Opinion

UCP Tax Cut Hits the Target but Misses the Mark

Opinion by Cory G. Litzenberger

Well for fear of being lynched, let me talk about how I think the UCP’s Job Creation Tax Cut may be (partially) incorrect.

While I applaud politicians for laying out their plans in advance of an election, my fear is that the plan is too slow in implementation and cuts too far.

I think a tax cut needs to be moderate and quick – not slow and deep.

Here are my thoughts for various tax changes we need to do in Alberta:

General Corporate Income Tax Rate:

Instead of cutting by 1% per year over 4 years, bring it back by 2% to 10% from 12% in the first year and keep it there.

By delaying the cut as the UCP currently proposes, it could reduce the impact it will have on the economy as the change to the bottom line will not be impacted enough for a corporation to make larger investment until year two or three of the plan.

Quicker action by government will result in quicker action by business, resulting in quicker action in the economy and job creation.

10% also still makes us the lowest jurisdiction in Canada.

Personal Income Tax change to 3 brackets:

– 8% for first $50k

– 10% for the next $100k

– 12% for over $150k

This reduction from 10% on the first $50,000 saves roughly $600 in personal income tax (after factoring in the basic personal tax credit) for every individual making more than $50,000 a year.

It also saves 2% for those making under $50,000 currently.

This is an important cut in order to reward people that call Alberta home, as you will see below.

A rich person paying 12% in Alberta on their personal income is better than them paying 0% because they live somewhere else.

Harmonized Sales Tax (HST) 5%

Yes, I think we need to remove the inflationary and regressive carbon tax as it is way too high of a burden and causes a ripple effect in inflationary pricing how it was implemented.

However, I suggest we implement a 5% HST (which is a flow-through for businesses and does not have the same impact on pricing).

Now, hear me out before you break out the yellow vest!

Currently, anyone visiting our province as either a tourist or a temporary worker from another province are using our infrastructure like roads, water, and yes, even hospital emergency rooms.

When these non-Alberta residents file their personal tax returns, they file it based on their home province of residence as of December 31. Since most of them don’t have a permanent residence in Alberta, this results is them paying income taxes to other provinces, while using our infrastructure for free.

Other provincial residents not paying any taxes in Alberta while here unfairly puts the cost on all of us that live here.

If we implemented an HST similar to the GST program, low income households would still receive credit back (just like GST credit) to offset most (if not all) of any HST they pay.

The $600 in income tax savings we mentioned above for everyone else, is equivalent to $12,000 of taxable supplies consumed ($24,000 in a double income household where they each make over $50,000 of income).

Don’t forget that basic grocery and shelter do not have sales taxes, and if Andrew Scheer gets elected, neither will basic home heating.(https://twitter.com/andrewscheer/status/854364648388182016)

This income tax reduction of $600 to $1,200 would offset much of the sales tax you would pay, but would now start to charge non-Alberta resident visitors and workers.

The reason for an HST instead of a PST is that currently, an HST is required to be charged by all GST registrants across Canada. If you are a GST registrant, you are automatically an HST registrant.

For example, in my office in Red Deer, I have to charge my Ontario customers HST and send it in to the government even though my business is in Alberta.

An HST could reduce the potential for tax leakage out of our province by funneling it back to Alberta because of other retailers in other provinces requiring to charge it on things purchased outside of, or shipped to, Alberta.

Results

– a competitive corporate tax rate to attract investment and do it quicker than the original UCP plan;

– low personal income tax to attract wealthy individuals (and their tax residency) back to Alberta to make it their place of residence, again, quickly;

– removal of the inflationary carbon tax;

– insertion of a relatively low cost HST so that we can get back some of that transfer payment money from the residents of other provinces.

In Summary

– Reduce Corporate moderately and quickly.

– Reduce Individual moderately and quickly.

– Remove Carbon tax.

– Implement an HST.

I know that the slight mention of a sales tax in Alberta makes the hair on the back of your neck stand straight up, and for many conservative politicians, they would resign before suggesting it. However, even as a fiscal-conservative tax accountant like myself, I believe that if it is implemented properly with tax reductions elsewhere, it can add to the bottom line for the province.

I also think it can do so without being a burden to those that live here by taxing those that don’t.

———

Cory G. Litzenberger, CPA, CMA, CFP, C.Mgr is the President & Founder of CGL Strategic Business & Tax Advisors; you can find out more about Cory’s biography at http://www.CGLtax.ca/Litzenberger-Cory.html

Business

Rhetoric—not evidence—continues to dominate climate debate and policy

From the Fraser Institute

Myths, fallacies and ideological rhetoric continue to dominate the climate policy discussion, leading to costly and ineffective government policies,

according to a new study published today by the Fraser Institute, an independent, nonpartisan Canadian public policy think-tank.

“When considering climate policies, it’s important to understand what the science and analysis actually show instead of what the climate alarmists believe to be true,” said Kenneth P. Green, Fraser Institute senior fellow and author of Four Climate Fallacies.

The study dispels several myths about climate change and popular—but ineffective—emission reduction policies, specifically:

• Capitalism causes climate change: In fact, according to several environment/climate indices and the Fraser Institute’s annual Economic Freedom of the World Index, the more economically free a country is, the more effective it is at protecting its environment and combatting climate change.

• Even small-emitting countries can do their part to fight climate change: Even if Canada reduced its greenhouse gas emissions to zero, there would be

little to no measurable impact in global emissions, and it distracts people from the main drivers of emissions, which are China, India and the developing

world.

• Vehicle electrification will reduce climate risk and clean the air: Research has shown that while EVs can reduce GHG emissions when powered with

low-GHG energy, they often are not, and further, have offsetting environmental harms, reducing net environmental/climate benefits.

• Carbon capture and storage is a viable strategy to combat climate change: While effective at a small scale, the benefits of carbon capture and

storage to reduce global greenhouse gas emissions on a massive scale are limited and questionable.

“Citizens and their governments around the world need to be guided by scientific evidence when it comes to what climate policies make the most sense,” Green said.

“Unfortunately, the climate policy debate is too often dominated by myths, fallacies and false claims by activists and alarmists, with costly and ineffective results.”

Kenneth P. Green

Senior Fellow, Fraser Institute

Business

Canada’s economic pain could be a blessing in disguise

This article supplied by Troy Media.

By Roslyn Kunin

By Roslyn Kunin

Tariffs, inflation, and falling incomes sound bad, but what if they’re forcing us to finally fix what’s broken?

Canada is facing serious economic headwinds—from falling incomes to rising inflation and U.S. trade hostility—but within this turmoil lies an opportunity. If we respond wisely, this crisis could become a turning point, forcing long-overdue reforms and helping us build a stronger, more independent economy.

Rather than reacting out of frustration, we can use these challenges to reassess what’s holding us back and move forward with practical solutions. From

trade policy to labour shortages and energy development, there are encouraging shifts already underway if we stay focused.

A key principle when under pressure is not to make things worse for ourselves. U.S. tariffs on Canadian steel and aluminum, and the chaotic renegotiation of NAFTA/CUSMA, certainly hurt our trade-dependent economy. But retaliatory tariffs don’t work in our favour. Canadian imports make

up a tiny fraction of the U.S. economy, so countermeasures barely register there, while Canadian consumers end up paying more. The federal government’s own countertariffs on items like orange juice and whisky raised costs here without changing American policy.

Fortunately, more Canadians are starting to realize this. Some provinces have reversed bans on U.S. goods. Saskatchewan, for example, recently lifted

restrictions on American alcohol. These decisions reflect a growing recognition that retaliating out of pride often means punishing ourselves.

More constructively, Canada is finally doing what should have happened long ago: diversifying trade. We’ve put too many economic eggs in one

basket, relying on an unpredictable U.S. market. Now, governments and businesses are looking for buyers elsewhere, an essential step toward greater stability.

At the same time, we’re starting to confront domestic barriers that have held us back. For years, it’s been easier for Canadian businesses to trade with the U.S. than to ship goods across provincial borders. These outdated restrictions—whether on wine, trucks or energy—have fractured our internal market. Now, federal and provincial governments are finally taking steps to create a unified national economy.

Labour shortages are another constraint limiting growth. Many Canadian businesses can’t find the skilled workers they need. But here, too, global shifts

are opening doors. The U.S.’s harsh immigration and research policies are pushing talent elsewhere, and Canada is emerging as the preferred alternative.

Scientists, engineers and graduate students, especially in tech and clean energy, are increasingly choosing Canada over the U.S. due to visa uncertainty and political instability. Our universities are already benefiting. If we continue to welcome international students and skilled professionals, we’ll gain a long-term advantage.

Just as global talent is rethinking where to invest their future, Canada has a chance to reassert leadership in one of its foundational industries: energy.

The federal government is now adopting a more balanced climate policy, shifting away from blanket opposition to carbon-based energy and focusing instead on practical innovation. Technologies such as carbon capture and storage are reducing emissions and helping clean up so-called dirty oil. These cleaner energy products are in demand globally.

To seize that opportunity, we need infrastructure: pipelines, refining capacity and delivery systems to get Canadian energy to world markets and across our own country. Projects like the Trans Mountain pipeline expansion, along with east-west grid connections and expanded refining, are critical to reducing dependence on U.S. imports and unlocking Canada’s full potential.

Perhaps the most crucial silver lining of all is a renewed awareness of the value of this country. As we approach July 1, more Canadians are recognizing how fortunate we are. Watching the fragility of democracy in the U.S., and confronting the uncomfortable idea of being reduced to a 51st state, has reminded us that Canada matters. Not just to us, but to the world.

Dr. Roslyn Kunin is a respected Canadian economist known for her extensive work in economic forecasting, public policy, and labour market analysis. She has held various prominent roles, including serving as the regional director for the federal government’s Department of Employment and Immigration in British Columbia and Yukon and as an adjunct professor at the University of British Columbia. Dr. Kunin is also recognized for her contributions to economic development, particularly in Western Canada.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Energy2 days ago

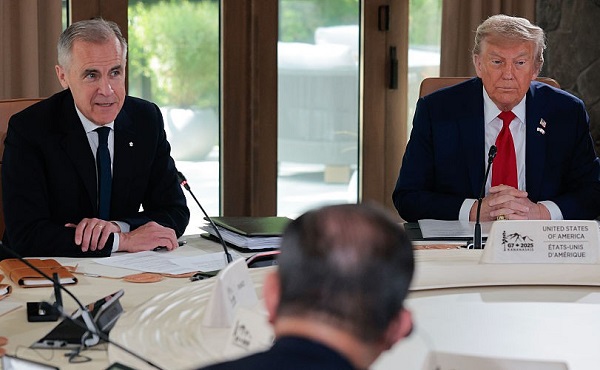

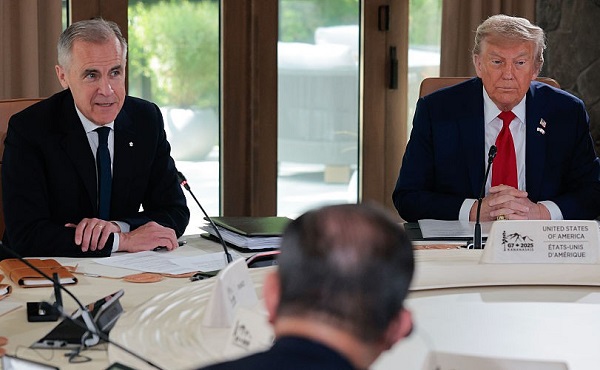

Energy2 days agoKananaskis G7 meeting the right setting for U.S. and Canada to reassert energy ties

-

Business2 days ago

Business2 days agoCarney’s Honeymoon Phase Enters a ‘Make-or-Break’ Week

-

Alberta2 days ago

Alberta2 days agoAlberta announces citizens will have to pay for their COVID shots

-

conflict2 days ago

conflict2 days agoIsrael bombs Iranian state TV while live on air

-

Business2 days ago

Business2 days agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Business1 day ago

Business1 day agoThe CBC is a government-funded giant no one watches

-

conflict1 day ago

conflict1 day agoMiddle East clash sends oil prices soaring

-

conflict2 days ago

conflict2 days agoTrump leaves G7 early after urging evacuation of Tehran