Alberta

Two Alberta UCP members kicked out of caucus after challenging Kenney’s leadership

EDMONTON — Members of Premier Jason Kenney’s United Conservative Party caucus have voted to turf two of their own for challenging the leader.

Backbencher Todd Loewen was ejected Thursday night after publicly announcing earlier in the day the party is adrift and out of touch under Kenney and that the premier must quit before things spiral further.

Backbencher Drew Barnes had been the most vocal critic of the government’s COVID-19 health restrictions, saying they are of questionable effect and an intolerable infringement on personal freedoms. He was also voted out.

“Members recognize the need for government caucus to remain strong and united behind our leader, Premier Jason Kenney, as we continue to fight through what looks to be the final stages of the COVID-19 pandemic and beyond,” UCP whip Mike Ellis said in a statement.

“There is simply no room in our caucus for those who continually seek to divide our party and undermine government leadership, especially at this critical juncture.”

Kenney’s spokeswoman, Jerrica Goodwin, added in a statement: “The premier is proud to stand with his caucus colleagues and lead Alberta through the greatest health and economic crisis in a century.”

Loewen, representing the northern rural riding of Central Peace-Notley, had been the chair of the UCP caucus. Barnes represents Cypress-Medicine Hat in the south.

Loewen and Barnes join a third backbencher, Pat Rehn, who was expelled earlier this year after his constituents complained he wasn’t doing any work or listening to their concerns.

Weeks of bubbling internal discontent within the caucus boiled over into an open challenge by Loewen in a public letter to Kenney published on Loewen’s Facebook page in the pre-dawn hours Thursday.

In the letter, Loewen called on the premier to resign, saying he no longer sees a commitment to teamwork and party principles.

“We did not unite around blind loyalty to one man. And while you promoted unity, it is clear that unity is falling apart,” writes Loewen.

He accused Kenney and his government of weak dealings with Ottawa, ignoring caucus members, delivering contradictory messages, and botching critical issues such as negotiations with doctors and a controversy over coal mining in the Rocky Mountains.

“Many Albertans, including myself, no longer have confidence in your leadership,” Loewen says in the letter.

“I thank you for your service, but I am asking that you resign so that we can begin to put the province back together again.”

In a radio interview later in the day, Loewen said he wanted to stay in the UCP and that he was not seeking to split the party but save it from looming disaster in the next election.

“The people are upset. They are leaving the party,” Loewen told 630 CHED. “We need to do what it takes to stop the bleeding.

“We need to have our constituency associations strong. We’ve got to quit losing board members.”

Loewen later received a message of support from a second UCP backbencher, Dave Hanson.

Hanson wrote on Facebook: “Todd, I applaud your courage and stand behind your decision.

“I hear the same thing from our supporters in my area. I along with many of our colleagues share in your frustration.”

Hanson, Barnes and Loewen are three of 18 UCP backbench members who broke with the government in early April over restrictions aimed at reducing the spread of COVID-19. The group said the rules were needlessly restrictive and infringed on personal freedoms. Sixteen wrote an open letter expressing those concerns.

Since then Barnes has remained vocal, actively questioning why the regulations are needed in low-infection areas and demanding to see data underlying the health decisions.

Kenney tolerated the open dissension for weeks. He has said he believes in free speech and that backbenchers are not in cabinet and don’t speak for his government. But Loewen was the first to openly challenge Kenney’s leadership.

Kenney’s poll numbers, along with party fundraising contributions, have dropped precipitously during the pandemic while those of Rachel Notley’s NDP have climbed.

Notley said regardless of Kenney’s internal political troubles, Albertans need to see him focus on governing the province.

Alberta has seen in recent weeks some of the highest COVID-19 case rates in North America that threaten to swamp the province’s health system.

“It’s not looking good,” said Notley.

“What we need as a result is for the premier to clean up his house, get his house in order and provide the kind of leadership that Albertans desperately need during one of the most challenging times in our history.”

There were rumours of a widening internal UCP breach two weeks ago when Kenney suspended the legislature’s spring sitting. He said it was to keep staff and legislature members safe from COVID-19.

On Wednesday, the government extended the hiatus for another week.

Political scientist Duane Bratt said Kenney had little choice but to expel Loewen but noted it took several hours of debate among the caucus to get there.

“This is not a good day for Jason Kenney. He is wounded by this. And I don’t think it’s over,” said Bratt with Mount Royal University in Calgary.

Pollster Janet Brown said the open dissension magnifies Kenney’s leadership woes. Brown said a premier relies on three pillars of support: party fundraising, caucus support and support in the popularity polls. Any one of those three can help offset crises somewhere else.

But Kenney, said Brown, doesn’t have support in any area right now.

“If you’re down in the polls, if you don’t have the confidence of your caucus and your donors are keeping their hands in their pockets, what’s your justification for continuing?” said Brown.

“It seems like he’s failing with all three audiences.”

This report by The Canadian Press was first published May 13, 2021.

Dean Bennett, The Canadian Press

Alberta

Ottawa-Alberta agreement may produce oligopoly in the oilsands

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

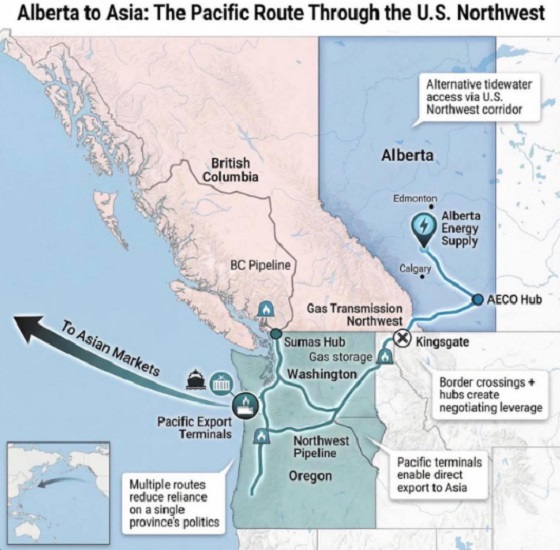

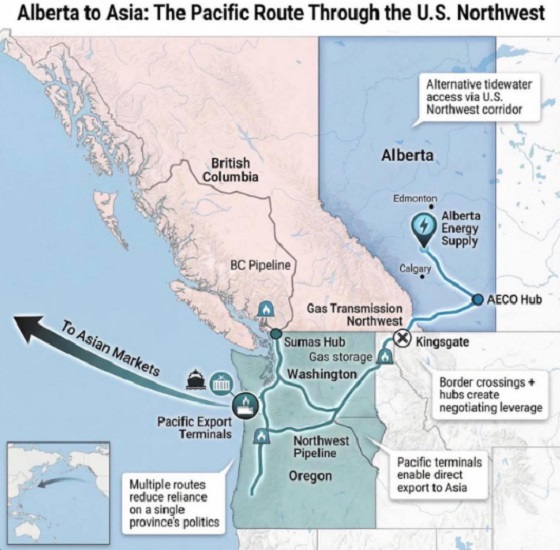

The federal and Alberta governments recently jointly released the details of a memorandum of understanding (MOU), which lays the groundwork for potentially significant energy infrastructure including an oil pipeline from Alberta to the west coast that would provide access to Asia and other international markets. While an improvement on the status quo, the MOU’s ambiguity risks creating an oligopoly.

An oligopoly is basically a monopoly but with multiple firms instead of a single firm. It’s a market with limited competition where a few firms dominate the entire market, and it’s something economists and policymakers worry about because it results in higher prices, less innovation, lower investment and/or less quality. Indeed, the federal government has an entire agency charged with worrying about limits to competition.

There are a number of aspects of the MOU where it’s not sufficiently clear what Ottawa and Alberta are agreeing to, so it’s easy to envision a situation where a few large firms come to dominate the oilsands.

Consider the clear connection in the MOU between the development and progress of Pathways, which is a large-scale carbon capture project, and the development of a bitumen pipeline to the west coast. The MOU explicitly links increased production of both oil and gas (“while simultaneously reaching carbon neutrality”) with projects such as Pathways. Currently, Pathways involves five of Canada’s largest oilsands producers: Canadian Natural, Cenovus, ConocoPhillips Canada, Imperial and Suncor.

What’s not clear is whether only these firms, or perhaps companies linked with Pathways in the future, will have access to the new pipeline. Similarly, only the firms with access to the new west coast pipeline would have access to the new proposed deep-water port, allowing access to Asian markets and likely higher prices for exports. Ottawa went so far as to open the door to “appropriate adjustment(s)” to the oil tanker ban (C-48), which prevents oil tankers from docking at Canadian ports on the west coast.

One of the many challenges with an oligopoly is that it prevents new entrants and entrepreneurs from challenging the existing firms with new technologies, new approaches and new techniques. This entrepreneurial process, rooted in innovation, is at the core of our economic growth and progress over time. The MOU, though not designed to do this, could prevent such startups from challenging the existing big players because they could face a litany of restrictive anti-development regulations introduced during the Trudeau era that have not been reformed or changed since the new Carney government took office.

And this is not to criticize or blame the companies involved in Pathways. They’re acting in the interests of their customers, staff, investors and local communities by finding a way to expand their production and sales. The fault lies with governments that were not sufficiently clear in the MOU on issues such as access to the new pipeline.

And it’s also worth noting that all of this is predicated on an assumption that Alberta can achieve the many conditions included in the MOU, some of which are fairly difficult. Indeed, the nature of the MOU’s conditions has already led some to suggest that it’s window dressing for the federal government to avoid outright denying a west coast pipeline and instead shift the blame for failure to the Smith government.

Assuming Alberta can clear the MOU’s various hurdles and achieve the development of a west coast pipeline, it will certainly benefit the province and the country more broadly to diversify the export markets for one of our most important export products. However, the agreement is far from ideal and could impose much larger-than-needed costs on the economy if it leads to an oligopoly. At the very least we should be aware of these risks as we progress.

Elmira Aliakbari

Alberta

A Christmas wish list for health-care reform

From the Fraser Institute

By Nadeem Esmail and Mackenzie Moir

It’s an exciting time in Canadian health-care policy. But even the slew of new reforms in Alberta only go part of the way to using all the policy tools employed by high performing universal health-care systems.

For 2026, for the sake of Canadian patients, let’s hope Alberta stays the path on changes to how hospitals are paid and allowing some private purchases of health care, and that other provinces start to catch up.

While Alberta’s new reforms were welcome news this year, it’s clear Canada’s health-care system continued to struggle. Canadians were reminded by our annual comparison of health care systems that they pay for one of the developed world’s most expensive universal health-care systems, yet have some of the fewest physicians and hospital beds, while waiting in some of the longest queues.

And speaking of queues, wait times across Canada for non-emergency care reached the second-highest level ever measured at 28.6 weeks from general practitioner referral to actual treatment. That’s more than triple the wait of the early 1990s despite decades of government promises and spending commitments. Other work found that at least 23,746 patients died while waiting for care, and nearly 1.3 million Canadians left our overcrowded emergency rooms without being treated.

At least one province has shown a genuine willingness to do something about these problems.

The Smith government in Alberta announced early in the year that it would move towards paying hospitals per-patient treated as opposed to a fixed annual budget, a policy approach that Quebec has been working on for years. Albertans will also soon be able purchase, at least in a limited way, some diagnostic and surgical services for themselves, which is again already possible in Quebec. Alberta has also gone a step further by allowing physicians to work in both public and private settings.

While controversial in Canada, these approaches simply mirror what is being done in all of the developed world’s top-performing universal health-care systems. Australia, the Netherlands, Germany and Switzerland all pay their hospitals per patient treated, and allow patients the opportunity to purchase care privately if they wish. They all also have better and faster universally accessible health care than Canada’s provinces provide, while spending a little more (Switzerland) or less (Australia, Germany, the Netherlands) than we do.

While these reforms are clearly a step in the right direction, there’s more to be done.

Even if we include Alberta’s reforms, these countries still do some very important things differently.

Critically, all of these countries expect patients to pay a small amount for their universally accessible services. The reasoning is straightforward: we all spend our own money more carefully than we spend someone else’s, and patients will make more informed decisions about when and where it’s best to access the health-care system when they have to pay a little out of pocket.

The evidence around this policy is clear—with appropriate safeguards to protect the very ill and exemptions for lower-income and other vulnerable populations, the demand for outpatient healthcare services falls, reducing delays and freeing up resources for others.

Charging patients even small amounts for care would of course violate the Canada Health Act, but it would also emulate the approach of 100 per cent of the developed world’s top-performing health-care systems. In this case, violating outdated federal policy means better universal health care for Canadians.

These top-performing countries also see the private sector and innovative entrepreneurs as partners in delivering universal health care. A relationship that is far different from the limited individual contracts some provinces have with private clinics and surgical centres to provide care in Canada. In these other countries, even full-service hospitals are operated by private providers. Importantly, partnering with innovative private providers, even hospitals, to deliver universal health care does not violate the Canada Health Act.

So, while Alberta has made strides this past year moving towards the well-established higher performance policy approach followed elsewhere, the Smith government remains at least a couple steps short of truly adopting a more Australian or European approach for health care. And other provinces have yet to even get to where Alberta will soon be.

Let’s hope in 2026 that Alberta keeps moving towards a truly world class universal health-care experience for patients, and that the other provinces catch up.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers

-

Business2 days ago

Business2 days agoState of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Alberta2 days ago

Alberta2 days agoHousing in Calgary and Edmonton remains expensive but more affordable than other cities

-

Alberta2 days ago

Alberta2 days agoWhat are the odds of a pipeline through the American Pacific Northwest?

-

Business2 days ago

Business2 days agoWarning Canada: China’s Economic Miracle Was Built on Mass Displacement

-

Agriculture2 days ago

Agriculture2 days agoThe Climate Argument Against Livestock Doesn’t Add Up

-

International2 days ago

International2 days agoGeorgia county admits illegally certifying 315k ballots in 2020 presidential election