killing of four Idaho students

Quick Hit:

Bryan Kohberger will plead guilty to murdering four Idaho college students, avoiding a death sentence but leaving victims’ families without answers. The plea deal means he’ll spend life in prison without ever explaining why he committed the brutal 2022 killings.

Key Details:

- Kohberger will plead guilty at a hearing scheduled for Wednesday at 11 a.m. local time.

- The plea deal removes the possibility of death by firing squad but ensures life in prison without parole.

- Victims’ families say the state “failed” them by agreeing to a deal that denies them an explanation for the murders.

Diving Deeper:

Bryan Kohberger, a former PhD criminology student at Washington State University, is expected to plead guilty to the November 2022 murders of four University of Idaho students, sparing himself the death penalty but also avoiding any explanation for his motive. Idaho defense attorney Edwina Elcox told the New York Post that under the plea, Kohberger will have to admit to the killings but won’t have to provide a reason for his actions. “There is no requirement that he says why for a plea,” Elcox explained.

Prosecutors reached the plea deal just weeks before the scheduled trial, which many believed would have revealed the full details and motives behind the shocking quadruple homicide. Kohberger is accused of murdering Kaylee Goncalves, 21; Madison Mogen, 21; Ethan Chapin, 20; and Xana Kernodle, 20, with a military-style Ka-Bar knife as they slept in their off-campus home in Moscow, Idaho. His DNA was allegedly found on a knife sheath left at the scene.

The Goncalves family blasted the state for the deal, saying, “They have failed us.” They had hoped a trial would uncover why Kohberger targeted their daughter and her friends. Prosecutors, however, argued that the plea ensures a guaranteed conviction and prevents the years of appeals that typically follow a death sentence, providing a sense of finality and keeping Kohberger out of the community forever.

Sentencing will not take place for several weeks following Wednesday’s hearing, which is expected to last about an hour as the judge confirms the plea agreement is executed properly. While the families may find some closure in knowing Kohberger will never be free again, they are left without the one thing a trial could have provided: answers.

(AP Photo/Matt Rourke, Pool)

-

Business2 days ago

Business2 days agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

COVID-192 days ago

COVID-192 days agoNew Peer-Reviewed Study Affirms COVID Vaccines Reduce Fertility

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Business2 days ago

Business2 days agoWorld Economic Forum Aims to Repair Relations with Schwab

-

Alberta2 days ago

Alberta2 days agoThe permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

-

Alberta2 days ago

Alberta2 days agoAlberta’s government is investing $5 million to help launch the world’s first direct air capture centre at Innisfail

-

Business2 days ago

Business2 days agoMunicipal government per-person spending in Canada hit near record levels

-

Business2 days ago

Business2 days agoA new federal bureaucracy will not deliver the affordable housing Canadians need