Business

Trudeau should follow Ford’s lead and scrap alcohol tax hike

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

The Canadian Taxpayers Federation is applauding the Ontario government’s move to freeze beer taxes and calling on the federal government to do the same.

“It’s good to see the Ford government providing relief and Prime Minister Justin Trudeau should do the same and scrap his upcoming alcohol tax hike,” said Franco Terrazzano, CTF Federal Director. “Canadians are struggling with affordability so at the very least Trudeau shouldn’t be making life more expensive with tax hikes.”

Today, the Ontario government announced it’s freezing its beer taxes and LCBO mark-up rates that were scheduled to increase this March. Ontario’s beer tax freeze will be in place until March 1, 2026.

Since Nov. 1, 2018, the Ontario government has cancelled scheduled beer basic tax and LCBO mark-up increases.

The federal government is scheduled to increase its excise tax by 4.7 per cent on April 1. First passed in the 2017 federal budget, its alcohol escalator tax automatically increases federal excise taxes on beer, wine and spirits every year by the rate of inflation, without a vote in Parliament.

“Premier Doug Ford is doing the right thing by freezing beer taxes,” said Jay Goldberg, CTF Ontario Director. “Ontarians are struggling with the high cost of living and Ford is showing leadership by freezing taxes.”

Business

Trudeau’s environment department admits carbon tax has only reduced emissions by 1%

From LifeSiteNews

The Trudeau Liberals had first seemed to claim that the unpopular carbon tax had cut emissions by 33%, only to explain that the figure is merely a projection for 2030 and the actual reduction thus far stands at 1%.

The Liberal government has admitted that the carbon tax has only reduced greenhouse gas emissions by 1 percent following claims that the unpopular surcharge had cut emissions by 33 percent.

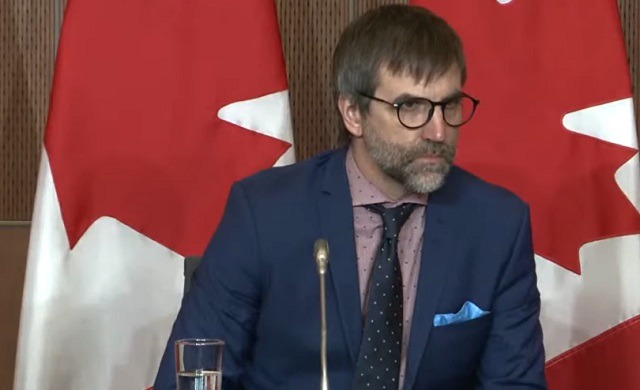

During a May 21 House of Commons environment committee meeting, Environment Minister Steven Guilbeault testified that the carbon tax cut greenhouse gas emissions by 33 percent, before his department backtracked to explain that the figure is a projection for the year 2030, and that the true figure sits at a mere 1 percent.

“I will be the first one to recognize it is complex,” said Guilbeault, according to information obtained by Blacklock’s Reporter.

“If you want simple answers, I am sorry. There is no simple answer when it comes to climate change or modeling,” he said, adding, “Carbon pricing works. This has never been clearer.”

“Carbon pricing alone accounts for around a third of emission reductions expected in Canada,” said Guilbeault, explaining this number was based on “complex statistical calculations.”

However, Conservative Members of Parliament (MPs) pointed out that the numbers provided by Guilbeault’s department do not add up to a 33 percent decrease in emissions, as the department had characterized.

“How many megatonnes of emissions have been directly reduced from your carbon tax since it was introduced?” Conservative MP Dan Mazier questioned.

According to Guilbeault, after the introduction of the carbon tax, emissions reduced by five megatonnes in 2018, fourteen megatonnes in 2019, seventeen megatonnes in 2020, eighteen megatonnes in 2021, and nineteen megatonnes in 2022.

However, the total tonnes of emissions reduced by the carbon tax comes to 73 million tonnes, or 2 percent, of the combined 3,597 million tonnes of emissions over the same five-year period, according to National Inventory Reports.

According to Blacklock’s, Guilbeault failed to explain how the environment department calculated a 33 percent benefit.

Conservative MP Michael Kram pressed Guilbeault, saying, “I want to make sure I have the math correct.”

“In 2022 emissions were at 708 megatonnes and the carbon tax was responsible for reducing 19 megatonnes,” he continued. “By my math that works out to a three percent reduction.”

Associate deputy environment minister Lawrence Hanson explained that the department’s 33 percent emissions cut is a projection of the emissions cut by 2030, not a current statistic.

“It’s the distinction between how much the carbon price might have affected emissions in one year versus how much in 2030,” said Hanson. “So when you heard us talking about its responsible for one third of reductions we were talking about the 2030 number.”

This explanation was echoed by Derek Hermanutz, director general of the department’s economic analysis directorate, who said, “When we talk about one third, it’s one third of our expected reductions. That’s getting to 2030.”

“Yes, but three percent of the total emissions have been reduced as a result of carbon pricing?” Kram pressed.

“No, emissions have declined three percent in total,” assistant deputy minister John Moffet responded.

“And so only one percent of that three percent is from the carbon tax?” Kram asked.

“To date,” Moffet replied.

Prime Minister Justin Trudeau’s carbon tax, framed as a way to reduce carbon emissions, has cost Canadian households hundreds of dollars annually despite rebates.

The increased costs are only expected to rise. A recent report revealed that a carbon tax of more than $350 per tonne is needed to reach Trudeau’s net-zero goals by 2050.

Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne, but the Trudeau government has a goal of $170 per tonne by 2030.

On April 1, Trudeau increased the carbon tax by 23 percent despite seven out of 10 provincial premiers and 70 percent of Canadians pleading with him to halt his plan.

Despite appeals from politicians and Canadians alike, Trudeau remains determined to increase the carbon tax regardless of its effects on citizens’ lives.

The Trudeau government’s current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum, the globalist group behind the socialist “Great Reset” agenda in which Trudeau and some of his cabinet are involved.

Automotive

The EV battery ‘catch-22’

From The Center Square

While setting aggressive goals for electric vehicle market share, the Biden administration also wants tariffs and or restrictions on the importation of vehicles and the minerals needed for their batteries – creating heightened concerns over supply chains in what can be described as a “Catch-22” situation.

Solutions to some of the problems include battery recycling and increased domestic mining, however, the U.S. is currently limited in its capacity for both. Federal funds are spurring new recycling plant projects, but questions remain on whether there will be enough used material to meet projected needs.

In his e-book, “The EV Transition Explained,” Robert Charette, longtime systems engineer, and contributing editor for IEEE Spectrum, says making the transition is harder than anyone thinks. He recently told The Center Square it is truer now than it ever was.

“None of this is simple,” he said.

His argument centers on the lack of planning and systems engineering on initiatives that are politically, not engineering, driven. While change is possible, he suggested it would require trillions more in government spending and enforcing those changes through law.

Charette identified many serious issues in setting up the EV battery infrastructure – and even if those challenges are met, he said, there may be tradeoffs between affordability, security and environmental concerns.

Profitability. Battery recycling is a still-developing process which is time consuming and expensive. The cost of purchasing recycled materials may be more costly than buying them new.

Manufacturing demand and potential backlog. The U.S. will require eight million batteries annually by 2030 to meet the government’s EV target, with increases each year after that.

Standardization. Batteries vary in configuration, size, and chemistry.

Domestic mining. While decreasing our dependency on outside sources, what are the environmental impacts? It can also take years to acquire permits and get a lithium mine up and running.

Mineral shortfalls. Secure and sustainable access to critical minerals like copper, lithium, cobalt, and nickel is essential for a smooth and affordable transition to clean energy. An analysis by the International Energy Agency indicates a “significant gap” between the world’s supply and demand for copper and lithium. Projected supplies will only meet 70% of the copper and 50% of the lithium needed to achieve 2035 climate targets.

The report said that “without the strong uptake of recycling and reuse, “mining capital requirements would need to be one-third higher. The agency also emphasizes China’s dominance in the refining and processing sector.

Transportation of discharged batteries classified as hazardous waste is one of the costliest steps of the recycling process. Experts suggest updates to federal EPA and DOT regulations for how battery-related waste is classified. In addition to health and safety, they say clearer definitions of what constitutes hazardous waste would help reduce transportation costs. Many recycling plants are being built in regions where production sites are located to address this.

Supply chain and skills gap shortages. The timetable set by the government is not aligned with the capabilities of the current supply chain. Software plays a key role in the management and operation of an EV battery, and automakers are competing for a limited supply of software and systems engineers.

Competing interests. The goal is to create a circular battery economy, reducing the need for raw materials. However, an EV battery that is no longer useful for propelling a car still has enough life left for other purposes such as residential energy storage. Experts propose a battery material hierarchy where repurposing and reusing retired EV batteries are more favorable to immediately recycling them, detouring them out of the cycle.

Charette says the biggest problem with recycling projections is that they are built on assumptions that have not been tested.

“We won’t know whether these assumptions hold until we reach a point where we are recycling millions of EV batteries,” he said.

Because most EV lithium-ion batteries produced through 2023 are still on the road, the International Council on Clean Transportation reports that the majority of materials being used as feedstock by recycling plants currently come from scrap materials created during battery production.

According to Charette, manufacturers also claim future generations of batteries will last 15 to 20 years, which he says would put a bigger kink in the used-battery supply chain.

Another issue contributing to consumers’ reluctance to buy an EV is the inability to determine the overall health of your battery. Current testing methods are inefficient and costly.

EV adoption has so far not met projections and with all the competing interests, Charette said the market will ultimately tell us what direction the situation is headed. He is also intrigued over the impact government pressure will have on the eventual outcome.

He said many individual components have yet to be worked out, adding that although there is a vision, “we’re a heck of a long way from that vision to getting where we need to go.”

In his opinion, battery recycling issues are even further behind than transitioning the electric grid to renewable energy sources.

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoWHO Accords Warrant Sovereignty Concern

-

Food2 days ago

Food2 days agoThe Bee-pocalypse: Another Scare Story the Media Got Wrong

-

COVID-192 days ago

COVID-192 days agoMalaysian doctor goes viral after apologizing for administering COVID shots

-

Agriculture19 hours ago

Agriculture19 hours agoThe China – Russia “Grain Entente” – what is at stake for Canada and its allies?

-

Bruce Dowbiggin16 hours ago

Bruce Dowbiggin16 hours agoThe Most Dangerous Man In Canada: Emmanuel Goldstein Reborn

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoAustralia passes digital ID bill, raising fears of government surveillance without accountability

-

Automotive20 hours ago

Automotive20 hours agoEV transition stalls despite government mandates and billion-dollar handouts

-

Automotive2 days ago

Automotive2 days agoThe EV battery ‘catch-22’