Opinion

The Dystopian Future of Canada, Part 2-Corona Virus Testing Cause or Curse?

Pandemic Elements 1: PCR Testing-

During this ‘pandemic,’ world citizens have been subjected to a daily dose of case numbers from provincial or federal health ministers both sides of the border that have the power to paralyze or to set communities and citizens free from constraining governmental measures.

Decreasing ‘numbers’ spread hope that the curve is flattening while increasing ‘positives’ send frightened citizens and companies into a tailspin.

At the heart of the debate is the PCR test which magnifies RNA strands anywhere from 30 to 40 times to create the reaction necessary for a ‘conclusive’ test. Yet according to medical professionals forensic technicians only use a magnification of 17 in their quest for trace compounds during investigations.

Even Dr. Anthony Fauci has admitted that the chances of a positive result being accurate at 35 cycles are “miniscule,” yet the Alberta Government relies on such testing levels (35) to determine the severity of the Covid 19 infection. Other groups such as the Ontario Government, the FDA, the CDC and the World Health Organization recommend 40 to 45 cycles.

REF: Your Coronavirus Test Is Positive. Maybe It Shouldn’t Be. – The New York Times (nytimes.com)

The PCR test was developed in 1985 by Dr. Kary Mullis for a primary application in biomedical research and criminal forensics yet it has become the foremost tool for Covid 19 detection. (see end of article for video)

In a 2019 interview, Mullis noted that it was never intended for detecting disease he felt that ‘Scientists are doing an awful lot of damage to the world in the name of helping it.’

Further research into PCR testing has yielded interesting results.

In addition to the inaccuracy of cycles above 17 which provide 100 % accuracy which drops to 20% with 33-34 cycles according to Dr. Mercola, the spectre of exactly what the test is searching for is raised.

With more than one Covid 19 test available, RNA (PCR), rapid (Antigen) or Serology (Antibody) there are also claims from the CDC that they do not have a sample of Covid 19 that they can produce to create a test from!

With numbers in the range that the Province of Alberta is reporting, the ‘pandemic,’ if PCR testing is performed with 17 cycles, would drop to a mere 8500 and across Canada, to 63,000. Looking at deaths, 11, 265 deaths have been attributed to Covid 19, yet according to many statistics 10% of deaths can only be attributed directly TO Covid 19 with the remainder being linked with co-morbidities. A comparison of death rates across Canada shows that from January to September 2018, 2019 and 2020 are nearly identical in total numbers despite our ‘pandemic.’

Another suspicious fact is that Dr. Hinshaw stated recently that there have been NO cases of the Flu reported (Global News November 13, 2020). If this is a flu season, where are the sick people? Could they have been tagged as Covid patients?

On November 18, 2020 Dr. Roger Hodgkinson, Hodkinson, Chairman of the Royal College of Physicians and Surgeons committee in Ottawa, CEO of a large private medical laboratory in Edmonton, Alberta and Chairman of a Medical Biotechnology company that sells Covid 19 tests addressed Edmonton City Council and passionately chastised the government response to the ‘pandemic.’

The video can be found at: https://www.youtube.com/watch?v=uEo3rnU12jw

“There is utterly unfounded public hysteria driven by the media and politicians. This is the biggest hoax ever perpetrated on an unsuspected public. There is absolutely nothing that can be done to contain this virus. This is nothing more than a bad flu season. It’s politics playing medicine and that’s a very dangerous game. There is no action needed,” he said. “Masks are utterly useless!”

“Positive testing results do NOT indicate clinical infection. It is simply driving public hysteria and ALL testing should STOP immediately,” he added. “The scale of the response is utterly ridiculous…all kinds of business closures, suicides …. you’re being led down the garden path by the Health Minister of this province.”

There is another side to danger of PCR testing; fraud.

Reports of positive tests results have been reported with NO testing done by labs in Red Deer on patients who registered to test but left before any test could be performed. From anecdotal evidence, there are at least 4 cases the writer has heard of the week of November 15th! I can imagine that there Legally speaking, if 4 false cases have been reported in addition to a 20% accuracy rate, then the government response is incredibly over the top and lockdowns, mask bylaws and cohort regulations are unwarranted.

During an October 24, 2020 rally in Edmonton (a, retired Dr. Lorna Levesque called on provincial and federal politicians to let ‘teachers teach instead of playing doctor,’ and to ‘stop testing and give our rights and freedoms back.’

The video can be found at:

She also represented the Great Barrington Declaration (https://gbdeclaration.org/), signed by close to 50,000 doctors and 640,000 citizens which calls on governments to stop lockdowns and mandatory masks. A short summary of the declaration follows:

“Current lockdown policies are producing devastating effects on short and long-term public health. The results (to name a few) include lower childhood vaccination rates, worsening cardiovascular disease outcomes, fewer cancer screenings and deteriorating mental health – leading to greater excess mortality in years to come, with the working class and younger members of society carrying the heaviest burden. Keeping students out of school is a grave injustice. “

“Why are my colleagues silent,” she asked. “When we took our Hippocratic Oath we swore to ‘do no harm,’ and yet here we are silent while our government mandate masks which are bacteria factories if not sterile and decrease oxygen into our lungs while increasing carbon dioxide. I am stunned by your silence!”

She also noted that ‘we cannot control the virus but Vitamin D helps build immunity just as Zinc does.’

The big question asked by citizens across Alberta is WHY are we using a flawed test procedure to decide the future of our economic, social and spiritual futures? Why do citizens have NO say in how we respond as a society?

In my November 18th piece, I answer that question. (https://www.todayville.com/the-dystopian-future-of-canada-part-i/)

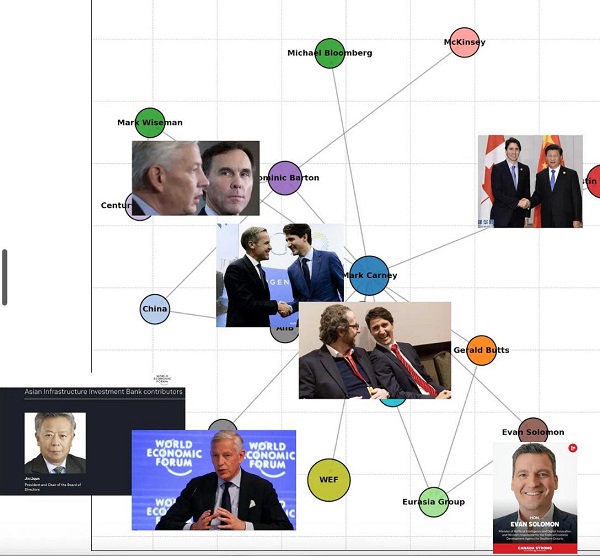

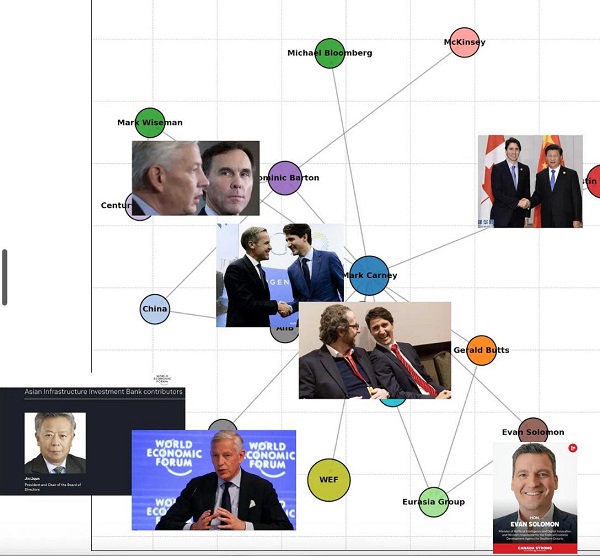

“The pandemic gives us an opportunity to reshape society…” Justin Trudeau said in his UN speech.

Further information from Dr. Mullis is below: (language warning)

A late addition to this piece is the following letter from Dr. Stephen Malthouse to the BC Minister of Health, due to the length of the piece, I include a link but add this short excerpt:

“Why are you still using PCR testing? The Deputy Chief Medical Officer for Health in Ontario has publicly stated that the PCR test yields over 50% false positives. A New York Times investigative report found that PCR testing yields up to 90% false positives due to excessive amplification beyond the recommendations of the manufacturer. The PCR test was never designed, intended or validated to be used as a diagnostic tool. Even the Alberta Health Services COVID-19 Scientific Advisory Group has stated “clinical sensitivity and specificity values have not been determined for lab developed RT-PCR testing in Canada”.8 Despite expert consensus, you continue to use this inappropriate and inaccurate test to report so-called “cases” and justify your decisions.9-18“

Footnotes in original letter.

https://www.pandemicdebate.com/post/letter-by-dr-stephen-malthouse-md-to-dr-bonnie-henry-b-c-provincial-health-officer

If you have any comments, please contact me through comments OR via email at [email protected]

Be awake, aware and alert for our enemy the devil seeks to destroy, deceive and create confusion….

Business

Carney should rethink ‘carbon capture’ climate cure

From the Fraser Institute

In case you missed it amid the din of Trump’s trade war, Prime Minister Carney is a big believer in “carbon capture and storage.” And his energy minister, Tim Hodgson, who said it’s “critical to build carbon capture systems for the oilsands,” wants the Smith government and oilsands companies to get behind a proposed project (which hasn’t been unable to raise sufficient private investment) in Cold Lake, Alberta.

The term “carbon capture and storage” (or CCS) essentially refers to technology that separates carbon dioxide (CO2) from emissions and either stores it or uses it for other products. Proponents claim that CCS could replace other more ham-handed climate regulations such as carbon taxes, emission caps, etc. The problem is, like many (or most) proposed climate panaceas, CCS is oversold. While it’s a real technology currently in use around the world (primarily to produce more oil and gas from depleting reservoirs), jurisdictions will likely be unable to affordably scale up CCS enough to capture and store enough greenhouse gas to meaningfully reduce the risks of predicted climate change.

Why? Because while you get energy out of converting methane (natural gas) to CO2 by burning it in a power plant to generate electricity, you have to put quite a lot of energy into the process if you want to capture, compress, transport and store the attendant CO2 emissions. Again, carbon capture can be profitable (on net) for use in producing more oil and gas from depleting reservoirs, and it has a long and respected role in oil and gas production, but it’s unclear that the technology has utility outside of private for-profit use.

And in fact, according to the International Institute for Sustainable Development (IISD), most CCS happening in Canada is less about storing carbon to avert climate change and more about stimulating oil production from existing operations. While there are “seven CCS projects currently operating in Canada, mostly in the oil and gas sector, capturing about 0.5% of national emissions,” CCS in oil and gas production does not address emissions from “downstream uses of those fuels” and will, perversely, lead to more CO2 emissions on net. The IISD also notes that CCS is expensive, costing up to C$200 per tonne for current projects. (For reference, today’s government-set minimum carbon market price to emit a tonne of CO2 emissions is C$95.) IISD concludes CCS is “energy intensive, slow to implement, and unproven at scale, making it a poor strategy for decarbonizing oil and gas production.”

Another article in Scientific American observes that industrial carbon capture projects are “too small to matter” and that “today’s largest carbon capture projects only remove a few seconds’ worth of our yearly greenhouse gas emissions” and that this is “costing thousands of dollars for every ton of CO2 removed.” And as a way to capture massive volumes of CO2 (from industrial emission streams of out the air) and sequestering it to forestall atmospheric warming (climate change), the prospects are not good. Perhaps this is why the article’s author characterizes CCS as a “figleaf” for the fossil fuel industry (and now, apparently, the Carney government) to pretend they are reducing GHG emissions.

Prime Minister Carney should sharpen his thinking on CCS. While real and profitable when used in oil and gas production, it’s unlikely to be useful in combatting climate change. Best to avoid yet another costly climate change “solution” that is overpromised, overpriced and has historically underperformed.

Energy

Is Carney ‘All Hat And No Cattle’?

From the National Citizens Coalition

By National Citizens Coalition President Peter Coleman

Mark Carney promised to lead Canada with bold vision and economic strength. But his latest stall tactics on removing red tape for Canadian oil and gas, his floundering in tariff negotiations despite lofty “elbows up” promises, and his refusal to address shocking interference allegations tied to his public safety minister so far show that he’s all hat and no cattle.

Today, Prime Minister Mark Carney held consultations and conversations with Indigenous groups on Bill C-5, which claims to fast-track “nation-building” energy projects. Yet he announced no major approvals on the horizon, and impressed no urgency or authority upon those in attendance who would seek to claim veto over vital projects.

Canada doesn’t need more endless talk or one bill to pick more losers than winners. We need action to remove anti-resource laws and regulatory roadblocks that choke our energy sector. Projects like pipelines and LNG facilities are critical for jobs, economic growth, and energy security, but they’re stalled by bureaucratic overreach and outdated policies. Hard-working Canadians deserve affordable energy. Our economy needs rescuing from tariff threat and a decade of Liberal sabotage. And Indigenous communities deserve real economic partnerships, not more delays and cowardly half-measures that often only placate anti-resource interests and insiders, not the real needs of the community.

Streamlined approvals with clear economic benefits will unlock prosperity for all Canadians. Carney’s stall tactics only hold back progress. It’s time to cut the red tape and get out of the way so that real Canadian leaders, and our great Canadian workers, can rebuild Canada after all that’s been broken.

Carney campaigned as the economic genius who could handle U.S. President Donald Trump’s tariff threats. Yet, with Trump’s August 1 deadline for a 35% tariff on Canadian goods approaching, Carney’s negotiations are going nowhere. His vague promises do nothing to protect Canadian jobs, industries, or families facing higher costs. Canadians deserve a leader who delivers results, not one who breaks campaign promises with empty rhetoric.

Meanwhile, he’s been shielding corruption and dodging accountability. Carney, now revealed to have 16 pages of conflicts that were kept from voters during the election, continues to protect Public Safety Minister Gary Anandasangaree, who faces serious allegations of lobbying for those with listed terrorist ties. Instead of demanding transparency, Carney is shielding his minister from scrutiny, doubling down on the Liberal tradition of dodging accountability. Canadians deserve a government that upholds integrity, not one that buries troubling connections to protect political allies. Is Carney just like Justin, who broke immigration and invited rampant foreign interference into government? Because this response is right out of his predecessor’s playbook.

Mark Carney’s leadership has been all talk and no action. Canada needs a government that unleashes our energy potential, lives up to its lofty campaign promises, and roots out corruption; not another Justin Trudeau.

We’re not falling for it. And neither are you. Demand action. Demand results.

–Peter Coleman, President, National Citizens Coalition

-

Education1 day ago

Education1 day agoWhy more parents are turning to Christian schools

-

Business2 days ago

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

Alberta1 day ago

Alberta1 day agoOPEC+ is playing a dangerous game with oil

-

Alberta1 day ago

Alberta1 day agoUpgrades at Port of Churchill spark ambitions for nation-building Arctic exports

-

Business1 day ago

Business1 day agoIs dirty Chinese money undermining Canada’s Arctic?

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections

-

COVID-191 day ago

COVID-191 day agoJapan disposes $1.6 billion worth of COVID drugs nobody used