Alberta

Province of Alberta loaning Orphan Well Association 100 Million to create jobs and accelerate clean up

From The Province of Alberta

Creating jobs, accelerating well cleanup

A government loan to the Orphan Well Association (OWA) will spur the creation of hundreds of green jobs and reduce the number of orphaned wells across Alberta.

As the first step in A Blueprint for Jobs, the province is extending its loan to the OWA by up to $100 million. This loan will bolster the association’s immediate reclamation efforts and generate up to 500 direct and indirect jobs in the oil services sector.

“Today’s investment is part of our Blueprint for Jobs. This taxpayer investment will create good-paying jobs while improving the environment. Actions like this will help to get Alberta back to work.”

“We are getting Albertans back to work while staying true to our province’s reputation as a responsible resource developer. This loan will increase economic activity across our province and is an important step in addressing the pressing issue of oil and gas liabilities – particularly in rural Alberta.”

“By staying on top of the orphaned well inventory, we’re helping to ensure a sustainable energy industry in Alberta. The Orphan Well Association continues to increase our efficiencies while also increasing the number of sites we are addressing. This loan will help us further these efforts while helping Alberta’s service sector and reducing the impact on affected landowners.”

Government and the OWA are currently finalizing specific loan terms and conditions, including establishing a repayment schedule. Both parties have agreed that this investment will be completed before April 1, 2021.

The Blueprint for Jobs is a plan to bring jobs and investment back to Alberta and restore the province’s position as the best place in the country to live, work, start a business, and raise a family. The Government of Alberta is focused on creating jobs, growing the economy and getting Alberta back to work.

Quick facts

- The loan extension will enable the OWA to:

- decommission approximately 1,000 wells

- start more than 1,000 environmental site assessments for reclamation

- The Alberta government previously provided the OWA with a $235 million interest-free loan. The OWA began repaying the loan in 2019, using money received from industry through the annual Orphan Fund Levy.

- In the coming weeks, government will be introducing a full suite of products, covering the entire lifecycle of wells from start to finish.

About the Orphan Well Association

The Orphan Well Association is an independent non-profit organization that operates under the delegated legal authority of the Alberta Energy Regulator (AER). The mandate of the OWA is to safely decommission orphan oil and gas wells, pipelines and production facilities, and restore the land as close to its original state as possible. Funding for the OWA comes primarily from the upstream oil and gas industry, through annual levies administered by the AER.

Key Terms

Inactive well: A well that has not been used for production, injection, or disposal for a specified amount of time – six months for high-risk wells, or 12 months for medium- and low- risk wells.

Orphan: A well, pipeline, or facility that does not have any legally responsible and/or financially able party to conduct abandonment and reclamation responsibilities.

Abandoned well: A well that is no longer needed to support oil and gas development and is permanently plugged, cut and capped according to Alberta Energy Regulator requirements.

Reclamation: The process of returning the site, as close as possible, to a state that’s equivalent to before it was disturbed. Companies are responsible for reclamation liability for 25 years, after which the liability reverts to the Crown.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

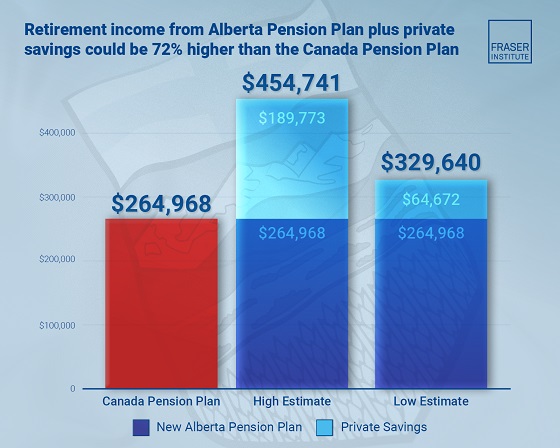

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!