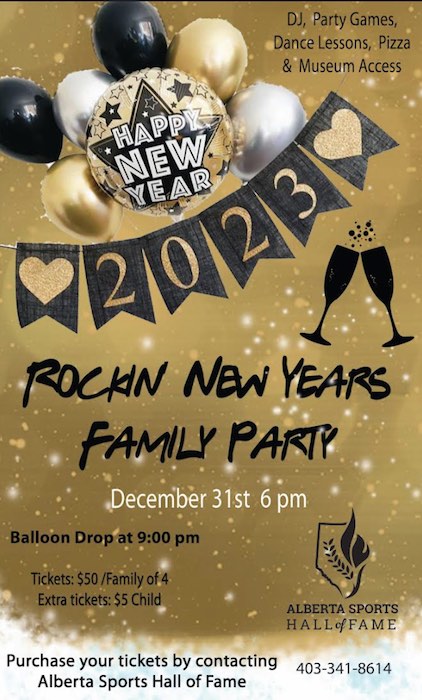

Entertainment

Top 5 reasons to celebrate the New Year together at the Alberta Sports Hall of Fame

Business

Taxpayers call on Trudeau to scrap Digital Services Tax as US threatens trade action

From the Canadian Taxpayers Federation

Author: Jay Goldberg

“Trudeau is determined to make Canadians’ lives more expensive and he’s willing to risk a trade war with the United States to do it”

The Canadian Taxpayers Federation is calling on the Trudeau government to scrap its Digital Services Tax in the wake of warnings from the United States Trade Representative that the United States will “do what’s necessary” to respond to the Trudeau government’s new tax.

“Canadian consumers know that Trudeau’s Digital Services Tax is nothing more than a tax grab, plain and simple,” said CTF Ontario Director Jay Goldberg. “With providers virtually certain to pass along increased costs to consumers, Prime Minister Justin Trudeau is sticking Canadians with higher taxes and risking the possibility of a trade conflict with the United States.”

The DST targets large foreign companies operating online marketplaces, social media platforms and earning revenue from online advertising, such as Amazon, Facebook, Google and VRBO. It is a three per cent tax on all online revenue these companies generate in Canada.

The Trudeau government pushed its new DST through Parliament last month and plans to apply it retroactively to as far back as 2022.

Since the Trudeau government first explored the idea of imposing a Digital Services Tax three years ago, the USTR has repeatedly warned the United States would retaliate.

“Should Canada adopt a DST, USTR would examine all options, including under our trade agreements and domestic statutes,” said the USTR in 2022.

USTR Katherine Tai is now warning that the U.S. is looking at “all available tools” to respond to Trudeau’s new tax.

“Trudeau is determined to make Canadians’ lives more expensive and he’s willing to risk a trade war with the United States to do it,” said Goldberg. “It’s clear the Digital Services Tax must go.”

Business

Internet bills should itemize Justin Trudeau’s new streaming tax

From the Canadian Taxpayers Federation

Author: Jay Goldberg

If streaming services want to fight back against the Trudeau government’s new streaming tax, which will cost them five per cent of their revenue each and every year, they need to be honest with customers and put the tax right on the bill so subscribers see it and understand how much it’s costing them.

The truth is this is a tax. It will cost Canadians money. And everyone knows it, including the prime minister. Maybe not the prime minister of 2024 but certainly the prime minister of 2018, when, in response to NDP pressure to tax streaming services, Justin Trudeau sensibly refused, saying: “The NDP is claiming that Netflix and other web giants are the ones who will pay these new taxes. The reality is that taxpayers will be the ones to pay those taxes.”

Well, that was then and this is now. Trudeau’s 2018 logic has been thrown out the window. The Canadian Radio-television and Telecommunications Commission announced last week it is “requiring online streaming services to contribute five per cent of their revenues to support the Canadian broadcasting system.” That means streaming services like Apple Music, Netflix, Spotify, YouTube and Disney+ will be hit with a new tax. And, as Trudeau pointed out in 2018, Canadians will be the ones paying the bill.

The government’s own analysis says the new measure will cost Canadians $200 million per year. When businesses are forced to hand over hundreds of millions of dollars to the government, they can’t just eat the cost. As Trudeau himself said, this streaming tax will be passed onto consumers. The industry agrees. Canadians should be “deeply concerned” with the government’s decision to “impose a discriminatory tax,” said Digital Media Association President and CEO Graham Davies, adding the move will only worsen the “affordability crisis.”

Translation: prepare for higher prices.

The streaming services targeted by these new measures shouldn’t take them lying down. They shouldn’t cooperate with the government’s plan to hide the new tax. Netflix, Spotify, Apple, Disney, YouTube and all the rest need to be honest with their customers about why prices are going up: the Liberals’ streaming tax.

Conservative Leader Pierre Poilievre recently wrote an op-ed in this paper telling corporations not to rely on lobbying behind the scenes to influence policy. If businesses want policies to change, they need to convince voters so voters will in turn convince politicians. Canadians have to understand why it’s going to cost them more to watch movies and listen to music. They are fed up with tax hikes. But only if they know what’s happening can they make politicians change course. That’s the right way to stop the streaming tax.

In case it’s not already obvious, simply sitting back and waiting for the next election isn’t good enough. “Obviously, my future government will do exactly the opposite of Trudeau on almost every issue,” wrote Poilievre in his NP op-ed. “But that does not mean that businesses will get their way. In fact, they will get nothing from me unless they convince the people first.”

That’s precisely why these streaming services, from Apple and Google to Spotify and YouTube, need to be honest with their customers about the streaming tax. They should add a separate item on every subscriber’s bill showing exactly how much Trudeau’s streaming tax is costing. They should direct angry calls to MP offices instead of customer service lines.

When everything feels unaffordable, a night in with a movie or a walk with a favourite album shouldn’t get hit with yet another tax hike.

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe Media Refuses to Accept Covid Reality

-

Alberta1 day ago

Alberta1 day ago‘Fireworks’ As Defence Opens Case In Coutts Two Trial

-

National1 day ago

National1 day agoLiberals offer no response as Conservative MP calls Trudeau a ‘liar’ for an hour straight

-

COVID-191 day ago

COVID-191 day agoLeaked documents: German gov’t lied about shots preventing COVID, knew lockdowns did more harm than good

-

Business1 day ago

Business1 day agoFederal government seems committed to killing investment in Canada

-

International1 day ago

International1 day agoSwitzerland’s new portable suicide ‘pod’ set to claim its first life ‘soon’

-

Economy1 day ago

Economy1 day agoKamala Harris’ Energy Policy Catalog Is Full Of Whoppers

-

Business1 day ago

Business1 day agoEstonia’s solution to Canada’s stagnating economic growth