Alberta

The Child Benefit You Got was Not an Error

The Child Benefit You Got was Not an Error

So a lot of people are wondering why money showed up for the Canada Child Benefit (CCB) yesterday (May 20) when they normally don’t qualify.

The CCB “one-time payment” for COVID-19 relief is actually formula driven but it is created by adding $3,600 for each additional child (not $300)… you’ll see in a minute why this is.

Step 1 – Add up the number of children that were under 6 years old in 2018 and multiply by $6,639.00

Step 2 – Add up the number of children that were between 6 and 17 years of age in 2018 and multiply by $5,602.00

This is your normal ANNUAL Canada Child Benefit entitlement before reductions.

However, for your May 2020 payment only, the formula adds $3,600 per child to bring the numbers to $10,239 and $9,202 per child based on age respectively.

If you have less than $31,120 of adjusted household income, you will get the full $300 extra, congrats, no more math for you.

For the rest of you it gets interesting or complicated, depending how you view math.

Any amount of adjusted household income between $31,120 and $67,426 causes your ANNUAL entitled CCB to be reduced by the following:

- 7% of the amount of household income if you have 1 child

- 13.5% of the amount of household income if you have 2 children

- 19% of the amount of household income if you have 3 children

- 23% of the amount of household income if you have 4 children or more

This is called the “first reduction”. The maximum amount of household income subject to the first reduction formula is $36,306 more than the base $31,120 (meaning an income of $65,976)

Those of you over this number, you are not done yet.

Any amount of adjusted household income over $67,426 causes your ANNUAL entitled CCB to be reduced by the following:

- 3.2% of the amount of household income if you have 1 child

- 5.7% of the amount of household income if you have 2 children

- 8% of the amount of household income if you have 3 children

- 9.5% of the amount of household income if you have 4 children or more

This is called the “second reduction”. There is no maximum amount of household income subject to the second reduction formula. You keep calculating until you hit zero.

For example. If you have one school-aged child in 2018, and your adjusted household income is $100,000 the formula would be this:

NORMAL MONTHLY BENEFIT:

- First reduction: 67,426-31,120 = $36,306 x 7% = $2,541.42

- Second reduction: 100,000-67,426 = $32,574 x 3.2% = $1,042.37

- 1 child: $5,602

- $5,602.00 minus $2,541.42 = $3,060.58 minus $1,042.37 = $2,018.21

- $2,978.21 divided by 12 = $168.18/month CCB as a Normal Benefit

COVID19 MAY 2020 BENEFIT:

- The first two reduction steps are the same but that 1 child is $3,600 more

- 1 child: $9,202

- $9,202.00 minus $2,541.42 = $6,660.58 minus $1,042.37 = $5,618.21

- $5,618.21 divided by 12 = $468.18/month CCB as a one-time Benefit (an extra $300 like promised)

So yes… an extra $300 per child for those already getting the benefit already… but for those that were not getting it before, but filed in 2018… and had an eligible child… the formula is recalculated with the $3,600 ($300 per month) change, and so many more households in Canada will be seeing some sort of amount.

For example, the lowest amount possible to collect would be with one school-aged child ($9,202 formula).

- Households that make up to $163,069 will receive the full $300 for this child.

- Households between $163,069 and $275,569 will receive less than $300 on a sliding scale from the Second reduction.

- Households over $275,569 in this scenario would receive zero.

So almost every household with eligible children in Canada will see something coming their way for the May benefit to help with the extra costs with no schools or dayhomes open.

Sincerely,

Your Friendly Neighbourhood Tax Nerds

CGL Strategic Business & Tax Advisors

CV of Cory G. Litzenberger, CPA, CMA, CFP, C.Mgr can be found here.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

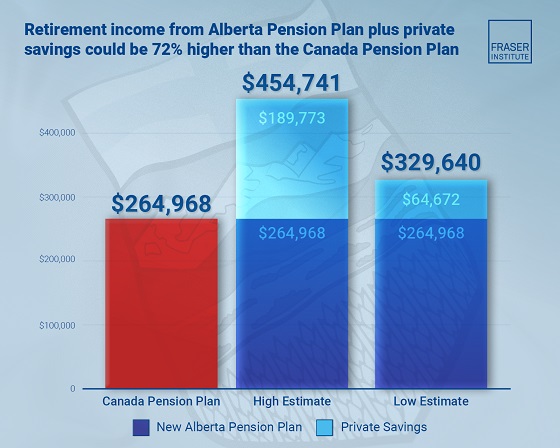

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Business24 hours ago

Business24 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!