Economy

Saskatchewan set to defy Trudeau gov’t, stop collecting carbon tax on electric home heat

From LifeSiteNews

Premier Scott Moe is ignoring a threat from Liberal Prime Minister Justin Trudeau that he could serve jail time for failing to impose the tax

Saskatchewan Premier Scott Moe now says that starting January 1 his province will no longer collect a federally imposed carbon tax on electric heat in addition to natural gas despite a threat from the Liberal government of Prime Minister Justin Trudeau that he could serve jail time should he defy the feds.

Moe and Saskatchewan Party MLA Jim Lemaigreas made the announcement last Thursday in a video posted on X (formerly Twitter).

“We are going to need to determine who is heating their home with electricity and then estimate the percentage of their power bill that is being used for that heat,” Moe said.

Moe added that his government is working out how to stop collecting the carbon tax on electric home heat. Regardless, anyone using electric heat in the province or natural gas to warm their home will not pay a federal carbon tax.

According to Moe, extending the carbon tax exemption to electric heat makes sense because 15% of people in the province use it to heat their homes. The other 85% use natural gas to heat their homes.

January and February can bring brutally cold temperatures to many parts of the province, and natural gas-fired furnaces are best at handling extreme temperatures. However, many in the province, especially those in the north, use electric heaters to heat their homes.

Moe noted how Saskatchewan owns its natural gas utility SaskEnergy, which by extension means taxpayers own it. He said the move to stop collecting the tax is ideal given the province controls its utilities, which acts as a safeguard from federal overreach.

“Well, we also own the electrical utility, and that’s why our government has decided that SaskPower will also stop collecting the carbon tax on electric heat,” Moe said.

On October 30, Moe first announced that he would stop collecting the carbon tax on home heating starting January 1, after Trudeau suspended his carbon tax on home heating oil, which is almost exclusively used in Atlantic Canada to heat homes, and not in his province.

“I cannot accept the federal government giving an affordability break to people in one part of Canada but not here,” Moe said in a video posted on X.

Moe promised that if the exemption was not extended to all other forms of home heating in his province, he would tell SaskEnergy, which is a Crown corporation that provides energy to all residents, to stop collecting the carbon tax on natural gas. This, Moe said, would effectively provide “Saskatchewan residents with the very same exemption that the federal government has given heating oil in Atlantic Canada.”

Moe’s government has gone as far as introducing legislation to back the scrapping of the federal carbon tax on natural gas. The legislation will shield all executives at SaskEnergy from being jailed or fined by the federal government if they stop collecting the tax.

The Trudeau Liberal government, however, has refused to rule out jail time for Moe if he refuses to collect the carbon tax on home heating.

On November 3, Liberal Finance Minister and Deputy Prime Minister Chrystia Freeland avoided directly answering whether Moe would be criminally charged for refusing to collect Trudeau’s controversial carbon tax for home heating within the province.

Trudeau has said that “Canada is a country of the rule of law, and we expect all Canadians to follow the law,” he said.

“That applies to provinces as much as it applies to individual citizens,” he added.

Alberta Premier Danielle Smith is also fighting Trudeau’s carbon tax and has vowed to use every tool available to her government to take him on.

Indeed, after Canadian Environment Minister Steven Guilbeault brushed off Smith’s invocation of the “Sovereignty Act” as being merely “symbolic,” the Alberta leader warned him that her province will be building new gas-fired power plants regardless of his new “clean energy” rules.

Moe has court rulings to back up his defiance of Trudeau in asserting provincial autonomy

Two recent court rulings dealt a serious blow to the Trudeau government’s environmental activism via legislation by asserting the provinces have autonomy when it comes to how they use and develop their own natural resources.

The most recent was when the Federal Court of Canada on November 16 overturned the Trudeau government’s ban on single-use plastic, calling it “unreasonable and unconstitutional.”

The Federal Court ruled in favor of the provinces of Alberta and Saskatchewan by stating that Trudeau’s government had overstepped its authority by classifying plastic as “toxic” as well as banning all single-use plastic items, like straws, bags, and eating utensils.

The second victory for Alberta and Saskatchewan concerns a Supreme Court ruling that stated that Trudeau’s law, C-69, dubbed the “no more pipelines” bill, is “mostly unconstitutional.” The decision returned authority over the pipelines to provincial governments, meaning oil and gas projects headed up by the provinces should be allowed to proceed without federal intrusion.

A draft version of the federal government’s new Clean Energy Regulations (CERs) introduced by Guilbeault projects billions in higher costs associated with a so-called “green” power transition, especially in the resource-rich provinces of Alberta, Saskatchewan, New Brunswick, and Nova Scotia, which use natural gas and coal to fuel power plants.

Business executives in Alberta’s energy sector have also sounded the alarm over the Trudeau government’s “green” transition, saying it could lead to unreliability in the power grid.

The Trudeau government’s current environmental goals – in lockstep with the United Nations’ “2030 Agenda for Sustainable Development” – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of the use of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum (WEF) – the globalist group behind the socialist “Great Reset” agenda – an organization in which Trudeau and some of his cabinet members are involved.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Economy

The stars are aligning for a new pipeline to the West Coast

From Resource Works

Mark Carney says another pipeline is “highly likely”, and that welcome news.

While attending this year’s Calgary Stampede, Prime Minister Mark Carney made it official that a new pipeline to Canada’s West Coast is “highly likely.”

While far from a guarantee, it is still great news for Canada and our energy industry. After years of projects being put on hold or cancelled, things are coming together at the perfect time for truly nation-building enterprises.

Carney’s comments at Stampede have been preceded by a number of other promising signs.

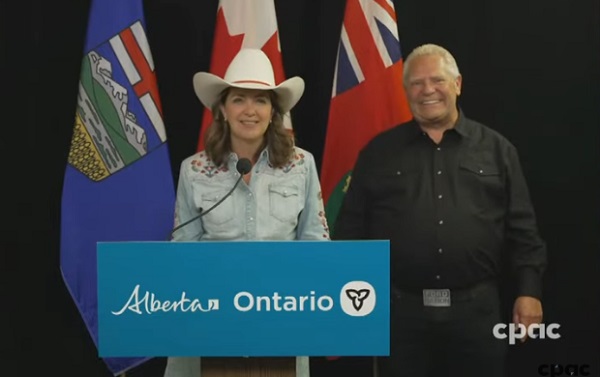

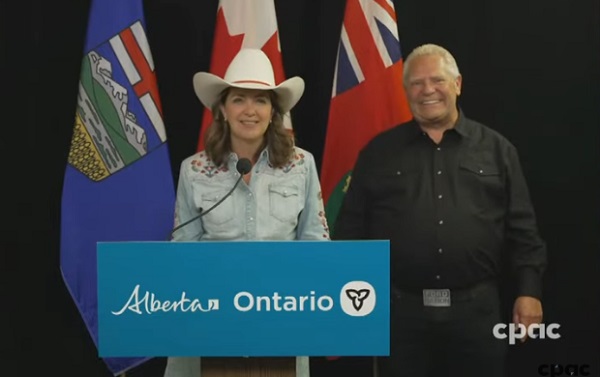

At a June meeting between Carney and the premiers in Saskatoon, Alberta Premier Danielle Smith proposed a “grand bargain” that would include a privately funded pipeline capable of moving a million barrels of oil a day, along with significant green investments.

Carney agreed with Smith’s plan, saying that Canada needed to balance economic growth with environmental responsibility.

Business and political leaders have been mostly united in calling for the federal government to speed up the building of pipelines, for economic and strategic reasons. As we know, it is very difficult to find consensus in Canada, with British Columbia Premier David Eby still reluctant to commit to another pipeline on the coast of the province.

Alberta has been actively encouraging support from the private sector to fund a new pipeline that would fulfil the goals of the Northern Gateway project, a pipeline proposed in 2008 but snuffed out by a hail of regulations under former Prime Minister Justin Trudeau.

We are in a new era, however, and we at Resource Works remarked that last month’s G7 meeting in Kananaskis could prove to be a pivotal moment in the history of Canadian energy. An Ipsos poll found that Canada was the most favoured nation for supplying oil in the G7, and our potential as an energy superpower has never been more important for the democratic world, given the instability caused by Russia and other autocratic energy powers.

Because of this shifting, uncertain global climate, Canadian oil and gas are more attractive than ever, and diversifying our exports beyond the United States has become a necessity in the wake of Donald Trump’s regime of tariffs on Canada and other friendly countries.

It has jolted Canadian political leaders into action, and the premiers are all on board with strengthening our economic independence and trade diversification, even if not all agree on what that should look like.

Two premiers who have found common ground are Danielle Smith and Ontario Premier Doug Ford. After meeting at Stampede, the pair signed two memorandums of understanding to collaborate on studying an energy corridor and other infrastructure to boost interprovincial trade. This included the possibility of an eastward-bound pipeline to Ontario ports for shipping abroad.

Ford explicitly said that “the days of relying on the United States 100 percent, those days are over.” That’s in line with Alberta’s push for new pipeline routes, especially to northwestern B.C., which are supported by Smith’s government.

On June 10, Resource Works founder and CEO Stewart Muir wrote that Canadian energy projects are a daunting endeavour, akin to a complicated jigsaw puzzle, but that getting discouraged by the complexity causes us to lose sight of the picture itself. He asserted that Canadians have to accept that messiness, not avoid it.

Prime Minister Carney has suggested he will make adjustments to existing regulations and controversial legislation like Bill C-69 and the emissions cap, all of which have slowed the development of new energy infrastructure.

This moment of alignment between Ottawa, the provinces, and other stakeholders cannot be wasted. The stars are aligning, and it will be a tragedy if we cannot take a great step into the future of our country.

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually

-

Daily Caller2 days ago

Daily Caller2 days agoBlackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse