Canadian Energy Centre

Lessons from rising tide of Indigenous ownership in Canadian oil and gas shared in Norway

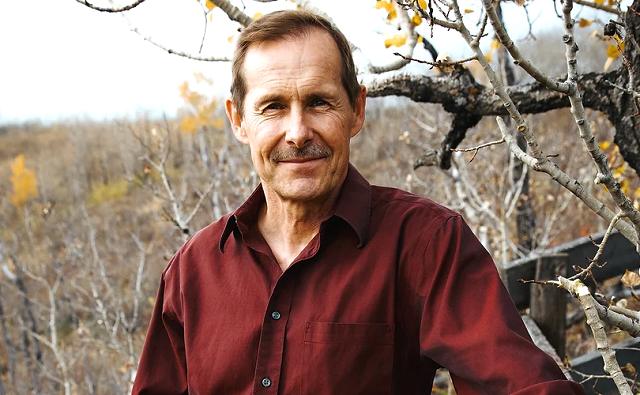

Indigenous Resource Network executive director John Desjarlais (right) and Norwegian prime minister Jonas Gahr Støre speak at the Arctic Frontiers Conference in Tromsø, Norway on Wednesday, Jan. 31, 2024. Photo courtesy Indigenous Resource Network.

From the Canadian Energy Centre

Since 2022, more than 75 First Nations and Métis communities in Alberta and British Columbia have agreed to ownership stakes in energy projects including the Coastal GasLink pipeline and major oil sands transportation networks.

The city of Tromsø, Norway, north of the Arctic Circle, is known as one of the best places in the world to see the northern lights.

For John Desjarlais, it was also a place to share lessons from the growing leadership of Indigenous communities in Canadian resource development projects.

In late January, Desjarlais – executive director of the Indigenous Resource Network – attended the Arctic Frontiers Conference in Tromsø, speaking on a panel with leaders including Norwegian prime minister Jonas Gahr Støre.

“Sharing some of the examples across borders is important. It reflects Indigenous peoples’ values on kinship and reciprocity,” says Desjarlais, a professional engineer and member of the Nehinaw Cree Métis community.

Indigenous people around the world including the Sami in northern Norway face similar socio-economic challenges to Indigenous communities in Canada, Desjarlais says.

“They want to develop on their own terms. We want to share those tips on how we all move forward,” he says.

“It is good business to partner with Indigenous partners. We’re starting to recognize not only the social value of reconciliation but also the business value. I think that’s happening much more quickly and progressively in Canada and that is being noted by our international allies.”

From liquefied natural gas (LNG) export terminals to oil and gas pipelines, natural gas-fired power plants and carbon capture and storage (CCS) projects to reduce emissions, more Indigenous communities in Canada are taking on a leadership role.

Since 2022, more than 75 First Nations and Métis communities in Alberta and British Columbia have agreed to ownership stakes in energy projects including the Coastal GasLink pipeline and major oil sands transportation networks.

“Those communities are moving forward in leaps and bounds in terms of their social impact,” Desjarlais says.

Each community can take their own approach to how invest the funds from their participation in resource projects, according to Justin Bourque, president of Athabasca Indigenous Investments.

The company represents 23 Indigenous communities in Alberta that became approximately 12 per cent owners of Enbridge oil sands pipelines in 2022.

“The different partners have done what works for their particular community and circumstance,” Bourque told CEC following the one-year anniversary of the deal.

“[Some] have used the funds disbursed to them to pay for more teachers or educational opportunities and building out their social infrastructure in their communities. One community is building a strategy around improving the quality of life for the elderly. Others have used the money to acquire lands or build infrastructure for their communities.”

Desjarlais says it is important to share these stories with Canada’s global partners.

“We don’t feed just national markets, we feed international markets. It’s important to showcase how we do things; that there is some best practice that is happening here, that we deliver responsible resource development,” he says.

“We are in a lot of different places to inspire that confidence that we can develop at the speed and the rate that the world needs and in line with sustainability.”

Canadian Energy Centre

Trans Mountain completion shows victory of good faith Indigenous consultation

Photo courtesy Trans Mountain Corporation

From the Canadian Energy Centre

‘Now that the Trans Mountain expansion is finally completed, it will provide trans-generational benefits to First Nations involved’

While many are celebrating the completion of the Trans Mountain pipeline expansion project for its benefit of delivering better prices for Canadian energy to international markets, it’s important to reflect on how the project demonstrates successful economic reconciliation with Indigenous communities.

It’s easy to forget how we got here.

The history of Trans Mountain has been fraught with obstacles and delays that could have killed the project, but it survived. This stands in contrast to other pipelines such as Energy East and Keystone XL.

Starting in 2012, proponent Kinder Morgan Canada engaged in consultation with multiple parties – including many First Nation and Métis communities – on potential project impacts.

According to Trans Mountain, there have been 73,000 points of contact with Indigenous communities throughout Alberta and British Columbia as the expansion was developed and constructed. The new federal government owners of the pipeline committed to ongoing consultation during early construction and operations phase.

Beyond formal Indigenous engagement, the project proponent conducted numerous environmental and engineering field studies. These included studies drawing on deep Indigenous input, such as traditional ecological knowledge studies, traditional land use studies, and traditional marine land use studies.

At each stage of consultation, the proponent had to take into consideration this input, and if necessary – which occurred regularly – adjust the pipeline route or change an approach.

With such a large undertaking, Kinder Morgan and later Trans Mountain Corporation as a government entity had to maintain relationships with many Indigenous parties and make sure they got it right.

Trans Mountain participates in a cultural ceremony with the Shxw’ōwhámél First Nation near Hope, B.C. Photograph courtesy Trans Mountain

Trans Mountain participates in a cultural ceremony with the Shxw’ōwhámél First Nation near Hope, B.C. Photograph courtesy Trans Mountain

It was the opposite of the superficial “checklist” form of consultation that companies had long been criticized for.

While most of the First Nation and Métis communities engaged in good faith with Kinder Morgan, and later the federal government, and wanted to maximize environmental protections and ensure they got the best deal for their communities, environmentalist opponents wanted to kill the project outright from the start.

After the government took over the incomplete expansion in 2018, green activists were transparent about using cost overruns as a tactic to scuttle and defeat the project. They tried to make Trans Mountain ground zero for their anti-energy divestment crusade, targeting investors.

It is an amazing testament to importance of Trans Mountain that it survived this bad faith onslaught.

In true eco-colonialist fashion, the non-Indigenous activist community did not care that the consultation process for Trans Mountain project was achieving economic reconciliation in front of their eyes. They were “fair weather friends” who supported Indigenous communities only when they opposed energy projects.

They missed the broad support for the Trans Mountain expansion. As of March 2023, the project had signed agreements with 81 Indigenous communities along the proposed route worth $657 million, and the project has created over $4.8 billion in contracts with Indigenous businesses.

Most importantly, Trans Mountain saw the maturing of Indigenous capital as Indigenous coalitions came together to seek equity stakes in the pipeline. Project Reconciliation, the Alberta-based Iron Coalition and B.C.’s Western Indigenous Pipeline Group all presented detailed proposals to assume ownership.

Although these equity proposals have not yet resulted in a sale agreement, they involved taking that important first step. Trans Mountain showed what was possible for Indigenous ownership, and now with more growth and perhaps legislative help from provincial and federal governments, an Indigenous consortium will be eventually successful when the government looks to sell the project.

If an Indigenous partner ultimately acquires an equity stake in Trans Mountain, observers close to the negotiations are convinced it will be a sizeable stake, well beyond 10 per cent. It will be a transformative venture for many First Nations involved.

Now that the Trans Mountain expansion is finally completed, it will provide trans-generational benefits to First Nations involved, including lasting work for Indigenous companies. It will also demonstrate the victory of good faith Indigenous consultation over bad faith opposition.

Alberta

Game changer: Trans Mountain pipeline expansion complete and starting to flow Canada’s oil to the world

Workers complete the “golden weld” of the Trans Mountain pipeline expansion on April 11, 2024 in the Fraser Valley between Hope and Chilliwack, B.C. The project saw mechanical completion on April 30, 2024. Photo courtesy Trans Mountain Corporation

From the Canadian Energy Centre

By Will Gibson

‘We’re going to be moving into a market where buyers are going to be competing to buy Canadian oil’

It is a game changer for Canada that will have ripple effects around the world.

The Trans Mountain pipeline expansion is now complete. And for the first time, global customers can access large volumes of Canadian oil, with the benefits flowing to Canada’s economy and Indigenous communities.

“We’re going to be moving into a market where buyers are going to be competing to buy Canadian oil,” BMO Capital Markets director Randy Ollenberger said recently, adding this is expected to result in a better price for Canadian oil relative to other global benchmarks.

The long-awaited expansion nearly triples capacity on the Trans Mountain system from Edmonton to the West Coast to approximately 890,000 barrels per day. Customers for the first shipments include refiners in China, California and India, according to media reports.

Shippers include all six members of the Pathways Alliance, a group of companies representing 95 per cent of oil sands production that together plan to reduce emissions from operations by 22 megatonnes by 2030 on the way to net zero by 2050.

The first tanker shipment from Trans Mountain’s expanded Westridge Marine Terminal is expected later in May.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

The new capacity on the Trans Mountain system comes as demand for Canadian oil from markets outside the United States is on the rise.

According to the Canada Energy Regulator, exports to destinations beyond the U.S. have averaged a record 267,000 barrels per day so far this year, up from about 130,000 barrels per day in 2020 and 33,000 barrels per day in 2017.

“Oil demand globally continues to go up,” said Phil Skolnick, New York-based oil market analyst with Eight Capital.

“Both India and China are looking to add millions of barrels a day of refining capacity through 2030.”

In India, refining demand will increase mainly for so-called medium and heavy oil like what is produced in Canada, he said.

“That’s where TMX is the opportunity for Canada, because that’s the route to get to India.”

Led by India and China, oil demand in the Asia-Pacific region is projected to increase from 36 million barrels per day in 2022 to 52 million barrels per day in 2050, according to the U.S. Energy Information Administration.

More oil coming from Canada will shake up markets for similar world oil streams including from Russia, Ecuador, and Iraq, according to analysts with Rystad Energy and Argus Media.

Expanded exports are expected to improve pricing for Canadian heavy oil, which “have been depressed for many years” in part due to pipeline shortages, according to TD Economics.

Photo courtesy Trans Mountain Corporation

Photo courtesy Trans Mountain Corporation

In recent years, the price for oil benchmark Western Canadian Select (WCS) has hovered between $18-$20 lower than West Texas Intermediate (WTI) “to reflect these hurdles,” analyst Marc Ercolao wrote in March.

“That spread should narrow as a result of the Trans Mountain completion,” he wrote.

“Looking forward, WCS prices could conservatively close the spread by $3–4/barrel later this year, which will incentivize production and support industry profitability.”

Canada’s Parliamentary Budget Office has said that an increase of US$5 per barrel for Canadian heavy oil would add $6 billion to Canada’s economy over the course of one year.

The Trans Mountain Expansion will leave a lasting economic legacy, according to an impact assessment conducted by Ernst & Young in March 2023.

In addition to $4.9 billion in contracts with Indigenous businesses during construction, the project leaves behind more than $650 million in benefit agreements and $1.2 billion in skills training with Indigenous communities.

Ernst & Young found that between 2024 and 2043, the expanded Trans Mountain system will pay $3.7 billion in wages, generate $9.2 billion in GDP, and pay $2.8 billion in government taxes.

-

National2 days ago

National2 days agoDespite claims of 215 ‘unmarked graves,’ no bodies have been found at Canadian residential school

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe WHO’s Proposed Pandemic Agreements Worsen Public Health

-

armed forces1 day ago

armed forces1 day agoTrudeau government has spent $10 million promoting DEI in the military as recruitment flounders

-

John Stossel1 day ago

John Stossel1 day agoProtecting Free Speech: The Early Warning Signs From Around The World

-

Health1 day ago

Health1 day agoTHE WPATH TAPES: Behind-The-Scenes Recordings Reveal What Top Gender Doctors Really Think About Sex Change Procedures

-

COVID-191 day ago

COVID-191 day agoTrudeau’s public health agency recommends another experimental COVID booster

-

illegal immigration2 days ago

illegal immigration2 days agoPanama’s Incoming President Wants To Shut Down His Country’s Most Treacherous Route For Migrants — But Will It Work?

-

Addictions1 day ago

Addictions1 day agoPoilievre attacks decriminalization of hard drugs with Safe Hospitals Act