Business

Red Deer Emergency Services lays charges for safety code violations

Red Deer Emergency Services (RDES) are reminding property owners to be vigilant with fire safety after six charges resulted in $19,500 in fines on June 30.

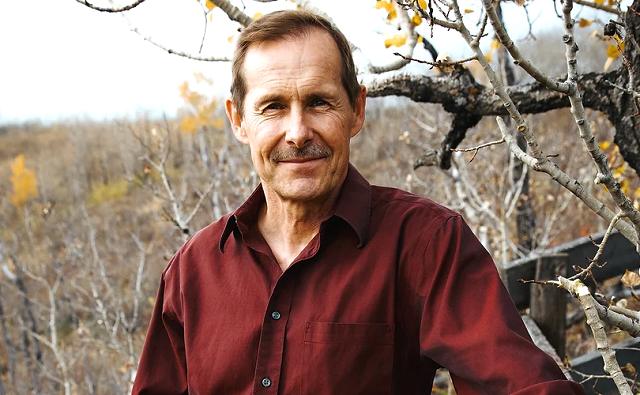

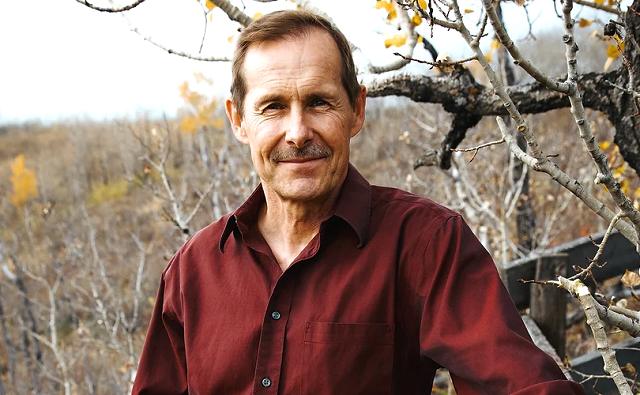

“We have been working closely with the property owner for some time, but unfortunately reached a point where charges were necessary to outline the gravity of the situation,” said Fire Marshal Tim Kivell. “Our priority is ensuring the safety of residents living in these facilities.”

The first inspection took place on September 10, 2020 at Stan Schalk Apartments, located at 4935 51 Street, and resulted in four charges:

- two charges of failing to inspect, test and maintain smoke alarms in the dwelling units,

- one charge for a partially blocked exit, and

- one charge for failing to maintain fire separations.

The second inspection took place on November 3, 2020 at the Buffalo Apartments, located at 5031 50 Street. This inspection resulted in two additional charges:

- one charge for failure to maintain door release hardware on an exit door, and

- one charge for improper storage of combustible materials.

The owner pled guilty to the charges in Red Deer Provincial Court on June 30, 2021, which resulted in $19,500 in fines being laid. The maximum fine under the Safety Codes Act is $100,000 for each offence and/or imprisonment for term not exceeding six months.

“Working smoke alarms and fire exits are absolutely essential as they can make the difference between life and death in an emergency. These are required in all residences,” said Kivell. “We will continue working with Potter’s Hands to ensure their facilities meet code requirements for the safety of their tenants.”

Property owners are responsible to ensure their buildings meet the minimum requirements under the Safety Codes Act and the National Fire Code of Canada 2019 (Alberta Edition), including ensuring smoke alarms within the dwelling unit are tested and cleaned prior to occupancy, and providing tenants with information about smoke alarm testing and maintenance. Rental property owners are also required to keep records of smoke alarm inspection, testing and maintenance for examination by authorities.

Landlords and renters can request information regarding Smoke Alarm Installation, Inspection, testing and Maintenance by emailing [email protected].

Automotive

New Analysis Shows Just How Bad Electric Trucks Are For Business

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By WILL KESSLER

Converting America’s medium- and heavy-duty trucks to electric vehicles (EV) in accordance with goals from the Biden administration would add massive costs to commercial trucking, according to a new analysis released Wednesday.

The cost to switch over to light-duty EVs like a transit van would equate to a 5% increase in costs per year while switching over medium- and heavy-duty trucks would add up to 114% in costs per year to already struggling businesses, according to a report from transportation and logistics company Ryder Systems. The Biden administration, in an effort to facilitate a transition to EVs, finalized new emission standards in March that would require a huge number of heavy-duty vehicles to be electric or zero-emission by 2032 and has created a plan to roll out charging infrastructure across the country.

“There are specific applications where EV adoption makes sense today, but the use cases are still limited,” Karen Jones, executive vice president at Ryder, said in an accompanying press release. “Yet we’re facing regulations aimed at accelerating broader EV adoption when the technology and infrastructure are still developing. Until the gap in TCT for heavier-duty vehicles is narrowed or closed, we cannot expect many companies to make the transition, and, if required to convert in today’s market, we face more supply chain disruptions, transportation cost increases, and additional inflationary pressure.”

Due to the increase in costs for businesses, the potential inflationary impact on the entire economy per year is between 0.5% and 1%, according to the report. Inflation is already elevated, measuring 3.5% year-over-year in March, far from the Federal Reserve’s 2% target.

Increased expense projections differ by state, with class 8 heavy-duty trucks costing 94% more per year in California compared to traditional trucks, due largely to a 501% increase in equipment costs, while cost savings on fuel only amounted to 52%. In Georgia, costs would be 114% higher due to higher equipment costs, labor costs, a smaller payload capacity and more.

The EPA also recently finalized rules mandating that 67% of all light-duty vehicles sold after 2032 be electric or hybrid. Around $1 billion from the Inflation Reduction Act has already been designated to be used by subnational governments in the U.S. to replace some heavy-duty vehicles with EVs, like delivery trucks or school buses.

The Biden administration has also had trouble expanding EV charging infrastructure across the country, despite allotting $7.5 billion for chargers in 2021. Current charging infrastructure frequently has issues operating properly, adding to fears of “range anxiety,” where EV owners worry they will become stranded without a charger.

Business

When politicians gamble, taxpayers lose

From the Canadian Taxpayers Federation

Author: Jay Goldberg

Trudeau and Ford bragged about how a $5 billion giveaway to Honda is going to generate 1,000 jobs. In case you’re thinking of doing the math, that’s $5 million per job.

Politicians are rolling the dice on the electric vehicle industry with your money.

If they bet wrong, and there’s a good chance they have, hardworking Canadians will be left holding the bag.

Prime Minister Justin Trudeau and Premier Doug Ford announced a $5-billion agreement with Honda, giving another Fortune 500 automaker a huge wad of taxpayer cash.

Then Trudeau released a video on social media bragging about “betting big” on the electric vehicle industry in Canada. The “betting” part of Trudeau’s statement tells you everything you need to know about why this is a big mistake.

Governments should never “bet” with taxpayer money. That’s the reality of corporate welfare: when governments give taxpayer money to corporations with few strings attached, everyday Canadians are left hoping and praying that politicians put the chips on the right numbers.

And these are huge bets.

When Trudeau and Ford announced this latest giveaway to Honda, the amount of taxpayer cash promised to the electric vehicle sector reached $57 billion. That’s more than the federal government plans to spend on health care this year.

Governments should never gamble with taxpayer money and there are at least three key reasons why this Honda deal is a mistake.

First, governments haven’t even proven themselves capable of tracking how many jobs are created through their corporate welfare schemes.

Trudeau and Ford bragged about how a $5 billion giveaway to Honda is going to generate 1,000 jobs. In case you’re thinking of doing the math, that’s $5 million per job.

Five million dollars per job is already outrageous. But some recent reporting from the Globe and Mail shows why corporate welfare in general is a terrible idea.

The feds don’t even have a proper mechanism for verifying if jobs are actually created after handing corporations buckets of taxpayer cash. So, while 1,000 jobs are promised through the Honda deal, the government isn’t capable of confirming whether those measly 1,000 jobs will materialize.

Second, betting on the electric vehicle industry comes with risk.

Trudeau and Ford gave the Ford Motor Company nearly $600 million to retool a plant in Oakville to build electric cars instead of gasoline powered ones back in 2020. But just weeks ago, Ford announced plans to delay the conversion for another three years, citing slumping electric vehicle sales.

Look into Ford’s quarterly reports and the danger of betting on electric vehicles becomes clear as day: Ford’s EV branch lost $1.3 billion in the first quarter of 2024. Reports also show Ford lost $130,000 on every electric vehicle sold.

The decline of electric vehicle demand isn’t limited to Ford. In the United States, electric vehicle sales fell by 7.3 per cent between the last quarter of 2023 and the first quarter of 2024.

Even Tesla’s sales were down 13 per cent in the first quarter of this year compared to the first quarter of 2023.

A Bloomberg headline from early April read “Tesla’s sales miss by the most ever in brutal blow for EVs.”

There’s certainly a risk in betting on electric vehicles right now.

Third, there’s the question of opportunity cost. Imagine what else our governments could be doing with $57 billion?

For about the same amount of money, the federal government could suspend the federal sales tax for an entire year. The feds could also use $57 billion to double health-care spending or build 57 new hospitals.

The solution for creating jobs isn’t to hand a select few companies buckets of cash just to lure them to Canada. Politicians should be focusing on creating the right environment for any company, large or small, to grow without a government handout.

To do that, Canada must be more competitive with lower business taxes, less red tape and more affordable energy. That’s a real recipe for success that doesn’t involve gambling with taxpayer cash.

It’s time for our politicians to kick their corporate welfare addiction. Until they do, Canadians will be left paying the price.

-

Alberta1 day ago

Alberta1 day agoCanadian Christian chiropractor fights ‘illegal’ $65,000 fine for refusing to wear mask

-

Media1 day ago

Media1 day agoCBC tries to hide senior executive bonuses

-

COVID-191 day ago

COVID-191 day agoCOVID Is Over — But Did We Learn Anything From It?

-

Great Reset2 days ago

Great Reset2 days agoAll 49 GOP senators call on Biden admin to withdraw support for WHO pandemic treaty

-

conflict1 day ago

conflict1 day ago‘Got Played’: Israel Reportedly Suspicious Biden Admin Had Backroom Talks With Mediators Over Ceasefire Deal

-

Energy1 day ago

Energy1 day agoU.S. EPA Unveils Carbon Dioxide Regulations That Could End Coal and Natural Gas Power Generation

-

illegal immigration2 days ago

illegal immigration2 days agoPanama Elects President Vowing Shutdown Of Key Routes To US Used By Over Half A Million Migrants

-

Fraser Institute1 day ago

Fraser Institute1 day agoTrudeau and Ford should attach personal fortunes to EV corporate welfare