Business

Red Deer Chamber of Commerce urging voters to choose a prosperous future

News release from the Red Deer and District Chamber of Commerce

A Vote for Prosperity is a Vote for a Better Alberta

Over the past few years Alberta has managed to emerge from the COVID 19 Pandemic in a strong position for growth and prosperity. Since 2019 the state of the business environment has improved in part due to the advocacy of the Alberta Chambers Network working together to advocate for strong business policies in Alberta. Some of those advances include lowering the general corporate tax rate turned declining investment in Alberta around, opening our borders to trade and labour mobility, leading efforts to build national trade corridors, and inspired reciprocity of provincial partners with a vision to build a stronger economy together. As well establishing the Alberta Indigenous Opportunities Corporation is setting a new standard for collaborative economic development to build healthy communities. And, for the first time in decades, our nonrenewable resource wealth is being prudently saved for the future.

Today, Alberta leads all provinces in wage growth and job creation per capita. But we cannot rest on our laurels. We need to continue to advocate for good business and economic development policies to continue to reach for a brighter future.

It is with this in mind the Red Deer & District Chamber of Commerce is supporting the Alberta Chambers of Commerce in their Vote Prosperity 2023 platform. This platform focuses on a number of policy recommendations with the goal of allowing our businesses to thrive and create the foundation for healthy and vibrant communities across our province.

Vote Prosperity 2023 informs a path forward for the next provincial government to continue expanding opportunities for shared prosperity. This path forward includes, furthering small businesses in Alberta’s corporate tax advantage to help entrepreneurs create jobs. Reducing regulatory burdens limiting trade and competition would improve cost competitiveness for business and affordability for residents, strengthening Alberta’s reputation as a proponent of commerce. Better preparing young Albertans with hands on learning would help them build careers around their talents and Alberta to develop a highly skilled workforce. Improving fiscal stability and value-for-money of local and provincial public services would enable investment attraction and the viability of our communities.

There are for pillars to the Vote Prosperity 2023 platform for business in Alberta:

1. Strengthening business competitiveness – Lead the nation in tax competitiveness and the reduction of regulatory burdens, Reduce Alberta’s greenhouse gas emissions while minimizing risks to business competitiveness, Enable competition and free trade for current and emerging sources of electricity. Work with Confederation partners to establish an internationally competitive regulatory environment for all industries.

2. Growing provincial trade – Facilitate collaboration among Indigenous communities and industry on economic development. Develop and expand economic corridors to increase access to domestic and international markets. Accelerate review and approval processes for trade-enabling infrastructure projects. Continue removing interprovincial trade barriers to strengthen local supply chains.

3. Building healthy communities – Deploy health care talent with sustainable resourcing throughout the province. Equip post-secondary institutions to meet employer demands through high-quality labor market information and targeted funding for in-demand occupations. Expand work-integrated and entrepreneurial learning models in K-12 and post-secondary education. Alleviate socio-economic and regulatory barriers to fully participate in the labour market.

4. Improving government accountability – Adhere to the fiscal sustainability framework and pay down debt. Appoint an independent panel of experts to review current and alternative revenue options with the view to deliver stable and predictable budgets. Eliminate or make transparent hidden and duplicative taxes within provincial purview. Align predictable funding for municipalities with performance metrics to improve local business services.

Albertans believe the province’s business community should have a role in developing a vision and providing leadership to move the province forward. Vote Prosperity 2023 provides that leadership. We encourage voters in the coming Alberta election to support candidates committed to our shared prosperity.

Representing over 24,000 businesses in our province, the Alberta Chambers is comprised of over 100 community Chambers throughout the province and the largest and most influential business association in the province. These pillars symbolize the outcome of nearly one hundred community-driven policies proposed by Chambers, with substantial contributions from the Red Deer Chamber. It is our belief these pillars are the foundation to restoring our province’s prosperity and the health and vibrancy of the communities that comprise it.

The Red Deer & District Chamber of Commerce in partnership with the Alberta Chambers is advocating this platform to all parties and candidates running for election this spring. For more information and to read the platform in its entirety, visit: https://www.abchamber.ca/wp-content/uploads/2023/04/VP-Designed-Platform-Doc.pdf

Established in 1894 the Red Deer & District Chamber of Commerce is a non-partisan, collaborative business leader representing over 825 member businesses. As one of Red Deer’s oldest and most established membership organizations we are striving to build a vibrant community that fosters an environment where businesses can lead, be innovative, sustainable, and grow.

Agriculture

Supply Management Is Making Your Christmas Dinner More Expensive

From the Frontier Centre for Public Policy

By Conrad Eder

The food may be festive, but the price tag isn’t, and supply management is to blame

With Christmas around the corner, Canadians will be heading to the grocery store to pick up the essentials for a tasty Christmas feast. Milk and eggs to make dinner rolls, butter for creamy mashed potatoes, an assortment of cheeses as an appetizer, and, of course, the Christmas turkey.

All delicious. All essential. And all more expensive than they need to be because of a longstanding government policy. It’s called supply management.

Consider what a family might purchase when hosting Christmas dinner. Two cartons of eggs, two cartons of milk, a couple of blocks of cheese, a few sticks of butter, and an eight-kilogram turkey. According to Agriculture and Agri-Food Canada and Statistics Canada, that basket of goods costs a little less than $80.

Using price premiums calculated in a 2015 University of Manitoba study, Canada’s supply management system is responsible for $16.69 to $20.48 of the cost of that Christmas dinner. That’s a 21 to 26 per cent premium Canadian consumers pay on those five staples alone. Planning on making a yogurt dip or serving ice cream with dessert? Those extra costs continue to climb.

Canadians pay these premiums for poultry, dairy and eggs because of how Canada’s supply management system works. Farmers must obtain government-issued production quotas that dictate how much they’re allowed to produce. Prices are set by government bodies rather than in an open market. High tariffs block imports and restrict competition from international producers.

The costs of supply management are significant, amounting to billions of dollars every year, yet they are largely hidden, spread across millions of households’ grocery bills. Meanwhile, the benefits flow to a small number of quota-holding farmers. Their quotas are worth millions of dollars and help ensure profitable returns.

These farmers have every incentive to lobby, organize and defend the current system. Wanting special protection is one thing. Actually being given it is another. It is the responsibility of elected officials to resist such demands. Elected to represent all Canadians, politicians should unapologetically prioritize the public interest over any special interests.

Yet in June 2025, Parliament did the opposite. Rather than solve a problem that costs Canadians billions each year, members of Parliament from every party, Liberal, Conservative, Bloc, NDP and Green, unanimously approved Bill C-202, further entrenching the system that makes grocery bills more expensive at a time when families can least afford it. Bill C-202 prohibits Canada from offering any further market access concessions on supply-managed sectors in future trade negotiations.

This decision is even more disappointing when we consider what other nations have already accomplished. Australia and New Zealand demonstrate that removing supply management is not only possible but beneficial.

Australia operated a dairy quota system for decades before abolishing it in 2000. New Zealand began dismantling its dairy supply management regime in 1984 and completed the process in 2001. Both countries found that competitive markets provided their citizens with the access to goods they needed without the hidden costs. If these countries could eliminate supply management, so can Canada.

As the government scrambles to combat the rising cost of living, one of the simplest and most effective solutions continues to be ignored. Eliminating supply management. Removing the quotas, the price controls and the tariffs would allow market competition to do what it does across every other product category. It delivers choice, quality and affordability.

As Canadians gather for Christmas dinner, the feast may be delicious, but it will once again be more expensive than it needs to be. That is the cost of supply management, and Canadians should no longer have to bear it.

Conrad Eder is a policy analyst at the Frontier Centre for Public Policy.

Business

Taxing food is like slapping a surcharge on hunger. It needs to end

This article supplied by Troy Media.

Cutting the food tax is one clear way to ease the cost-of-living crisis for Canadians

About a year ago, Canada experimented with something rare in federal policymaking: a temporary GST holiday on prepared foods.

It was short-lived and poorly communicated, yet Canadians noticed it immediately. One of the most unavoidable expenses in daily life—food—became marginally less costly.

Families felt a modest but genuine reprieve. Restaurants saw a bump in customer traffic. For a brief moment, Canadians experienced what it feels like when government steps back from taxing something as basic as eating.

Then the tax returned with opportunistic pricing, restoring a policy that quietly but reliably makes the cost of living more expensive for everyone.

In many ways, the temporary GST cut was worse than doing nothing. It opened the door for industry to adjust prices upward while consumers were distracted by the tax relief. That dynamic helped push our food inflation rate from minus 0.6 per cent in January to almost four per cent later in the year. By tinkering with taxes rather than addressing the structural flaws in the system, policymakers unintentionally fuelled volatility. Instead of experimenting with temporary fixes, it is time to confront the obvious: Canada should stop taxing food altogether.

Start with grocery stores. Many Canadians believe food is not taxed at retail, but that assumption is wrong. While “basic groceries” are zero-rated, a vast range of everyday food products are taxed, and Canadians now pay over a billion dollars a year in GST/HST on food purchased in grocery stores.

That amount is rising steadily, not because Canadians are buying more treats, but because shrinkflation is quietly pulling more products into taxable categories. A box of granola bars with six bars is tax-exempt, but when manufacturers quietly reduce the box to five bars, it becomes taxable. The product hasn’t changed. The nutritional profile hasn’t changed. Only the packaging has changed, yet the tax flips on.

This pattern now permeates the grocery aisle. A 650-gram bag of chips shrinks to 580 grams and becomes taxable. Muffins once sold in six-packs are reformatted into three-packs or individually wrapped portions, instantly becoming taxable single-serve items. Yogurt, traditionally sold in large tax-exempt tubs, increasingly appears in smaller 100-gram units that meet the definition of taxable snacks. Crackers, cookies, trail mixes and cereals have all seen slight weight reductions that push them past GST thresholds created decades ago. Inflation raises food prices; Canada’s outdated tax code amplifies those increases.

At the same time, grocery inflation remains elevated. Prices are rising at 3.4 per cent, nearly double the overall inflation rate. At a moment when food costs are climbing faster than almost everything else, continuing to tax food—whether on the shelf or in restaurants—makes even less economic sense.

The inconsistencies extend further. A steak purchased at the grocery store carries no tax, yet a breakfast wrap made from virtually the same inputs is taxed at five per cent GST plus applicable HST. The nutritional function is not different. The economic function is not different. But the tax treatment is entirely arbitrary, rooted in outdated distinctions that no longer reflect how Canadians live or work.

Lower-income households disproportionately bear the cost. They spend 6.2 per cent of their income eating outside the home, compared with 3.4 per cent for the highest-income households. When government taxes prepared food, it effectively imposes a higher burden on those often juggling two or three jobs with limited time to cook.

But this is not only about the poorest households. Every Canadian pays more because the tax embeds itself in the price of convenience, time and the realities of modern living.

And there is an overlooked economic dimension: restaurants are one of the most effective tools we have for stimulating community-level economic activity. When people dine out, they don’t just buy food. They participate in the economy. They support jobs for young and lower-income workers. They activate foot traffic in commercial areas. They drive spending in adjacent sectors such as transportation, retail, entertainment and tourism.

A healthy restaurant sector is a signal of economic confidence; it is often the first place consumers re-engage when they feel financially secure. Taxing prepared food, therefore, is not simply a tax on convenience—it is a tax on economic participation.

Restaurants Canada has been calling for the permanent removal of GST/HST on all food, and they are right. Eliminating the tax would generate $5.4 billion in consumer savings annually, create more than 64,000 foodservice jobs, add over 15,000 jobs in related sectors and support the opening of more than 2,600 new restaurants across the country. No other affordability measure available to the federal government delivers this combination of economic stimulus and direct relief.

And Canadians overwhelmingly agree. Eighty-four per cent believe food should not be taxed, regardless of where it is purchased. In a polarized political climate, a consensus of that magnitude is rare.

Ending the GST/HST on all food will not solve every affordability issue but it is one of the simplest, fairest and most effective measures the federal government can take immediately.

Food is food. The tax system should finally accept that.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Daily Caller1 day ago

Daily Caller1 day agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Great Reset1 day ago

Great Reset1 day agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Automotive1 day ago

Automotive1 day agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Digital ID1 day ago

Digital ID1 day agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Alberta1 day ago

Alberta1 day agoSchools should go back to basics to mitigate effects of AI

-

Community23 hours ago

Community23 hours agoCharitable giving on the decline in Canada

-

Bruce Dowbiggin1 day ago

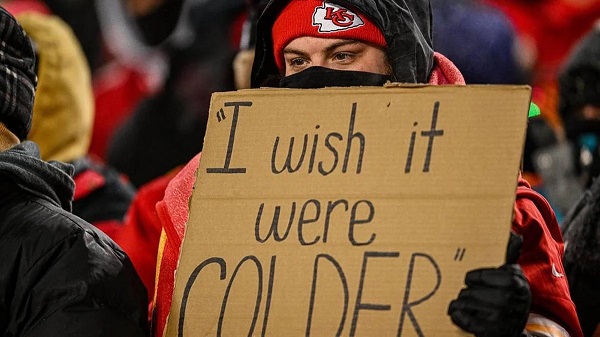

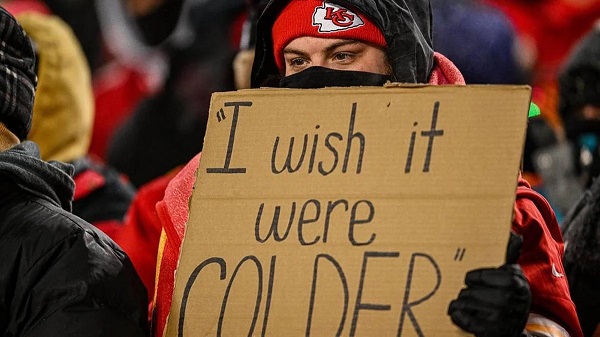

Bruce Dowbiggin1 day agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria