Alberta

Alberta investigates Red Deer County family’s lead-contaminated water well near gravel mine

By Bob Weber

Red Deer County – Alberta Environment is investigating how a family’s water well near a gravel mine became so contaminated by lead it’s no longer drinkable.

The investigation comes as Red Deer County considers expanding mine operations that Jody Young suspects are the source of the lead she and her family may have been drinking for months.

“We have it in our blood,” said Young. “My son’s levels are actually higher than mine.”

Young, who lives just south of Red Deer near the banks of the Red Deer River, has lived within a few hundred metres of the county’s gravel mine for more than a decade.

She grew used to the slight murkiness of her once-clear well water as the mines near her central Alberta home stepped up production. Tests a few years ago showed the water was OK and she preferred the tap to a plastic bottle.

But the water kept getting worse.

“We’ve gone from just seeing it in a bathtub to being able to see it in a glass of water,” she said.

So last summer she asked Alberta Health Services to test her family’s well water. Within days, she got a call.

“They told us to immediately stop drinking our water,” she said. “We weren’t to cook with it. We were advised not even to brush our teeth with it.”

Lead — which can cause anemia, weakness, kidney and brain damage — was above levels fit for human consumption. So was aluminum.

Both metals were subsequently found in blood samples from her family.

“It was deeply concerning to learn of well water contamination in Red Deer County,” said Alberta Environment spokeswoman Carla Jones in an email. “The source of these metals is under investigation.”

On Feb. 7, Young plans to appear at a public hearing hosted by Red Deer County to oppose proposed changes to a county land-use bylaw. The changes would permit gravel mines on land virtually adjacent to her water well.

The proposed expansion site, privately owned, is also on land considered environmentally significant by provincial regulators.

“We are in full compliance with Alberta Environment on our pit,” said Dave Dittrick, Red Deer County’s assistant manager. Private operators would have to follow the same regulations, he said.

“Everything they do will have to be in compliance.”

Dittrick said although the county is co-operating with Alberta Environment, it hasn’t seen the data that prompted Alberta Health’s concern.

“We have not seen any information to substantiate these claims,” he said.

Gravel, or aggregate, mines are needed for everything from paving roads to building houses. Although they’re everywhere in Alberta, data on them is hard to find.

Mines larger than five hectares must be registered and come under provincial regulation. Mines that go below the water table or involve significant water use require a Water Act licence.

“Alberta has a robust regulatory approval process to manage environmental impacts of gravel pits,” said Alberta Environment spokesman Miguel Racin.

Smaller mines — the expansion near Young’s well would be about three hectares — are largely regulated by local land-use bylaws.

But observers say such mines are an increasing concern as Alberta continues to grow.

“It’s a problem in every county,” said Vivian Pharis, an environmentalist who has been involved in previous conflicts over such mines.

“We don’t have any good provincial regulations. The primary decision is made at the municipal level and, as soon as the zoning gets changed, then it seems Alberta Environment’s hands are tied.”

Hydrogeologist Jon Fennell, who has consulted on several mine projects, said gravel mines run the risk of exposing and releasing chemicals formerly held stable.

“If you’re opening (a mine) up and exposing things to oxygen, they can weather and oxidize and get mobilized,” he said. “Any time you disturb the earth, things change.”

While municipalities are in charge of much of the gravel mine permitting process, Fennell points out they are also heavy gravel users.

“They’re very pro-gravel in some parts of the province,” he said.

Red Deer County’s previous attempt to expand its aggregate operations near Young’s home was thrown out in 2022 by a Court of King’s Bench judge over an unfair process.

Enforcement is lax even for mines that do come under provincial rules, Fennell said. Operators may be required to monitor water levels, but not water quality.

“It’s not required,” he said. “If you don’t look, you don’t find.”

Gravel mines are necessary, said Dittrick.

“Aggregate is needed for development and development is ongoing,” he said.

Some sources may be more appropriate than others, said Fennell.

“We have to get (gravel) from somewhere. The question is, from where?”

Young wonders how long her family has been drinking lead-contaminated water. And she wonders why she has to wonder about that at all.

“I’ve had some real moments with this,” she said.

She recalls learning about some of her son’s computer searches.

“I found he was Googling about lead poisoning. He was researching potential impacts to himself.”

This report by The Canadian Press was first published Jan. 17, 2023.

Alberta

Political parties will be part of municipal elections in Edmonton and Calgary pilot projects

Strengthening Alberta’s local elections

Alberta’s government is introducing legislation to ensure Albertans can rely on transparent, free and fair elections, and municipally-elected officials have clearer accountability measures.

In a democratic society, Albertans expect their local elections to be free and fair, and their elected officials to be held to account by clear rules that govern their local councils. The Municipal Affairs Statutes Amendment Act proposes amendments to the Local Authorities Election Act (LAEA) and the Municipal Government Act (MGA) to add greater transparency to local election processes and ensure local councils and elected officials continue to remain accountable to the citizens who elected them.

“Our government is committed to strengthening Albertans’ trust in their local governments and the democratic process that elects local leaders. The changes we are making increase transparency for Alberta voters and provide surety their votes will be counted accurately. We know how important local democracy is to Albertans, and we will work with local authorities to protect and enhance the integrity of local elections.”

Local Authorities Election Act

Albertans expect free and fair elections and that’s why it’s important we strengthen the rules that govern local elections. To strengthen public trust in local elections, Alberta’s government will eliminate the use of electronic tabulators and other automated voting machines. All Albertans should be able to trust the methods and results of local elections; requiring all ballots to be counted by hand, clarifying rules and streamlining processes for scrutineers will provide voters greater assurance in the integrity of the results.

All eligible Albertans should be able to vote in local elections without impediment. Alberta’s government will limit the barriers for eligible voters to cast a ballot by expanding the use of special ballots. Currently, special ballots can only be requested for very specific reasons, including physical disability, absence from the municipality, or for municipal election workers. By expanding the use of special ballots, the government is encouraging more voter participation.

Amendments in the Municipal Affairs Statutes Amendment Act would increase transparency in local elections by enabling political parties at the local level. Political parties would be enabled in a pilot project for Edmonton and Calgary. The act will not require candidates to join a political party in order to run for a local or municipal office, but will create the opportunity to do so.

In addition, proposed changes to the Local Authorities Election Act would allow municipalities the option to require criminal record checks for local candidates, thus increasing transparency and trust in candidates who may go on to become elected officials.

Municipal Government Act

The role of an elected official is one with tremendous responsibility and expectations. Changes proposed to the Municipal Government Act (MGA) will strengthen the accountability of locally elected officials and councils. These include requiring mandatory orientation training for councillors, allowing elected officials to recuse themselves for real or perceived conflicts of interest without third-party review and requiring a councillor’s seat to become vacant upon disqualification.

If passed, the Municipal Affairs Statutes Amendment Act will also unlock new tools to build affordable and attainable housing across Alberta. Proposed amendments under the MGA would also create more options for municipalities to accelerate housing developments in their communities. Options include:

- Exempting non-profit, subsidized affordable housing from both municipal and education property taxes;

- Requiring municipalities to offer digital participation for public hearings about planning and development, and restricting municipalities from holding extra public hearings that are not already required by legislation; and

- Enabling municipalities to offer multi-year residential property tax exemptions.

Municipal Affairs will engage municipalities and other partners over the coming months to hear perspectives and gather feedback to help develop regulations.

Quick facts

- The LAEA establishes the framework for the conduct of elections in Alberta municipalities, school divisions, irrigation districts and Metis Settlements.

- The MGA establishes the rules governing the conduct of local elected officials once on council, as well as the overall administration and operation of municipal authorities in Alberta, including any policy those authorities may wish to implement.

Related information

Alberta

Alberta official reveals ‘almost all’ wildfires in province this year have been started by humans

From LifeSiteNews

Alberta Minister of Forestry and Parks Todd Loewen said his department estimates that most of the province’s wildfires this year are man-made and not caused by ‘climate change.’

Alberta officials have announced that almost all fires in 2024 are believed to have been caused by humans despite ongoing claims that “climate change” is to blame.

On April 24, Alberta Minister of Forestry and Parks Todd Loewen revealed that his department estimates that most of the province’s wildfires this year are man-made and not caused by “climate change” as claimed by mainstream media and politicians.

“We expect that almost all of the wildfires we’ve experienced so far this year are human caused, given the point we’re at in the season and the types of weather we’re seeing,” Loewen stated.

Already, Alberta has put out 172 wildfires this year, and 63 are actively burning. However, Loewen did not seem overly alarmed, instead warning Albertans to watch their local fire bans and restrictions to reduce the high number of man-made wildfires.

“I urge you to assess your property for wildfire danger and take any preventive action you can to address these risks,” he said.

“This includes breaking up fuel sources that could ignite a structure, removing trees in close proximity to your home, and properly maintaining your gutters and roofs to rid the materials that could easily ignite such as leaves and dry needles,” Loewen added.

Loewen’s announcement comes just weeks after Alberta Premier Danielle Smith promised that arsonists who ignite wildfires in Alberta will be held accountable for their crimes.

“As we approach the wildfire season, it is important to understand that 67% of wildfires in Alberta are started by people,” she explained.

“If you start a wildfire, you can be charged, fined, and held liable for all costs associated with fighting the wildfire,” Smith added.

Smith made the comments after last year revealing that most of the wildfires in her province (500 of the 650) were caused by humans and not “climate change,” as has been pushed by the legacy media and opposition politicians.

“All I know is in my province we have 650 fires and 500 of them were human caused,” she said, “so we have to make sure that when people know that when it’s dry out there and we get into forest fire season that they’re being a lot more careful because anytime you end up with an ignition that happens it can have devastating consequences.”

The Alberta government has also created an ad campaign highlighting the fact that most fires are caused by humans and not “climate change,” as many left-leaning politicians claim.

As reported by LifeSiteNews last year, Smith ordered arson investigators to look into why some of the wildfires that raged across the vast expanse of the province had “no known cause” shortly after they spread.

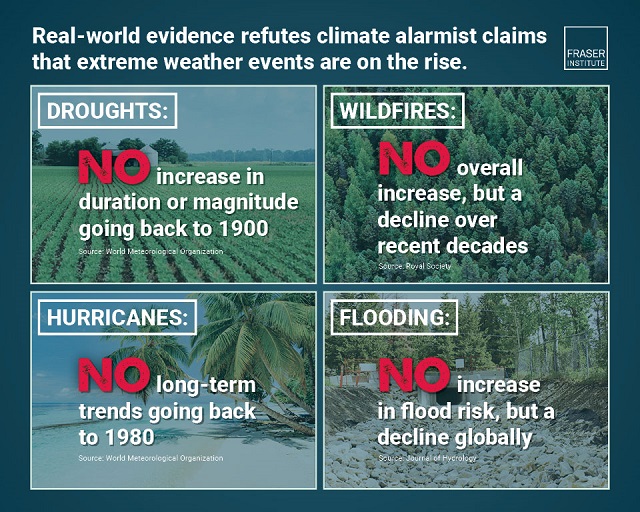

Indeed, despite claims that wildfires have drastically increased due to “climate change,” 2023 research revealed that wildfires have decreased globally while media coverage has spiked 400 percent.

Furthermore, many of the fires last spring and summer were discovered to be caused by arsonists and not “climate change.”

Royal Canadian Mounted Police (RCMP) have arrested arsonists who have been charged with lighting fires across the country, including in the Yukon, British Columbia, and Alberta.

In Quebec, satellite footage also showed the mysterious simultaneous eruption of several blazes across the province, sparking concerns that the fires were a coordinated effort by arsonists.

Despite the overwhelming evidence, Prime Minister Justin Trudeau and mainstream media continue to claim that the fires are unprecedentedly dangerous and caused by “climate change” in an attempt to pass further regulations on natural resources.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization with which Trudeau and some in his cabinet are involved.

-

conflict2 days ago

conflict2 days agoCol. Douglas Macgregor torches Trump over support for bill funding wars in Ukraine and Israel

-

Health2 days ago

Health2 days agoTransgender activists are threatening the author of scathing UK report on child ‘sex changes’

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoThe end of Canada: The shift from democracy to totalitarian behavior in the ‘pandemic era’

-

Alberta2 days ago

Alberta2 days agoAlberta’s baby name superstar steals the show again

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoNow We Are Supposed to Cheer Government Surveillance?

-

Business17 hours ago

Business17 hours agoDon’t be fooled by high-speed rail

-

Alberta17 hours ago

Alberta17 hours agoActivity-Based Hospital Funding in Alberta: Insights from Quebec and Australia

-

Business15 hours ago

Business15 hours agoUN plastics plans are unscientific and unrealistic