Housing

Red Deer & District Chamber of Commerce Form Task Force on Homelessness

News release from the Red Deer & District Chamber of Commerce

The Red Deer & District Chamber of Commerce (the Chamber) has formed a Task Force to better understand the homelessness situation in Red Deer and identify areas where the business community can help address the issue and affect change.

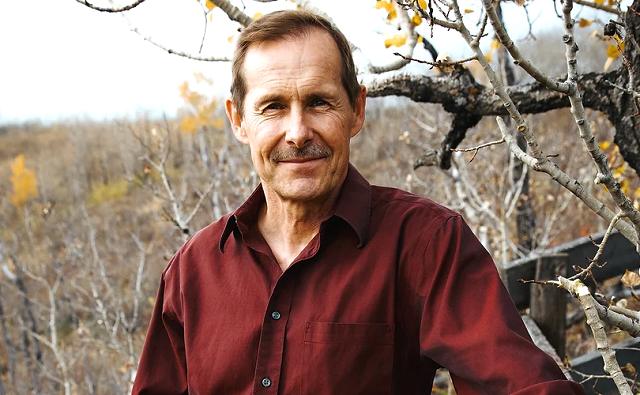

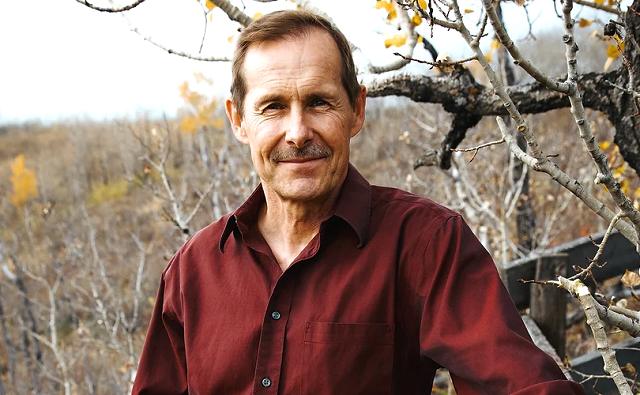

Chaired by local community leader and business owner Lyn Radford, the Task Force consists of business owners and leaders in the Red Deer business sector.

“We all have a role to play in a vibrant and thriving Red Deer,” said Radford. “The Red Deer & District Chamber of Commerce recognizes that effectively addressing homelessness requires a collaborative approach involving the government, social sector organizations, businesses, and residents working together.”

“As Red Deerians, the Task Force members understand that addressing homelessness will contribute to the overall well-being and livability of the community that we are proud to call home,” add Scott Robinson, Chief Executive of the Chamber. “And as members of the business community, they have a vested interest in understanding the homelessness situation to help enhance the economic viability of our community.”

The Chamber announced its intention to launch a Task Force on Homelessness in March 2023. Currently, the Task Force is completing an environmental scan to understand the scope of the homelessness situation before engaging in consultations with the broader Red Deer community through a series of community consultations. Community consultations are anticipated to launch in the fall, with an interim report of findings available in early 2024. A final report will be made public in the spring of 2024.

Once scheduled, information on the community consultations will be shared publicly on reddeerchamber.com.

Economy

Ottawa’s homebuilding plans might discourage much-needed business investment

From the Fraser Institute

In the minds of most Canadians, there’s little connection between housing affordability and productivity growth, a somewhat wonky term used mainly by economists. But in fact, the connection is very real.

To improve affordability, the Trudeau government recently announced various financing programs to encourage more investment in residential housing including $6 billion for the Canada Housing Infrastructure Fund and $15 billion for an apartment construction loan program.

Meanwhile, Carolyn Rogers, senior deputy governor of the Bank of Canada, recently said weak business investment is contributing to Canada’s weak growth in productivity (essentially the value of economic output per hour of work). Therefore, business investment to promote productivity growth and income growth for workers is also an economic priority.

But here’s the problem. There’s only so much financial capital at reasonable interest rates to go around.

Because Canada is a small open economy, it might seem that Canadian investors have unlimited access to offshore financial capital, but this is not true. Foreign lenders and investors incur foreign exchange risk when investing in Canadian-dollar denominated assets, and the risk that Canadian asset values will decline in real value. Suppliers of financial capital expect to receive higher yields on their investments for taking on more risk. Hence, investment in residential housing (which the Trudeau government wants to promote) and investment in business assets (which the Bank of Canada warns is weak) compete against each other for scarce financial capital supplied by both domestic and foreign savers.

For perspective, investment in residential housing as a share of total investment increased from 22.4 per cent in 2000 to 41.3 per cent in 2021. Over the same period, investment in two asset categories critical to improving productivity—information and communications equipment and intellectual property products including computer software—decreased from 30.3 per cent of total domestic investment in 2000 to 22.7 per cent in 2021.

What are the potential solutions?

Of course, more financial capital might be available at existing interest rates for domestic investment in residential housing and productivity-enhancing business assets if investment growth declines in other asset categories such as transportation, roads and hospitals. But these assets also contribute to improved productivity and living standards.

Regulatory and legal pressures on Canadian pension funds to invest more in Canada and less abroad would also free up domestic savings for increased investments in residential housing, machinery and equipment and intellectual property products. But this amounts to an implicit tax on Canadians with domestic pension fund holdings to subsidize other investors.

Alternatively, to increase domestic savings, governments in Canada could increase consumption taxes (e.g. sales taxes) while reducing or even eliminating capital gains taxes, which reduce the after-tax expected returns to investing in businesses, particularly riskier new and emerging domestic companies. (Although according to the recent federal budget, the Trudeau government plans to increase capital gains taxes.)

Or governments could reduce the regulatory burden on private-sector businesses, especially small and medium-sized enterprises, so financial capital and other inputs used to comply with often duplicative or excessive regulation can be used to invest in productivity-enhancing assets. And governments could eliminate restrictions on foreign investment in large parts of the Canadian economy including telecommunications, banking and transportation. By increasing competition, governments can improve productivity.

Eliminating such restrictions would also arguably increase the supply of foreign financial capital flowing into Canada to the extent that large foreign investors would prefer to manage their Canadian assets rather than take portfolio investment positions in Canadian-owned companies.

Canadians would undoubtedly benefit from increases in housing construction (and subsequently, increased affordability) and improved productivity from increased business investment. However, government subsidies to home builders, including the billions recently announced by the Trudeau government, simply move available domestic savings from one set of investments to another. The policy goal should be to increase the availability of risk-taking financial capital so the costs of capital decrease for Canadian investors.

Author:

Housing

Trudeau’s 2024 budget could drive out investment as housing bubble continues

From LifeSiteNews

By David James

The extent to which the Canadian economy is distorted by a property bubble can be seen by comparing government debt with household debt, with the latter being 130 percent of GDP, nearly twice as much as American households.

Prime Minister Justin Trudeau’s federal government has brought in its 2024 budget, which projects C$53 billion in new spending over the next 5 years. It includes a significant capital gains tax increase, which some are warning will drive away investment, and a plan for more government-controlled public housing.

The Trudeau government is wrestling with a problem that is afflicting most English-speaking economies: how to deal with the consequences of a 20-year house price bubble that has led to deep social divisions, especially between baby boomers and people under 40.

House prices have tripled over the last 20 years on average, fuelled by the combination of aggressive bank lending and, until recently, falling interest rates. Neither is directly controlled by the federal government. There is no avenue to restrict how much banks lend and the Bank of Canada sets interest rates independently.

Accordingly, the Trudeau government is left to tinker at the edges. It will legislate an increase, from one half to two-thirds, in the share of capital gains subject to taxation for annual investment profits greater than C$250,000. The change will apply to individuals, companies and trusts.

Christina Freeland, Canada’s minister for finance, claimed improbably that only 0.13 percent of Canadians with an average income of $1.42 million are expected to pay more income tax on their capital gains in any given year.

That is a dubious forecast. The average house price in Canada 20 years ago was C$241,000; it is now C$719,000. Any Canadians who bought an investment property (family homes are exempt) before about 2015 are likely to have a capital gain larger than C$250,000 should they sell.

The government’s claim that the change will only affect a tiny proportion of Canada’s population is also belied by the government’s own forecast that the tax change will raise over C$20 billion over five years.

The extent to which the Canadian economy is distorted by a property bubble can be seen by comparing government debt with household debt. Canada’s government debt is fairly modest by current international standards: 67.8 percent of GDP in March 2023, down from 73 percent in the previous year. That is about half the U.S. government debt and half the average for G7 countries.

Canada’s budget deficit is also cautious by Western standards. In 2023-24 it was C$40 billion, equivalent to 1.4 percent of GDP. The U.S. budget deficit is currently over 6 percent of GDP.

By contrast Canada’s household debt, inflated by large mortgages, is at over 130 percent of GDP, making borrowers vulnerable to rising interest rates. U.S. household debt is about 75 percent of GDP. Attracted by rising house prices and the advantages of negative gearing (deducting rental losses from a property investment from income tax), Canadians have seen property as their preferred investment option.

Investors account for 30 percent of home buying in Canada, and about one in five properties is owned by an investor. Worse, the enthusiasm for property investment seems to be intensifying. According to one survey, 23 percent of Canadians who do not own a residential investment property say that they are likely to purchase one in the next five years, and 51 percent of current investors say that they are likely to purchase an additional residential investment property within the same time frame.

The problem with the bias towards property investment is that it is actually a punt on land values – and land is inherently unproductive. Business groups have criticized the government’s capital gains hike as a disincentive for investment and innovation, but the far bigger issue is investors’ focus on property, which is crowding out interest in other kinds of investments.

That means the main source investment capital for businesses will tend to come from institutions, such as mutual funds, which typically have a global, rather than local, orientation.

Faced with forces largely out of its control, the Trudeau government is fiddling at the edges. It has announced the introduction of what it calls “Canada’s Housing Plan”, which is aimed at unlocking over 3.8 million homes by 2031. Two million are expected to be new homes, with the government contributing to more than half of them. This will be done by converting underused federal offices into homes, building homes on Canada Post properties, redeveloping National Defence lands, creating more loans for building apartments in Ottawa, and looking at taxing vacant land.

The initiatives may have some effect on supply and demand, but the property price excesses are mainly a financial problem caused by unrestrained bank lending that has been fuelled by low interest rates. When a correction does occur, it will most likely be because of changed global financial conditions, not government policy or fiscal changes.

There are other measures that could be taken to address the property bubble such as reducing, or removing, negative gearing or more heavily taxing capital gains only on property but not other types of investments. But these policies would no doubt would be politically unsalable, so the Trudeau government is instead making minor changes, probably hoping that the problem will fix itself.

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoThe Predictable Wastes of Covid Relief

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoBook Burning Goes Digital

-

John Stossel23 hours ago

John Stossel23 hours agoThe Swamp Survived: Why Trump Failed to “Drain the Swamp”

-

Alberta1 day ago

Alberta1 day agoCanadian Christian chiropractor fights ‘illegal’ $65,000 fine for refusing to wear mask

-

Media1 day ago

Media1 day agoCBC tries to hide senior executive bonuses

-

conflict2 days ago

conflict2 days agoOver 200 Days Into War, Family Of American Hostage in Gaza Strives For Deal To Bring Son Home

-

Automotive21 hours ago

Automotive21 hours agoNew Analysis Shows Just How Bad Electric Trucks Are For Business

-

Energy24 hours ago

Energy24 hours agoU.S. EPA Unveils Carbon Dioxide Regulations That Could End Coal and Natural Gas Power Generation