Economy

Climate Panic Behind Energy Crisis

Climate activists, including members of Extinction Rebellion, participate in a demonstration in front of the Thurgood Marshall US Courthouse on June 30, 2022 in New York City. (Photo by Spencer Platt/Getty Images)

My testimony to U.S. Congress

I was delighted to be invited to testify before the United States Congress for the seventh time in two years. Below are my oral remarks. All references can be found in my full testimony, which draws on much of what I have published here on Substack over the last 18 months. To read my full testimony, please click here.

Good morning Chairwoman Maloney, Environment Subcommittee Chairman Khanna, and Ranking Member Comer, and members of the Committee. I am grateful to you for inviting my testimony.

I share this committee’s concern with climate change and misinformation. It is for that reason that I have, for more than 20 years, conducted energy analysis, worked as a journalist, and advocated for renewables, coal-to-natural gas switching, and nuclear power to reduce carbon emissions.

At the same time, I am deeply troubled by the way concern over climate change is being used to repress domestic energy production. The U.S. is failing to produce sufficient quantities of natural gas and oil for ourselves and our allies. The result is the worst energy crisis in 50 years, continuing inflation, and harm to workers and consumers in the U.S. and the Western world. Energy shortages are already resulting in rising social disorder and the toppling of governments, and they are about to get much worse.

We should do more to address climate change but in a framework that prioritizes energy abundance, reliability, and security. Climate change is real and we should seek to reduce carbon emissions. But it’s also the case that U.S. carbon emissions declined 22% between 2005 and 2020, global emissions were flat over the last decade, and weather-related disasters have declined since the beginning of this century. There is no scientific scenario for mass death from climate change. A far more immediate and dangerous threat is insufficient energy supplies due to U.S. government policies and actions aimed at reducing oil and gas production.

The Biden administration claims to be doing all it can to increase oil and natural gas production but it’s not. It has issued fewer leases for oil and gas production on federal lands than any other administration since World War II. It blocked the expansion of oil refining. It is using environmental regulations to reduce liquified natural gas production and exports. It has encouraged greater production by Venezuela, Saudi Arabia, and other OPEC nations, rather than in the U.S. And its representatives continue to emphasize that their goal is to end the use of fossil fuels, including the cleanest one, natural gas, thereby undermining private sector investment.

If this committee is truly concerned about corporate profits and misinformation, then it must approach the issue fairly. The big tech companies make larger profits than big oil but have for some reason not been called to account. Nor has there been any acknowledgement that the U.S. oil and gas industry effectively subsidized American consumers to the tune of $100 billion per year for most of the last 12 years, resulting in many bankruptcies and financial losses. As for misinformation about climate change and energy, it is rife on all sides, and I question whether the demands for censorship by big tech firms are being made in good faith, or are consistent with the rights protected by the First Amendment.

Efforts by the Biden administration and Congress to increase reliance on weather dependent renewable energies and electric vehicles (EVs) risk undermining American industries and helping China. China has more global market share of the production of renewables, EVs, and their material components than OPEC has over global oil production. It would be a grave error for the U.S. to sacrifice its hard-won energy security for dependence on China for energy. While I support the repatriation of those industries to the U.S., doing so will take decades, not years. Increased costs tied to higher U.S. labor and environmental standards could further impede their development. There are also significant underlying physical problems with renewables, stemming from their energy-dilute, material-intensive nature, that may not be surmountable. Already we have seen that their weather-dependence, large land requirements, and large material throughput result in renewables making electricity significantly more expensive everywhere they are deployed at scale.

The right path forward would increase oil and natural gas production in the short and medium terms, and increase nuclear production in the medium to long terms. The U.S. government is, by extending and expanding heavy subsidies for renewables, expanding control over energy markets, but without a clear vision for the role of oil, gas, and nuclear.

We should seek a significant expansion of natural gas and oil production, pipelines, and refineries to provide greater energy security for ourselves, and to produce in sufficient quantities for our allies. We should seek a significant expansion of nuclear power to increase energy abundance and security, produce hydrogen, and one day phase out the use of all fossil fuels. While the latter shouldn’t be our main focus, particularly now, radical decarbonization can and should be a medium- to long-term objective within the context of creating abundant, secure, and low-cost energy supplies to power our remarkable nation and civilization.

Business

Large-scale energy investments remain a pipe dream

I view the recent announcements by the Government of Canada as window dressing, and not addressing the fundamental issue which is that projects are drowning in bureaucratic red tape and regulatory overburden. We don’t need them picking winners and losers, a fool’s errand in my opinion, but rather make it easier to do business within Canada and stop the hemorrhaging of Foreign Direct Investment from this country.

Thanks for reading William’s Substack!

Subscribe for free to receive new posts and support my work.

Changes are afoot—reportedly, carve-outs and tweaks to federal regulations that would help attract investment in a new oil pipeline from Alberta. But any private proponent to come out of this deal will presumably be handpicked to advance through the narrow Bill C-5 window, aided by one-off fixes and exemptions.

That approach can only move us so far. It doesn’t address the underlying problem.

Anyone in the investment world will tell you a patchwork of adjustments is nowhere near enough to unlock the large-scale energy investment this country needs. And from that investor’s perspective, the horizon stretches far beyond a single political cycle. Even if this government promises clarity today in the much-anticipated memorandum of understanding (MOU), who knows whether it will be around by the time any major proposal actually moves forward.

With all of the talk of “nation-building” projects, I have often been asked what my thoughts are about what we must see from the federal government.

The energy sector is the file the feds have to get right. It is by far the largest component of Canadian exports, with oil accounting for $147 billion in 2024 (20 percent of all exports), and energy as a whole accounting for $227 billion of exports (30 percent of all exports).

Furthermore, we are home to some of the largest resource reserves in the world, including oil (third-largest in proven reserves) and natural gas (ninth-largest). Canada needs to wholeheartedly embrace that. Natural resource exceptionalism is exactly what Canada is, and we should be proud of it.

One of the most important factors that drives investment is commodity prices. But that is set by market forces.

Beyond that, I have always said that the two most important things one considers before looking at a project are the rule of law and regulatory certainty.

The Liberal government has been obtuse when it comes to whether it will continue the West Coast tanker ban (Bill C-48) or lift it to make way for a pipeline. But nobody will propose a pipeline without the regulatory and legal certainty that they will not be seriously hindered should they propose to build one.

Meanwhile, the proposed emissions cap is something that sets an incredibly negative tone, a sentiment that is the most influential factor in ensuring funds flow. Finally, the Impact Assessment Act, often referred to as the “no more pipelines bill” (Bill C-69), has started to blur the lines between provincial and federal authority.

All three are supposedly on the table for tweaks or carve-outs. But that may not be enough.

It is interesting that Norway—a country that built its wealth on oil and natural gas—has adopted the mantra that as long as oil is a part of the global economy, it will be the last producer standing. It does so while marrying conventional energy with lower-carbon standards. We should be more like Norway.

Rather than constantly speaking down to the sector, the Canadian government should embrace the wealth that this represents and adopt a similar narrative.

The sector isn’t looking for handouts. Rather, it is looking for certainty, and a government proud of the work that they do and is willing to say so to Canada and the rest of the world. Foreign direct investment outflows have been a huge issue for Canada, and one of the bigger drags on our economy.

Almost all of the major project announcements Prime Minister Mark Carney has made to date have been about existing projects, often decades in the making, which are not really “additive” to the economy and are reflective of the regulatory overburden that industry faces en masse.

I have always said governments are about setting the rules of the game, while it is up to businesses to decide whether they wish to participate or to pick up the ball and look elsewhere.

Capital is mobile and will pursue the best risk-adjusted returns it can find. But the flow of capital from our country proves that Canada is viewed as just too risky for investors.

The government’s job is not to try to pick winners and losers. History has shown that governments are horrible at that. Rather, it should create a risk-appropriate environment with stable and capital-attractive rules in place, and then get out of the way and see where the chips fall.

Link to The Hub article: Large-scale energy investments remain a pipe dream

Formerly the head of institutional equity research at FirstEnergy Capital Corp and ATB Capital Markets. I have been involved in the energy sector in either the sell side or corporately for over 25 years

Thanks for reading William’s Substack!

Subscribe for free to receive new posts and support my work.

Business

Will the Port of Churchill ever cease to be a dream?

From Resource Works

The Port of Churchill has long been viewed as Canada’s northern gateway to global markets, but decades of under-investment have held it back.

A national dream that never materialised

For nearly a century, Churchill, Manitoba has loomed in the national imagination. In 1931, crowds on the rocky shore watched the first steamships pull into Canada’s new deepwater Arctic port, hailed as the “thriving seaport of the Prairies” that would bring western grain “1,000 miles nearer” to European markets. The dream was that this Hudson Bay town would become a great Canadian centre of trade and commerce.

The Hudson Bay Railway was blasted across muskeg and permafrost to reach what engineers called an “incomparably superior” harbour. But a short ice free season and high costs meant Churchill never grew beyond a niche outlet beside Canada’s larger ports, and the town’s population shrank.

False starts, failed investments

In 1997, Denver based OmniTrax bought the port and 900 kilometre rail line with federal backing and promises of heavy investment. Former employees and federal records later suggested those promises were not fully kept, even as Ottawa poured money into the route and subsidies were offered to keep grain moving north. After port fees jumped and the Canadian Wheat Board disappeared, grain volumes collapsed and the port shut, cutting rail service and leaving northern communities and miners scrambling.

A new Indigenous-led revival — with limits

The current revival looks different. The port and railway are now owned by Arctic Gateway Group, a partnership of First Nations and northern municipalities that stepped in after washouts closed the line and OmniTrax walked away. Manitoba and Ottawa have committed $262.5 million over five years to stabilize the railway and upgrade the terminal, with Manitoba’s share now at $87.5 million after a new $51 million provincial pledge.

Prime Minister Mark Carney has folded Churchill into his wider push on “nation building” infrastructure. His government’s new Major Projects Office is advancing energy, mining and transmission proposals that Ottawa says add up to more than $116 billion in investment. Against that backdrop, Churchill’s slice looks modest, a necessary repair rather than a defining project.

The paperwork drives home the point. The first waves of formally fast tracked projects include LNG expansion at Kitimat, new nuclear at Darlington and copper and nickel mines. Churchill sits instead on the office’s list of “transformative strategies”, a roster of big ideas still awaiting detailed plans and costings, with a formal Port of Churchill Plus strategy not expected until the spring of 2026 under federal–provincial timelines.

Churchill as priority — or afterthought?

Premier Wab Kinew rejects the notion that Churchill is an afterthought. Standing with Carney in Winnipeg, he called the northern expansion “a major priority” for Manitoba and cast the project as a way for the province “to be able to play a role in building up Canada’s economy for the next stage of us pushing back against” U.S. protectionism. He has also cautioned that “when we’re thinking about a major piece of infrastructure, realistically, a five to 10 year timeline is probably realistic.”

On paper, the Port of Churchill Plus concept is sweeping. The project description calls for an upgraded railway, an all weather road, new icebreaking capacity in Hudson Bay and a northern “energy corridor” that could one day move liquefied natural gas, crude oil, electricity or hydrogen. Ottawa’s joint statement with Manitoba calls Churchill “without question, a core component to the prosperity of the country.”

Concepts without commitments

The vision is sweeping, yet most of this remains conceptual. Analysts note that hard questions about routing, engineering, environmental impacts and commercial demand still have to be answered. Transportation experts say they struggle to see a purely commercial case that would make Churchill more attractive than larger ports, arguing its real value is as an insurance policy for sovereignty and supply chain resilience.

That insurance argument is compelling in an era of geopolitical risk and heightened concern about Arctic security. It is also a reminder of how limited Canada’s ambition at Churchill has been. For a hundred years, governments have been willing to dream big in northern Manitoba, then content to underbuild and underdeliver, as the port’s own history of near misses shows. A port that should be a symbol of confidence in the North has spent most of its life as a seasonal outlet.

A Canadian pattern — high ambition, slow execution

The pattern is familiar across the country. Despite abundant resources, capital and engineering talent, mines, pipelines, ports and power lines take years longer to approve and build here than in competing jurisdictions. A tangle of overlapping regulations, court challenges and political caution has turned review into a slow moving veto, leaving a politics of grand announcements followed by small, incremental steps.

Churchill is where those national habits are most exposed. The latest round of investment, led by Indigenous owners and backed by both levels of government, deserves support, as does Kinew’s insistence that Churchill is a priority. But until Canada matches its Arctic trading rhetoric with a willingness to build at scale and at speed, the port will remain a powerful dream that never quite becomes a real gateway to the world.

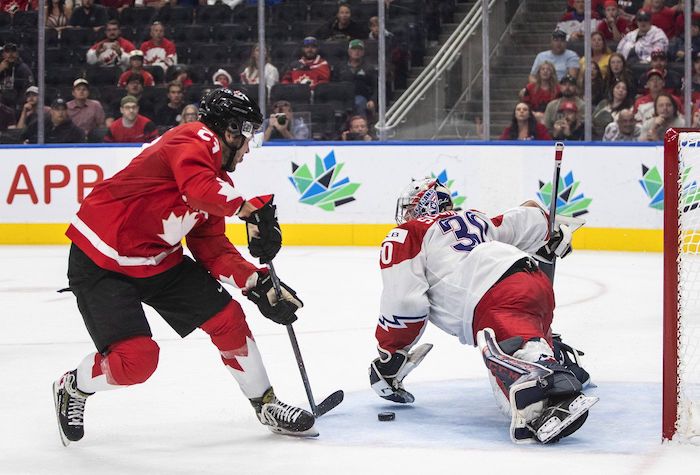

Headline photo credit to THE CANADIAN PRESS/John Woods

-

COVID-1911 hours ago

COVID-1911 hours agoNew report warns Ottawa’s ‘nudge’ unit erodes democracy and public trust

-

Great Reset2 days ago

Great Reset2 days agoEXCLUSIVE: A Provincial RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

Health2 days ago

Health2 days agoDisabled Canadians petition Parliament to reverse MAiD for non-terminal conditions

-

Daily Caller2 days ago

Daily Caller2 days agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command

-

Crime1 day ago

Crime1 day agoHow Global Organized Crime Took Root In Canada

-

Digital ID2 days ago

Digital ID2 days agoLeslyn Lewis urges fellow MPs to oppose Liberal push for mandatory digital IDs

-

Business2 days ago

Business2 days agoThe Payout Path For Indigenous Claims Is Now National Policy

-

Energy1 day ago

Energy1 day agoExpanding Canadian energy production could help lower global emissions