Gerry Feehan

Hiking in Ireland (part 2 of a 3 part series)

Hiking Ireland (second in a three-part series)

‘A good walk spoiled’ is how Mark Twain described the game of golf. But clearly Huck Finn’s author never had the pleasure of strolling the links of Ireland. Having said that, after eight days chunking shots and misreading putts at Ballybunion, Lahinch, and a number of other venerable golf courses with seven buddies, I was more than ready to hang up the clubs and go walkabout.

Five of the lads made their way to Dublin Airport for the long flight back to Canada, but I and two lucky buddies remained behind at the Brooks Hotel, awaiting the arrival of our better halves – and the second portion of our Emerald Isle adventure. We were bound for a week of relaxed hiking in the west of Ireland. I was looking forward to a calmer, tamer chapter than the golf marathon. A road trip with the boys can leave one’s body – and brain – badly bruised.

We were slumped in easy chairs in the lobby of the Brooks perusing the Irish Times when a cab pulled up and the gals came swinging through the doors. We kissed hello while Connor, the affable doorman, unloaded bags. After a quick freshen up we hit Dublin’s late afternoon streets, introducing the ladies to the Stag’s Head, our favourite Temple Bar pub, where we slurped a Guinness, stared up at the stuffed stags staring down upon us and chowed down on some fine Irish stew. In the morning, before boarding the train for Killarney – the starting point of our hike – we enjoyed a city walking tour, visiting the statues of sweet Molly Malone and Oscar Wilde who, amongst other great witticisms, coined the phrase about imitation being the sincerest form of flattery. As an unrepentant pilferer of other people’s ideas, I tip my hat to Oscar.

In the morning, before boarding the train for Killarney – the starting point of our hike – we enjoyed a city walking tour, visiting the statues of sweet Molly Malone and Oscar Wilde who, amongst other great witticisms, coined the phrase about imitation being the sincerest form of flattery. As an unrepentant pilferer of other people’s ideas, I tip my hat to Oscar.

Oscar Wilde in clever repose

Making small talk in the taxi en route to the train station, I looked up at the sky and asked the driver, “Are you expecting rain?” He looked at me as if I were daft and said, “This is Ireland lad, we are always expecting rain.”

Sun and cloud dance together on MacGillycuddy’s Reeks

The train-view from Dublin to Killarney was uneventful – lots of tunnels and high hedges. On arrival, a dark-haired woman with a friendly face and a broad smile greeted us on the platform. Elaine Farrell introduced herself as we threw our packs in the back of an eight-seater van. Elaine, from Ireland Walk, Hike, Bike, would be our driver, private guide and constant companion for the week.

Elaine Farrell and canine friend enjoying Killarney Lake

The forecast for hiking was not as favourable as it had been for our golf week but, as the locals joyfully proclaim: “You don’t come to Ireland for the weather.”

The first day began with a soggy boat trip to the headwaters of the Three Lakes, in Killarney National Park. As we motored the narrow waters, the third-generation boatman entertained us with local history – some of which may have been true – and an infectious laugh. We docked at Lord Brandon’s Cottage from whence we tromped the ancient Butter Road from Mol’s Gap back to Killarney town.

A lovely Irish beach day!

After two nights in Killarney, we packed for Cahersiveen and a beach hike on the north shore of the Ring of Kerry. From there we moved on to Dingle and a glorious trek skirting Annascaul Lake.

We climbed up and through a mountain pass connecting the south of Dingle peninsula to the north. As we reached the summit, we encountered a solitary shepherd clad in leather breeches, a soiled woolen sweater and gumboots. He also sported a grizzled visage.

The shy shepherd.

I asked for his picture but he shook his head resolutely, “I’m not that attractive. Better to get a shot of the dog.” But the border collie was having none of it and hurried off in search of a wayward lamb.

Elaine turned and, as always, sloshed ahead, warning us around wet spots and cautioning against the few poisonous plants. “Beware the kidney vetch,” she said, “it can lead to Dingle chin.” She laughed, then strode into a field of bog cotton.

Every hike was different and unique. One afternoon we marched along a lonely beach, skirting sea-scoured boulders, tidal pools and the rising sea. Another day it was a narrow path, with ancient stone walls flanking our journey. There were high traverses and stunning outlooks to the ocean.

Mossy stone walls mark the ancient path.

foxtail season

And every night was unique. A fine pub with great dinner. Fish and chips with mushy peas, spring lamb, stew. And good company.

Mushy peas anyone?

Elaine always ate with us. In my experience it is unusual for a guide to eat supper with the guests; usually they’re exhausted after a long day attending to the whims of indulged tourists, so the tour boss lets them have a peaceful, solitary evening. But Elaine’s energy never abated. She was there ‘til the bitter end each night. And in the morning there she was, knapsack packed and water bottle full, ready to pilot us on a new adventure. These names won’t mean much to you, but if you’re thinking of traversing Ireland’s paths you should consider the Kerry Way, Derrynane, the Dingle Peninsula, Slea Head and the pilgrimage up Mount Brandon.

On our Mt. Brandon day, the final chapter in our weeklong experience, the summit was socked in – so Elaine spontaneously changed the itinerary. Scanning the horizon, she spotted the remains of a 15th century lookout on Brandon Head overlooking the sea and said, “Shall we give that a go?”

Elaine photo bombs the kissing gate at Brandon Head.

We jumped in the van, veering past ripening hay fields and a soggy peat bog toward what appeared to be a trailhead. Elaine asked the local landowner for permission to enter and directions to the summit – which were happily proffered – and off we trod up the steep pitch. The hike was a highlight – and the reward spectacular. As we climbed toward the ruins the path narrowed to a ridge; to the south all of verdant Dingle laid out below us, to the north certain death loomed over a sheer cliff.

The rugged coast of Brandon Head.

We ate lunch in the lee of the old fort, protected from the buffeting wind by a crumbling wall. “Brilliant,” Elaine said. We all looked around and silently agreed.

If you go: www.irelandwalkhikebike.com

Gerry Feehan is an award-winning travel writer and photographer. He and his wife Florence now live in Kimberley, BC! Thanks to Kennedy Wealth Management for sponsoring this travel series.

Gerry Feehan is an award-winning travel writer and photographer. He and his wife Florence now live in Kimberley, BC! Thanks to Kennedy Wealth Management for sponsoring this travel series.

We will travel again but in the meantime, enjoy Gerry’s ‘Buddy Trip to Ireland’

Gerry Feehan

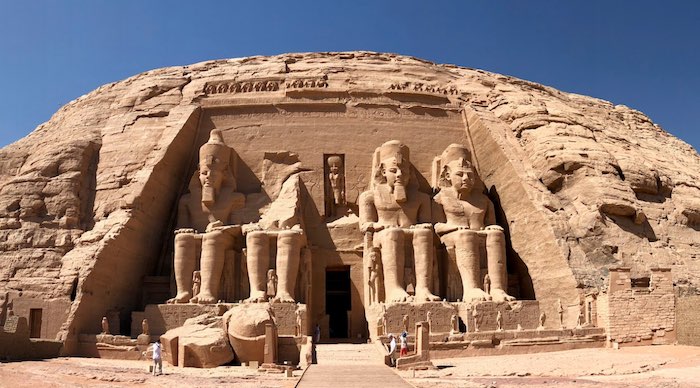

Abu Simbel

Abu Simbel is a marvel of ancient and modern engineering

I love looking out the window of an airplane at the earth far below, seeing where coast meets water or observing the eroded remains of some ancient formation in the changing light. Alas, the grimy desert sand hadn’t been cleaned from the windows of our EgyptAir jet, so we couldn’t see a thing as we flew over Lake Nasser en route to Abu Simbel. I was hopeful that this lack of attention to detail would not extend to other minor maintenance items, such as ensuring the cabin was pressurized or the fuel tank full.

We had just spent a week on a dahabiya sailboat cruising the Nile River, and after disembarking at Aswan, were headed further south to see one of Egypt’s great

monuments. There are a couple of ways to get to Abu Simbel from Aswan. You can ride a bus for 4 hours through the scorched Sahara Desert, or you can take a plane for the short 45-minute flight.

Opaque windows notwithstanding, I was glad we had chosen travel by air. Abu Simbel is spectacular, but there’s really not much to see except the monument itself and a small adjacent museum. So most tourists, us included, make the return trip in a day. And fortunately we had Sayed Mansour, an Egyptologist, on board. Sayed was there to explain all and clear our pained expressions.

Although it was early November, the intense Nubian sun was almost directly overhead, so Sayed led us to a quiet, shady spot where he began our introduction to

Egyptian history. Abu Simbel is a marvel of engineering — both modern and ancient. The temples were constructed during the reign of Ramses II. Carved from solid rock in a sandstone cliff overlooking the mighty river, these massive twin temples stood sentinel at a menacing bend in the Nile — and served as an intimidating obstacle to would-be invaders — for over 3000 years. But eventually Abu Simbel fell into disuse and succumbed to the inevitable, unrelenting Sahara. The site was nearly swallowed by sand when it was “rediscovered” by European adventurers in the early 19 th century. After years of excavation and restoration, the monuments resumed their original glory.

Then, in the 1960’s, Egyptian president Abdel Nasser decided to construct a new “High Dam” at Aswan. Doing so would create the largest man-made lake in the

world, 5250 sq km of backed-up Nile River. This ambitious project would bring economic benefit to parched Egypt, control the unpredictable annual Nile flood and also supply hydroelectric power to a poor, under-developed country. With the dam, the lights would go on in most Egyptian villages for the first time. But there were also a couple of drawbacks, which were conveniently swept under the water carpet by the government. The new reservoir would displace the local Nubian population whose forbearers had farmed the fertile banks of the Nile River for millennia. And many of Egypt’s greatest monuments and tombs would be forever submerged beneath the deep new basin — Abu Simbel included. But the government proceeded with the dam, monuments be damned.

Only after the water began to rise did an international team of archaeologists, scientists — and an army of labourers — begin the process of preserving these

colossal wonders. In an urgent race against the rising tide, the temples of Abu Simbel were surgically sliced into gigantic pieces, transported up the bank to safety and reassembled. The process was remarkable, a feat of engineering genius. And today the twin edifices, honouring Ramses and his wife Nefertari remain, gigantic, imperious and intact. But instead of overlooking a daunting corner of the Nile, this UNESCO World Heritage site now stands guard over a vast shimmering lake.

Sayed led us into the courtyard from our shady refuge and pointed to the four giant Colossi that decorate the exterior façade of the main temple. These statues of

Ramses were sculpted directly from Nile bedrock and sat stonily observing the river for 33 centuries. It was brutally hot under the direct sun. I was grateful for the new hat I had just acquired from a gullible street merchant. Poor fellow didn’t know what hit him. He started out demanding $40, but after a prolonged and brilliant negotiating session, I closed the deal for a trifling $36. It was difficult to hold back a grin as I sauntered away sporting my new fedora — although the thing did fall apart a couple of days later.

Sayed walked us toward the sacred heart of the shrine and lowered his voice. Like all Egyptians, Sayed’s native tongue is Arabic. But, oddly, his otherwise perfect English betrayed a slight cockney accent. (Sayed later disclosed that he had spent a couple of years working in an East London parts factory.) He showed us how the great hypostyle hall of the temple’s interior is supported by eight enormous pillars honouring Osiris, god of the underworld.

Exploring the inner temple

Nefertari

Sayed then left us to our devices. There were no other tourists. We had this incredible place to ourselves. In the dim light, we scampered amongst the sculptures

and sarcophagi, wandering, hiding and giggling as we explored the interior and its side chambers. At the far end lay the “the holiest of holies” a room whose walls were adorned with ornate carvings honouring the great Pharaoh’s victories — and offering tribute to the gods that made Ramses’ triumphs possible.

Exterior photographs of Abu Simbel are permitted, but pictures from within the sanctuary are verboten — a rule strictly enforced by the vigilant temple guardians — unless you offer a little baksheesh… in which case you can snap away to your heart’s content. Palms suitably greased, the caretakers are happy to pose with you in front of a hidden hieroglyph or a forbidden frieze, notwithstanding the stern glare of Ramses looking down from above.

A little baksheesh is key to holding the key

After our brief few hours at Abu Simbel, we hopped back on the plane. The panes weren’t any clearer but, acknowledging that there really wasn’t much to see in the Sahara — and that dirty airplane windows are not really a bona fide safety concern — I took time on the short flight to relax and bone up on Ramses the Great, whose mummified body awaited us at the Egyptian Museum in Cairo.

Exodus Travel skilfully handled every detail of our Egypt adventure: www.exodustravels.com/

Gerry Feehan is an award-winning travel writer and photographer. He lives in Kimberley, BC.

Thanks to Kennedy Wealth Management for sponsoring this series. Click on the ads and learn more about this long-term local business.

Gerry Feehan

Cairo – Al-Qahirah

The Pyramids of Giza

The first thing one notices upon arrival in Egypt is the intense level of security. I was screened once, scanned twice and patted down thrice between the time we landed at the airport and when we finally stepped out into the muggy Cairo evening. At our hotel the scrutiny continued with one last investigation of our luggage in the lobby. Although Egyptian security is abundant in quantity, the quality is questionable. The airport x-ray fellow, examining the egg shaker in my ukulele case, sternly demanded, “This, this, open this.” When I innocently shook the little plastic thing to demonstrate its impermeability he recoiled in horror, but then observed it with fascination and called over his supervisor. Thus began an animated, impromptu percussion session. As for the ukulele, it was confiscated at hotel check-in and imprisoned in the coat check for the duration of our Cairo stay. The reasons proffered for the seizure of this innocuous little instrument ranged from “safety purposes” to “forbidden entertainment”. When, after a very long day, we finally collapsed exhausted into bed, I was shaken — but did not stir.

Al-Qahirah has 20 million inhabitants, all squeezed into a thin green strip along the Nile River. Fading infrastructure and an exponential growth in vehicles have contributed to its well-deserved reputation as one of the world’s most traffic-congested cities. The 20km trip from our hotel in the city center, to the Great Pyramid of Cheops at Giza across the river, took nearly two hours. The driver smiled, “Very good, not rush hour.”

Our entrance fee for the Giza site was prepaid but we elected to fork out the extra Egyptian pounds to gain access to the interior of the Great Pyramid. Despite the up-charge — and the narrow, dark, claustrophobic climb – the reward, standing in Cheop’s eternal resting place, a crypt hidden deep inside the pyramid, was well worth it. We also chose to stay after sunset, dine al fresco in the warm Egyptian evening, and watch the celebrated ‘sound and light’ performance. The show was good. The food was marginal. Our waiter’s name was Fahid. Like many devout Muslim men, he sported a zabiba, or prayer bump, a callus developed on the forehead from years of prostration. Unfortunately throughout the event Fahid hovered over us, attentive to the point of irritation, blocking our view of the spectacle while constantly snapping fingers at his nervous underlings. The ‘son et lumière’ show was a little corny, but it’s pretty cool to see a trio of 4500-year-old pyramids – and the adjoining Great Sphinx — illuminated by 21 st century technology.

The Great Sphinx

Giza at nightThe next night our group of six Canucks attended an Egyptian cooking class. Our ebullient hostess was Anhar, (‘the River’ in Arabic). Encouraged by her contagious enthusiasm, we whipped up a nice tabouli salad, spicy chicken orzo soup and eggplant moussaka. We finished up with homemade baklava. Throughout the evening, Anhar quizzed us about the ingredients, the herbs and spices, their origins and proper method of preparation. Anyone who answered correctly was rewarded with her approving nod and a polite clap. Soon a contest ensued. Incorrect answers resulted in a loud communal ‘bzzzt’ — like the sound ending a hockey game. It’s not polite to blow one’s own horn, but the Feehan contingent acquitted themselves quite nicely. If I still had her email, Anhar could confirm this.

Cairo was not the highlight of our three-week Egyptian holiday, but a visit to the capital is mandatory. First there’s the incredible Pyramids. But as well there’s the Egyptian Museum that houses the world’s largest collection of Pharaonic antiquities including the golden finery of King Tutankhamen and the mummified remains of Ramses the Great. Ramses’ hair is rust coloured and thinning a little, but overall he looks pretty good for a guy entering his 34 th century.

Ramses the Great

Then there’s Khan el-Khalili, the old souk or Islamic bazaar. We strolled its ancient streets and narrow meandering alleyways, continually set upon by indefatigable street hawkers. “La shukraan, no thanks,” we repeated ineffectually a thousand times. The souk’s cafes were jammed. A soccer match was on. The ‘beautiful game’ is huge in Egypt. Men and women sat, eyes glued to the screen, sipping tea and inhaling hubbly bubbly.

The Old Souk Bazaar

Selfies, Souk style

An aside. When traveling in Egypt, be sure to carry some loose change for the hammam (el baño for those of you who’ve been to Mexico). At every hotel, restaurant, museum and temple — even at the humblest rural commode — an attendant vigilantly guards the lavatory. And have small bills for the requisite baksheesh. You’re not getting change.

After our evening in the souk we had an early call. Our guide Sayed Mansour met us at 6am in the hotel lobby. “Yella, yella. Hurry, let’s go,” he said. “Ana mish bahasir – I’m not joking.” “Afwan,” we said. “No problem,” and jumped into the van. As we pulled away from the curb Sayed began the day’s tutorial, reciting a poem by Percy Blythe Shelly:

I met a traveller from an antique land,

Who said—“Two vast and trunkless legs of stone

Stand in the desert. . . . My name is Ozymandias, King of Kings;

Look on my Works, ye Mighty, and despair!”

And we were off, through the desert, to Alexandria. Founded by Alexander the Great in 332 BC, Egypt’s ancient capital was built on the Nile delta, where the world’s longest river meets the Mediterranean Sea. The day was a bit of a bust. The city was once renowned for its magnificent library and the famed Lighthouse of Alexandria. But the former burnt down shortly after Christ was born and the latter — one of the original seven wonders of the ancient world – toppled into the sea a thousand years ago. Absent some interesting architecture, a nice view of the sea from the Citadel — and Sayed’s entertaining commentary — Alexandria wasn’t really worth the long day trip. Besides, we needed to get back to Cairo and pack our swimwear. Sharm el Sheikh and the warm waters of the Red Sea were next up on the Egyptian agenda.

Gerry with some Egyptian admirers

Exodus Travel skilfully handled every detail of our trip: www.exodustravels.com And, if you’re thinking of visiting Egypt, I can suggest a nice itinerary. No sense reinventing the pyramid: [email protected]

Gerry Feehan is an award-winning travel writer and photographer. He lives in Kimberley, BC.

Thanks to Kennedy Wealth Management for sponsoring this series. Click on the ads and learn more about this long-term local business.

-

Business2 days ago

Business2 days agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Business1 day ago

Business1 day agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

International2 days ago

International2 days agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Energy1 day ago

Energy1 day agoIf Canada Wants to be the World’s Energy Partner, We Need to Act Like It

-

Alberta1 day ago

Alberta1 day agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoHow Vimy Ridge Shaped Canada

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis