Alberta

Standing for Alberta – The Fight for a Fair Deal Within Canada

A new organization called Fairness Alberta has recently joined the ongoing national conversation discussing Alberta’s role in the Canadian landscape as a major contributor to the wealth and general prosperity of the country. Arguments surrounding the value of Alberta, which position it as Canada’s neglected province, have long been a contentious topic at the regional and national levels.

In 2016, Conservative MP Michelle Rempel famously made waves at parliament when she accused the federal government of treating Alberta like a “fart in the room, that no one wants to acknowledge or talk about” (1).

In October 2019, the results of the Canadian Federal Election saw the outrage of many across western Canada, giving rise to the popular Western Exit, better known as WEXIT, movement. Based on fundamental principles of economic liberty and social stability, WEXIT advocates for Western Canadian sovereignty through the secession of the western provinces from the rest of the country.

In January 2020, Alberta Proud hosted The Value of Alberta: A One-Day Conference on Alberta’s Future, featuring keynote topics such as “The Economic Value of Alberta”, “Is there a Canadian Manifesto without Alberta?” and “Reasons Alberta Struggles to fit and Where we go Next”.

On Monday, May 25, Fairness Alberta joined the ranks of Albertans dissatisfied with the federal government’s treatment of Alberta, seeking to take a stand against biased policies and regulations. This Proudly Canadian, Fiercely Albertan organization operates on non-partisan, factual fundamentals, seeking not to deepen the divide between Alberta and the rest of the country, but to bridge the gap through education, discussion and understanding.

Bill Bewick, Executive Director Fairness Alberta, brings extensive experience to the organization with a PhD in Political Science from Michigan State University and years spent working as a political consultant, as well as within the Alberta legislature. “It is entirely outside of our mandate to speculate about separatism,” says Bewick of the WEXIT movement, “our goal is to get a better deal for Alberta, within Canada.”

At the core of their organization, Fairness Alberta believes Canadians should recognize how a prosperous Alberta benefits Canada as a whole. According to Bewick, FA founders and members share a fundamental frustration regarding “how little people and politicians seem to understand about the amount of money leaving Alberta every year.” The Alberta Transfer Meter, operated by Fairness Alberta, features a running total of Alberta’s net contributions to other provinces in the form of federal taxes and EI premiums over the last two decades. According to the Meter, Albertans have seen an estimated total of $324 billion of their tax dollars spent in other Canadian provinces from the year 2000 to 2019.

Dedicated to informing the rest of the country about “the importance of Alberta’s contributions to Canada, and about the unfair nature of various federal policies, actions, and decisions from Ottawa”, Fairness Alberta hopes to help level the Canadian playing field in regards to fiscal, trade, energy, procurement and infrastructure issues.

“Alberta’s contributions are taken for granted,” says Bewick, “We want to encourage investment in a place that has shown high levels of productivity in the past and has a lot of potential for the future.” In achieving this goal, Bewick adds, “we really think education and open discussion are critical in reaching a common ground and having any significant change take place.”

Since their official launch, Fairness Alberta has experienced positive pick-up and feedback from the Alberta public, and is committed to continued growth and expansion throughout the rest of Canada. Dialogue based and donation driven, Bewick encourages the public to reach out, share feedback and join the conversation surrounding Alberta’s future.

For more information on Fairness Alberta and how to get involved, visit https://www.fairnessalberta.ca.

For more stories, visit Todayville Calgary.

Alberta

‘Far too serious for such uninformed, careless journalism’: Complaint filed against Globe and Mail article challenging Alberta’s gender surgery law

Macdonald Laurier Institute challenges Globe article on gender medicine

The complaint, now endorsed by 41 physicians, was filed in response to an article about Alberta’s law restricting gender surgery and hormones for minors.

On June 9, the Macdonald-Laurier Institute submitted a formal complaint to The Globe and Mail regarding its May 29 Morning Update by Danielle Groen, which reported on the Canadian Medical Association’s legal challenge to Alberta’s Bill 26.

Written by MLI Senior Fellow Mia Hughes and signed by 34 Canadian medical professionals at the time of submission to the Globe, the complaint stated that the Morning Update was misleading, ideologically slanted, and in violation the Globe’s own editorial standards of accuracy, fairness, and balance. It objected to the article’s repetition of discredited claims—that puberty blockers are reversible, that they “buy time to think,” and that denying access could lead to suicide—all assertions that have been thoroughly debunked in recent years.

Given the article’s reliance on the World Professional Association for Transgender Health (WPATH), the complaint detailed the collapse of WPATH’s credibility, citing unsealed discovery documents from an Alabama court case and the Cass Review’s conclusion that WPATH’s guidelines—and those based on them—lack developmental rigour. It also noted the newsletter’s failure to mention the growing international shift away from paediatric medical transition in countries such as the UK, Sweden, and Finland. MLI called for the article to be corrected and urged the Globe to uphold its commitment to balanced, evidence-based journalism on this critical issue.

On June 18, Globe and Mail Standards Editor Sandra Martin responded, defending the article as a brief summary that provided a variety of links to offer further context. However, the three Globe and Mail news stories linked to in the article likewise lacked the necessary balance and context. Martin also pointed to a Canadian Paediatric Society (CPS) statement linked to in the newsletter. She argued it provided “sufficient context and qualification”—despite the fact that the CPS itself relies on WPATH’s discredited guidelines. Notwithstanding, Martin claimed the article met editorial standards and that brevity justified the lack of balance.

MLI responded that brevity does not excuse misinformation, particularly on a matter as serious as paediatric medical care, and reiterated the need for the Globe to address the scientific inaccuracies directly. MLI again called for the article to be corrected and for the unsupported suicide claim to be removed. As of this writing, the Globe has not responded.

Letter of complaint

June 9, 2025

To: The Globe and Mail

Attn: Sandra Martin, standards editor

CC: Caroline Alphonso, health editor; Mark Iype, deputy national editor and Alberta bureau chief

To the editors;

Your May 29 Morning Update: The Politics of Care by Danielle Groen, covering the Canadian Medical Association’s legal challenge to Alberta’s Bill 26, was misleading and ideologically slanted. It is journalistically irresponsible to report on contested medical claims as undisputed fact.

This issue is far too serious for such uninformed, careless journalism lacking vital perspectives and scientific context. At stake is the health and future of vulnerable children, and your reporting risks misleading parents into consenting to irreversible interventions based on misinformation.

According to The Globe and Mail’s own Journalistic Principles outlined in its Editorial Code of Conduct, the credibility of your reporting rests on “solid research, clear, intelligent writing, and maintaining a reputation for honesty, accuracy, fairness, balance and transparency.” Moreover, your principles go on to state that The Globe will “seek to provide reasonable accounts of competing views in any controversy.” The May 29 update violated these principles. There is, as I will show, a widely available body of scientific information that directly contests the claims and perspectives presented in your article. Yet this information is completely absent from your reporting.

The collapse of WPATH’s credibility

The article’s claim that Alberta’s law “falls well outside established medical practice” and could pose the “greatest threat” to transgender youth is both false and inflammatory. There is no global medical consensus on how to treat gender-distressed young people. In fact, in North America, guidelines are based on the Standards of Care developed by the World Professional Association for Transgender Health (WPATH)—an organization now indisputably shown to place ideology above evidence.

For example, in a U.S. legal case over Alabama’s youth transition ban, WPATH was forced to disclose over two million internal emails. These revealed the organization commissioned independent evidence reviews for its latest Standards of Care (SOC8)—then suppressed those reviews when they found overwhelmingly low-quality evidence. Yet WPATH proceeded to publish the SOC8 as if it were evidence-based. This is not science. It is fraudulent and unethical conduct.

These emails also showed Admiral Rachel Levine—then-assistant secretary for Health in the Biden administration—pressured WPATH to remove all lower age recommendations from the guidelines—not on scientific grounds, but to avoid undermining ongoing legal cases at the state level. This is politics, not sound medical practice.

The U.K.’s Cass Review, a major multi-year investigation, included a systematic review of the guidelines in gender medicine. A systematic review is considered the gold standard because it assesses and synthesizes all the available research in a field, thereby reducing bias and providing a large comprehensive set of data upon which to reach findings. The systematic review of gender medicine guidelines concluded that WPATH’s standards of care “lack developmental rigour” and should not be used as a basis for clinical practice. The Cass Review also exposed citation laundering where medical associations endlessly recycled weak evidence across interlocking guidelines to fabricate a false consensus. This led Cass to suggest that “the circularity of this approach may explain why there has been an apparent consensus on key areas of practice despite the evidence being poor.”

Countries like Sweden, Finland, and the U.K. have now abandoned WPATH and limited or halted medicalized youth transitions in favour of a therapy-first approach. In Norway, UKOM, an independent government health agency, has made similar recommendations. This shows the direction of global practice is moving away from WPATH’s medicalized approach—not toward it. As part of any serious effort to “provide reasonable accounts of competing views,” your reporting should acknowledge these developments.

Any journalist who cites WPATH as a credible authority on paediatric gender medicine—especially in the absence of contextualizing or competing views—signals a lack of due diligence and a fundamental misunderstanding of the field. It demonstrates that either no independent research was undertaken, or it was ignored despite your editorial standards.

Puberty blockers don’t ‘buy time’ and are not reversible

Your article repeats a widely debunked claim: that puberty blockers are a harmless pause to allow young people time to explore their identity. In fact, studies have consistently shown that between 98 per cent and 100 per cent of children placed on puberty blockers go on to take cross-sex hormones. Before puberty blockers, most children desisted and reconciled with their birth sex during or after puberty. Now, virtually none do.

This strongly suggests that blocking puberty in fact prevents the natural resolution of gender distress. Therefore, the most accurate and up-to-date understanding is that puberty blockers function not as a pause, but as the first step in a treatment continuum involving irreversible cross-sex hormones. Indeed, a 2022 paper found that while puberty suppression had been “justified by claims that it was reversible … these claims are increasingly implausible.” Again, adherence to the Globe’s own editorial guidelines would require, at minimum, the acknowledgement of the above findings alongside the claims your May 29 article makes.

Moreover, it is categorically false to describe puberty blockers as “completely reversible.” Besides locking youth into a pathway of further medicalization, puberty blockers pose serious physical risks: loss of bone density, impaired sexual development, stunted fertility, and psychosocial harm from being developmentally out of sync with peers. There are no long-term safety studies. These drugs are being prescribed to children despite glaring gaps in our understanding of their long-term effects.

Given the Globe’s stated editorial commitment to principles such as “accuracy,” the crucial information from the studies linked above should be provided in any article discussing puberty blockers. At a bare minimum, in adherence to the Globe’s commitment to “balance,” this information should be included alongside the contentious and disputed claims the article makes that these treatments are reversible.

No proof of suicide prevention

The most irresponsible and dangerous claim in your article is that denying access to puberty blockers could lead to “depression, self-harm and suicide.” There is no robust evidence supporting this transition-or-suicide narrative, and in fact, the findings of the highest-quality study conducted to date found no evidence that puberty suppression reduces suicide risk.

Suicide is complex and attributing it to a single cause is not only false—it violates all established suicide reporting guidelines. Sensationalized claims like this risk creating contagion effects and fuelling panic. In the public interest, reporting on the topic of suicide must be held to the most rigorous standards, and provide the most high-quality and accurate information.

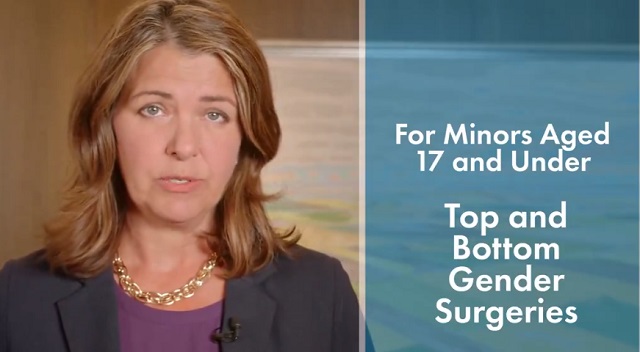

Euphemism hides medical harm

Your use of euphemistic language obscures the extreme nature of the medical interventions being performed in gender clinics. Calling double mastectomies for teenage girls “paediatric breast surgeries for gender-affirming reasons” sanitizes the medically unnecessary removal of a child’s healthy organs. Referring to phalloplasty and vaginoplasty as “gender-affirming surgeries on lower body parts” conceals the fact that these are extreme operations involving permanent disfigurement, high complication rates, and often requiring multiple revisions.

Honest journalism should not hide these facts behind comforting language. Your reporting denies youth, their parents, and the general public the necessary information to understand the nature of these interventions. Members of the general public rely greatly on the news media to equip them with such information, and your own editorial standards claim you will fulfill this core responsibility.

Your responsibility to the public

As a flagship Canadian news outlet, your responsibility is not to amplify activist messaging, but to report the truth with integrity. On a subject as medically and ethically fraught as paediatric gender medicine, accuracy is not optional. The public depends on you to scrutinize claims, not echo ideology. Parents may make irreversible decisions on behalf of their children based on the narratives you promote. When reporting is false or ideologically distorted, the cost is measured in real-world harm to some of our society’s most vulnerable young people.

I encourage the Globe and Mail to publish an updated version on this article in order to correct the public record with the relevant information discussed above, and to modify your reporting practices on this matter going forward—by meeting your own journalistic standards—so that the public receives balanced, correct, and reliable information on this vital topic.

Trustworthy journalism is a cornerstone of public health—and on the issue of paediatric gender medicine, the stakes could not be higher.

Sincerely,

Mia Hughes

Senior Fellow, Macdonald-Laurier Institute

Author of The WPATH Files

The following 41 physicians have signed to endorse this letter:

Dr. Mike Ackermann, MD

Dr. Duncan Veasey, Psy MD

Dr. Rick Gibson, MD

Dr. Benjamin Turner, MD, FRCSC

Dr. J.N. Mahy, MD, FRCSC, FACS

Dr. Khai T. Phan, MD, CCFP

Dr. Martha Fulford, MD

Dr. J. Edward Les, MD, FRCPC

Dr. Darrell Palmer, MD, FRCPC

Dr. Jane Cassie, MD, FRCPC

Dr. David Lowen, MD, FCFP

Dr. Shawn Whatley, MD, FCFP (EM)

Dr. David Zitner, MD

Dr. Leonora Regenstreif, MD, CCFP(AM), FCFP

Dr. Gregory Chan, MD

Dr. Alanna Fitzpatrick, MD, FRCSC

Dr. Chris Millburn, MD, CCFP

Dr. Julie Curwin, MD, FRCPC

Dr. Roy Eappen, MD, MDCM, FRCP (c)

Dr. York N. Hsiang, MD, FRCSC

Dr. Dion Davidson, MD, FRCSC, FACS

Dr. Kevin Sclater, MD, CCFP (PC)

Dr. Theresa Szezepaniak, MB, ChB, DRCOG

Dr. Sofia Bayfield, MD, CCFP

Dr. Elizabeth Henry, MD, CCFP

Dr. Stephen Malthouse, MD

Dr. Darrell Hamm, MD, CCFP

Dr. Dale Classen, MD, FRCSC

Dr. Adam T. Gorner, MD, CCFP

Dr. Wesley B. Steed, MD

Dr. Timothy Ehmann, MD, FRCPC

Dr. Ryan Torrie, MD

Dr. Zachary Heinricks, MD, CCFP

Dr. Jessica Shintani, MD, CCFP

Dr. Mark D’Souza, MD, CCFP(EM), FCFP*

Dr. Joanne Sinai, MD, FRCPC*

Dr. Jane Batt, MD*

Dr. Brent McGrath, MD, FRCPC*

Dr. Leslie MacMillan MD FRCPC (emeritus)*

Dr. Ian Mitchell, MD, FRCPC*

Dr. John Cunnington, MD

*Indicates physician who signed following the letter’s June 9 submission to the Globe and Mail, but in advance of this letter being published on the MLI website.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Alberta3 hours ago

Alberta3 hours ago‘Far too serious for such uninformed, careless journalism’: Complaint filed against Globe and Mail article challenging Alberta’s gender surgery law