Business

PETER SUTHERLAND SR GENERATING STATION POWERS NORTHEAST ONTARIO

PETER SUTHERLAND SR GENERATING STATION POWERS NORTHEAST ONTARIO

On the Abitibi River in northeastern Ontario, the Peter Sutherland Sr. Generating Station (GS) powers 25,000 homes and businesses with renewable waterpower. The development was a partnership between Ontario Power Generation (OPG) and Coral Rapids Power: a wholly-owned company of the Taykwa Tagamou Nation (TTN). The development is named after a respected elder from TTN. The $300-million project was completed in 2017.

On the Abitibi River in northeastern Ontario, almost two years of construction and eight years of planning have culminated in a new hydroelectric station capable of powering 25,000 homes and businesses with clean, renewable, and affordable power.

The 28-megawatt (MW) Peter Sutherland Sr. Generating Station (GS), located about 80 kilometres north of the town of Smooth Rock Falls on the New Post Creek, went into service on April 2017, well ahead of its scheduled 2018 target. In addition, the $300- million project stayed on budget.

That’s a testament to the solid planning and execution between OPG and its partner in the development, Coral Rapids Power, a wholly-owned company of the Taykwa Tagamou Nation (TTN). The development, which is named after a respected elder from TTN, has already had a positive impact on the First Nation community.

“We had about 50 TTN members working on the project at one point or another, which was significant for our First Nation partner,” said Paul Burroughs, Project Director at OPG. “They were part of the project team working to help make this a success.”

As part of the project agreement, Coral Rapids Power has a one-third ownership in the facility, meaning they will receive a share of profits from the station and be a partner for life over the 90 or so years the plant is expected to operate. As TTN’s first foray into hydro development, the project took several decades to get off the ground before the First Nation agreed to partner with OPG in 2007 as part of a past grievances settlement. Construction of the station began in 2015.

Construction work on the Peter Sutherland Sr. Generating Station

The project provides the TTN community with a long-term investment opportunity and a sustainable economic base. Further, it provides spinoff benefits for the entire northeast region.

“The relationship we’ve built with OPG is based on a foundation of respect, trust, and all working toward a common goal,” said Wayne Ross, President of Coral Rapids Power. “There have been many benefits from this project for our community, including good-paying jobs, transferable skills and a long-term revenue stream.”

In addition, approximately $53.5 million in subcontracts were awarded to TTN joint- venture businesses during the construction phase of the station.

“The partnership is about creating a lifelong relationship with the First Nation,” said Burroughs.

The project has created skilled jobs and unique learning opportunities benefitting TTN members who will pursue work in a range of different career fields. Labour needs included engineers, equipment operators, labourers, drillers, cement workers, ironworkers, electricians, welders, carpenters, and camp support services.

At the peak of construction, there were about 220 workers employed on the project, many of whom reside in the local community.

“Our partnership is about more than just megawatts,” said Mike Martelli, President, Renewable Generation. “It’s also about creating skilled jobs and ongoing revenue that will benefit this community for years to come.”

In addition to the direct employment opportunities, existing local businesses and the regional economy benefitted from contracting work, as well as local project purchasing and expenditures. The estimated sales multiplier associated with the project is $1.50 – that is for every dollar expended an additional $0.50 was spent in northern Ontario.

The new station is operated by OPG’s northeastern operations control room in Timmins and is maintained by technicians located at a nearby work centre at Abitibi Canyon.

Inside the completed Peter Sutherland Sr. Generating Station

Peter Sutherland Sr. GS is the latest asset in OPG’s clean energy portfolio, which includes successful joint ventures with other First Nations. In early 2015, OPG and the Moose Cree First Nation celebrated the completion of the Lower Mattagami Hydroelectric Project, northern Ontario’s largest hydroelectric project in 50 years.

Ontario’s 58 northeastern hydroelectric facilities provide a clean, renewable, and reliable source of power to Ontarians year- round. Their combined capacity is over 3,000 MW.

Thanks to Todayville for helping us bring our members’ stories of collaboration and innovation to the public.

Click to read a foreward from JP Gladu, Chief Development and Relations Officer, Steel River Group; Former President and CEO, Canadian Council for Aboriginal Business.

JP Gladu, Chief Development and Relations Officer, Steel

River Group; Former President & CEO, Canadian Council for Aboriginal Business

Click to read comments about this series from Jacob Irving, President of the Energy Council of Canada.

Jacob Irving, President of Energy Council of Canada

The Canadian Energy Compendium is an annual initiative by the Energy Council of Canada to provide an opportunity for cross-sectoral collaboration and discussion on current topics in Canada’s energy sector. The 2020 Canadian Energy Compendium: Innovations in Energy Efficiency is due to be released November 2020.

Click below to read more stories from Energy Council of Canada’s Compendium series.

INDIGENOUS CONSULTATION AND ENGAGEMENT AT CANADA’S ENERGY AND UTILITY REGULATORS

Hydro-Québec takes partnerships, environmental measures and sharing of wealth to new levels

Business

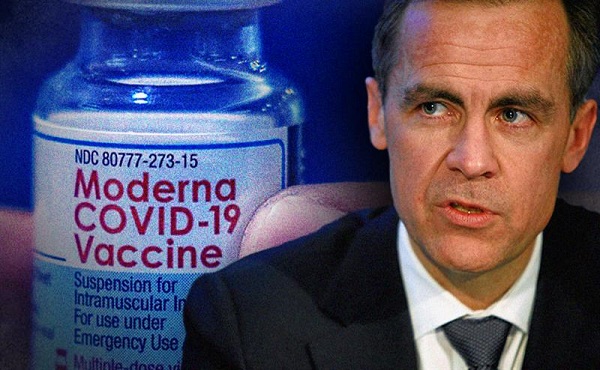

Carney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

From LifeSiteNews

Carney’s Liberal government signed nearly $400 million in contracts with Pfizer and Moderna for COVID shots, despite halted booster programs and ongoing delays in compensating Canadians for jab injuries.

Prime Minister Mark Carney has awarded Pfizer and Moderna nearly $400 million in new COVID shot contracts.

On June 30th, the Liberal government quietly signed nearly $400 million contracts with vaccine companies Pfizer and Moderna for COVID jabs, despite thousands of Canadians waiting to receive compensation for COVID shot injuries.

The contracts, published on the Government of Canada website, run from June 30, 2025, until March 31, 2026. Under the contracts, taxpayers must pay $199,907,418.00 to both companies for their COVID shots.

Notably, there have been no press releases regarding the contracts on the Government of Canada website nor from Carney’s official office.

Additionally, the contracts were signed after most Canadians provinces halted their COVID booster shot programs. At the same time, many Canadians are still waiting to receive compensation from COVID shot injuries.

Canada’s Vaccine Injury Support Program (VISP) was launched in December 2020 after the Canadian government gave vaccine makers a shield from liability regarding COVID-19 jab-related injuries.

There has been a total of 3,317 claims received, of which only 234 have received payments. In December, the Canadian Department of Health warned that COVID shot injury payouts will exceed the $75 million budget.

The December memo is the last public update that Canadians have received regarding the cost of the program. However, private investigations have revealed that much of the funding is going in the pockets of administrators, not injured Canadians.

A July report by Global News discovered that Oxaro Inc., the consulting company overseeing the VISP, has received $50.6 million. Of that fund, $33.7 million has been spent on administrative costs, compared to only $16.9 million going to vaccine injured Canadians.

Furthermore, the claims do not represent the total number of Canadians injured by the allegedly “safe and effective” COVID shots, as inside memos have revealed that the Public Health Agency of Canada (PHAC) officials neglected to report all adverse effects from COVID jabs and even went as far as telling staff not to report all events.

The PHAC’s downplaying of jab injuries is of little surprise to Canadians, as a 2023 secret memo revealed that the federal government purposefully hid adverse effect so as not to alarm Canadians.

The secret memo from former Prime Minister Justin Trudeau’s Privy Council Office noted that COVID jab injuries and even deaths “have the potential to shake public confidence.”

“Adverse effects following immunization, news reports and the government’s response to them have the potential to shake public confidence in the COVID-19 vaccination rollout,” read a part of the memo titled “Testing Behaviourally Informed Messaging in Response to Severe Adverse Events Following Immunization.”

Instead of alerting the public, the secret memo suggested developing “winning communication strategies” to ensure the public did not lose confidence in the experimental injections.

Since the start of the COVID crisis, official data shows that the virus has been listed as the cause of death for less than 20 children in Canada under age 15. This is out of six million children in the age group.

The COVID jabs approved in Canada have also been associated with severe side effects, such as blood clots, rashes, miscarriages, and even heart attacks in young, healthy men.

Additionally, a recent study done by researchers with Canada-based Correlation Research in the Public Interest showed that 17 countries have found a “definite causal link” between peaks in all-cause mortality and the fast rollouts of the COVID shots, as well as boosters.

Interestingly, while the Department of Health has spent $16 million on injury payouts, the Liberal government spent $54 million COVID propaganda promoting the shot to young Canadians.

The Public Health Agency of Canada especially targeted young Canadians ages 18-24 because they “may play down the seriousness of the situation.”

Business

Carney government should apply lessons from 1990s in spending review

From the Fraser Institute

By Jake Fuss and Grady Munro

For the summer leading up to the 2025 fall budget, the Carney government has launched a federal spending review aimed at finding savings that will help pay for recent major policy announcements. While this appears to be a step in the right direction, lessons from the past suggest the government must be more ambitious in its review to overcome the fiscal challenges facing Canada.

In two letters sent to federal cabinet ministers, Finance Minister François-Philippe Champagne outlined plans for a “Comprehensive Expenditure Review” that will see ministers evaluate spending programs in each of their portfolios based on the following: whether they are “meeting their objectives” are “core to the federal mandate” and “complement vs. duplicate what is offered elsewhere by the federal government or by other levels of government.” Ultimately, as a result of this review, ministers are expected to find savings of 7.5 per cent in 2026/27, rising to 10 per cent the following year, and reaching 15 per cent by 2028/29.

This news comes after the federal government has recently made several major policy announcements that will significantly impact the bottom line. Most notably, the government added an additional $9.3 billion to the defence budget for this fiscal year, and committed to more than double the annual defence budget by 2035. Without any policies to offset the fiscal impact of this higher defence spending (along with other recent changes), this year’s budget deficit (which the Liberal’s election platform initially pegged at $62.3 billion) will likely surpass $70.0 billion, and potentially may reach as high as $92.2 billion.

A spending review is long overdue. Recent research suggests that each year the federal government spends billions towards programs that are inefficient and/or ineffective, and which should be eliminated to find savings. Moreover, past governments (both federal and provincial) have proven that fiscal adjustments based on spending reviews can be very successful—just look at the Chrétien government’s 1995 Program Review.

In its 1995 budget, the federal Chrétien government launched a comprehensive review of all federal spending that—along with several minor tax increases—ultimately balanced the federal budget in two years and helped Canada avert a fiscal crisis. Two aspects of this review were critical to its success: it reviewed all federal spending initiatives with no exceptions, and it was based on clear criteria that not only tested whether spending was efficient, but which also reassessed the federal government’s role in delivering programs and services to Canadians. Unfortunately, the Carney government’s review is missing these two critical aspects.

The Carney government already plans to exclude large swathes of the budget from its spending review. While it might be reasonable for the government to exclude defence spending given our recent commitments (though that doesn’t appear to be the plan), the Carney government has instead chosen to exclude all transfers to individuals (such as seniors’ benefits) and provinces (such as health-care spending) from any spending cuts. Based on the last official spending estimates for this year, these two areas alone represent a combined $254.6 billion—or more than half of total spending after excluding debt charges—that won’t be reviewed.

This is a major weakness in the government’s plan. Not only does this limit the dollar value of savings available, it also means a significant portion of the government’s budget is missing out on a reassessment that could lead to more effective delivery of services for Canadians.

For example, as part of the 1995 program review, the Chrétien government overhauled how it delivered welfare transfers to provincial governments. Specifically, the federal government replaced two previous programs with a new Canada Health and Social Transfer (CHST) that addressed some major flaws with how the government delivered welfare assistance. While the transition to the CHST did include a $4.6 billion reduction in spending on government transfers, the new structure gave the federal government better control over spending growth in the future and allowed provincial governments more flexibility to tailor social assistance programs to local needs and preferences.

In addition to considering all areas of spending, the Carney government’s spending review also needs to be more ambitious in its criteria. While the current criteria are an important start—for example, it’s critical the government identifies and eliminates spending programs that aren’t achieving their stated objectives or which are simply duplicating another program—the Carney government should take it one step further and explicitly reflect on the role of the federal government itself.

Among other criteria that focused on efficiency and affordability of programs, the 1995 program review also evaluated every spending program based on whether government intervention was even necessary, and whether or not the federal government specifically should be involved. As such, not only did the program review eliminate costly inefficiencies, it also included the privatization of government-owned entities such as Petro-Canada and Canadian National Railway—which generated considerable economic benefits for Canadians.

Today, the federal government devotes considerable amounts of spending each year towards areas that are outside of its jurisdiction and/or which government shouldn’t be involved in the first place—national pharmacare, national dental care, and national daycare all being prime examples. Ignoring the fact that many of these areas (including the three examples) are already excluded from the Carney government’s spending review, the government’s criteria makes no explicit effort to test whether a program is targeting an area that’s outside of the federal purview.

For instance, while the government will test whether or not a spending program fits within the federal mandate, that mandate will not actually ensure the government stays within its own jurisdictional lane. Instead, the mandate simply lays out the key priorities the Carney government intends to focus on—including vague goals including, “Bringing down costs for Canadians and helping them to get ahead” which could be used to justify considerable federal overreach. Similarly, the government’s other criterion to not duplicate programs offered by other levels of government provides little meaningful restriction on government spending that is outside of its jurisdiction so long as that spending can be viewed as “complementing” provincial efforts. In other words, this spending review is unlikely to meaningfully check the costly growth in the size of government that Canada has experienced over the last decade.

Simply put, the Carney government’s spending review, while a step in the right direction, is missing key elements that will limit its effectiveness. Applying key lessons from the Chrétien government’s spending review is crucial for success today.

Grady Munro

Policy Analyst, Fraser Institute

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoNew Book Warns The Decline In Marriage Comes At A High Cost

-

Business1 day ago

Business1 day agoPrime minister can make good on campaign promise by reforming Canada Health Act

-

Addictions1 day ago

Addictions1 day ago‘Over and over until they die’: Drug crisis pushes first responders to the brink

-

International1 day ago

International1 day agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller1 day ago

Daily Caller1 day agoUSAID Quietly Sent Thousands Of Viruses To Chinese Military-Linked Biolab

-

Business2 days ago

Business2 days ago103 Conflicts and Counting Unprecedented Ethics Web of Prime Minister Mark Carney