Agriculture

The China – Russia “Grain Entente” – what is at stake for Canada and its allies?

From the Macdonald Laurier Institute

By Serghey Sukhankin

Moscow – with China’s help, approval, and likely, guidance – intends to challenge the West by changing the rules of trade in foods critical to global buyers.

Throughout its entire history the Soviet Union faced one existential peril that was never solved until its collapse in 1991 – the prospect of food shortage and mass starvation. Its cumbersome, utterly ineffective, and artificially subsidized agricultural sector was a living testament to the erroneous nature of a planned command-administrative economic model.

The situation with food and staples became so dire that starting from 1963 the Soviet Bloc (the USSR, Hungary, Bulgaria, and Czechoslovakia) started importing wheat from the United States, Canada, and Australia. This practice continued until the demise of the Soviet Empire. Everything changed after the collapse of the USSR and introduction of market-oriented reforms in Russia in the 1990s, along with the growth of commodity prices and Russia’s inclusion in the global economic architecture.

By 2000, Russia had already doubled the amount of grain it produced, making it one of the world’s top producers of this strategic commodity. By the late 2010s to early 2020s, Russia emerged as a one of the world’s largest exporters of grain and agricultural products.

However, Russia quickly realized that commodities – especially food along with hydrocarbons – could become a very useful tool of coercion in geopolitical confrontations with its rivals. This became abundantly clear after the outbreak of Russia’s full-scale war of aggression against Ukraine in 2022, when both Russia’s top-tier politicians (such as Deputy Chairman of the Security Council and former President Dmitry Medvedev) and chief propagandists (such as Margarita Simonyan, the editor-in-chief of the Russian state-controlled broadcaster RT) claimed “hunger” to be Russia’s natural ally, and threaten to cut supplies of food staples to “unfriendly countries.”

At the same time, Russia tried to spark a confrontation between Ukraine and Poland, Hungary, Slovakia over commodities and staples supplies. Ironically, rather than hurting the West, Russia’s actions had a worse impact on so-called “friendly countries” – especially those in the Global South, where access to inexpensive and available foodstuffs is a matter of life and death.

Russia’s strategy of intimidation was also ineffective due to its invasion of Ukraine in February 2022. Its so-called “special military operation” was supposed to be quick and decisive. Two years later, the war has imposed massive pressure on the Russian budget, requiring a constant cash flow that mainly comes from exporting raw materials and commodities.

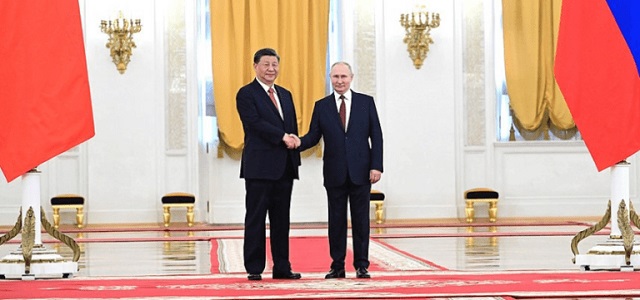

Forced to evolve its strategy, Russia seems to be abandoning its plan of threatening to starve its adversaries. Instead, Moscow – with China’s help, approval, and likely, guidance – intends to challenge the West by changing the rules of trade in foods critical to global buyers. This strategy is being implemented via pursuit of two interrelated initiatives: formation of a “Grain Entente” between Beijing and Moscow, and the use of the BRICS trading bloc (consisting of nine nations led by founding countries Brazil, Russia, India, China, and South Africa) as a critical vehicle of change.

The first major step in this direction was made in October 2023, when the Russian Food Export Trade LLC company and China Chengtong International Limited concluded the “grain deal of the century” – the largest contract of this type ever signed between the two countries – according to which the Russian side pledges to deliver 70 million tons of various types of grain (produced in the Urals, Siberia, and the Far East) over the next twelve years for US$26.5 billion. As a result, already in the first quarter of 2024, Russia broke a historical record by supplying China with large volumes of oats (.7 times more than the previous year) and buckwheat (3.3 more than the previous year) receiving a staggering US$127 million. Yet, mounting grain sales is only the tip of the iceberg. The most critical development is China’s gradual overtaking of Russia’s logistical infrastructure, which could pave the way for China’s growing control over Eurasian logistics and trade routes.

In September 2023, officials from Russia and China met at the 8th Eastern Economic Summit in Vladivostok, where officials from Russia and China agreed to create a logistical hub – the “Grain Terminal Nizhneleninskoye–Tongjiang” in the Jewish Autonomous Oblast. The goal is to create the Russia’s first “land-based grain fleet.” Consisting of 22,000 containers transporting grain, it will be capable of moving up to 600,000 tons of grain with a maximum storage capacity of up to 8 million per year. The strategic significance of this move is clear. On one hand, it allows Russia to “safeguard” itself against sanctions pressure, which will likely make Russia’s behaviour in Europe (and elsewhere) even more aggressive and unpredictable. On the other hand, China – which will acquire de facto control over Russia’s grain – will see Beijing become the world’s largest grain hub, giving it enormous power to influence and set global food prices.

Russia’s next major move was to push for the creation of a BRICS grain exchange. Fully supported by Russian President Vladimir Putin, the proposed grain exchange would bring together some of the world’s biggest grain buyers and exporters, cumulatively accounting for more than 42 per cent of global grain production (at nearly 1.2 million ) and 40 per cent of global consumption. International observers and subject experts have already warned that Russia- and China- adverse exporters of grain and agricultural products such as the United States, Canada, and Australia “might face challenges in maintaining their market share and negotiating for favourable trade terms, while facing competition from cheaper Russian .” In effect, this may have “significant implications for global agricultural dynamics, ranging from geopolitical and geoeconomic realignments to increased competition in agricultural trade. For traditional exporters such as Australia and the US, it is a call to reassess their national policies and strategies to navigate the evolving landscape of international trade to maintain competitiveness.”

The emergence of the BRICS grain exchange – which will undoubtedly increase Russia’s (and most likely China’s) geoeconomic role – is only a part of a much bigger strategic challenge. If the BRICS grain exchange is successful, it will have a spillover effect on another critical product – the fertilizers required by both developed and developing nations. Russia already has a competitive advantage in fertilizer production, and post-2022, has tried to use its fertilizers as geopolitical tools pressuring international organizations (such as the United Nations) to lobby for the end of sanctions imposed on Russia after its full-scale invasion of Ukraine.

– If the Russia-China grain alliance proliferates and BRICS becomes a major player in the global flow of grains and other foodstuffs, it could prompt even greater changes to the established world market. Analysis of Russian-language sources and publications indicates that the next step would be the creation of an alternative to the “West-dominated” financial architecture, and ultimately, the transformation of global trade.

Russia’s plans (undoubtedly supported by China) pose a very serious challenge to Canada, its allies, and other liberal democracies.

They will likely suffer economic losses of grain exports due to the cheapness of Russian grain, and that country’s current occupation of a large part of Ukraine’s most fertile black-earth areas. If unchecked, Russia could assume control of more than 30 percent of global grain supplies.

Currently, the Indo-Pacific region is Canada’s largest export destination, with agriculture and food exports totaling $9.4 billion in 2022. If China gains unfettered access to Russian grain, it could seriously undercut Canada’s trade.

Making matters worse for Canada, its relationship with New Delhi is arguably at an all-time low, making it challenging to pivot sales of its agricultural products toward India or other countries without significant economic losses.

Looking at the bigger picture, there are a host of other potential threats to the global foods market, from the ongoing war in Ukraine to droughts and adverse climate conditions in the US, Argentina, and Australia. Amid growing uncertainty and upheaval, it’s possible that the global foods market will be carved up and dominated by Russia and other undemocratic, aggressive nations. Given Russia’s strategic goal of weakening the European Union, and ultimately causing its disintegration, it will continue to use artificially created food shortages in Africa and the Greater Middle East as a geopolitical weapon against the EU. The Kremlin hopes to replicate the crisis that occurred in 2015, when hundreds of thousands (now, potentially millions) of illegal migrants and asylum seekers poured into the EU – wreaking havoc, fostering intra-EU conflict, and assisting the rise of far-right (and left) populists.

The first step in Russia’s grand strategy is the de facto establishment of the Russo-Chinese “Grain Entente.” The next move will be the creation of a BRICS grain exchange and inclusion of other strategic commodities under the umbrella of BRICS operations. This is clearly a wakeup call for the West. We need to heed it, or else risk more dire, far-reaching consequences.

Dr. Sergey Sukhankin is a Senior Fellow at the Jamestown Foundation (Washington, DC) and a Fellow at the North American and Arctic Defence and Security Network (NAADSN). His project discussing the activities of Russian PMCs, “War by Other Means,” informed the United Nations General Assembly report entitled “Use of Mercenaries as a Means of Violating Human Rights and Impeding the Exercise of the Right of Peoples to Self-Determination.”

This article was published with support from Konrad-Adenauer-Stiftung Canada.

Agriculture

Lacombe meat processor scores $1.2 million dollar provincial tax credit to help expansion

Alberta’s government continues to attract investment and grow the provincial economy.

The province’s inviting and tax-friendly business environment, and abundant agricultural resources, make it one of North America’s best places to do business. In addition, the Agri-Processing Investment Tax Credit helps attract investment that will further diversify Alberta’s agriculture industry.

Beretta Farms is the most recent company to qualify for the tax credit by expanding its existing facility with the potential to significantly increase production capacity. It invested more than $10.9 million in the project that is expected to increase the plant’s processing capacity from 29,583 to 44,688 head of cattle per year. Eleven new employees were hired after the expansion and the company plans to hire ten more. Through the Agri-Processing Investment Tax Credit, Alberta’s government has issued Beretta Farms a tax credit of $1,228,735.

“The Agri-Processing Investment Tax Credit is building on Alberta’s existing competitive advantages for agri-food companies and the primary producers that supply them. This facility expansion will allow Beretta Farms to increase production capacity, which means more Alberta beef across the country, and around the world.”

“This expansion by Beretta Farms is great news for Lacombe and central Alberta. It not only supports local job creation and economic growth but also strengthens Alberta’s global reputation for producing high-quality meat products. I’m proud to see our government supporting agricultural innovation and investment right here in our community.”

The tax credit provides a 12 per cent non-refundable, non-transferable tax credit when businesses invest $10 million or more in a project to build or expand a value-added agri-processing facility in Alberta. The program is open to any food manufacturers and bio processors that add value to commodities like grains or meat or turn agricultural byproducts into new consumer or industrial goods.

Beretta Farms’ facility in Lacombe is a federally registered, European Union-approved harvesting and meat processing facility specializing in the slaughter, processing, packaging and distribution of Canadian and United States cattle and bison meat products to 87 countries worldwide.

“Our recent plant expansion project at our facility in Lacombe has allowed us to increase our processing capacities and add more job opportunities in the central Alberta area. With the support and recognition from the Government of Alberta’s tax credit program, we feel we are in a better position to continue our success and have the confidence to grow our meat brands into the future.”

Alberta’s agri-processing sector is the second-largest manufacturing industry in the province and meat processing plays an important role in the sector, generating millions in annual economic impact and creating thousands of jobs. Alberta continues to be an attractive place for agricultural investment due to its agricultural resources, one of the lowest tax rates in North America, a business-friendly environment and a robust transportation network to connect with international markets.

Quick facts

- Since 2023, there are 16 applicants to the Agri-Processing Investment Tax Credit for projects worth about $1.6 billion total in new investment in Alberta’s agri-processing sector.

- To date, 13 projects have received conditional approval under the program.

- Each applicant must submit progress reports, then apply for a tax credit certificate when the project is complete.

- Beretta Farms has expanded the Lacombe facility by 10,000 square feet to include new warehousing, cooler space and an office building.

- This project has the potential to increase production capacity by 50 per cent, thereby facilitating entry into more European markets.

Related information

Agriculture

Unstung Heroes: Canada’s Honey Bees are not Disappearing – They’re Thriving

Canada’s Bee Apocalypse began in 2008. That was the year the Canadian Association of Professional Apiculturists (CAPA) first reported unusually high rates of winter bee colony losses. At 35 percent, the winter die-off that year was more than twice the normal 15 percent rate of attrition.

“Successive annual losses at [these] levels … are unsustainable by Canadian beekeepers,” the CAPA warned. This set off an avalanche of dire media reports that now appear on a regular basis. Among the many examples over the years: Huge Honey Bee Losses Across Canada” and “Canada’s bee colonies see worst loss in 20 years”. As each of these stories reminds readers, the disappearance of honey bees will doom our food supply, given their crucial role in pollinating crops including canola, soyabeans, apples, tomatoes and berries.

This year the black-and-yellow striped Cassandras are back at work, with headlines shouting “Scientists warn of severe honeybee losses in 2025” and “The Bees are Disappearing Again”. If it’s spring, the bees must be disappearing. Again.

It is, however, mathematically impossible for any species to be in an allegedly continuous and calamitous state of decline over nearly two decades and never actually reduce in number. For despite the steady supply of grave warnings regarding their imminent collapse, Canada’s bees are actually buzzing with life.

In 2007, according to Statistics Canada, there were 589,000 honey bee colonies in Canada,; in 2024, they reached 829,000, just shy of 2021’s all-time high of 834,000. Figuring a conservative summertime average of 50,000 bees per colony, that means there are approximately 12 billion more honey bees in Canada today than when the Bee Apocalypse first hit.

As for beekeepers, their numbers have also been growing steadily, and now stand at 15,430 – the most recorded since 1988. As CAPA’s report acknowledges, “the Canadian beekeeping industry has been resilient and able to grow, as proven by the overall increase in the number of bee colonies since 2007 despite the difficulties faced every winter.”

How is this possible? As is usually the case where there’s a need to be filled, the market holds the answer.

It is true that Canadian honey bees face a long list of threats and challenges ranging from mites and viruses to Canada’s harsh winters. It is also true that they perform a crucial service in pollinating crops, the value of which is estimated at $7 billion annually. However, this underscores the fact that bees are a livestock bred for a particular agricultural purpose, no different from cattle, chickens or pen-raised salmon. They are a business.

And in spite of its alleged status as an environmental totem, the honey bee isn’t even native to North America. It was first imported by European settlers for its honey-making abilities in the 1600s. Since then, it has been cultivated with deliberate commercial intent – allowing it to outcompete native pollinators such as bumble bees and butterflies even though it is poorly suited to the local winter. (This highlights the irony of all those native-plant pollinator gardens virtuously installed in neighbourhoods across Canada that end up supporting an invasive honey bee population.)

The significance of the bee economy means that when a beehive collapses over the winter for whatever reason, beekeepers have plenty of motivation to regenerate that colony as swiftly as possible. While hives can create their own queens over time, this can be a slow process given the cold Canadian climate. The better option is to simply buy a new queen from a warmer country.

In 2024, Canada imported 300,000 queens worth $12 million, mostly from the U.S., Italy, Australia and Chile. That works out to $40 each. In a miracle of nature, each of these new queens can lay up to 2,500 eggs a day, and each egg takes just two to three weeks to reach full maturity as a worker or drone. It is also possible to import entire “bee packages” that include a queen and 8,000 to 10,000 bees.

As a result, even a devastating 50 percent winter loss rate, something that has occurred only rarely in Canada in individual provinces and never nationally, isn’t necessarily fatal to any beekeeping operation. The beekeeper can purchase imported queens in April, split their existing colonies and be back in business by May or June.

And regardless of the honey bee’s apparent difficulties with Canada’s unforgiving weather (efforts are ongoing to breed a hardier Canadian variant), there’s no shortage of bees worldwide. Earlier this year, the German statistical agency reported the global beehive count rose from 69 million in 1990 to 102 million in 2023. Another study looking back to 1961 by New Zealand researchers found the number of honey bee colonies has “nearly doubled” over this time, while honey production has “almost tripled.” As the New Zealand report observes, “Headlines of honey bee colony losses have given an

impression of large-scale global decline of the bee population that endangers beekeeping, and that the world is on the verge of mass starvation.” Such claims, the authors note, are “somewhat inaccurate.” In truth, things have never been better for bees around the world.

Here in Canada, the ability to import queens from other countries, together with their prodigious reproductive capabilities, backstops the amazing resiliency of the bee industry. Yes, bees die. Sometimes in large numbers. But – and this is the bit the headlines always ignore – they come back. Because the market needs them to come back.

If there is a real threat to Canada’s bee population, it’s not environmental. It’s the risk that unencumbered trade in bees might somehow be disrupted by tariffs or similar bone-headed human interventions. Left on their own, bees have no problem keeping busy.

The longer, original version of this story first appeared at C2CJournal.ca

-

Alberta2 days ago

Alberta2 days agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Energy2 days ago

Energy2 days agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

Alberta2 days ago

Alberta2 days agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis

-

Canadian Energy Centre1 day ago

Canadian Energy Centre1 day agoAlberta oil sands legacy tailings down 40 per cent since 2015