Business

Australian senator compares Trudeau’s treatment of Freedom Convoy protesters to Communist China

From LifeSiteNews

‘This push towards a digital ID future is another step toward a Chinese Communist Party-style social credit system, which will force you to support the current thing at the risk of total cancellation,’ Senator Alex Antic said

An Australian senator compared Prime Minister Justin Trudeau’s handling of the Freedom Convoy with Communist China.

During a November 13 meeting in the Australian Senate, Senator Alex Antic used the freezing of Canadians’ bank accounts during the 2022 Freedom Convoy as an example of the dangers of digital currency, comparing Trudeau’s actions with China’s social credit system.

“I’ve been warning about digital ID for some time, and it wasn’t so long ago that, like many of these issues which turn out to be correct, it was considered to be nothing but a conspiracy theory,” he said.

“We saw how that worked a couple of years ago with the financial cancellation of the Canadian truckers when they were protesting COVID lockdowns and restrictions,” Antic appealed. “The advancement of technology is inevitable, but this push towards a digital ID future is another step towards a Chinese Communist Party-style social credit system, which will force you to support the current thing at the risk of total cancellation.”

The Trudeau government’s similarities to China’s Communist government have become increasingly evident to both Canadians and other countries. Indeed, Trudeau himself admitted that he has a “level of admiration” for China’s “basic dictatorship.”

His imitation of China’s credit score system was revealed during the 2022 Freedom Convoy protest in Ottawa with thousands of Canadians calling for an end to COVID mandates by camping outside Parliament.

In response, Trudeau’s government enacted the EA on February 14, 2022, to shut down the popular movement. Trudeau revoked the EA on February 23 after the protesters had been cleared out. At the time, seven of Canada’s 10 provinces opposed the use of the EA by Trudeau.

Under the EA, Deputy Prime Minister Chrystia Freeland froze the bank accounts of Canadians who donated to the 2022 Freedom Convoy, which protested vaccine mandates and COVID regulations.

As articulated by LifeSiteNews correspondent David James, this type of financial crackdown is precisely why many fear the move toward an entirely digital, cashless society.

“What Freeland has outlined is an unprecedented incursion into financial activity that is designed to lock the people whom the government deems to be undesirable out of the system entirely,” James wrote in an op-ed.

“It confirms what many have been warning about for some time: that one of the core elements of the so-called Great Reset is to enslave populations by surveilling and controlling their transactions,” he continued. “China has already implemented its version of digital tyranny with its Social Credit System, which it will combine with its Central Bank Digital Currency [CBDC]. Now Trudeau and Freeland have drawn back the curtain in Canada to reveal their version of digital despotism.”

Antic’s use of Canada as an example comes as governments around the world are pushing digital currency despite warnings that it will lead to a social credit system.

“Last week, the European Parliament and the Council of the European Union reached a final agreement on a law to create the European Digital Identity, or eID, the EU’s first fully digital identification system,” Antic announced.

“This law will provide Europeans with a digital wallet containing digital versions of their ID cards — their drivers licences, their academic certificates, their medical records, their bank account information and so on,” he explained. “The next major step in the EU will be to create a digital euro and a central bank digital currency, which is currently being developed by the European Central Bank.”

“I’ve been warning about digital ID for some time, and it wasn’t so long ago that, like many of these issues which turn out to be correct, it was considered to be nothing but a conspiracy theory,” he added.

Currently, Australia is moving toward introducing digital currency with consultation on the bill having recently closed.

“You can see how it’s going to happen: We’ll get a digital currency and, once those steps are in place, a digital snare trap will have been created,” Antic warned. “We must reject a digital ID future, and time is running out for people in this place to understand that they are playing with fire.”

Alberta

Falling resource revenue fuels Alberta government’s red ink

From the Fraser Institute

By Tegan Hill

According to this week’s fiscal update, amid falling oil prices, the Alberta government will run a projected $6.4 billion budget deficit in 2025/26—higher than the $5.2 billion deficit projected earlier this year and a massive swing from the $8.3 billion surplus recorded in 2024/25.

Overall, that’s a $14.8 billion deterioration in Alberta’s budgetary balance year over year. Resource revenue, including oil and gas royalties, comprises 44.5 per cent of that decline, falling by a projected $6.6 billion.

Albertans shouldn’t be surprised—the good times never last forever. It’s all part of the boom-and-bust cycle where the Alberta government enjoys budget surpluses when resource revenue is high, but inevitably falls back into deficits when resource revenue declines. Indeed, if resource revenue was at the same level as last year, Alberta’s budget would be balanced.

Instead, the Alberta government will return to a period of debt accumulation with projected net debt (total debt minus financial assets) reaching $42.0 billion this fiscal year. That comes with real costs for Albertans in the form of high debt interest payments ($3.0 billion) and potentially higher taxes in the future. That’s why Albertans need a new path forward. The key? Saving during good times to prepare for the bad.

The Smith government has made some strides in this direction by saving a share of budget surpluses, recorded over the last few years, in the Heritage Fund (Alberta’s long-term savings fund). But long-term savings is different than a designated rainy-day account to deal with short-term volatility.

Here’s how it’d work. The provincial government should determine a stable amount of resource revenue to be included in the budget annually. Any resource revenue above that amount would be automatically deposited in the rainy-day account to be withdrawn to support the budget (i.e. maintain that stable amount) in years when resource revenue falls below that set amount.

It wouldn’t be Alberta’s first rainy-day account. Back in 2003, the province established the Alberta Sustainability Fund (ASF), which was intended to operate this way. Unfortunately, it was based in statutory law, which meant the Alberta government could unilaterally change the rules governing the fund. Consequently, by 2007 nearly all resource revenue was used for annual spending. The rainy-day account was eventually drained and eliminated entirely in 2013. This time, the government should make the fund’s rules constitutional, which would make them much more difficult to change or ignore in the future.

According to this week’s fiscal update, the Alberta government’s resource revenue rollercoaster has turned from boom to bust. A rainy-day account would improve predictability and stability in the future by mitigating the impact of volatile resource revenue on the budget.

Business

Higher carbon taxes in pipeline MOU are a bad deal for taxpayers

The Canadian Taxpayers Federation is criticizing the Memorandum of Understanding between the federal and Alberta governments for including higher carbon taxes.

“Hidden carbon taxes will make it harder for Canadian businesses to compete and will push Canadian entrepreneurs to shift production south of the border,” said Franco Terrazzano, CTF Federal Director. “Politicians should not be forcing carbon taxes on Canadians with the hope that maybe one day we will get a major project built.

“Politicians should be scrapping all carbon taxes.”

The federal and Alberta governments released a memorandum of understanding. It includes an agreement that the industrial carbon tax “will ramp up to a minimum effective credit price of $130/tonne.”

“It means more than a six times increase in the industrial price on carbon,” Prime Minister Mark Carney said while speaking to the press today.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

A Leger poll shows 70 per cent of Canadians believe businesses pass most or some of the cost of the industrial carbon tax on to consumers. Meanwhile, just nine per cent believe businesses pay most of the cost.

“It doesn’t matter what politicians label their carbon taxes, all carbon taxes make life more expensive and don’t work,” Terrazzano said. “Carbon taxes on refineries make gas more expensive, carbon taxes on utilities make home heating more expensive and carbon taxes on fertilizer plants increase costs for farmers and that makes groceries more expensive.

“The hidden carbon tax on business is the worst of all worlds: Higher prices and fewer Canadian jobs.”

-

Alberta6 hours ago

Alberta6 hours agoFrom Underdog to Top Broodmare

-

armed forces2 days ago

armed forces2 days ago2025 Federal Budget: Veterans Are Bleeding for This Budget

-

Alberta1 day ago

Alberta1 day agoAlberta and Ottawa ink landmark energy agreement

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoTrump’s New AI Focused ‘Manhattan Project’ Adds Pressure To Grid

-

International1 day ago

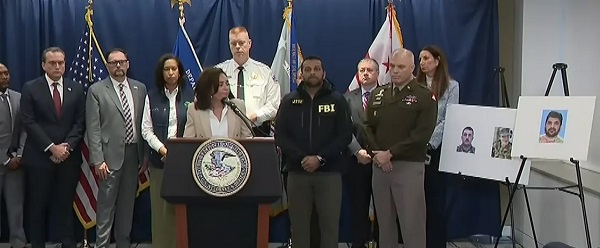

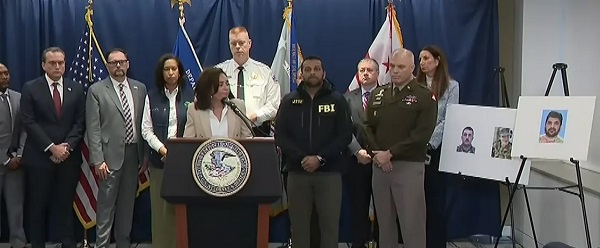

International1 day agoAfghan Ex–CIA Partner Accused in D.C. National Guard Ambush

-

Carbon Tax1 day ago

Carbon Tax1 day agoCanadian energy policies undermine a century of North American integration

-

International1 day ago

International1 day agoIdentities of wounded Guardsmen, each newly sworn in

-

International2 days ago

International2 days agoTrump Admin Pulls Plug On Afghan Immigration Following National Guard Shooting