Alberta

Where Iron and Earth Meet – Oil & Gas Workers for Renewable Energy

Iron and Earth is a Canadian non-profit organization led by oilsands workers who advocate for a balanced approach towards a green energy transition. The organization was founded in 2015 during the economic crisis that led to the termination of thousands of oil and gas workers nationwide. It began as a collective of boots-on-the-ground employees who had experienced the hard times brought on by the boom-bust nature of the oil and gas industry, and wanted to be a part of the movement to diversify and build resilience in Canada.

According to the Iron and Earth mission statement, Where Iron and Earth Meet, “There’s a place for the oilsands, and there’s a place for renewable energy. The intention is not to shut down the oilsands, but to see they are managed more sustainably while developing our renewable energy resources more ambitiously.”

According to the Iron and Earth mission statement, Where Iron and Earth Meet, “There’s a place for the oilsands, and there’s a place for renewable energy. The intention is not to shut down the oilsands, but to see they are managed more sustainably while developing our renewable energy resources more ambitiously.”

Dialogues surrounding sustainability and diversification often place renewable energy alternatives at odds with the oil and gas industry, with little room for productive discussion. Iron and Earth provides a platform for oilsands workers, business owners, non-profits, politicians and consumers to meet at the same table and collaborate effectively to build a more sustainable future for all Canadians. Rather than contribute to divisive narratives that position oil and gas and renewable energy as mutually exclusive industries, Iron and Earth advocates for a balanced approach towards diversification, sustainability and a renewable transition.

“Iron and Earth is proof of the dichotomy of people working in the oil and gas industry who care about the environment very, very much,” says Bruce Wilson, board member for Iron and Earth. “There is a diverse array of political affiliations and backgrounds within the organization, from individuals presently working in oil and gas to those who have recently transitioned, to those who have never worked in the industry at all.” Wilson joined Iron and Earth in 2018 after more than 30 years in the oil and gas industry, including 17 years with Shell International.

“Iron and Earth is proof of the dichotomy of people working in the oil and gas industry who care about the environment very, very much,” says Bruce Wilson, board member for Iron and Earth. “There is a diverse array of political affiliations and backgrounds within the organization, from individuals presently working in oil and gas to those who have recently transitioned, to those who have never worked in the industry at all.” Wilson joined Iron and Earth in 2018 after more than 30 years in the oil and gas industry, including 17 years with Shell International.

By focusing on industry overlaps, Iron and Earth highlights the ways in which fossil fuels and renewable energy can be beneficial, reinforcing sectors that can produce positive outcomes for the Canadian workforce and the global climate crisis. “Fortunately for many of the workers who are affected by the ongoing boom and bust cycles of the oilsands, many renewable energy jobs require the same skills and tradespeople that are currently working in the Canadian oil and gas industry” (1).

Iron and Earth streamlines the transfer of skills between industries by offering a number of programs and resources to support workers seeking to transition away from fossil fuels into renewable energy. This includes offering training, classroom education, and hands-on experience to broaden the understanding of industry overlaps that will aid oil and gas workers in finding their fit in clean technology.

Iron and Earth streamlines the transfer of skills between industries by offering a number of programs and resources to support workers seeking to transition away from fossil fuels into renewable energy. This includes offering training, classroom education, and hands-on experience to broaden the understanding of industry overlaps that will aid oil and gas workers in finding their fit in clean technology.

These processes and resources operate with respect to the reality that transitions away from oil and gas into renewables can be a daunting and difficult process for many. Former Canadian oil and gas worker and current Iron and Earth spokesperson, Nick Kendrick, came to Iron and Earth in 2018 after reaching a fork in the road in his own career path. After 5 years in oil and gas, Kendrick was faced with the employment insecurity many workers in the Canadian oil and gas industry are familiar with. “When I started in oil and gas, prices were booming,” he says, “but by the time I got up north, the industry was struggling. People were getting laid off, and I realized it might be time to make a move.”

Kendrick made the decision to return to school at the University of Calgary, where he pursued a Master’s Degree in Sustainable Energy. It was there he connected with Iron and Earth for his capstone project, where he facilitated the drafting of a strategic path forward for the organization. This included mapping out geographic locations that offered the most opportunity to deliver impactful training workshops and support upcoming renewable energy projects, as well as encourage Indigenous participation.

“Leaving oil and gas for renewables is a very scary thing, especially in Alberta,” says Kendrick, “I admire how Iron and Earth’s approach is not to completely abandon the oilsands. They’ve been very foundational for Canada, but they’re not sustainable. It’s time to help each other progress onto something new.”

In September 2020, Iron and Earth unveiled their Prosperous Transition Plan, framing the future for Canada’s green transition. The Prosperous Transition Plan boldly calls on the Trudeau Government to invest $110 billion over the next decade into a green recovery for Canada. The plan highlights four focal points of the Canadian economy: workforce, business, infrastructure and environment. With an emphasis on repurposing oil and gas infrastructure and getting people back to work, Iron and Earth’s Prosperous Transition Plan focuses on recovering from the COVID-19 pandemic, decarbonizing the economy and addressing inequality to ensure a prosperous future.

In September 2020, Iron and Earth unveiled their Prosperous Transition Plan, framing the future for Canada’s green transition. The Prosperous Transition Plan boldly calls on the Trudeau Government to invest $110 billion over the next decade into a green recovery for Canada. The plan highlights four focal points of the Canadian economy: workforce, business, infrastructure and environment. With an emphasis on repurposing oil and gas infrastructure and getting people back to work, Iron and Earth’s Prosperous Transition Plan focuses on recovering from the COVID-19 pandemic, decarbonizing the economy and addressing inequality to ensure a prosperous future.

With more than 1000 active members across Canada from a variety of industrial trades, Iron and Earth is continually expanding and advocating for ethical, legitimate solutions to facilitate Canada’s transition to renewable energy. “These are not utopian suggestions,” says Wilson, “they are pragmatic solutions that require purposeful, ambitious action from the government … Change and thrive is the business model for the future.”

To learn more about Iron and Earth’s mission and Prosperous Transition Plan, visit https://www.ironandearth.org.

For more stories, visit Todayville Calgary.

Alberta

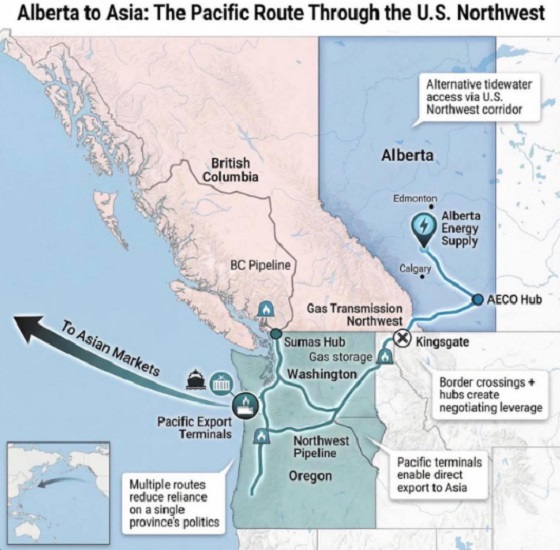

What are the odds of a pipeline through the American Pacific Northwest?

From Resource Works

Can we please just get on with building one through British Columbia instead?

Alberta Premier Danielle Smith is signalling she will look south if Canada cannot move quickly on a new pipeline, saying she is open to shipping oil to the Pacific via the U.S. Pacific Northwest. In a year-end interview, Smith said her “first preference” is still a new West Coast pipeline through northern British Columbia, but she is willing to look across the border if progress stalls.

“Anytime you can get to the West Coast it opens up markets to get to Asia,” she said. Smith also said her focus is building along “existing rights of way,” pointing to the shelved Northern Gateway corridor, and she said she would like a proposal submitted by May 2026.

Deadlines and strings attached

The timing matters because Ottawa and Edmonton have already signed a memorandum of understanding that backs a privately financed bitumen pipeline to a British Columbia port and sends it to the new Major Projects Office. The agreement envisages at least one million barrels a day and sets out a plan for Alberta to file an application by July 1, 2026, while governments aim to finish approvals within two years.

The bargain comes with strings. The MOU links the pipeline to the Pathways carbon capture network, and commits Alberta to strengthen its TIER system so the effective carbon credit price rises to at least 130 dollars a tonne, with details to be settled by April 1, 2026.

Shifting logistics

If Smith is floating an American outlet, it is partly because Pacific Northwest ports are already drawing Canadian exporters. Nutrien’s plan for a $1-billion terminal at Washington State’s Port of Longview highlighted how trade logistics can shift when proponents find receptive permitting lanes.

But the political terrain in Washington and Oregon is unforgiving for fossil fuel projects, even for natural gas. In 2023, federal regulators approved TC Energy’s GTN Xpress expansion over protests from environmental groups and senior officials in West Coast states, with opponents warning about safety and wildfire risk. The project would add about 150 million cubic feet per day of capacity.

A record of resistance

That decision sits inside a longer record of resistance. The anti-development activist website “DeSmog” eagerly estimated that more than 70 percent of proposed coal, oil, and gas projects in the Pacific Northwest since 2012 were defeated, often after sustained local organizing and legal challenges.

Even when a project clears regulators, economics can still kill it. Gas Outlook reported that GTN later said the expansion was “financially not viable” unless it could obtain rolled-in rates to spread costs onto other utilities, a request regulators rejected when they approved construction.

Policy direction is tightening too. Washington’s climate framework targets cutting climate pollution 95 percent by 2050, alongside “clean” transport, buildings, and power measures that push electrification. Recent state actions described by MRSC summaries and NRDC notes reinforce that direction, including moves to help utilities plan a transition away from gas.

Oregon is moving in the same direction. Gov. Tina Kotek issued an executive order directing agencies to move faster on clean energy permitting and grid connections, tied to targets of cutting emissions 50 percent by 2035 and 90 percent by 2050, the Capital Chronicle reported.

For Smith, the U.S. corridor talk may be leverage, but it also underscores a risk, the alternative could be tougher than the Canadian fight she is already waging. The surest way to snuff out speculation is to make it unnecessary by advancing a Canadian project now that the political deal is signed. As Resource Works argued after the MOU, the remaining uncertainty sits with private industry and whether it will finally build, rather than keep testing hypothetical routes.

Resource Works News

Alberta

Alberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

From the Fraser Institute

By Nadeem Esmail, Mackenzie Moir and Lauren Asaad

In October, Alberta’s provincial government announced forthcoming legislative changes that will allow patients to pay out-of-pocket for any diagnostic test they want, and without a physician referral. The policy, according to the Smith government, is designed to help improve the availability of preventative care and increase testing capacity by attracting additional private sector investment in diagnostic technology and facilities.

Unsurprisingly, the policy has attracted Ottawa’s attention, with discussions now taking place around the details of the proposed changes and whether this proposal is deemed to be in line with the Canada Health Act (CHA) and the federal government’s interpretations. A determination that it is not, will have both political consequences by being labeled “non-compliant” and financial consequences for the province through reductions to its Canada Health Transfer (CHT) in coming years.

This raises an interesting question: While the ultimate decision rests with Ottawa, does the Smith government’s new policy comply with the literal text of the CHA and the revised rules released in written federal interpretations?

According to the CHA, when a patient pays out of pocket for a medically necessary and insured physician or hospital (including diagnostic procedures) service, the federal health minister shall reduce the CHT on a dollar-for-dollar basis matching the amount charged to patients. In 2018, Ottawa introduced the Diagnostic Services Policy (DSP), which clarified that the insured status of a diagnostic service does not change when it’s offered inside a private clinic as opposed to a hospital. As a result, any levying of patient charges for medically necessary diagnostic tests are considered a violation of the CHA.

Ottawa has been no slouch in wielding this new policy, deducting some $76.5 million from transfers to seven provinces in 2023 and another $72.4 million in 2024. Deductions for Alberta, based on Health Canada’s estimates of patient charges, totaled some $34 million over those two years.

Alberta has been paid back some of those dollars under the new Reimbursement Program introduced in 2018, which created a pathway for provinces to be paid back some or all of the transfers previously withheld on a dollar-for-dollar basis by Ottawa for CHA infractions. The Reimbursement Program requires provinces to resolve the circumstances which led to patient charges for medically necessary services, including filing a Reimbursement Action Plan for doing so developed in concert with Health Canada. In total, Alberta was reimbursed $20.5 million after Health Canada determined the provincial government had “successfully” implemented elements of its approved plan.

Perhaps in response to the risk of further deductions, or taking a lesson from the Reimbursement Action Plan accepted by Health Canada, the province has gone out of its way to make clear that these new privately funded scans will be self-referred, that any patient paying for tests privately will be reimbursed if that test reveals a serious or life-threatening condition, and that physician referred tests will continue to be provided within the public system and be given priority in both public and private facilities.

Indeed, the provincial government has stated they do not expect to lose additional federal health care transfers under this new policy, based on their success in arguing back previous deductions.

This is where language matters: Health Canada in their latest CHA annual report specifically states the “medical necessity” of any diagnostic test is “determined when a patient receives a referral or requisition from a medical practitioner.” According to the logic of Ottawa’s own stated policy, an unreferred test should, in theory, be no longer considered one that is medically necessary or needs to be insured and thus could be paid for privately.

It would appear then that allowing private purchase of services not referred by physicians does pass the written standard for CHA compliance, including compliance with the latest federal interpretation for diagnostic services.

But of course, there is no actual certainty here. The federal government of the day maintains sole and final authority for interpretation of the CHA and is free to revise and adjust interpretations at any time it sees fit in response to provincial health policy innovations. So while the letter of the CHA appears to have been met, there is still a very real possibility that Alberta will be found to have violated the Act and its interpretations regardless.

In the end, no one really knows with any certainty if a policy change will be deemed by Ottawa to run afoul of the CHA. On the one hand, the provincial government seems to have set the rules around private purchase deliberately and narrowly to avoid a clear violation of federal requirements as they are currently written. On the other hand, Health Canada’s attention has been aroused and they are now “engaging” with officials from Alberta to “better understand” the new policy, leaving open the possibility that the rules of the game may change once again. And even then, a decision that the policy is permissible today is not permanent and can be reversed by the federal government tomorrow if its interpretive whims shift again.

The sad reality of the provincial-federal health-care relationship in Canada is that it has no fixed rules. Indeed, it may be pointless to ask whether a policy will be CHA compliant before Ottawa decides whether or not it is. But it can be said, at least for now, that the Smith government’s new privately paid diagnostic testing policy appears to have met the currently written standard for CHA compliance.

Lauren Asaad

Policy Analyst, Fraser Institute

-

Business2 days ago

Business2 days agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

Agriculture17 hours ago

Agriculture17 hours agoWhy is Canada paying for dairy ‘losses’ during a boom?

-

Daily Caller2 days ago

Daily Caller2 days agoParis Climate Deal Now Decade-Old Disaster

-

Automotive1 day ago

Automotive1 day agoFord’s EV Fiasco Fallout Hits Hard

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Crime2 days ago

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

Alberta18 hours ago

Alberta18 hours agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

Censorship Industrial Complex19 hours ago

Censorship Industrial Complex19 hours agoTop constitutional lawyer warns against Liberal bills that could turn Canada into ‘police state’