Business

Sweet Capones making sweet dreams come true with special training opportunities for employees

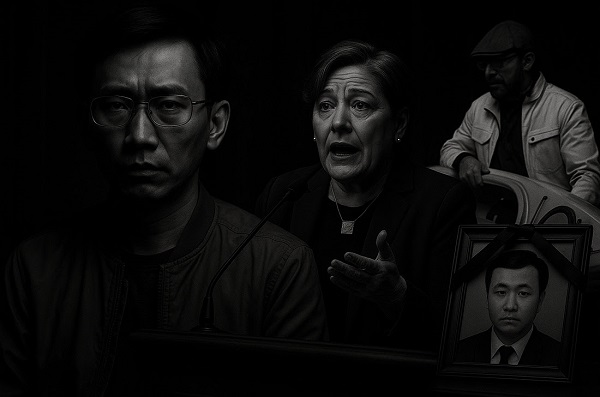

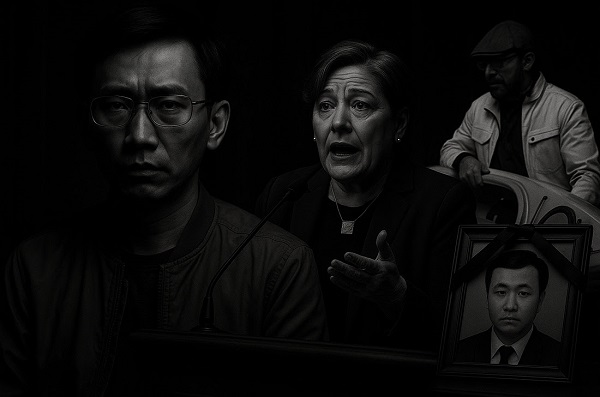

Pictured here is Ciarrea Martin, café manager of Sweet Capone’s Red Deer location. The popular bakery is gearing up to launch training programs to help folks have a better chance of landing employment.

By Mark Weber

Known for their scrumptious cannolis, Sweet Capone’s Italian Bakery and Cannoli Shop is now launching what promises to be life-changing training opportunities.

“I was a paramedic before we started Sweet Capone’s and I absolutely loved my job; I loved helping people,” explained Carina Moran who owns the bakery along with her husband Joel.

They first opened the popular establishment six years ago, having since expanded to Lacombe as well. An injury forced a shift in direction from being a paramedic, and thus the establishment of Sweet Capone’s – which has met with tremendous success.

“I first started selling our family’s cannolis out of our house, but I always felt that the shop needed to stand for something much more – that was always on my heart,” she said. “We’ve always been ‘seeding’ into organizations around us – we’ve been helping local soup kitchens, homeless shelters and women’s shelters by giving donations. It’s a wonderful way to help, but I think the thing we have always had an issue with that it never felt like it was enough,” she said, adding that she has felt how vital it is to support those need help – particularly folks who need a hand in landing employment. “There are people who are constantly looked over – they want to have job skills, and they want others to take a chance on them, but they are often given a pass.”

To date, Carina and Joel have made it a priority to hire those who could use an opportunity to put their gifts and skills to work, but just haven’t been given the chance.

Take Ciarrea, who manages the café in the Red Deer location. A single mom at a young age, she didn’t have managerial experience at first.

“Sweet Capone’s was her very first job. We have believed in her, and we’ve given her opportunity because really – at the end of the day – she did have managerial skills through having to manage a house with two little kids,” noted Carina.

“Now, she’s our manager and we’ve also sent her back to school to take managerial courses. And then one of our delivery drivers is a war veteran – again, he needed someone to take a chance on him.”

Some of Sweet Capone’s bakery workers are immigrants who simply needed an open door to walk through as well. So that has been the approach the couple has consistently taken. But it’s all about to be taken to a new level.

“One of my favourite quotes is from Desmond Tutu – ‘Instead of pulling people out of the water, we need to go upstream and find out why they are falling in in the first place’,” said Carina. “If we give people a chance to develop skills and confidence in themselves; to have someone believe in them and give them an opportunity – I really believe it could help to save them before they got to a place of entering a world where nobody would help them out. They may then start seeking other paths or other things that don’t serve them well.”

To that end, a recent grant to help develop women entrepreneurs is helping Sweet Capone’s to take on a new kind of mission – to be able to provide training to those who need an open door so they can build a better life and a more secure future.

“We are already on the way to making plans about what it would look like to have another location somewhere else, and how can we get that up and running? What organizations are we going to work with to help us with the training competent?”

She also has her eye on those emerging from treatment programs who need someone to offer them a chance when it comes to employment.

Ultimately, Carina points to her Christian faith as being the key inspiration behind delving into this exciting new venture. “I feel like there are so many people in this world who just get passed over, and they just aren’t given a chance.”

She also believes it will take a team to bring this vision ultimately to fruition.

“To see Ciaerra grow and also surprise herself with what she is capable of when all she needed was the opportunity – it’s 100 per cent her – she shows up every day and she just gives it her all,” explained Carina. “Watching her grow in a safe environment has been very, very cool.”

At the end of the day, Carina emphasizes that this initiative is all about others.

“I’m a girl of faith, and God has put this on my heart,” she explained. “I’m just obeying Him – I’m just doing what He told me to do. That’s it. It’s always been on my heart – He has had this on my heart since day one.”

She has also been inspired by her own kids – who launched the Caring Cookie Company a few years back. “They raised money for the homeless shelter, but what it also did for my husband and I is it showed us how easy it is to get caught up as a business owner in the world of profit,” she explained. “The boys brought it back down to what matters. Sometimes, you stop seeing the human side of things, and our kids really showed us that. We really started to think about what we’re doing with our lives – what are we doing with this business?”

It really boils down to taking a step of faith.

“You have to step out with that intention first of all – and the rest will follow.”

As mentioned, Ciarrea started with Sweet Capone’s nearly four years ago. “Essentially, I had never had a job before coming here,” she explained. “I really wanted to work, so I was looking for a job everywhere.”

Ciarrea explained to Carina how much she loved the bakery and told her how much she would like to work at Sweet Capone’s.

It wasn’t long before she got a call about a position that had opened.

“It was a couple of shifts a week, and I said yes! Anything – just to be at the store,” she recalled.

Over time, she learned the day-to-day routines at the bakery and has never looked back.

Like Carina, her Christian faith inspires her in virtually everything she does. And her sense of gratitude is unmistakable. “They were just very willing, (and welcomed) us with open arms,” Ciarrea added, reflecting on those early days.

“Every time I have had any type of struggle, complication or an area that I’ve needed work in, they’ve always taken me under their wing.”

“There are things that I need to work on as well, and Carina isn’t afraid to tell me that,” she said. “It’s incredible for me because I love to grow and learn. It’s been incredible to work alongside them both, and to see how they do things. They are an amazing team!”

She’s thrilled with the news about the expanded training programs. With aspirations of one day owning her own eatery, Ciarrea is indeed grateful for the experience and the wisdom that the Morans have poured into her life. And ultimately, she certainly agrees that it’s also about giving someone an opportunity. It’s often at that point that their true potential has the chance to flourish.

“It’s about having that understanding that maybe just looking at a piece of paper isn’t a complete description or definition of a person,” she explained. “I also know that from the beginning, we have stood for helping to raise people up – whether it be in their personal lives or work lives.”

Business

US Energy Secretary says price of energy determined by politicians and policies

From the Daily Caller News Foundation

During the latest marathon cabinet meeting on Dec. 2, Energy Secretary Chris Wright made news when he told President Donald Trump that “The biggest determinant of the price of energy is politicians, political leaders, and polices — that’s what drives energy prices.”

He’s right about that, and it is why the back-and-forth struggle over federal energy and climate policy plays such a key role in America’s economy and society. Just 10 months into this second Trump presidency, the administration’s policies are already having a profound impact, both at home and abroad.

While the rapid expansion of AI datacenters over the past year is currently being blamed by many for driving up electric costs, power bills were skyrocketing long before that big tech boom began, driven in large part by the policies of the Obama and Biden administration designed to regulate and subsidize an energy transition into reality. As I’ve pointed out here in the past, driving up the costs of all forms of energy to encourage conservation is a central objective of the climate alarm-driven transition, and that part of the green agenda has been highly effective.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

President Trump, Wright, and other key appointees like Interior Secretary Doug Burgum and EPA Administrator Lee Zeldin have moved aggressively throughout 2025 to repeal much of that onerous regulatory agenda. The GOP congressional majorities succeeded in phasing out Biden’s costly green energy subsidies as part of the One Big Beautiful Bill Act, which Trump signed into law on July 4. As the federal regulatory structure eases and subsidy costs diminish, it is reasonable to expect a gradual easing of electricity and other energy prices.

This year’s fading out of public fear over climate change and its attendant fright narrative spells bad news for the climate alarm movement. The resulting cracks in the green facade have manifested rapidly in recent weeks.

Climate-focused conflict groups that rely on public fears to drive donations have fallen on hard times. According to a report in the New York Times, the Sierra Club has lost 60 percent of the membership it reported in 2019 and the group’s management team has fallen into infighting over elements of the group’s agenda. Greenpeace is struggling just to stay afloat after losing a huge court judgment for defaming pipeline company Energy Transfer during its efforts to stop the building of the Dakota Access Pipeline.

350.org, an advocacy group founded by Bill McKibben, shut down its U.S. operations in November amid funding woes that had forced planned 25 percent budget cuts for 2025 and 2026. Employees at EDF voted to form their own union after the group went through several rounds of budget cuts and layoffs in recent months.

The fading of climate fears in turn caused the ESG management and investing fad to also fall out of favor, leading to a flood of companies backtracking on green investments and climate commitments. The Net Zero Banking Alliance disbanded after most of America’s big banks – Goldman Sachs, J.P. Morgan Chase, Citigroup, Wells Fargo and others – chose to drop out of its membership.

The EV industry is also struggling. As the Trump White House moves to repeal Biden-era auto mileage requirements, Ford Motor Company is preparing to shut down production of its vaunted F-150 Lightning electric pickup, and Stellantis cancelled plans to roll out a full-size EV truck of its own. Overall EV sales in the U.S. collapsed in October and November following the repeal of the $7,500 per car IRA subsidy effective Sept 30.

The administration’s policy actions have already ended any new leasing for costly and unneeded offshore wind projects in federal waters and have forced the suspension or abandonment of several projects that were already moving ahead. Capital has continued to flow into the solar industry, but even that industry’s ability to expand seems likely to fade once the federal subsidies are fully repealed at the end of 2027.

Truly, public policy matters where energy is concerned. It drives corporate strategies, capital investments, resource development and movement, and ultimately influences the cost of energy in all its forms and products. The speed at which Trump and his key appointees have driven this principle home since Jan. 20 has been truly stunning.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

Oil tanker traffic surges but spills stay at zero after Trans Mountain Expansion

From the Canadian Energy Centre

Bigger project maintains decades-long marine safety record

The Trans Mountain system continues its decades-long record of zero marine spills, even as oil tanker traffic has surged more than 800 per cent since the pipeline’s expansion in May 2024.

The number of tankers calling at Trans Mountain’s Westridge Marine Terminal in the Port of Vancouver in one month now rivals the number that used to go through in one year.

A global trend toward safer tanker operations

Trans Mountain’s safe operations are part of a worldwide trend. Global oil tanker traffic is up, yet spills are down, according to the International Tanker Owners Pollution Federation, a London, UK-based nonprofit that provides data and response support.

Transport Canada reports a 95 per cent drop in ship-source oil spills and spill volumes since the 1970s, driven by stronger ship design, improved response and better regulations.

“Tankers are now designed much more safely. They are double-hulled and compartmentalized to mitigate spills,” said Mike Lowry, spokesperson for the Western Canada Marine Response Corporation (WCMRC).

WCMRC: Ready to protect the West Coast

One of WCMRC’s new response vessels arrives in Barkley Sound. Photo courtesy Western Canada Marine Response Corporation

From eight marine bases including Vancouver and Prince Rupert, WCMRC stands at the ready to protect all 27,000 kilometres of Canada’s western coastline.

Lowry sees the corporation as similar to firefighters — training to respond to an event they hope they never have to see.

In September, it conducted a large-scale training exercise for a worst-case spill scenario. This included the KJ Gardner — Canada’s largest spill response vessel and a part of WCMRC’s fleet since 2024.

“It’s part of the work we do to make sure everybody is trained and prepared to use our assets just in case,” Lowry said.

Expanding capacity for Trans Mountain

The K.J. Gardner is the largest-ever spill response vessel in Canada. Photo courtesy Western Canada Marine Response Corporation

WCMRC’s fleet and capabilities were doubled with a $170-million expansion to support the Trans Mountain project.

Between 2012 and 2024, the company grew from 13 people and $12 million in assets to more than 200 people and $213 million in assets.

“About 80 per cent of our employees are mariners who work as deckhands, captains and marine engineers on our vessels,” Lowry said.

“Most of the incidents we respond to are small marine diesel spills — the last one was a fuel leak from a forest logging vessel near Nanaimo — so we have deployed our fleet in other ways.”

Tanker safety starts with strong rules and local expertise

Tanker loading at the Westridge Marine Terminal in the Port of Vancouver. Photo courtesy Trans Mountain Corporation

Speaking on the ARC Energy Ideas podcast, Trans Mountain CEO Mark Maki said tanker safety starts with strong regulations, including the use of local pilots to guide vessels into the harbour.

“On the Mississippi River, you have Mississippi River pilots because they know how the river behaves. Same thing would apply here in Vancouver Harbour. Tides are strong, so people who are familiar with the harbor and have years and decades of experience are making sure the ships go in and out safely,” Maki said.

“A high standard is applied to any ship that calls, and our facility has to meet very strict requirements. And we have rejected ships, just said, ‘Nope, that one doesn’t fit the bill.’ A ship calling on our facilities is very, very carefully looked at.”

Working with communities to protect sensitive areas

Beyond escorting ships and preparing for spills, WCMRC partners with coastal communities to map sensitive areas that need rapid protection including salmon streams, clam beds and culturally important sites like burial grounds.

“We want to empower communities and nations to be more prepared and involved,” Lowry said.

“They can help us identify and protect the areas that they value or view as sensitive by working with our mapping people to identify those areas in advance. If we know where those are ahead of time, we can develop a protection strategy for them.”

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoConservative MP Leslyn Lewis slams Liberal plan targeting religious exemption in hate speech bil

-

Business2 days ago

Business2 days agoCanada’s climate agenda hit business hard but barely cut emissions

-

Health2 days ago

Health2 days agoNews RFK Jr.’s vaccine committee to vote on ending Hepatitis B shot recommendation for newborns

-

International1 day ago

International1 day agoFBI may have finally nabbed the Jan. 6 pipe bomber

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoIntegration Or Indignation: Whose Strategy Worked Best Against Trump?

-

espionage1 day ago

espionage1 day agoDigital messages reportedly allege Chinese police targeted dissident who died suspiciously near Vancouver

-

Health2 days ago

Health2 days ago23,000+ Canadians died waiting for health care in one year as Liberals pushed euthanasia

-

MAiD1 day ago

MAiD1 day ago101-year-old woman chooses assisted suicide — press treats her death as a social good