From The Center Square

Canada caved to President Donald Trump demands by pulling its digital services tax hours before it was to go into effect on Monday.

Trump said Friday that he was ending all trade talks with Canada over the digital services tax, which he called a direct attack on the U.S. and American tech firms. The DST required foreign and domestic businesses to pay taxes on some revenue earned from engaging with online users in Canada.

“Based on this egregious Tax, we are hereby terminating ALL discussions on Trade with Canada, effective immediately,” the president said. “We will let Canada know the Tariff that they will be paying to do business with the United States of America within the next seven day period.”

By Sunday, Canada relented in an effort to resume trade talks with the U.S., it’s largest trading partner.

“To support those negotiations, the Minister of Finance and National Revenue, the Honourable François-Philippe Champagne, announced today that Canada would rescind the Digital Services Tax (DST) in anticipation of a mutually beneficial comprehensive trade arrangement with the United States,” according to a statement from Canada’s Department of Finance.

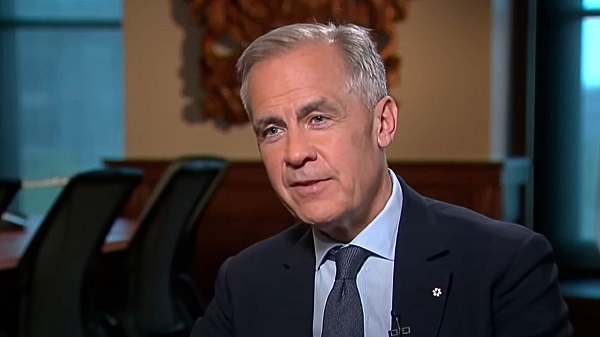

Canada’s Department of Finance said that Prime Minister Mark Carney and Trump agreed to resume negotiations, aiming to reach a deal by July 21.

U.S. Commerce Secretary Howard Lutnick said Monday that the digital services tax would hurt the U.S.

“Thank you Canada for removing your Digital Services Tax which was intended to stifle American innovation and would have been a deal breaker for any trade deal with America,” he wrote on X.

Earlier this month, the two nations seemed close to striking a deal.

Trump said he and Carney had different concepts for trade between the two neighboring countries during a meeting at the G7 Summit in Kananaskis, in the Canadian Rockies.

Asked what was holding up a trade deal between the two nations at that time, Trump said they had different concepts for what that would look like.

“It’s not so much holding up, I think we have different concepts, I have a tariff concept, Mark has a different concept, which is something that some people like, but we’re going to see if we can get to the bottom of it today.”

Shortly after taking office in January, Trump hit Canada and Mexico with 25% tariffs for allowing fentanyl and migrants to cross their borders into the U.S. Trump later applied those 25% tariffs only to goods that fall outside the free-trade agreement between the three nations, called the United States-Mexico-Canada Agreement.

Trump put a 10% tariff on non-USMCA compliant potash and energy products. A 50% tariff on aluminum and steel imports from all countries into the U.S. has been in effect since June 4. Trump also put a 25% tariff on all cars and trucks not built in the U.S.

Economists, businesses and some publicly traded companies have warned that tariffs could raise prices on a wide range of consumer products.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families, and pay down the national debt.

A tariff is a tax on imported goods paid by the person or company that imports them. The importer can absorb the cost of the tariffs or try to pass the cost on to consumers through higher prices.

Trump’s tariffs give U.S.-produced goods a price advantage over imported goods, generating revenue for the federal government.