Alberta

Alberta cracking down on mask exemptions – Note required

Masking exceptions for health conditions

- Starting May 13, the rules around exemptions from wearing a mask due to a medical condition are changing. Individuals will now be required to obtain a medical exception letter verifying their health condition from an authorized health-care provider.

- The medical exception letter must come from a nurse practitioner, physician or psychologist. It may be presented when in a public setting, if requested by enforcement officials or retrospectively in court if a ticket is issued.

- This is modelled after the approaches currently used in Saskatchewan and other provinces.

Update 221: COVID-19 pandemic in Alberta (May 13, 4:15 p.m.)

Cases remain high in all parts of Alberta. Continue following the restrictions in place to stop the spread of COVID-19 and protect the health-care system.

Latest updates

- Over the last 24 hours, 1,558 new cases were identified.

- There are 722 people in hospital due to COVID-19, including 177 in intensive care.

- There are 24,586 active cases in the province.

- To date, 188,475 Albertans have recovered from COVID-19.

- In the last 24 hours, there were nine additional COVID-related deaths reported: one on April 28, one on May 8, two on May 10, one on May 11, three on May 12, and one on May 13.

- The testing positivity rate was 10.6 per cent.

- There were 15,266 tests (4,375,995 total) completed in the last 24 hours and a total of 2,103,334 people tested overall.

- All zones across the province have cases:

- Calgary Zone: 11,584 active cases and 75,055 recovered

- South Zone: 1,255 active cases and 10,227 recovered

- Edmonton Zone: 5,470 active cases and 67,097 recovered

- North Zone: 3,618 active cases and 20,117 recovered

- Central Zone: 2,647 active cases and 15,961 recovered

- 12 active cases and 18 recovered cases in zones to be confirmed

- Additional information, including case totals, is online.

- Alberta has identified 276 additional cases of variants of concern, bringing the provincial total to 39,989.

- Currently, 907 schools, about 38 per cent, are on alert or have outbreaks, with 6,736 cases in total.

- 439 schools are on alert, with 1,067 total cases.

- Outbreaks are declared in 468 schools, with a total of 5,669 cases.

- In-school transmission has likely occurred in 818 schools. Of these, 273 have had only one new case occur as a result.

- There are currently 115 active and 9,487 recovered cases at long-term care facilities and supportive/home living sites.

- To date, 1,251 of the 2,121 reported deaths (59 per cent) have been in long-term care facilities or supportive/home living sites.

COVID-19 vaccination program

- As of May 12, 2,019,714 doses of COVID-19 vaccine have been administered in Alberta, with 38 per cent of the population having received at least one dose. There are now 322,247 Albertans fully vaccinated with two doses.

- All Albertans age 12 and older are eligible to book appointments through AHS or a participating pharmacy provincewide.

- Legislation now allows Albertans up to three hours of paid, job-protected leave to get a COVID-19 vaccine.

New vaccination campaign launches

- Back to Normal is a new phase of Alberta’s vaccination campaign, intended to emphasize the crucial importance of Albertans getting vaccinated so life can return to normal.

- This advertisement is the first element of the campaign. Additional advertising showing other aspects of daily life will be released soon.

Masking exceptions for health conditions

- Starting May 13, the rules around exemptions from wearing a mask due to a medical condition are changing. Individuals will now be required to obtain a medical exception letter verifying their health condition from an authorized health-care provider.

- The medical exception letter must come from a nurse practitioner, physician or psychologist. It may be presented when in a public setting, if requested by enforcement officials or retrospectively in court if a ticket is issued.

- This is modelled after the approaches currently used in Saskatchewan and other provinces.

Restrictions in place for high case regions

- Restrictions are in place. Outdoor gatherings are limited to five people, most schools have moved to online learning, retail capacity is reduced and in-person dining and services are not allowed at restaurants, bars and cafés.

- Municipalities that have fewer than 50 cases per 100,000 people and/or fewer than 30 active cases are able to return to Step 0 level restrictions.

Enforcement of public health measures

- Fines for non-compliance with public health measures have doubled to $2,000.

- Unpaid fines are backstopped with stronger fine collection actions and restrictions on registry services. For example, a person may have to pay their outstanding fine before they can renew their driver’s licence.

- Repeat offenders will be targeted with a new multi-agency enforcement framework.

- Tickets can be given at the time of an incident or post-infraction – someone who isn’t charged immediately may receive a ticket after authorities do further investigation.

Rapid testing

- The province has launched a new rapid testing partnership with Alberta Chambers of Commerce.

- Businesses and service providers are no longer required to have a health-care provider oversee their rapid testing program.

- Rapid tests are available for employers.

Continuing care

- Restrictions for visitors to continuing care facilities have been eased.

- These changes will vary by site based on the design of the building, wishes of residents and other factors.

- Each site must develop their own visiting approach that falls within the guidelines set out and reflects the risk tolerance of the residents who live at that site.

COVID Care Teams outreach

- If you or others in your home have been directed to self-isolate/quarantine by Alberta Health Services and are unable to do so safely at home, please contact 211 to discuss options, including accessing an assigned hotel to safely isolate (free of charge). Financial assistance may also be available in the amount of $625, upon completion of the self-isolation period.

Albertans downloading tracer app

- All Albertans are encouraged to download the secure ABTraceTogether app, which is integrated with provincial contact tracing. The federal app is not a contact tracing app.

- Secure contact tracing is an effective tool to stop the spread by notifying people who were exposed to a confirmed case so they can isolate and be tested.

- As of May 13, 314,511 Albertans were using the ABTraceTogether app, 69 per cent on iOS and 31 per cent on Android.

- Secure contact tracing is a cornerstone of Alberta’s Relaunch Strategy.

MyHealth Records quick access

- Parents and guardians can access the COVID-19 test results for children under the age of 18 through MyHealth Records (MHR) as soon as they are ready.

- More than 600,000 Albertans have MHR accounts.

Addiction and mental health supports

- Confidential supports are available. The Mental Health Help Line at 1-877-303-2642 and the Addiction Help Line at 1-866-332-2322 operate 24 hours a day, seven days a week. Resources are also available online.

- The Kids Help Phone is available 24-7 and offers professional counselling, information and referrals and volunteer-led, text-based support to young people by texting CONNECT to 686868.

- Online resources provide advice on handling stressful situations and ways to talk with children.

Family violence prevention

- A 24-hour Family Violence Information Line at 310-1818 provides anonymous help in more than 170 languages.

- Alberta’s One Line for Sexual Violence is available at 1-866-403-8000, from 9 a.m. to 9 p.m.

- People fleeing family violence can call local police or the nearest RCMP detachment to apply for an Emergency Protection Order, or follow the steps in the Emergency Protection Orders Telephone Applications (COVID-19).

- Information sheets and other resources on family violence prevention are at alberta.ca/COVID19.

Alberta’s government is responding to the COVID-19 pandemic by protecting lives and livelihoods with precise measures to bend the curve, sustain small businesses and protect Alberta’s health-care system.

Quick facts

- Legally, all Albertans must physically distance and isolate when sick or with symptoms.

- Good hygiene is your best protection: wash your hands regularly for at least 20 seconds, avoid touching your face, cough or sneeze into an elbow or sleeve, and dispose of tissues appropriately.

- Please share acts of kindness during this difficult time at #AlbertaCares.

- Alberta Connects Contact Centre (310-4455) is open Monday to Friday, 8:15 a.m. to 4:30 p.m.

Alberta

Calgary’s new city council votes to ban foreign flags at government buildings

From LifeSiteNews

It is not yet clear if the flag motion applies to other flags, such as LGBT ones.

Western Canada’s largest city has put in place what amounts to a ban on politically charged flags from flying at city-owned buildings.

“Calgary’s Flag Policy means any country recognized by Canada may have their flag flown at City Hall on their national day,” said Calgary’s new mayor Jeromy Farkas on X last month.

“But national flag-raisings are now creating division. Next week, we’ll move to end national flag-raisings at City Hall to keep this a safe, welcoming space for all.”

The motion to ban foreign flags from flying at government buildings was introduced on December 15 by Calgary councilor Dan McLean and passed by a vote of 8 to 7. He had said the previous policy to allow non-Canadian flags to fly, under former woke mayor Jyoti Gondek, was “source of division within our community.”

“In recent months, this practice has been in use in ways that I’ve seen have inflamed tensions, including instances where flag raisings have been associated with anti-Semitic behavior and messaging,” McLean said during a recent council meeting.

The ban on flag raising came after the Palestinian flag was allowed to be raised at City Hall for the first time.

Farkas, shortly after being elected mayor in the fall of 2025, had promised that he wanted a new flag policy introduced in the city.

It is not yet clear if the flag motion applies to other flags, such as LGBT ones.

Despite Farkas putting forth the motion, as reported by LifeSiteNews he is very much in the pro-LGBT camp. However, he has promised to focus only on non-ideological issues during his term.

McLean urged that City Hall must be a place of “neutrality, unity, and respect” for everyone.

“When City Hall becomes a venue for geopolitical expressions, it places the city in the middle of conflicts that are well beyond our municipal mandates,” he said.

As reported by LifeSiteNews, other jurisdictions in Canada are considering banning non-Canadian flags from flying over public buildings.

Recently a political party in British Columbia, OneBC, introduced legislation to ban non-domestic government flags at public buildings in British Columbia.

Across Canada there has also been an ongoing issue with so-called “Pride” flags being raised at schools and city buildings.

Alberta

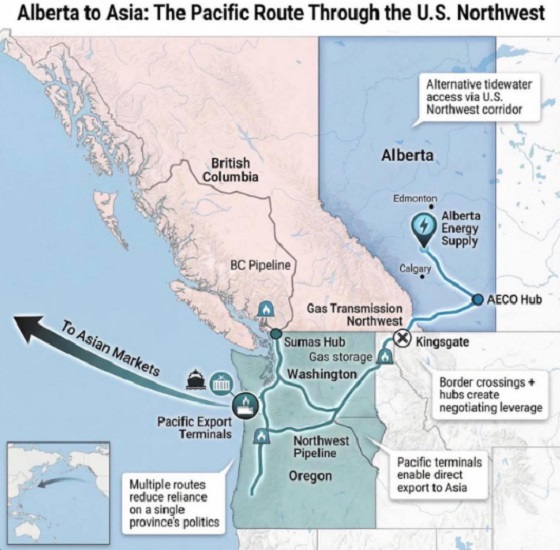

What are the odds of a pipeline through the American Pacific Northwest?

From Resource Works

Can we please just get on with building one through British Columbia instead?

Alberta Premier Danielle Smith is signalling she will look south if Canada cannot move quickly on a new pipeline, saying she is open to shipping oil to the Pacific via the U.S. Pacific Northwest. In a year-end interview, Smith said her “first preference” is still a new West Coast pipeline through northern British Columbia, but she is willing to look across the border if progress stalls.

“Anytime you can get to the West Coast it opens up markets to get to Asia,” she said. Smith also said her focus is building along “existing rights of way,” pointing to the shelved Northern Gateway corridor, and she said she would like a proposal submitted by May 2026.

Deadlines and strings attached

The timing matters because Ottawa and Edmonton have already signed a memorandum of understanding that backs a privately financed bitumen pipeline to a British Columbia port and sends it to the new Major Projects Office. The agreement envisages at least one million barrels a day and sets out a plan for Alberta to file an application by July 1, 2026, while governments aim to finish approvals within two years.

The bargain comes with strings. The MOU links the pipeline to the Pathways carbon capture network, and commits Alberta to strengthen its TIER system so the effective carbon credit price rises to at least 130 dollars a tonne, with details to be settled by April 1, 2026.

Shifting logistics

If Smith is floating an American outlet, it is partly because Pacific Northwest ports are already drawing Canadian exporters. Nutrien’s plan for a $1-billion terminal at Washington State’s Port of Longview highlighted how trade logistics can shift when proponents find receptive permitting lanes.

But the political terrain in Washington and Oregon is unforgiving for fossil fuel projects, even for natural gas. In 2023, federal regulators approved TC Energy’s GTN Xpress expansion over protests from environmental groups and senior officials in West Coast states, with opponents warning about safety and wildfire risk. The project would add about 150 million cubic feet per day of capacity.

A record of resistance

That decision sits inside a longer record of resistance. The anti-development activist website “DeSmog” eagerly estimated that more than 70 percent of proposed coal, oil, and gas projects in the Pacific Northwest since 2012 were defeated, often after sustained local organizing and legal challenges.

Even when a project clears regulators, economics can still kill it. Gas Outlook reported that GTN later said the expansion was “financially not viable” unless it could obtain rolled-in rates to spread costs onto other utilities, a request regulators rejected when they approved construction.

Policy direction is tightening too. Washington’s climate framework targets cutting climate pollution 95 percent by 2050, alongside “clean” transport, buildings, and power measures that push electrification. Recent state actions described by MRSC summaries and NRDC notes reinforce that direction, including moves to help utilities plan a transition away from gas.

Oregon is moving in the same direction. Gov. Tina Kotek issued an executive order directing agencies to move faster on clean energy permitting and grid connections, tied to targets of cutting emissions 50 percent by 2035 and 90 percent by 2050, the Capital Chronicle reported.

For Smith, the U.S. corridor talk may be leverage, but it also underscores a risk, the alternative could be tougher than the Canadian fight she is already waging. The surest way to snuff out speculation is to make it unnecessary by advancing a Canadian project now that the political deal is signed. As Resource Works argued after the MOU, the remaining uncertainty sits with private industry and whether it will finally build, rather than keep testing hypothetical routes.

Resource Works News

-

Agriculture21 hours ago

Agriculture21 hours agoWhy is Canada paying for dairy ‘losses’ during a boom?

-

Automotive1 day ago

Automotive1 day agoFord’s EV Fiasco Fallout Hits Hard

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Alberta22 hours ago

Alberta22 hours agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

Censorship Industrial Complex23 hours ago

Censorship Industrial Complex23 hours agoTop constitutional lawyer warns against Liberal bills that could turn Canada into ‘police state’

-

espionage2 days ago

espionage2 days agoCarney Floor Crossing Raises Counterintelligence Questions aimed at China, Former Senior Mountie Argues

-

International2 days ago

International2 days agoOttawa is still dodging the China interference threat

-

Health2 days ago

Health2 days agoAll 12 Vaccinated vs. Unvaccinated Studies Found the Same Thing: Unvaccinated Children Are Far Healthier