Alberta

INDUSTRY-INDIGENOUS RELATIONS: A TREND TOWARD DEEPER ENGAGEMENT

INDUSTRY-INDIGENOUS RELATIONS: A TREND TOWARD DEEPER ENGAGEMENT

The Canadian oil and natural gas industry has a strong history of engagement with Indigenous peoples. Since its early initiatives, the petroleum sector has had many learnings and opportunities for growth with respect to its interactions with Indigenous communities. Consequently, these relationships have evolved towards ever-deepening forms of engagement including consultation and business partnerships. However, the nature of these relationships has been difficult to communicate with credibility; arrangements between companies and communities are often confidential, thus limiting the ability of industry to share positive stories of engagement.

The Canadian Association of Petroleum Producers (CAPP), an association that represents Canada’s oil and natural gas producers, has utilized multiple surveys of its members in order to better understand the relationship between industry and Indigenous peoples. One of these surveys, known as the Telling Our Story survey, was commissioned by CAPP and conducted by Dr. Ken Coates of the University of Saskatchewan. Additionally, CAPP developed its own survey focused on procurement, community investment and consultation capacity funding in the oil sands. These surveys provide data that demonstrate the value producers place on building long-term, sustainable relationships with Indigenous communities. In particular, economic engagement is viewed as a primary opportunity to establish good relations and support Indigenous self- determination.

Survey Methodology

The purpose of the Telling Our Story survey was to collect information about the oil and natural gas industry’s efforts to engage Indigenous communities. Research was conducted by Dr. Ken Coates, Canada Research Chair in Regional Innovation at the Johnson-Shoyama Graduate School of Public Policy, University of Saskatchewan. Dr. Coates used a comprehensive survey of industry representatives, in partnership with CAPP, plus CAPP’s member companies and partner associations including the Canadian Council for Aboriginal Business, the Petroleum Services Association of Canada, the Canadian Energy Pipeline Association, and the Canadian Association of Geophysical Contractors. A total of 122 companies participated in the study, representing a cross-section of the oil and natural gas industry in Canada. Data was collected in a confidential manner, anonymized and aggregated into a final report. The survey highlighted key themes related to industry’s engagement with Indigenous communities.

Consultation and Community Engagement

Companies within the oil and natural gas industry have developed long-term relationships with communities, and these relationships are multifaceted. Of course, a core aspect of relationship-building takes place through consultation processes. The trend toward consultation accelerated in 2004 with the Supreme Court of Canada decision on Haida Nation v. British Columbia, which determined the Crown has a duty to consult and accommodate Indigenous peoples when making a decision that could affect their constitutional rights. Procedural aspects of this duty can be delegated to industry, and now industry conducts the majority of project consultations. Survey respondents noted that today, companies are actively engaged in this process, seeking to ensure meaningful, two-way discussion in consultations. CAPP members indicated that they view these relationships formed through consultation as critically important to their business. Many companies have teams of staff dedicated to consulting and building relationships with communities, and funding is often provided to support community capacity to engage in consultations. A separate survey of CAPP’s oil sands members found that between 2015 and 2016, oil sands operators provided $40.79 million for consultation capacity funding to local Indigenous communities.

Associated with consultations are a variety of forms of engagement. CAPP’s members placed particular value on supporting various community activities, social and cultural priorities, and infrastructure needs. The aforementioned survey of oil sands members found that between 2015 and 2016 operators in the region spent $48.6 million on Indigenous community investment. According to companies, these focused investments positively impact relationships. Furthermore, there has been a trend toward the negotiation of long- term, collaborative agreements between project proponents and Indigenous communities in areas of operation that address community concerns and include clauses related to procurement, employment, community investment, dispute resolution, capacity funding and other topics of importance to the proponent and the community.

Economic Engagement

According to oil and natural gas producers, there is a strong emphasis on economic engagement as the priority in building relationships. In particular, procurement – the purchasing of goods and services from Indigenous businesses – presents a significant opportunity for mutual benefit. Both joint venture partnerships and preferential contracting arrangements with Indigenous-owned companies enable companies to build links and trust with communities. The focus on these arrangements is evidenced by substantial financial investment: in 2015 to 2016, oil sands producers spent $3.3 billion on procurement from 399 Indigenous owned- companies in 65 Alberta communities. While a sizable proportion of Indigenous businesses may be small or new, the data suggests their role in the sector will continue to increase.

This type of engagement allows Indigenous peoples to leverage their own expertise, build capacity, and ultimately establish pathways to prosperity. In this regard, industry can play an important role in supporting successful, self-determining communities. Although procurement was ranked most highly in terms of its benefit to the relationship between producers and communities, there are other forms of economic engagement; a number of companies have Indigenous recruitment strategies and support training programs intended to build the technical skillset of Indigenous employees and contractors.

Conclusion

The research commissioned by CAPP highlights the emphasis that oil and natural gas sector companies place on meaningful consultation, partnerships, and in particular, economic engagement. Industry has made strides in building deeper partnerships, and it is expected that the trend toward more meaningful engagement will continue. As an industry association, CAPP believes the oil and natural gas sector has an important role in tangibly advancing reconciliation together with Indigenous peoples in response to the Truth and Reconciliation Commission’s Call to Action 92. CAPP believes its role in reconciliation can be described as identifying and finding feasible ways to share economic opportunities arising from resource development, while continuing to learn, grow and improve strong relationships based on trust, respect, and open communication. Industry’s understanding will continue to develop, and the sector is open to further dialogue in order to inform its understanding of industry’s role in reconciliation.

Thanks to Todayville for helping us bring our members’ stories of collaboration and innovation to the public.

Click to read a foreward from JP Gladu, Chief Development and Relations Officer, Steel River Group; Former President and CEO, Canadian Council for Aboriginal Business.

JP Gladu, Chief Development and Relations Officer, Steel River Group; Former President & CEO, Canadian Council for Aboriginal Business

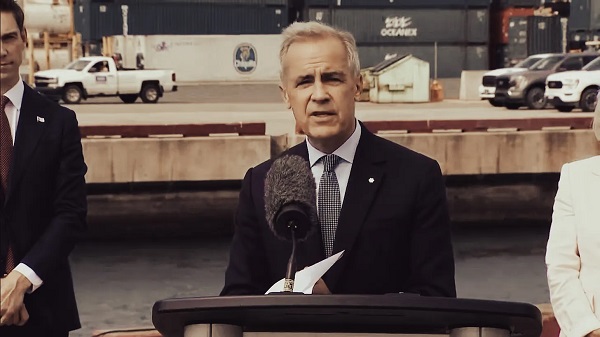

Click to read comments about this series from Jacob Irving, President of the Energy Council of Canada.

Jacob Irving, President of Energy Council of Canada

The Canadian Energy Compendium is an annual initiative by the Energy Council of Canada to provide an opportunity for cross-sectoral collaboration and discussion on current topics in Canada’s energy sector. The 2020 Canadian Energy Compendium: Innovations in Energy Efficiency is due to be released November 2020.

Click below to read more stories from Energy Council of Canada’s Compendium series.

PETER SUTHERLAND SR GENERATING STATION POWERS NORTHEAST ONTARIO

Alberta

Sylvan Lake high school football coach fired for criticizing gender ideology sends legal letter to school board

From LifeSiteNews

The letter on behalf of Alberta high school volunteer football coach Taylor ‘Teej’ Johannesson mentions ‘workplace harassment’ while demanding his job back.

A Sylvan Lake high school football coach who was fired for sharing his views opposing transgender ideology on social media in a video discussing his Christian faith sent a legal demand to his former school board demanding he get his job back.

H.J. Cody High School volunteer coach Taylor “Teej” Johannesson, as reported by LifeSiteNews, earlier this month was fired by his school’s principal because he spoke out against gender-confused youth who “take their hatred of Christians” to another level by committing violent acts against them.

School principal Alex Lambert fired Teej, as he is known, as a result of a TikTok video in which he speaks out against radical gender ideology and the dangers it brings.

In a recent update involving his case, local media with knowledge of Johannesson’s issues with the principal at H.J. Cody High School in Sylvan Lake, Alberta, confirmed a legal demand letter was sent to the school.

The letter reads, “From his perspective, this opposition is consistent with the Alberta government’s position and legislation prohibiting prescribing prescription hormones to minors and providing care to them that involves transition surgeries.”

In the letter, the school board’s “workplace harassment” procedure is mentioned, stating, “Any act of workplace harassment or workplace violence shall be considered unacceptable conduct whether that conduct occurs at work, on Division grounds, or at division-sponsored activities.”

The legal demand letter, which was sent to school officials last week, reads, “Given that Mr. Johannesson’s expression in the TikTok Video was not connected to his volunteer work, the principal and the division have no authority to regulate his speech and punish him by the Termination decision, which is ultra vires (“beyond the powers.)”

Johannesson has said, in speaking with local media, that his being back at work at the school as a volunteer coach has meaning: “It’s about trying to create some change within the school system.”

He noted how, for “too long,” a certain “political view, one ideology, has taken hold in the school system.”

“I’m hoping that this demand letter, and all the attention that they’ve gotten over this, causes them to make some change,” he stated.

Johannesson has contacted Alberta’s Chief of Staff for the Minister of Education about his firing and was told that there is a board meeting taking place over the demand letter.

According to Teej, Lambert used his TikTok video as an excuse to get rid of someone in the school with conservative political views and who is against her goal to place “safe space stickers” all over the school.

Teej has been in trouble before with the school administration. About three years ago, he was called in to see school officials for posting on Twitter a biological fact that “Boys have a penis. Girls have a vagina.”

Alberta’s Conservative government under Premier Danielle Smith has in place a new policy protecting female athletes from gender-confused men that has taken effect across the province.

As LifeSiteNews previously reported, the Government of Alberta is currently fighting a court order that is blocking the province’s newly passed ban on transgender surgeries and drugs for children.

Alberta also plans to ban books with sexually explicit as well as pornographic material, many of which contain LGBT and even pedophilic content, from all school libraries.

Alberta

Parents group blasts Alberta government for weakening sexually explicit school book ban

From LifeSiteNews

By

The revised rules no longer place restrictions on written descriptions of sexual content.

Some parental rights advocates have taken issue with the Conservative government of Alberta’s recent updates to a ban on sexually explicit as well as pornographic material from all school libraries, saying the new rules water down the old ones as they now allow for descriptions of extreme and graphic sexual acts in written form.

As reported by LifeSiteNews last week, Alberta Education Minister Demetrios Nicolaides of the ruling United Conservative Party (UCP) released revised rules outlining the province’s ban on sexually explicit content in school libraries.

The original ban included all forms of sexually explicit as well as pornographic material. However, after a large public school board alleged the ban applied to classic books, the government changed the rules, removing a clause for written sexual content that has some parental rights groups up in arms.

Tanya Gaw, founder of the conservative-leaning Action4Canada, noted to media that while she is happy with Premier Danielle Smith for the original book ban, she has deep concerns with the revised rules.

“We are very concerned about the decision that no longer places restrictions on written descriptions of those acts, which is problematic,” she said in an interview with The Epoch Times.

Gaw noted how kids from kindergarten to grade 12 should “never” be “exposed to graphic written details of sex acts: incest, molestation, masturbation, sexual assaults, and profane vulgar language.”

According to John Hilton-O’Brien, who serves as the executive director of Parents for Choice in Education, the new rule changes regarding written depictions “still shifts the burden onto parents to clean up what should never have been purchased in the first place.”

He did say, however, that the new “Ministerial Order finally makes catalogs public, and what we see there is troubling.”

Alberta’s revised rules state that all school library books must not contain “explicit visual depictions of a sexual act.” To make it clear, the standards in detail go over the types of images that are banned due to their explicit pornographic nature.

All Alberta schools have until October 31 to provide a list of books that will be removed under the new rules, with the ban taking effect on January 5, 2026.

As reported by LifeSiteNews in May, Smith’s UCP government went ahead with plans to ban books with sexually explicit as well as pornographic material, many of which contain LGBT and even pedophilic content, from all school libraries.

The ban was to take effect on October 1.

The UCP’s crackdown on sexual content in school libraries comes after several severely sexually explicit graphic novels were found in school libraries in Calgary and Edmonton.

The pro-LGBT books in question at multiple school locations are Gender Queer, a graphic novel by Maia Kobabe; Flamer, a graphic novel by Mike Curato; Blankets, a graphic novel by Craig Thompson; and Fun Home, a graphic novel by Alison Bechdel.

-

Business2 days ago

Business2 days agoRed tape is killing Canadian housing affordability

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoUK Police Chief Hails Facial Recognition, Outlines Drone and AI Policing Plans

-

Health2 days ago

Health2 days agoMAiD should not be a response to depression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPost election report indicates Canadian elections are becoming harder to secure

-

International2 days ago

International2 days agoTrump to Confront Starmer Over UK Free Speech Laws During State Visit

-

Duane Rolheiser2 days ago

Duane Rolheiser2 days agoUnite the Kingdom Rally: demonstrators take to the streets in historical numbers to demand end to mass migration in the UK

-

Crime2 days ago

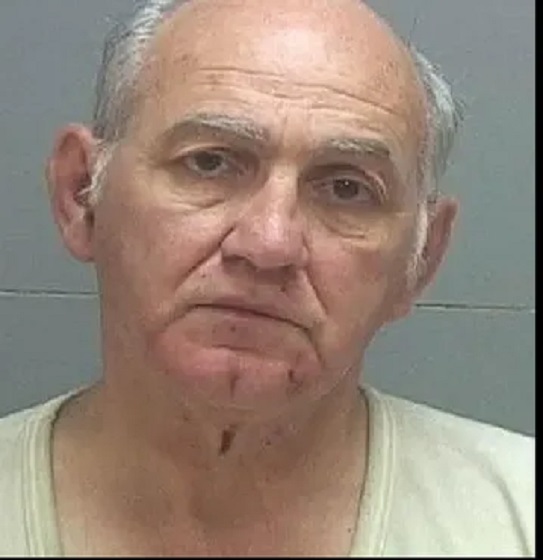

Crime2 days agoOlder man arrested at Kirk shooting admits to protecting real gunman

-

MAiD2 days ago

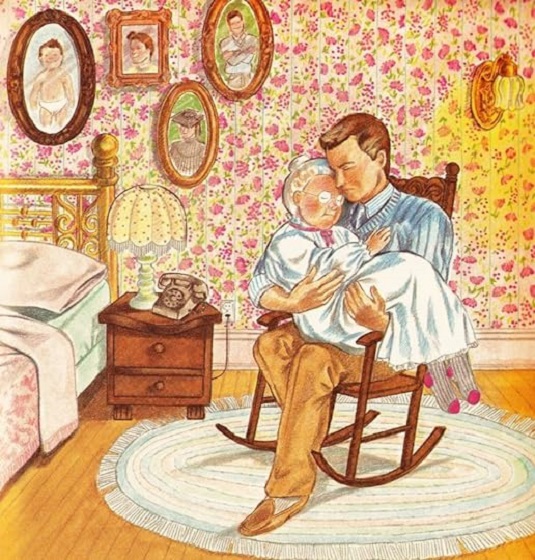

MAiD2 days agoFamous Canadian children’s author Robert Munsch says he plans to die by euthanasia