Economy

Ruthless, reckless, damaging: the Hon. Steven Guilbeault is MLI’s Policy-maker of the year

From the MacDonald Laurier Institute

Guilbeault has treated the fact that Canada is a democracy, a market economy, and a federation as inconveniences to be overcome.

The Liberals have been chided for focusing on communications over substance, for announcing policies rather than implementing them. But there is an exception to this rule: the ruthlessly efficient Environment Minister Steven Guilbeault. No one else in Canada has been as influential, and, in my view, no one else has done so much damage.

From an emissions cap to toxic plastic straws, and from Clean Electricity Regulations to the Clean Fuel Standard, Guilbeault has been advancing economy-killing and constitution-defying laws at a frenzied pace.

He was appointed Minister of Environment and Climate Change Canada in October 2021. At the time of his appointment, Guilbeault appeared as the perfect villain: a caricature of the West-hating, anti-oil Liberal that has confounded the aspirations of Canadians west of the Laurentian corridor for decades. In the last two years he has disappointed few of his supporters and assuaged none of his critics’ fears.

Dubbed the “Green Jesus of Montreal” by La Presse, the 2001 image of Guilbeault being walked off in handcuffs in his faux orange prison jumpsuit emblazoned with the Greenpeace logo, following a CN Tower-scaling stunt to bring attention to climate change, features frequently in the social media accounts of his more outspoken critics.

The Canadian oil and gas sector has had a rough decade – from the shale revolution that flooded North America with cheap oil, to the COVID-19 pandemic – but it persisted. The sector achieved record breaking production, and royalties for governments, last year. The coming-into-service of TMX and CGL pipelines promises to grant additional export capacity for Canadian hydrocarbons.

But, like the final boss of a video game, Guilbeault is proving to be a formidable challenger to the country’s most important economic sector, even as the country struggles under declining productivity, persistent inflation and an affordability crisis. What Texas, Putin and OPEC could not undermine, Guilbeault is poised to do. This is intended as criticism but I expect Guilbeault would be pleased with the acknowledgment.

In this year alone he has advanced four sector-destroying policies, as part of the federal government’s much derided “pancake” approach to climate policy: stacking increasingly suffocating and incompatible regulations on Canadian industry to meet our Paris Accord commitments.

Carbon pricing schemes have broadly been accepted within heavy industry across Canada, if grudgingly. But with voters unwilling to accept a price per tonne of GHGs high enough to meaningfully address emissions, the Government has had to resort to additional, bespoke, mechanisms.

The Clean Fuel Regulations (CFR) came into effect on July 1, mandating reductions in the carbon intensity of transportation fuels through various methods, such as blending in biofuels. The Parliamentary Budget Officer found that the CFR are broadly regressive, impacting poorer households the most. The four Atlantic Premiers in particular contested the CFR on the grounds they would disproportionately hurt their residents, calling them “unfair and offensive to Atlantic Canadians” and demanding they be delayed. But Guilbeault blamed any price increase on refiners rather than his regulations, saying “there is simply no reason that they need to push costs onto consumers.”

While imploring refiners to decarbonize their product at a loss, Guilbeault also tacked on a ZEV (zero emissions vehicle) mandate to ensure any investments made in clean fuels today would have an ever-shrinking market and timeline to recoup costs. In other words, Guilbeault is asking refiners to invest in cleaner fuels while promising to ban their products before they could make back their money. The final regulations, mandating a 100 percent zero-emission vehicles sales target by 2035, were announced on December 19.

Such a move requires dramatically more capacity in the country’s electricity grid, up to 25% by some estimates. But, unbothered by the laws of physics, Guilbeault went ahead and introduced draft Clean Electricity Regulations (CER) in August. The CER will impose obligations on electricity generation to achieve net zero emissions in the grid by 2035 and will necessarily take large swathes of Canada’s existing generation capacity offline. In practice this means a phase out of coal, which is happening; and natural gas, which cannot realistically happen – particularly in the cold Prairie provinces of Alberta and Saskatchewan where hydroelectric generating capacity is limited, nuclear is years away, and intermittent wind and solar are unsuitable. The CER prompted Alberta Premier Danielle Smith to launch a national ad campaign protesting that “No one wants to freeze in the dark”.

More sober western voices have also warned against the CER. The CEO of SaskPower sent a letter arguing that while the utility was “on track to meet our commitment to reduce GHG emissions by 50 per cent below 2005 levels by 2030”, the CER are “not possible from technological, financial and logistical perspectives.” But Guilbeault has remained adamant that there will be no special carve outs for any province.

The crowning achievement of Guilbeault’s economy-destroying climate policies was announced on December 7: an emissions cap, and cut, on one sector only, Canadian oil and gas. The announcement was not made in downtown Calgary, amongst those most affected, but in Dubai at COP28. Such a cap is counterproductive, expensive, and both economically and politically self-sabotaging. There is no limit to the punishment Guilbeault is willing to impose on the energy sector, regardless of the collateral damage to the rest of the Canadian economy.

Guilbeault’s accomplishments do not end at stymying Canada’s upstream and downstream oil and gas sector. It’s been a fractious time for federal-provincial relations, and a challenging one for the Canadian Constitution. On a list that included Danielle’s Smith’s Alberta Sovereignty Act and Scot Moe’s Saskatchewan First Act; and invocations by Ontario, Quebec, and Saskatchewan of the notwithstanding clause; it was not one, but two of Minister Guilbeault’s laws that were declared unconstitutional by Canadian courts this year.

In the first instance, the Supreme Court of Canada determined the Impact Assessment Act – previously known as Bill C-69, or the No More Pipelines Act – to reach far beyond federal jurisdiction, granting Parliament “a practically untrammeled power to regulate projects qua projects, regardless of whether Parliament has jurisdiction to regulate a given physical activity in its entirety.” The vast majority of sections within the IAA were deemed unconstitutional.

Guilbeault doubled down, saying that the federal government would “course correct”, but that it would be unlikely to change the outcome of the IAA process for projects.

Just one month later, the Federal Court of Canada held that the federal government’s labelling of all Plastic Manufactured Items (PMI) as toxic was both unreasonable and unconstitutional. Again, Guilbeault was undeterred, and announced on December 8 that the federal government would appeal it.

It appears that, in Guilbeault’s view, federalism is an inconvenient and unacceptable barrier to accomplishing meaningful progress on climate change. For an ideologue like Guilbeault, the Constitution was not designed for, and is not up to the task of, addressing the existential threat posed by fossil fuels. But that is no reason not to try. He will continue to seek new avenues to restrain industry and the provinces; he will just have to tighten up the language.

No amount of tweaking will prevent the Clean Electricity Regulations and oil & gas emissions cap from facing challenges from Alberta and Saskatchewan. The federal government will rely on its criminal law power to see them through. He has suggested that violating the Clean Electricity Regulations, for example running coal fired plants beyond 2030, would be an offense under the Criminal Code. The joke in the Prairies is that he wants his western counterparts to have orange jumpsuits that match his own.

Guilbeault is seen as a true believer. His mission is to save the planet from climate change, and to save oil and gas producing apostates from themselves. Nothing will persuade him he should moderate his efforts. But I would be remiss not to point out that Guilbeault has shown the ability to tolerate pragmatism in his own Cabinet.

The first instance was with nuclear energy. Long a lightning rod for 20th century environmentalists, Guilbeault has historically been opposed to nuclear. In the Liberals’ Green Bond Framework, released in March 2022, nuclear energy was excluded alongside sin industries like tobacco & alcohol sales, arms manufacturing, gambling, and fossil fuels. After public opinion evolved, and in the face of successful nuclear refurbishments and new reactor developments in the GTA, the Liberal government reversed its decision. Guilbeault duly ate his humble pie, saying in April 2023 that:

“In the past I haven’t been the person who supported the most the development of nuclear energy. But when you look at what international experts like the International Energy Agency or the IPCC is saying, they’re saying, to prevent global temperatures from reaching 1.5 degrees Celsius, to achieve our carbon neutrality targets, we need this technology.”

This could not have been easy, and I applaud him for evolving his views in line with the evidence.

But he was not convinced enough to directly advocate for nuclear technology at COP28. On December 2, 2023 in Dubai, 22 states including Canada signed a landmark declaration committing to triple nuclear energy by 2050. Minister Guilbeault seemed to be everywhere at COP28; but he was not there for that announcement, missing the traditional ‘family photo’ of world leaders signing the nuclear declaration.

Likewise, Guilbeault had to accept with great reluctance the Liberals’ political gambit of exempting heating oil from carbon pricing. Their coalition must combine urban environmentalists and Atlantic Canadian townsfolk to win the next election. In the case of heating oil, the Atlantic caucus carried the day. But Guilbeault made clear it was a ploy not to be repeated, telling the Canadian Press in an interview on November 6th that he would not stand for any further concessions:

“As long as I’m the environment minister, there will be no more exemptions to carbon pricing…It’s certainly not ideal that we did it and in a perfect world we would not have to do that, but unfortunately we don’t live in a perfect world.”

Guilbeault is a threat to Canada’s prosperity, and to our allies’ too. Germany, Japan, Korea and others have come asking for more energy exports, only to be told there was no business case. The federal government’s own policies are making it so.

But more to the point his climate policies, committed though they may be, are destined to fail.

It is often said that if you want to go fast, go alone; but if you want to go far, go together.

Guilbeault is very far ahead from industry, the provinces, Canadians, and increasingly his own caucus. He is alienating voters who are concerned more about affordability and housing. There will likely be a backlash. As far as Guilbeault has swung the pendulum to the left, it will come swinging back at him and the Liberals the other way. The energy transition is a marathon, and Guilbeault is a sprinter.

One could almost admire Guilbeault’s unwavering commitment to his principles – his willingness to advance his goals in the face of criticism, resistance and alarm. But through his actions, Guilbeault has treated the fact that Canada is a democracy, a market economy, and a federation as inconveniences to be overcome.

Canadians that care about these things will find many reasons to be concerned with Guilbeault’s efforts this year. His impact on the nation’s politics and economy will be felt long after his policies have been overturned.

Heather Exner-Pirot is the director of energy, natural resources, and environment at the Macdonald-Laurier Institute.

Economy

Prime minister’s misleading capital gains video misses the point

From the Fraser Institute

By Jake Fuss and Alex Whalen

According to a 2021 study published by the Fraser Institute, 38.4 per cent of those who paid capital gains taxes in Canada earned less than $100,000 per year, and 18.3 per cent earned less than $50,000. Yet in his video, Prime Minister Trudeau claims that his capital gains tax hike will affect only the richest “0.13 per cent of Canadians”

This week, Prime Minister Trudeau released a video about his government’s decision to increase capital gains taxes. Unfortunately, he made several misleading claims while failing to acknowledge the harmful effects this tax increase will have on a broad swath of Canadians.

Right now, individuals and businesses who sell capital assets pay taxes on 50 per cent of the gain (based on their full marginal rate). Beginning on June 25, however, the Trudeau government will increase that share to 66.7 per cent for capital gains above $250,000. People with gains above that amount will again pay their full marginal rate, but now on two-thirds of the gain.

In the video, which you can view online, the prime minister claims that this tax increase will affect only the “very richest” people in Canada and will generate significant new revenue—$20 billion, according to him—to pay for social programs. But economic research and data on capital gains taxes reveal a different picture.

For starters, it simply isn’t true that capital gains taxes only affect the wealthy. Many Canadians who incur capital gains taxes, such as small business owners, may only do so once in their lifetimes.

For example, a plumber who makes $90,000 annually may choose to sell his business for $500,000 at retirement. In that year, the plumber’s income is exaggerated because it includes the capital gain rather than only his normal income. In fact, according to a 2021 study published by the Fraser Institute, 38.4 per cent of those who paid capital gains taxes in Canada earned less than $100,000 per year, and 18.3 per cent earned less than $50,000. Yet in his video, Prime Minister Trudeau claims that his capital gains tax hike will affect only the richest “0.13 per cent of Canadians” with an “average income of $1.4 million a year.”

But this is a misleading statement. Why? Because it creates a distorted view of who will pay these capital gains taxes. Many Canadians with modest annual incomes own businesses, second homes or stocks and could end up paying these higher taxes following a onetime sale where the appreciation of their asset equals at least $250,000.

Moreover, economic research finds that capital taxes remain among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. By increasing them the government will deter investment in Canada and chase away capital at a time when we badly need it. Business investment, which is crucial to boost living standards and incomes for Canadians, is collapsing in Canada. This tax hike will make a bad economic situation worse.

Finally, as noted, in the video the prime minister claims that this tax increase will generate “almost $20 billion in new revenue.” But investors do not incur capital gains taxes until they sell an asset and realize a gain. A higher capital gains tax rate gives them an incentive to hold onto their investments, perhaps until the rate is reduced after a change in government. According to economists, this “lock-in” effect can stifle economic activity. The Trudeau government likely bases its “$20 billion” number on an assumption that investors will sell their assets sooner rather than later—perhaps before June 25, to take advantage of the old inclusion rate before it disappears (although because the government has not revealed exactly how the new rate will apply that seems less likely). Of course, if revenue from the tax hike does turn out to be less than anticipated, the government will incur larger budget deficits than planned and plunge us further into debt.

Contrary to Prime Minister Trudeau’s claims, raising capital gains taxes will not improve fairness. It’s bad for investment, the economy and the living standards of Canadians.

Authors:

Automotive

The EV battery ‘catch-22’

From The Center Square

While setting aggressive goals for electric vehicle market share, the Biden administration also wants tariffs and or restrictions on the importation of vehicles and the minerals needed for their batteries – creating heightened concerns over supply chains in what can be described as a “Catch-22” situation.

Solutions to some of the problems include battery recycling and increased domestic mining, however, the U.S. is currently limited in its capacity for both. Federal funds are spurring new recycling plant projects, but questions remain on whether there will be enough used material to meet projected needs.

In his e-book, “The EV Transition Explained,” Robert Charette, longtime systems engineer, and contributing editor for IEEE Spectrum, says making the transition is harder than anyone thinks. He recently told The Center Square it is truer now than it ever was.

“None of this is simple,” he said.

His argument centers on the lack of planning and systems engineering on initiatives that are politically, not engineering, driven. While change is possible, he suggested it would require trillions more in government spending and enforcing those changes through law.

Charette identified many serious issues in setting up the EV battery infrastructure – and even if those challenges are met, he said, there may be tradeoffs between affordability, security and environmental concerns.

Profitability. Battery recycling is a still-developing process which is time consuming and expensive. The cost of purchasing recycled materials may be more costly than buying them new.

Manufacturing demand and potential backlog. The U.S. will require eight million batteries annually by 2030 to meet the government’s EV target, with increases each year after that.

Standardization. Batteries vary in configuration, size, and chemistry.

Domestic mining. While decreasing our dependency on outside sources, what are the environmental impacts? It can also take years to acquire permits and get a lithium mine up and running.

Mineral shortfalls. Secure and sustainable access to critical minerals like copper, lithium, cobalt, and nickel is essential for a smooth and affordable transition to clean energy. An analysis by the International Energy Agency indicates a “significant gap” between the world’s supply and demand for copper and lithium. Projected supplies will only meet 70% of the copper and 50% of the lithium needed to achieve 2035 climate targets.

The report said that “without the strong uptake of recycling and reuse, “mining capital requirements would need to be one-third higher. The agency also emphasizes China’s dominance in the refining and processing sector.

Transportation of discharged batteries classified as hazardous waste is one of the costliest steps of the recycling process. Experts suggest updates to federal EPA and DOT regulations for how battery-related waste is classified. In addition to health and safety, they say clearer definitions of what constitutes hazardous waste would help reduce transportation costs. Many recycling plants are being built in regions where production sites are located to address this.

Supply chain and skills gap shortages. The timetable set by the government is not aligned with the capabilities of the current supply chain. Software plays a key role in the management and operation of an EV battery, and automakers are competing for a limited supply of software and systems engineers.

Competing interests. The goal is to create a circular battery economy, reducing the need for raw materials. However, an EV battery that is no longer useful for propelling a car still has enough life left for other purposes such as residential energy storage. Experts propose a battery material hierarchy where repurposing and reusing retired EV batteries are more favorable to immediately recycling them, detouring them out of the cycle.

Charette says the biggest problem with recycling projections is that they are built on assumptions that have not been tested.

“We won’t know whether these assumptions hold until we reach a point where we are recycling millions of EV batteries,” he said.

Because most EV lithium-ion batteries produced through 2023 are still on the road, the International Council on Clean Transportation reports that the majority of materials being used as feedstock by recycling plants currently come from scrap materials created during battery production.

According to Charette, manufacturers also claim future generations of batteries will last 15 to 20 years, which he says would put a bigger kink in the used-battery supply chain.

Another issue contributing to consumers’ reluctance to buy an EV is the inability to determine the overall health of your battery. Current testing methods are inefficient and costly.

EV adoption has so far not met projections and with all the competing interests, Charette said the market will ultimately tell us what direction the situation is headed. He is also intrigued over the impact government pressure will have on the eventual outcome.

He said many individual components have yet to be worked out, adding that although there is a vision, “we’re a heck of a long way from that vision to getting where we need to go.”

In his opinion, battery recycling issues are even further behind than transitioning the electric grid to renewable energy sources.

-

COVID-192 days ago

COVID-192 days agoNIH Quietly Altered Definition For Gain-Of-Function Research On Its Website, Former Fauci Aide Confirms

-

Bruce Dowbiggin2 days ago

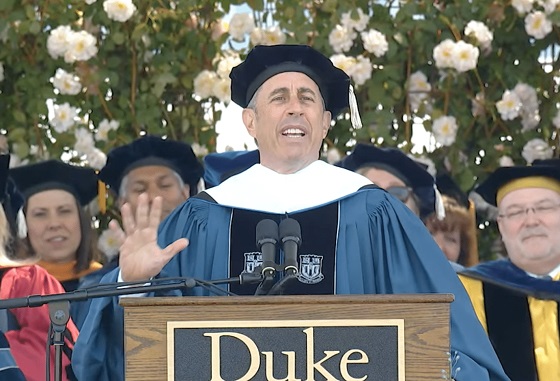

Bruce Dowbiggin2 days agoJerry Came to See The Babies. And They Walked Out On Him

-

Crime2 days ago

Crime2 days agoThe US Canadian border: Greatest number of terrorist watch list individuals being apprehended at northern border

-

Energy2 days ago

Energy2 days agoPope Francis calls for ‘global financial charter’ at Vatican climate change conference

-

Opinion2 days ago

Opinion2 days agoOrdinary working Canadians are not buying into transgender identity politics

-

Business2 days ago

Business2 days agoOttawa should end war on plastics for sake of the environment

-

Energy2 days ago

Energy2 days agoNew Report Reveals Just How Energy Rich America Really Is

-

Energy2 days ago

Energy2 days agoLNG leader: Haisla Nation Chief Councillor Crystal Smith on the world’s first Indigenous project