Fraser Institute

Federal government’s fiscal record—one for the history books

From the Fraser Institute

By Jake Fuss and Grady Munro

Per-person federal spending is expected to equal $11,901 this year. To put this into perspective, this is significantly more than Ottawa spent during the global financial crisis in 2008 or either world war.

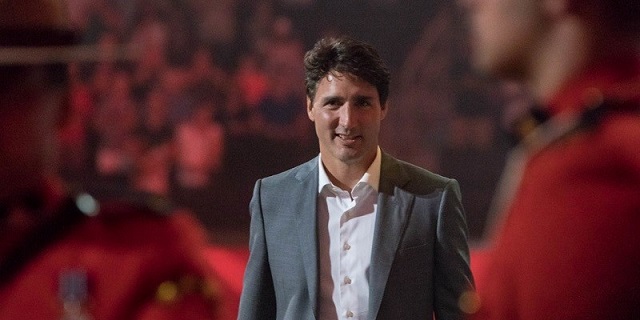

The Trudeau government tabled its 2024 budget earlier this month and the contents of the fiscal plan laid bare the alarming state of federal finances. Both spending and debt per person are at or near record highs and prospects for the future don’t appear any brighter.

In the budget, the Trudeau government outlined plans for federal finances over the next five years. Annual program spending (total spending minus debt interest costs) will reach a projected $483. billion in 2024/25, $498.7 billion in 2025/26, and continue growing in the years following. By 2028/29 the government plans to spend $542.0 billion on programs—an 18.4 per cent increase from current levels.

This is not a new or surprising development for federal finances. Since taking office in 2015, the Trudeau government has shown a proclivity to spend at nearly every turn. Prime Minister Trudeau has already recorded the five highest levels of federal program spending per person (adjusted for inflation) in Canadian history from 2018 to 2022. Projections for spending in the 2024 budget assert the prime minister is now on track to have the eight highest years of per-person spending on record by the end of the 2025/26 fiscal year.

Per-person federal spending is expected to equal $11,901 this year. To put this into perspective, this is significantly more than Ottawa spent during the global financial crisis in 2008 or either world war. It’s also about 28.0 per cent higher than the full final year of Stephen Harper’s time as prime minister, meaning the size of the federal government has expanded by more than one quarter in a decade.

The government has chosen to borrow substantial sums of money to fund a lot of this marked growth in spending. Federal debt under the Trudeau government has risen before, during and after COVID regardless of whether the economy is performing relatively well or comparatively poor. Between 2015 and 2024, Ottawa is expected to run 10 consecutive deficits, with total gross debt set to reach $2.1 trillion within the next 12 months.

The scale of recent debt accumulation is eye-popping even after accounting for a growing population and the relatively high inflation of the past two years. By the end of the current fiscal year, each Canadian will be burdened with $12,769 more in total federal debt (adjusted for inflation) than they were in 2014/15.

You can attribute some of this increase in borrowing to the effects of COVID, but debt had already grown by $2,954 per person from 2014 to 2019—before the pandemic. Moreover, budget estimates show gross debt per person (adjusted for inflation) is expected to rise by more than $2,500 by 2028/29.

As with spending, the Trudeau government is on track to record the six highest years of federal debt per-person (adjusted for inflation) in Canadian history between 2020/21 and the end of its term next autumn. Why should Canadians care about this record debt?

Simply put, rising debt leads to higher interest payments that current and future generations of taxpayers must pay—leaving less money for important priorities such as health care and social services. Moreover, all this spending and debt hasn’t helped improve living standards for Canadians. Canada’s GDP per person—a broad measure of incomes—was lower at the end of 2023 than it was nearly a decade ago in 2014.

The Trudeau government’s track record with federal finances is one for the history books. Ottawa’s spending continues to be at near-record levels and Canadians have never been burdened with more debt. Those aren’t the type of records we should strive to achieve.

Authors:

Business

National dental program likely more costly than advertised

From the Fraser Institute

By Matthew Lau

At the beginning of June, the Canadian Dental Care Plan expanded to include all eligible adults. To be eligible, you must: not have access to dental insurance, have filed your 2024 tax return in Canada, have an adjusted family net income under $90,000, and be a Canadian resident for tax purposes.

As a result, millions more Canadians will be able to access certain dental services at reduced—or no—out-of-pocket costs, as government shoves the costs onto the backs of taxpayers. The first half of the proposition, accessing services at reduced or no out-of-pocket costs, is always popular; the second half, paying higher taxes, is less so.

A Leger poll conducted in 2022 found 72 per cent of Canadians supported a national dental program for Canadians with family incomes up to $90,000—but when asked whether they would support the program if it’s paid for by an increase in the sales tax, support fell to 42 per cent. The taxpayer burden is considerable; when first announced two years ago, the estimated price tag was $13 billion over five years, and then $4.4 billion ongoing.

Already, there are signs the final cost to taxpayers will far exceed these estimates. Dr. Maneesh Jain, the immediate past-president of the Ontario Dental Association, has pointed out that according to Health Canada the average patient saved more than $850 in out-of-pocket costs in the program’s first year. However, the Trudeau government’s initial projections in the 2023 federal budget amounted to $280 per eligible Canadian per year.

Not all eligible Canadians will necessarily access dental services every year, but the massive gap between $850 and $280 suggests the initial price tag may well have understated taxpayer costs—a habit of the federal government, which over the past decade has routinely spent above its initial projections and consistently revises its spending estimates higher with each fiscal update.

To make matters worse there are also significant administrative costs. According to a story in Canadian Affairs, “Dental associations across Canada are flagging concerns with the plan’s structure and sustainability. They say the Canadian Dental Care Plan imposes significant administrative burdens on dentists, and that the majority of eligible patients are being denied care for complex dental treatments.”

Determining eligibility and coverage is a huge burden. Canadians must first apply through the government portal, then wait weeks for Sun Life (the insurer selected by the federal government) to confirm their eligibility and coverage. Unless dentists refuse to provide treatment until they have that confirmation, they or their staff must sometimes chase down patients after the fact for any co-pay or fees not covered.

Moreover, family income determines coverage eligibility, but even if patients are enrolled in the government program, dentists may not be able to access this information quickly. This leaves dentists in what Dr. Hans Herchen, president of the Alberta Dental Association, describes as the “very awkward spot” of having to verify their patients’ family income.

Dentists must also try to explain the program, which features high rejection rates, to patients. According to Dr. Anita Gartner, president of the British Columbia Dental Association, more than half of applications for complex treatment are rejected without explanation. This reduces trust in the government program.

Finally, the program creates “moral hazard” where people are encouraged to take riskier behaviour because they do not bear the full costs. For example, while we can significantly curtail tooth decay by diligent toothbrushing and flossing, people might be encouraged to neglect these activities if their dental services are paid by taxpayers instead of out-of-pocket. It’s a principle of basic economics that socializing costs will encourage people to incur higher costs than is really appropriate (see Canada’s health-care system).

At a projected ongoing cost of $4.4 billion to taxpayers, the newly expanded national dental program is already not cheap. Alas, not only may the true taxpayer cost be much higher than this initial projection, but like many other government initiatives, the dental program already seems to be more costly than initially advertised.

Business

Prairie provinces and Newfoundland and Labrador see largest increases in size of government

From the Fraser Institute

By Jake Fuss and Grady Munro

A recent study found that Canada has experienced one of the largest increases in the size of government of any advanced country over the last decade. But within Canada, which provinces have led the way?

The size of government refers to the extent to which resources within the economy are controlled and directed by the government, and has important implications for economic growth, living standards, and economic freedom—the degree to which people are allowed to make their own economic choices.

Too much of anything can be harmful, and this is certainly true regarding the size of government. When government grows too large it begins to take on roles and resources that are better left to the private sector. For example, rather than focusing on core functions like maintaining the rule of law or national defence, a government that has grown too large might begin subsidizing certain businesses and industries over others (i.e. corporate welfare) in order to pick winners and losers in the market. As a result, economic growth slows and living standards are lower than they otherwise would be.

One way to measure the size of government is by calculating total general government spending as a share of the economy (GDP). General government spending refers to spending by governments at all levels (federal, provincial, and municipal), and by measuring this as a share of gross domestic product (GDP) we can compare across jurisdictions of different sizes.

A recent study compared the size of government in Canada as a whole with that of 39 other advanced economies worldwide, and found that Canada experienced the second-largest increase in the size of government (as a share of the economy) from 2014 to 2024. In other words, since 2014, governments in Canada have expanded their role within the economy faster than governments in virtually every other advanced country worldwide—including all other countries within the Group of Seven (France, Germany, Italy, Japan, the United Kingdom, and the United States). Moreover, the study showed that Canada as a whole has exceeded the optimal size of government (estimated to fall between 24 and 32 per cent of GDP) at which a country can maximize their economic growth. Beyond that point, growth slows and is lower than it otherwise would be.

However, Canada is a decentralized country and provinces vary as to the extent to which governments direct overall economic activity. Using data from Statistics Canada, the following charts illustrate which provinces in Canada have the largest size of government and which have seen the largest increases since 2014.

The chart above shows total general government spending as a share of GDP for all ten provinces in 2023 (the latest year of available provincial data). The size of government in the provinces varies considerably, ranging from a high of 61.4 per cent in Nova Scotia to a low of 30.0 per cent in Alberta. There are geographical differences, as three Atlantic provinces (Nova Scotia, Prince Edward Island, and New Brunswick) have the largest governments while the three western-most provinces (Alberta, Saskatchewan, and British Columbia) have the smallest governments. However, as of 2023, all provinces except Alberta exceeded the optimal size of government—which again, is between 24 and 32 per cent of the economy.

To show which provinces have experienced the greatest increase in the size of government in recent years, the second chart shows the percentage point increase in total general government spending as a share of GDP from 2014 to 2023. It should be noted that this is measuring the expansion of the federal government’s role in the economy—which has been substantial nationwide—as well as growth in the respective provincial and municipal governments.

The increases in the size of government since 2014 are largest in four provinces: Newfoundland and Labrador (10.82 percentage points), Alberta (7.94 percentage points), Saskatchewan (7.31 percentage points), and Manitoba (7.17 percentage points). These are all dramatic increases—for perspective, in the study referenced above, Estonia’s 6.66 percentage point increase in its size of government was the largest out of 40 advanced countries.

The remaining six provinces experienced far lower increases in the size of government, ranging from a 2.74 percentage point increase in B.C. to a 0.44 percentage point increase in Quebec. However, since 2014, every province in Canada has seen government expand its role within the economy.

Over the last decade, Canada has experienced a substantial increase in the size of total government. Within the country, Newfoundland and Labrador and the three Prairie provinces have led the way in growing their respective governments.

-

Alberta14 hours ago

Alberta14 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime13 hours ago

Crime13 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Health12 hours ago

Health12 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Bruce Dowbiggin15 hours ago

Bruce Dowbiggin15 hours agoThe Game That Let Canadians Forgive The Liberals — Again

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

Alberta2 days ago

Alberta2 days agoAlberta uncorks new rules for liquor and cannabis