Opinion

Budget 2019 – Poor wording requires 2 ex-spouses within 5 years for Home Buyers Plan

This is one of those rare times I hope I am wrong in my interpretation, and look forward to being proven wrong by my professional colleagues.

On March 19, 2019 the federal government tabled its election-year budget. One of the newest and strangest provisions is the ability for people going through a separation or divorce to potentially have access to their RRSP under the Home Buyers Plan.

Now in my article and podcast entitled: “Escape Room – The NEW Small Business Tax Game – Family Edition” with respect to the Tax On Split Income (TOSI) rules, I made a tongue in cheek argument that people will be better off if they split, because then the TOSI rules won’t apply.

In keeping with the divorce theme, beginning in the year of hindsight, 2020, the federal government is giving you an incentive to split up and get your own place.

However, there are a few hoops:

On page 402 of the budget, under new paragraph 146.01(2.1)(a), at the time of your RRSP withdrawal under the Home Buyers Plan, you must make sure that:

- – the home you are buying is not the current home you are living in and you are disposing of the interest in the current home within two years; or

- – you are buying out your former spouse in your current home; and

you need to:

- be living separate and apart from your spouse or common-law partner;

- have been living separate and apart for a period of at least 90 days (markdown October 3, 2019 on the calendar),

- began living separate and apart from your spouse or common-law partner, this year, or any time in the previous 4 years (ok, you don’t have to wait for October); and…

…here is where the tabled proposed legislation gets messy.

Proposed subparagraph 146.01(2.1)(a)(ii) refers to where the individual

- wouldn’t be entitled to the home buyers plan because of living with a previous spouse in the past 4 years that isn’t the current spouse they are separating from

“(ii) in the absence of this subsection, the individual would not have a regular eligible amount because of the application of paragraph (f) of that definition in respect of a spouse or common-law partner other than the spouse referred to in clauses (i)(A) to (C), and…”

The problem with the wording of this provision, is that it is written in the affirmative by the legislators using the word “and”. This means, you must be able to answer “true” to all the tests for the entire paragraph to apply.

The way I read this, the only way to answer “true” to this subparagraph is if you have a second spouse (ie: spouse other than the spouse referred to) that you shared a home with and you split from in the past four years.

If you have a second spouse that you shared a home with in the past four years, then “paragraph (f)” in the definition of “regular eligible amount” would apply and the answer would be “true”.

If the answer is “true” you can then get access to your RRSP Home Buyers Plan.

If you don’t have a second spouse then, even though “paragraph (f)” might be met, the phrase “spouse other than the spouse referred to” would not be met, and therefore the answer would be “false”.

This would, in turn, cause the entire logic test of the provision to be “false” and so you would not be able to take out a “regular eligible amount” from your RRSP for the Home Buyers plan because you do not meet the provisions.

If my interpretation is correct then I would really be curious as to what part of the economy they are trying to stimulate.

In my opinion the legislation could be fixed with a simple edit:

“(ii) in the absence of this subsection, the individual would not have a regular eligible amount because of the application of paragraph (f) of that definition in respect of:

(A) a spouse or common-law partner; or

(B) a spouse or common-law partner other than the spouse referred to in clauses (i)(A) to (C); and…”

—

Cory G. Litzenberger, CPA, CMA, CFP, C.Mgr is the President & Founder of CGL Strategic Business & Tax Advisors; you can find out more about Cory’s biography at http://www.CGLtax.ca/Litzenberger-Cory.html

International

$2.6 million raised for man who wrestled shotgun from Bondi Beach terrorist

More than $2.6 million has been raised for a suburban Sydney shop owner who put himself directly in the line of fire to stop a terrorist during last Sunday’s attack at Bondi Beach, a moment of raw courage that has resonated far beyond Australia’s shores.

The GoFundMe campaign for Ahmed al Ahmed surpassed the $2.6 million mark by Sunday morning, fueled by more than 45,000 donations after video of his actions spread rapidly online. The footage shows Ahmed charging one of the attackers, tackling him to the ground, wrenching a shotgun from his hands, and turning the weapon back on the would-be killer to prevent further carnage.

Ahmed, you are an Australian hero.

You put yourself at risk to save others, running towards danger on Bondi Beach and disarming a terrorist.

In the worst of times, we see the best of Australians. And that's exactly what we saw on Sunday night.

On behalf of every Australian, I… pic.twitter.com/mAoObU3TZD

— Anthony Albanese (@AlboMP) December 16, 2025

Ahmed, 44, is a father of two young daughters, ages five and six, and owns a small shop in suburban Sydney. His intervention came at a brutal cost. As he fought to disarm the first attacker, a second terrorist opened fire on him, shooting him multiple times in an effort to stop him from taking control of the gun. Ahmed survived, but only narrowly.

The overwhelming financial support has turned Ahmed into an unlikely national figure — not because he sought attention, but because he acted when others couldn’t. The outpouring of donations has unfolded alongside growing public anger toward Prime Minister Anthony Albanese’s government, which has faced mounting criticism over its handling of rising antisemitic violence across Australia in the wake of recent terror incidents.

For many Australians, the contrast has been impossible to miss: ordinary citizens stepping up with courage and clarity while political leaders scramble after the fact. Ahmed didn’t wait for instructions or statements. He saw a threat, moved toward it, and stopped it — and millions of people around the world have now responded in kind.

Energy

The Top News Stories That Shaped Canadian Energy in 2025 and Will Continue to Shape Canadian Energy in 2026

From Energy Now

By Jim Warren

The times have been excessively interesting. This is especially true for the conventional energy sector where there was much more news served up in 2025 than normal people can comfortably digest in just 12 months.

The past year provided a few flourishes of good news for supporters of conventional energy. But, for the most part it was a continuation of the disappointment, frustration and uncertainty which characterized the Justin Trudeau years.

Unfortunately, there’s a chance that disappointment and frustration will follow us into 2026.

Yet, the Festive Season demands all glasses be at least half full when we ring in the New Year. And, for all we know, the inveterate optimists among us could actually turn out to be right on a few counts.

The Alberta-Ottawa Memorandum of Understanding (MOU) may actually result in a pipeline being launched. And maybe the bit in the MOU about the cost of CO2 emissions rising to $130 per tonne will turn out to be just a typo. The Carney government could be forced to call an election in 2026. And Pierre Poilievre and the Conservatives, who unequivocally support expansion of conventional energy production and exports, could win it.

If the pipeline problem is satisfactorily resolved, we can then return to time honoured grievances we’ve put on the back burner, such as equalization and Canada’s catch and release legal system.

Let’s drink to that.

In keeping with the traditions of news publications at year-end, here is a list of the top 2025 news stories and events affecting Canada’s oil and gas industries in Canada.

The nine news items we came up with are presented below, listed in chronological order. You, the reader, may have some additional ones of your own.

1. Goodbye Justin Trudeau, You Will Not Be Missed

The arrogant poser, with the colourful socks, who acted like virtue oozed from every pore of his body is now persona non grata. Six days into 2025 Justin Trudeau announced his intention to resign as prime minister and member of parliament. It was one of the most joyous occasions of the year—heartily celebrated by many fans of the oil and gas industries.

For nine long years, the Trudeau government imposed environmental and climate change legislation intended to reduce expansion of conventional energy production and consumption. The Trudeau government’s actions have been be characterized as efforts designed to cancel the future of Canada’s conventional energy sector. Trudeau, his cabinet and caucus will forever be remembered for measures such as Bill C-48/the Tanker Ban and C-69/the No More Pipelines Bill—legislation that will live in infamy.

Danielle Smith probably said it best. “Pierre Trudeau only wanted to steal our oil, Justin Trudeau wanted to kill the industry.”

2. Trump and the Trade War

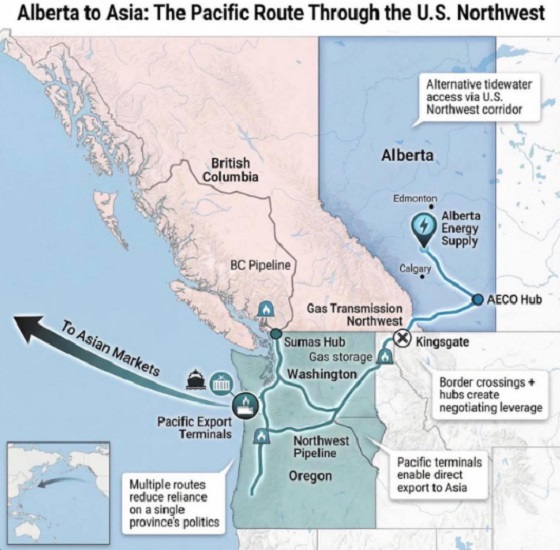

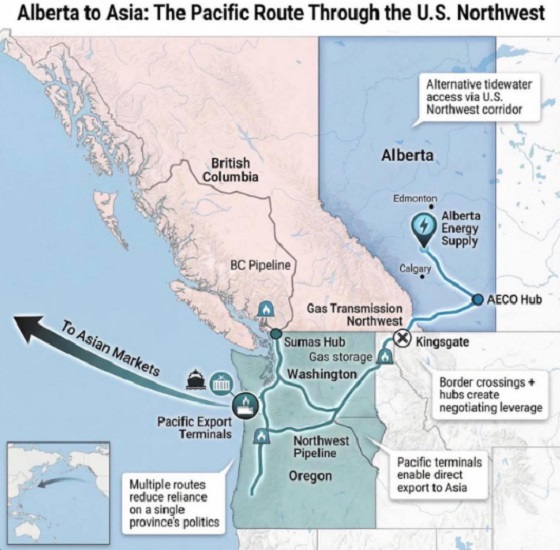

Donald Trump and his tariff war have had some important, positive effects in Canada. They exposed the vulnerabilities associated with relying on a single country to purchase approximately 93% of our oil exports. The critical importance of increasing access to new non-US customers for Canadian oil and natural gas was made crystal clear. Several polls taken over the course of 2025 indicated a majority of Canadians now support the construction of new oil and gas pipelines to one or more of Canada’s coasts.

Oil is Canada’s single most important export commodity. And, a growing number of people appreciate handcuffing the conventional energy sector and limiting export options is economic madness; especially when the country is experiencing economic distress and the fiscal crisis created by Liberal Ottawa.

One of the unfortunate outcomes of the new tariffs Trump imposed on Canada is that in January they breathed new life into the political corpse of the Liberal party. Amazingly, this allowed them to elbow their way to an astonishing revival of fortunes and a minority election win on April 28.

3. Premier Danielle Smith’s Nine Bad Laws

Danielle Smith presented Mark Carney with a list of nine demands on March 25, 11 days after he replaced Justin Trudeau as prime minister. The list focused on the fortunes of the conventional energy sector and the barriers to new pipelines. It featured what Smith referred to as “the nine bad laws”—the laws that have to go if Canada is to recover from the economic and fiscal damage done during the Justin Trudeau years.

According to Smith, Liberal policies had adversely impacted the prosperity of Alberta and the rest of Canada and driven away billions in new capital investments.

The nine bad laws

- Removal of the federal laws, regulations and policies that restrict access to oil and gas corridors to the East, West and North coasts.

- Repeal Bill C-69

- Cancel Bill C-48

- Rescind the oil and gas emissions cap

- Drop the clean electricity regulations

- Dump the industrial carbon tax

- End the net zero car sales mandate, including the ban on gas and diesel car sales by 2035

- Eliminate the ban on single use plastics

- Remove the restrictions on the free speech of conventional energy companies

The demands have been described as the things Albertans require to believe Confederation can accommodate their interests. They represent a set of issues which if not promptly addressed will continue to harm the economy and create a national unity crisis.

The Ottawa-Alberta MOU signed on November 27 proposes to eliminate or adjust several of the nine bad laws.

4. Canada’s Federal Election

Early in January of 2025 it finally looked like the stars had aligned in favour of the oil and gas community. Justin Trudeau was a terminally wounded lame duck, having announced his intention to resign as prime minister. And, it appeared the electoral fortunes of the Liberals were in the toilet.

There was dissention in the Liberal ranks—Deputy Prime Minister Chrystia Freeland had resigned the previous month. And, opinion polls taken in December and early January had shown the Conservatives had a commanding lead over the Liberals. Pierre Poilievre and company were heading for a majority. And, they were pledged to support the expansion of oil and gas production and the construction of new export pipelines from Alberta to one or more of Canada’s coasts.

By late January, fear of the Trump tariffs and Canada’s mainstream media had changed the political arithmetic. Canadians embraced a new superhero, Mark Carney. The legacy media extolled his record as an international financial wizard, macroeconomic guru, and leader of prominent institutions.

During the election campaign Carney adopted a duplicitous approach to discussing energy and pipeline policy. He embraced the longstanding Liberal strategy of saying one thing in the West while saying the opposite when talking to Quebecers.

More recently, Carney has been saying one thing to B.C. and oil pipeline opponent, Premier David Eby, and something entirely different to supporters of the oil and gas industries in Alberta and Saskatchewan.

Following the defection of three Conservative MPs to the government side of the House the Carney government is just one seat shy of a majority.

5. Bill C-5 Promises Much But Delivers Nothing

The Building Canada Act/Bill C-5 was heralded as the solution to Canada’s failure to get major economic development projects, including oil pipelines, approved and built ever since the Justin Trudeau Liberals formed their first government in 2015. It was passed by the House of Commons on June 20, 2025 with the support of both Liberal and Conservative MPs. The promotional efforts of the government and mainstream media pundits had many people thinking it would deal with many of the issues identified in Danielle Smith’s list of nine bad laws.

The government claimed Bill C-5 would expedite approvals for nation building projects that would help secure Canada’s economic future and diversify export opportunities. The Liberals said they would use every tool at their disposal to get projects promptly approved and completed. Those tools did not include ending the West coast tanker ban or changing Bill C-69, the Impact Assessment Act.

Bill C-5 turned out to be the most overhyped nothing burger of 2025.

On September 11, Ottawa announced the first five projects which qualified for the approval process established under Bill C-5. A second tranche of six projects was announced on November 13. The common denominator for all eleven projects is that they had all been previously proposed and approved and some were already under construction. In the first five months following the enactment of Bill C-5 there have been no big new investments announced that hadn’t already been announced.

6. LNG Canada Begins Exporting Liquified Natural Gas

David Eby, and the government of British Columbia have vigorously opposed construction of an oil pipeline running from Alberta to Prince Rupert. Pipelines carrying natural gas produced in B.C. to LNG terminals on the West coast are another matter.

Several large and small LNG projects have been approved by B.C. and the federal government. The largest of them, LNG Canada, began shipping liquified natural gas (LNG) from its processing facilities at Kitimat on June 30 this year. By the end of November, 25 cargoes of LNG had been shipped from the new terminal. When all phases of LNG Canada’s $40 billion system are fully operational they will be capable of exporting 3.68 billion feet of B.C. natural gas per day.

Thus far, LNG Canada’s operation is the only large LNG project that is up and running. Proponents of some of the other projects are apparently still looking for additional financing. And, there are concerns about a global LNG supply glut developing. Yet, a global oversupply is hard to envision given growing demand for natural gas in East and South Asia.

One thing is certain, all of B.C.’s currently approved LNG projects have met the criteria required to be announced by the federal government as new developments made possible only by the miracle of Bill C-5.

7. The Memorandum of Understanding (MOU)

There are indeed fans of oil and gas who enthusiastically welcomed the unveiling of the Memorandum of Understanding (MOU) on November 27. There were also some who denounced the deal, and skeptics who remain undecided. If there is a lack of meaningful progress toward building an oil pipeline from Alberta to Prince Rupert by mid-2026, the number of Albertans opposed to the MOU can be expected to grow.

Many of the skeptics contend it is yet another example of the Carney government’s unwillingness to clearly and forthrightly endorse a revived version of the Northern Gateway pipeline (a Northern Gateway 2.0).

Yet, Danielle Smith has been reported as saying the MOU addresses several of the demands contained in her list of “nine bad laws”.

The MOU proposes to drop federal clean energy regulations for Alberta, allow carbon capture projects to use CO2 for enhanced oil recovery without penalty, suggests a tanker ban carve out is possible on the northern B.C. coast and, perhaps most importantly, it elevates Northern Gateway 2.0 to the realm of the possible.

Waiting for the agreement between Ottawa and Alberta was frustrating for supporters of fossil fuels who were not privy to the behind closed doors discussions and negotiations which apparently began on or shortly after June 1. Subsequently, Danielle Smith optimistically identified dates when she hoped to announce federal movement on the nine bad laws and an agreement to get Northern Gateway 2.0 launched.

We hoped to hear something concrete by the week of the Calgary Stampede. It turned out there was no big announcement but Smith remained positive regarding discussions. The prime minister offered only highly qualified support for some of Alberta’s demands when speaking publicly.

The next deadline suggested was some time in October. October came and went. We listened for a commitment from the prime minister and got crickets. Smith said she was still fairly confident a deal would be forthcoming, probably by Grey Cup.

The day of the big game came and went and there was still no announcement. The goal posts had apparently been moved again. But wait, just a few days after Saskatchewan’s win on the gridiron, the government news agency, CBC, reported a rumour was going round claiming a deal was close at hand. And so it was.

The wait was exhausting. Here’s hoping the end result was worth it.

8. The “Green Jesus” of Montreal Quits Cabinet

Steven Guilbeault, one of the most politically divisive people to ever serve as a federal minister resigned from the Carney cabinet on November 27—within a few hours of the announcement of the Alberta-Ottawa Memorandum of Understanding.

Guilbeault’s resignation is one of the best signs to date that the MOU is a serious document.

Guilbeault is a high profile environmental activist (some would say fanatic) and climate change alarmist—famous for media stunts like scaling the CN Tower and demonstrating on the roof of Ralph Klein’s house in Edmonton. He became MP for a Montreal riding in the October 2019 federal election. Justin Trudeau appointed him Minister for the Environment and Climate Change in October of 2021 and gave him free rein over policy decisions.

The Trudeau government’s enactment of several of the policies harmful to the conventional energy sector such as Bill C-48/the Tanker Ban and Bill C-69/the No More Pipelines Bill actually occurred before Guilbeault became environment minister. However, under Guilbeault’s watch a series of excessively ambitious regulatory measures inimical to the future of the oil and gas sectors, costly to consumers and economically harmful were implemented.

Guilbeault’s actions as minister imposed added costs on Canadian consumers who were dealing with an escalating cost of living. They contributed to the abysmal showing of the Liberals in party preference polls for most of 2024—as a consequence the Party finally gave Justin Trudeau the boot in January 2025.

Examples of Guilbeault’s environment and climate change policy legacy include:

- The environment ministry’s announcement of a hard cap on oil and gas emissions in the fall of 2021. This measure would effectively set limits on the growth of natural gas and oil production. The governments of Alberta and Saskatchewan vehemently opposed these measures as a federal intrusion into areas of provincial responsibility under the Constitution. The Supreme Court agreed and declared that the offending sections of Bill C-69/the Impact Assessment Act were unconstitutional—Guilbeault made no effort to amend his regulations.

- Guilbeault was responsible for the major updating of the consumer carbon tax regulations announced in December of 2021. Those included the plan to increase the level of the tax to $170 for every tonne of CO2 emitted. The carbon tax angered voters already struggling with increases in the cost of living and caused support for the Liberals to tank by December of 2025.

- Guilbeault introduced regulations limiting the number of gas and diesel fueled vehicles sold by Canadian manufacturers with a total phase out target of 2035. The regulations were published in December 2023. In early 2025, our new prime minister announced he was postponing implementation of the sales reduction target for at least one year. The Guilbeault regulations were largely responsible for Stellantis’ decision to shift thousands of jobs and production to US factories.

- Guilbeault’s swan song as environment minister was the publication of updated clean electricity standards and regulations limiting the energy sources which can be used to produce electricity without penalties by 2030. The regulations were published by Guilbeault’s department in December of 2024. The Government of Saskatchewan has announced its intention to defy this mandate. It intends to continue using coal to generate electricity for another decade and possibly longer.

When Mark Carney assembled his first cabinet he demoted Guilbeault, moving him from the prestigious environment portfolio to the Department of Canadian Identity and Culture. Incidentally Carney left Jonathan Wilkinson, Guilbeault’s predecessor, as environment minister, out of Cabinet altogether.

9. What’s Old is New Again: Anti-Pipeline Lobbying, Misinformation and Insanity by the Sea

We better fasten our seat belts heading into 2026. Climate change alarmists, their allies in the media and several members of the federal Liberal caucus have already launched their assault on the MOU and prospects for a new oil pipeline to the West coast. Visions of Trans Mountain all over again.

The Complicit Media

In the days leading up to the federal budget, a frantic Elizabeth May falsely claimed Canada was legally bound to meet its net zero and green transition targets under terms of the 2015 Paris Agreement on Climate Change. She claimed the Trudeau/Guilbeault anti-oil-and-gas legacy must remain inviolate lest we incur the wrath of the UN—a supposedly terrifying prospect.

In reality the only things the parties to the Paris Agreement bound themselves to was the submission of an outline of their plans for reducing greenhouse gas emissions, and to submit an updated version of their plans every five years. No penalties of any sort are provided under the agreement should a country fail to get its homework handed in on time.

The legacy media gave May a free ride on that fabrication—no effort was made to correct her. May was similarly allowed a pass when she claimed oil tankers carrying oil from Prince Rupert would have to cross the most dangerous waters in Canada.

(See the Energy Now column MAY DAY! THE GREEN PARTY’S ELIZABETH MAY HAS IT WRONG: An Alberta to Prince Rupert Oil Pipeline Will Contribute to Greater Global Oil Tanker Safety – Jim Warren ).

Another disturbing example is how the environmental movement and the legacy media have been falsely presenting the Vancouver-based environmental lobby group, Coastal First Nations, as though it is some sort of official representative voice for all First Nations governments from Western B.C. Furthermore, neither environmentalists nor the traditional media acknowledge that many First Nations are actively involved in the oil industry and support the new pipeline proposal.

We can expect to see a lot more flagrant misinformation passing for news in 2026.

Insanity by the Sea

Then we have B.C. premier, David Eby, the poster child for the failure of the Team Canada approach to ensuring Canada successfully navigates the challenges presented by the Trump tariffs. Eby’s sense of team spirit does not extend to allowing neighbouring provinces to export commodities like oil through British Columbia.

No surprise, Mark Carney has proven loathe to publicly criticize Eby for his unCanadian obstruction.

The B.C. government is hostage to the minority of voters who constitute Eby’s base of support—the lunatic fringe of anti-development environmental zealots who back the NDP.

Eby fumes over the possibility of a pipeline being built. Yet he remains mute over bad legislation and hyper-woke courts that threaten the status of non-Indigenous land titles in his province. His priorities are clearly shaped by fear of being removed as NDP leader and/or losing the next provincial election.

Hopes for the election of a sane government are frustrated by division and disarray among B.C. Conservatives.

Steven Guilbeault Will Rise Again

Here’s another troubling prediction for 2026. Steven Guilbeault will take a leadership role in the movement to shred the MOU. Guilbeault and his fellow environmental crusaders intend to force the Liberal government to recant and return to the more rigidly orthodox green agenda Mark Carney supported before becoming prime minister.

It will up to Canadians who truly think “Team Canada” to overcome yet even more challenges in 2026. In the meantime, investors will continue to take their energy opportunities and money elsewhere.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Business1 day ago

Business1 day agoState of the Canadian Economy: Number of publicly listed companies in Canada down 32.7% since 2010

-

Alberta1 day ago

Alberta1 day agoHousing in Calgary and Edmonton remains expensive but more affordable than other cities

-

Business2 days ago

Business2 days agoJudge Declares Mistrial in Landmark New York PRC Foreign-Agent Case

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoUK Police Pilot AI System to Track “Suspicious” Driver Journeys

-

Alberta1 day ago

Alberta1 day agoWhat are the odds of a pipeline through the American Pacific Northwest?

-

Business2 days ago

Business2 days agoWarning Canada: China’s Economic Miracle Was Built on Mass Displacement