Business

Green Technology Is “Pie In The Sky” According To Premier Kenny

The economic benefits of oil and gas in Alberta are well known. The volatility of the boom and bust cycle is also a familiar song and dance in this province. When you take into consideration the environmental impact of the resource, the fossil fuel industry is a double-edged sword. It’s also commonly understood that moving to a renewable future, with less environmental impact, is better for everyone in the long run.

To me, the solution is pretty straight forward: the sooner we move to a renewable long-term energy mix, the better off we will be.

The path forward that I’ve heard from the Alberta business community is that we need a strong fossil fuel industry to support a renewable industry – that we can have oil and gas companies working side by side with renewable energy companies, growing the Canadian energy industry together. Profits from a strong economy can be used to finance our diversification.

During the April 24th press conference, Jason Kenny threw that narrative out the window. He wants Alberta to be a petrol state, full stop.

When Tom Ross from 660 news asked the Premier about working with the US on the Green New Deal, he got quite upset. He made it absolutely clear that he is only interested in fossil fuel jobs.

“Our focus is on getting people back to work in Alberta, not pie in the sky ideological schemes.”

For the UCP, the only good job is an oil job.

The Premier went on to say “That kind of question in the middle of an economic crisis from a Calgary based media outlet, frankly, throws me for a loop”.

What message does that send to the thousands of Albertans who are working in renewable energy?

What about Iron and Earth, the non-profit that is training oil field workers with additional skills so they can work in both fields? What about the students at SAIT, NAIT, the University of Calgary, and the University of Alberta who are in alternative energy courses?

What about the people who are currently working in renewable energy at companies like BluEarth, Eavor, and SkyFire? Do their jobs not count? Are the projects that they operate and profit from “pie in the sky”?

What about the former Prime Minister Stephen Harper and his new role at Terrestrial Energy? Does the work he’s doing to develop nuclear power in Canada qualify as “pie in the sky”?

The main goal of the Green New Deal is “meeting 100 percent of the power demand in the United States through clean, renewable, and zero-emission energy sources”

That’s a completely reasonable goal in my opinion. There is no reason why Canada and Alberta shouldn’t work with the US to help them develop their plan. Unless your goal is to create oil jobs instead of jobs.

There are shovel-ready projects that will put Albertans to work in areas other than oil and gas. Not to mention the potential in this province in areas like software, technology, manufacturing, and engineering services. There are viable solutions being left cold because the UCP is so focused on fossil fuels, they can’t see anything else.

Teck Resources exits energy industry group CAPP, citing cost-cutting

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Business

Prime minister can make good on campaign promise by reforming Canada Health Act

From the Fraser Institute

While running for the job of leading the country, Prime Minister Carney promised to defend the Canada Health Act (CHA) and build a health-care system Canadians can be proud of. Unfortunately, to have any hope of accomplishing the latter promise, he must break the former and reform the CHA.

As long as Ottawa upholds and maintains the CHA in its current form, Canadians will not have a timely, accessible and high-quality universal health-care system they can be proud of.

Consider for a moment the remarkably poor state of health care in Canada today. According to international comparisons of universal health-care systems, Canadians endure some of the lowest access to physicians, medical technologies and hospital beds in the developed world, and wait in queues for health care that routinely rank among the longest in the developed world. This is all happening despite Canadians paying for one of the developed world’s most expensive universal-access health-care systems.

None of this is new. Canada’s poor ranking in the availability of services—despite high spending—reaches back at least two decades. And wait times for health care have nearly tripled since the early 1990s. Back then, in 1993, Canadians could expect to wait 9.3 weeks for medical treatment after GP referral compared to 30 weeks in 2024.

But fortunately, we can find the solutions to our health-care woes in other countries such as Germany, Switzerland, the Netherlands and Australia, which all provide more timely access to quality universal care. Every one of these countries requires patient cost-sharing for physician and hospital services, and allows private competition in the delivery of universally accessible services with money following patients to hospitals and surgical clinics. And all these countries allow private purchases of health care, as this reduces the burden on the publicly-funded system and creates a valuable pressure valve for it.

And this brings us back to the CHA, which contains the federal government’s requirements for provincial policymaking. To receive their full federal cash transfers for health care from Ottawa (totalling nearly $55 billion in 2025/26) provinces must abide by CHA rules and regulations.

And therein lies the rub—the CHA expressly disallows requiring patients to share the cost of treatment while the CHA’s often vaguely defined terms and conditions have been used by federal governments to discourage a larger role for the private sector in the delivery of health-care services.

Clearly, it’s time for Ottawa’s approach to reflect a more contemporary understanding of how to structure a truly world-class universal health-care system.

Prime Minister Carney can begin by learning from the federal government’s own welfare reforms in the 1990s, which reduced federal transfers and allowed provinces more flexibility with policymaking. The resulting period of provincial policy innovation reduced welfare dependency and government spending on social assistance (i.e. savings for taxpayers). When Ottawa stepped back and allowed the provinces to vary policy to their unique circumstances, Canadians got improved outcomes for fewer dollars.

We need that same approach for health care today, and it begins with the federal government reforming the CHA to expressly allow provinces the ability to explore alternate policy approaches, while maintaining the foundational principles of universality.

Next, the Carney government should either hold cash transfers for health care constant (in nominal terms), reduce them or eliminate them entirely with a concordant reduction in federal taxes. By reducing (or eliminating) the pool of cash tied to the strings of the CHA, provinces would have greater freedom to pursue reform policies they consider to be in the best interests of their residents without federal intervention.

After more than four decades of effectively mandating failing health policy, it’s high time to remove ambiguity and minimize uncertainty—and the potential for politically motivated interpretations—in the CHA. If Prime Minister Carney wants Canadians to finally have a world-class health-care system then can be proud of, he should allow the provinces to choose their own set of universal health-care policies. The first step is to fix, rather than defend, the 40-year-old legislation holding the provinces back.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

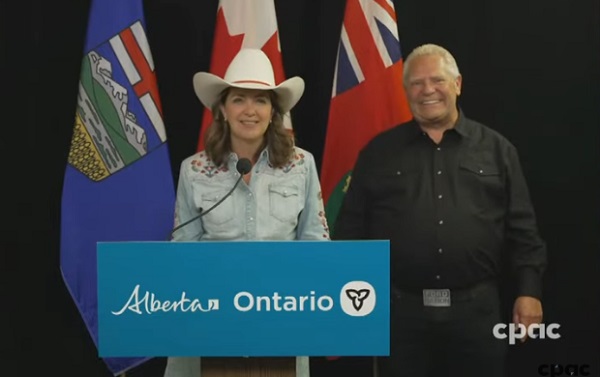

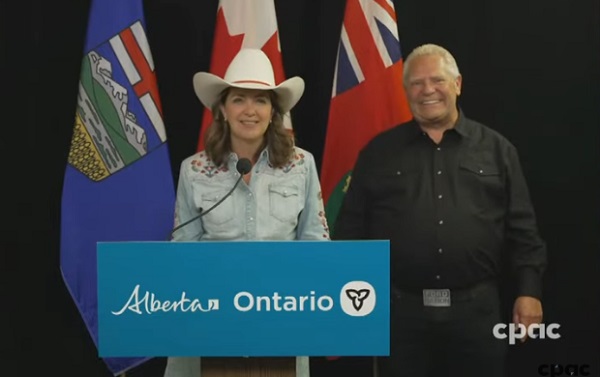

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Fraser Institute24 hours ago

Fraser Institute24 hours agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually