Crime

The Bureau Exclusive: The US Government Fentanyl Case Against China, Canada, Mexico

Canadian federal police recently busted a massive fentanyl lab with evident links to Mexico and Chinese crime networks in British Columbia.

Canada increasingly exploited by China for fentanyl production and export, with over 350 gang networks operating, Canadian Security Intelligence Service reports

As the Trump Administration gears up to launch a comprehensive war on fentanyl trafficking, production, and money laundering, the United States is setting its sights on three nations it holds accountable: China, Mexico, and Canada. In an exclusive investigation, The Bureau delves into the U.S. government’s case, tracking the history of fentanyl networks infiltrating North America since the early 1990s, with over 350 organized crime groups now using Canada as a fentanyl production, transshipment, and export powerhouse linked to China, according to Canadian intelligence.

Drawing on documents and senior Drug Enforcement Administration sources—including a confidential brief from an enforcement and intelligence expert who spoke on condition of anonymity due to the sensitivity of the matter—we unravel the evolution of this clandestine trade and its far-reaching implications, leading to the standoff that will ultimately pit President Donald Trump against China’s Xi Jinping.

In a post Tuesday morning that followed his stunning threat of 25 percent tariffs against Mexico and Canada, President Trump wrote:

“I have had many talks with China about the massive amounts of drugs, in particular fentanyl, being sent into the United States—but to no avail. Representatives of China told me that they would institute their maximum penalty, that of death, for any drug dealers caught doing this but, unfortunately, they never followed through, and drugs are pouring into our country, mostly through Mexico, at levels never seen before.”

While Trump’s announcements are harsh and jarring, the sentiment that China is either lacking motivation to crack down on profitable chemical precursor sales—or even intentionally leveraging fentanyl against North America—extends throughout Washington today.

And there is no debate on where the opioid overdose crisis originates.

At a November 8 symposium hosted by Georgetown University’s Initiative for U.S.-China Dialogue on Global Issues, David Luckey, a defense researcher at RAND Corporation, said: “The production, distribution, and use of illegally manufactured fentanyl should be thought of as an ecosystem, and the People’s Republic of China is at the beginning of the global fentanyl supply chain.”

The Bureau’s sources come from the hardline geopolitical camp on this matter. They believe Beijing is attempting to destabilize the U.S. with fentanyl, in what is technically called hybrid warfare. They explained how Canada and Mexico support the networks emanating from China’s economy and political leadership. In Canada, the story is about financial and port infiltration and control of the money laundering networks Mexican cartels use to repatriate cash from fentanyl sales on American streets.

And this didn’t start with deadly synthetic opioids, either.

“Where the drugs come from dictates control. If marijuana is coming from Canada, then control lies there,” the source explained. “Some of the biggest black market marijuana organizations were Chinese organized crime groups based in Brooklyn and Flushing, Queens, supplied from Canada.

“You had organizations getting seven or eight tons of marijuana a week from Canada, all controlled by Chinese groups,” the source said. “And we have seen black market marijuana money flowing back into Canadian banks alongside fentanyl money.”

Canada’s legal framework currently contributes to its appeal for China-based criminal organizations. “Canada’s lenient laws make it an attractive market,” the expert explained. “If someone gets caught with a couple of kilos of fentanyl in Canada, the likelihood of facing a 25-year sentence is very low.”

The presence in Toronto and Vancouver of figures like Tse Chi Lop—a globally significant triad leader operating in Markham, Ontario, and with suspected links to Chinese Communist Party security networks—underscores the systemic gaps.

“Tse is a major player exploiting systemic gaps in Canadian intelligence and law enforcement collaboration,” the source asserted.

Tse Chi Lop was operating from Markham and locations across Asia prior to his arrest in the Netherlands and subsequent extradition to Australia. He is accused of being at the helm of a vast drug syndicate known as “The Company” or “Sam Gor,” which is alleged to have laundered billions of dollars through casinos, property investments, and front companies across the globe.

Reporting by The Bureau has found that British Columbia, and specifically Vancouver’s port, are critical transshipment and production hubs for Triad fentanyl producers and money launderers working in alignment with Mexican cartels and Iranian-state-linked criminals. Documents that surfaced in Ottawa’s Hogue Commission—mandated to investigate China’s interference in Canada’s recent federal elections—demonstrate that BC Premier David Eby flagged his government’s growing awareness of the national security threats related to fentanyl with Justin Trudeau’s former national security advisor.

A confidential federal document, released through access to information, states, according to the Canadian Security Intelligence Service (CSIS): “Synthetic drugs are increasingly being produced in Canada using precursor chemicals largely sourced from China.”

“Preliminary reporting by the BC Coroner’s Service confirms that toxic, unregulated drugs claimed the lives of at least 2,511 people in British Columbia in 2023, the largest number of drug-related deaths ever reported to the agency,” the record says. “CSIS identifies more than 350 organized crime groups actively involved in the domestic illegal fentanyl market … which Premier Eby is particularly concerned about.”

A sanitized summary on Eby’s concerns from the Hogue Commission adds: “On fentanyl specifically, Canada, the United States, and Mexico are working on supply reduction, including as it relates to precursor chemicals and the prevention of commercial shipping exploitation. BC would be a critical partner in any supply reduction measures given that the Port of Vancouver is Canada’s largest port.”

But before Beijing’s chemical narcotics kingpins took over fentanyl money laundering networks from Canada, the story begins in the early 1990s when fentanyl first appeared on American streets, according to a source with full access to DEA investigative files.

The initial appearance of fentanyl in the United States was linked to a chemist in Ohio during 1992 or 1993, they said. This illicit operation led to hundreds of overdose deaths in cities like Chicago and New York, as heroin laced with fentanyl—known as “Tango & Cash”—flooded the streets. The DEA identified and dismantled the source, temporarily removing fentanyl from the illicit market.

Fentanyl seemed to vanish from the illicit market, lying dormant.

The mid-2000s saw a resurgence, this time with Mexican cartels entering the methamphetamine and fentanyl distribution game, and individuals of Chinese origin taking up roles in Mexico City. “One major case was Zhenli Ye Gon in 2007, where Mexican authorities seized $207 million from his home in Mexico City,” The Bureau’s source said. “He was a businessman accused of being involved in the trafficking of precursor chemicals for methamphetamine production.”

Ye Gon, born in Shanghai and running a pharma-company in Mexico, was believed to be perhaps the largest methamphetamine trafficker in the Western Hemisphere. Educated at an elite university in China, he made headlines not only for his alleged narcotics activities but also for his lavish lifestyle. While denying drug charges in the U.S., he claimed he had received duffel bags filled with cash from members of President Felipe Calderón’s party—a claim that was denied by officials. His arrest also caused a stir in Las Vegas, where Ye Gon was a “VIP” high roller who reportedly gambled more than $125 million, with the Venetian casino gifting him a Rolls-Royce.

Despite high-profile crackdowns, the threat of fentanyl ebbed and flowed, never truly disappearing.

Meanwhile, in 2005 and 2006, over a thousand deaths on Chicago’s South Side were traced to a fentanyl lab in Toluca, Mexico, operated by the Sinaloa Cartel. After the DEA shut it down, fentanyl essentially went dormant again.

A new chapter unfolded in 2013 as precursor chemicals—mainly N-phenethyl-4-piperidone (NPP) and 4-anilinopiperidine (4-ANPP)—began arriving from China. This is when fentanyl overdoses started to rise exponentially in Vancouver, where triads linked to Beijing command money laundering in North America.

“These chemicals were entering Southern California, Texas, and Arizona, smuggled south into Mexico, processed into fentanyl, and then brought back into the U.S., often mixed with Mexican heroin,” the U.S. government source explained.

At the time, a kilo of pure fentanyl cost about $3,000. By 2014, it was called “China White” because heroin was being laced with fentanyl, making it far more potent. In February 2015, the DEA issued its first national alert on fentanyl and began analyzing the role of Chinese organized crime in the fentanyl trade and related money laundering.

The profitability and efficiency of fentanyl compared to traditional narcotics like heroin made it an attractive commodity for drug cartels.

By 2016, fentanyl was being pressed into counterfeit pills, disguised as OxyContin, Percocet, or other legitimate pharmaceuticals. Dark web marketplaces and social media platforms became conduits for its distribution.

The merging of hardcore heroin users and “pill shoppers”—individuals seeking diverted pharmaceuticals—into a single user population occurred due to the prevalence of fentanyl-laced pills. This convergence signified a dangerous shift in the opioid crisis, broadening the scope of those at risk of overdose.

The profitability for traffickers was staggering. One pill could sell for $30 in New England, and Mexican cartels could make 250,000 pills from one kilo of fentanyl, which cost around $3,000 to $5,000. This was far more lucrative and efficient than heroin, which takes months to cultivate and process.

This shift marked a significant turning point in the global drug trade, with synthetic opioids overtaking traditional narcotics.

By 2016, entities linked to the Chinese state were entrenched in Mexico’s drug trade. Chinese companies were setting up operations in cartel-heavy cities, including mining companies, import-export businesses, and restaurants.

“The growth of Chinese influence in Mexico’s drug trade was undeniable,” the source asserted.

Recognizing the escalating crisis, the DEA launched Project Sleeping Giant in 2018. The initiative highlighted the role of Chinese organized crime, particularly the triads, in supplying precursor chemicals, laundering money for cartels, and trafficking black market marijuana.

“Most people don’t realize that Chinese organized crime has been upstream in the drug trade for decades,” the U.S. expert noted.

When the COVID-19 pandemic hit in 2020, drug trafficking organizations adapted swiftly. With borders closed and travel restricted, cartels started using express mail services like FedEx to ship fentanyl and methamphetamine.

This shift highlighted the cartels’ agility in exploiting vulnerabilities and adapting to global disruptions.

By 2022, the DEA intensified efforts to combat the fentanyl epidemic, initiating Operation Chem Kong to target Chinese chemical suppliers.

An often-overlooked aspect of the drug trade is the sophisticated money laundering operations that sustain it, fully integrated into China’s economy through triad money brokers. Chinese groups are now the largest money launderers in the U.S., outpacing even Colombian groups.

“We found Chinese networks picking up drug money in over 22 states,” the source explained. “They’d fly one-way to places like Georgia or Illinois, pick up cash, and drive it back to New York or the West Coast.”

Remarkably, these groups charged significantly lower fees than their Colombian counterparts, sometimes laundering money for free in exchange for access to U.S. dollars.

This strategy not only facilitated money laundering but also circumvented China’s strict currency controls, providing a dual benefit to the criminal organizations.

They used these drug-cash dollars to buy American goods, ship them to China, and resell them at massive markups. Chinese brokers weren’t just laundering fentanyl or meth money; they also laundered marijuana money and worked directly with triads. Operations like “Flush with Cash” in New York identified service providers moving over $1 billion annually to China.

But navigating the labyrinth of Chinese criminal organizations—and their connectivity with China’s economy and state actors—poses significant challenges for law enforcement.

“The challenge is the extreme compartmentalization in Chinese criminal groups,” the U.S. expert emphasized. “You might gain access to one part of the organization, but two levels up, everything is sealed off.”

High-level brokers operate multiple illicit enterprises simultaneously, making infiltration and dismantling exceedingly difficult.

The intricate tapestry of Chinese fentanyl trafficking highlights a convergence of international criminal enterprises exploiting systemic vulnerabilities across borders. The adaptability of these networks—in shifting trafficking methods, leveraging legal disparities, and innovating money laundering techniques—poses a formidable challenge to Western governments.

The leniency in certain jurisdictions including Canada not only hinders enforcement efforts but also incentivizes criminal activities by reducing risks and operational costs.

As the United States prepares to intensify its crackdown on fentanyl networks, having not only politicians and bureaucrats—but also the citizens they are serving—understand the importance of a multifaceted and multinational counter strategy is critical, because voters will drive the political will needed.

And this report, sourced from U.S. experts, provides a blueprint for other public interest journalists to follow.

“This briefing will help you paint the picture regarding Chinese organized crime, the triads, CCP, or PRC involvement with the drug trade and money laundering—particularly with precursor chemicals and black market marijuana,” the primary source explained.

The Bureau is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

Crime

Suspected ambush leaves two firefighters dead in Idaho

Quick Hit:

Two firefighters were killed and another wounded Sunday after a gunman opened fire on first responders tackling a blaze near Coeur d’Alene, Idaho. The shooter was later found dead, and authorities believe the fire may have been set to lure crews into an ambush.

Key Details:

- The ambush began around 2 p.m. local time as fire crews arrived at a brush fire and were met with sniper-style gunfire from a wooded area.

- SWAT teams located the deceased suspect roughly five hours later, with a weapon nearby. His identity has not yet been released.

- The Kootenai County Sheriff said the ongoing fire could not be addressed during the gunfight, calling the attack a “heinous direct assault” on first responders.

Diving Deeper:

A deadly ambush on Sunday afternoon left two Idaho firefighters dead and a third injured after they were shot while attempting to contain a brush fire on Canfield Mountain. The surprise attack reportedly began around 2 p.m., when bullets suddenly rained down on emergency crews from hidden positions in the wooded terrain near Coeur d’Alene.

Authorities now believe the blaze may have been deliberately set as bait. Kootenai County Sheriff Bob Norris described the situation as “an active sniper attack,” saying the scene quickly escalated into chaos with gunfire coming from multiple directions.

“We don’t know if there’s one, two, three or four [shooters],” Norris said in an early evening press conference. “I’m hoping that someone has a clear shot and is able to neutralize [the suspect], because they’re not showing any signs of surrendering.”

Roughly five hours after the first shots were fired, SWAT officers found a body next to a firearm along the Canfield Mountain Trail. Authorities have not confirmed whether the individual was the sole assailant, nor have they publicly identified the person. The FBI, along with state and local agencies, had been deployed to the scene to assist with the operation.

The two firefighters who died have not yet been named. The third, who sustained a gunshot wound, was transported to Kootenai Health and remains hospitalized. His current condition is unknown.

The firefight effectively halted efforts to contain the brush fire, which remained active late into Sunday. “It’s going to keep burning. We can’t put any resources on it right now,” Norris said during the standoff. Shelter-in-place orders were issued for the surrounding area, including the popular Canfield Mountain Trailhead, but those restrictions were lifted after the suspect was found dead.

Idaho Governor Brad Little reacted to the tragedy on social media, calling the ambush “a heinous direct assault on our brave firefighters.” He added, “Teresa and I are heartbroken. I ask all Idahoans to pray for them and their families as we wait to learn more.”

Federal and local officials are continuing to investigate the incident, including the origins of the fire and whether additional suspects may have been involved.

Crime

Florida rescues 60 missing kids in nation’s largest-ever operation

Quick Hit:

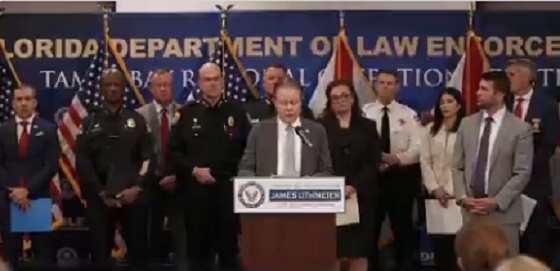

Florida authorities have recovered 60 “critically missing” children in a two-week operation across the Tampa Bay area. The joint state and federal effort, dubbed Operation Dragon Eye, led to eight arrests and uncovered new human trafficking investigations.

Key Details:

-

The children, aged 9 to 17, were found across Hillsborough, Pinellas, and Pasco counties. The operation was carried out with help from the U.S. Marshals, state prosecutors, and local police departments.

-

Florida Attorney General James Uthmeier confirmed eight individuals were arrested on charges including human trafficking, child endangerment, and drug-related offenses. Additional investigations are underway.

-

The Florida Department of Law Enforcement (FDLE) hailed the operation as the most successful child recovery effort in U.S. history, declaring, “Florida doesn’t look the other way — we hunt predators and bring kids home.”

🚨 MAJOR BREAKING: U.S. Marshals and Florida officials announce LARGEST single child rescue operation in American history.

Over 2 weeks, 60 KIDS are safe, in custody.

This involved over 20 agencies and 100+ people. 8 people were arrested, charged with human trafficking, child… pic.twitter.com/trkcFMhtmX

— Eric Daugherty (@EricLDaugh) June 23, 2025

Diving Deeper:

Over a two-week span, law enforcement agencies across Florida joined forces for what’s being called a historic child recovery mission. Dubbed Operation Dragon Eye, the coordinated effort led to the rescue of 60 critically missing children—some as young as 9 years old—in the Tampa Bay region, including Hillsborough, Pinellas, and Pasco counties.

According to Fox 13, federal and state agencies worked alongside local law enforcement, with direct involvement from the U.S. Marshals Service and Florida prosecutors. The term “critically missing,” as defined by the Marshals Service, applies to minors facing heightened threats such as exposure to violent crime, sexual exploitation, substance abuse, or domestic violence.

Florida Attorney General James Uthmeier praised the operation’s success in a statement posted to social media Monday. “We will keep fighting evil head-on and bringing accountability to those who harm children,” he said, confirming eight suspects had been taken into custody, with additional investigations now underway related to human trafficking networks.

Charges filed against the arrested individuals include human trafficking, child endangerment, custodial interference, and drug possession.

The Florida Department of Law Enforcement described the effort as “the most successful missing child recovery operation in American history.” In a statement, the agency said its analysts and field agents “were proud to stand shoulder to shoulder with the U.S. Marshals” and emphasized that “Florida doesn’t look the other way.”

Several nonprofits and local support groups played a vital role in caring for the recovered children, including More Too Life, the Children’s Home Network, Bridging Freedom, Bridges of Hope, Family Support Services of Pasco and Pinellas, and Redefining Refuge.

Dr. Katherine Gomez of the Florida Department of Juvenile Justice said many of these children had felt hopeless and alone. “Oftentimes these young people have felt like there’s no one in their corner. They feel abandoned… like they have to look out for themselves because no one else will,” she told WFLA.

FDLE Commissioner Mark Glass acknowledged the emotional toll such operations take on officers, who are exposed to the trauma these children endure. “They have to see everything that happens to these children, and we need to pray for them because they had to take that burden home,” he said.

Glass added that while the operation struck a major blow to human trafficking in the region, the threat remains. “The fight isn’t over.”

U.S. Marshal Bill Berger of the Middle District of Florida warned that traffickers often return to their victims if not apprehended. “If the offenders are not apprehended, they will reconnect with these children. They are, in my opinion, leeches,” Berger stated.

Officials vowed continued vigilance to keep predators behind bars and ensure every vulnerable child is found and protected.

-

COVID-1910 hours ago

COVID-1910 hours agoOntario man launches new challenge against province’s latest attempt to ban free expression on roadside billboards

-

Energy18 hours ago

Energy18 hours agoThis Canada Day, Celebrate Energy Renewal

-

Business2 days ago

Business2 days agoWhile China Hacks Canada, B.C. Sends Them a Billion-Dollar Ship Building Contract

-

Alberta1 day ago

Alberta1 day agoSo Alberta, what’s next?

-

Alberta9 hours ago

Alberta9 hours agoAlberta Next Takes A Look At Alberta Provincial Police Force

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoThe Physics Behind The Spanish Blackout

-

Alberta11 hours ago

Alberta11 hours agoCanadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

-

Business13 hours ago

Business13 hours agoPotential For Abuse Embedded In Bill C-5