International

Prime Minister Trudeau called ‘dictator’ to his face in blistering speech in European Parliament

It wasn’t the response Prime Minister Trudeau was hoping for. In fact in a career filled with humiliations on various international trips, Wednesday’s speech at the EU in Brussels has to be the worst experience of all for Canada’s PM.

As part of a longer speech in which Trudeau called on the EU for more support for Ukraine, Canada’s Prime Minister blamed the leaders of the Freedom Convoy for threatening democracy. That assertion did not go over very well.

Croatian MP Mislav Kolakusic responded by calling out Trudeau for violating the civil rights of Canadians participating in the Freedom Convoy protests. In a blistering speech to fellow EU Parliamentarians, Kolakusic turned to Trudeau and called his actions in crushing the Ottawa protest “dictatorship of the worst kind”. Trudeau sat quietly and listened as the MP from Croatia informed him many Europeans watched as he “trampled women with horses,” and blocked “the bank accounts of single parents.”

Click on the video below to see the humiliating tongue-lashing.

PM Trudeau, in recent months, under your quasi-liberal boot, Canada 🇨🇦 has become a symbol of civil rights violations. The methods we have witnessed may be liberal to you, but to many citizens around the🌎it seemed like a dictatorship of the worst kind. pic.twitter.com/FZuc6aDZ1I

— Mislav Kolakusic MEP 🇭🇷🇪🇺 (@mislavkolakusic) March 23, 2022

Kolakusic wasn’t the only European Union to express outrage with Prime Minister Trudeau today. Here’s German MEP Christine Anderson.

German MEP Christine Anderson to Justin Trudeau at European Parliament: "You are a disgrace to democracy. Please spare us your presence." https://t.co/rbs5IoKRbG

— Don Wilson, LLB 🇨🇦 (@DNSWilson) March 24, 2022

Meanwhile, Romanian MEP Christian Terhes outright refused to attend Trudeau’s speech. Probably a good thing for Trudeau judging by the tone of this social media post from Terhes today.

The following is from the Facebook page of Christian Terhes MEP from Romania.

Finally, thanks to Montreal based communicator Viva Frei for this compilation.

International

CBS settles with Trump over doctored 60 Minutes Harris interview

CBS will pay Donald Trump more than $30 million to settle a lawsuit over a 2024 60 Minutes interview with Kamala Harris. The deal also includes a new rule requiring unedited transcripts of future candidate interviews.

Key Details:

- Trump will receive $16 million immediately to cover legal costs, with remaining funds earmarked for pro-conservative messaging and future causes, including his presidential library.

- CBS agreed to release full, unedited transcripts of all future presidential candidate interviews—a policy insiders are calling the “Trump Rule.”

- Trump’s lawsuit accused CBS of deceptively editing a 60 Minutes interview with Harris in 2024 to protect her ahead of the election; the FCC later obtained the full transcript after a complaint was filed.

Tonight, on a 60 Minutes election special, Vice President Kamala Harris shares her plan to strengthen the economy by investing in small businesses and the middle class. Bill Whitaker asks how she’ll fund it and get it through Congress. https://t.co/3Kyw3hgBzr pic.twitter.com/HdAmz0Zpxa

— 60 Minutes (@60Minutes) October 7, 2024

Diving Deeper:

CBS and Paramount Global have agreed to pay President Donald Trump more than $30 million to settle a lawsuit over a 2024 60 Minutes interview with then–Vice President Kamala Harris, Fox News Digital reported Tuesday. Trump accused the network of election interference, saying CBS selectively edited Harris to shield her from backlash in the final stretch of the campaign.

The settlement includes a $16 million upfront payment to cover legal expenses and other discretionary uses, including funding for Trump’s future presidential library. Additional funds—expected to push the total package well above $30 million—will support conservative-aligned messaging such as advertisements and public service announcements.

As part of the deal, CBS also agreed to a new editorial policy mandating the public release of full, unedited transcripts of any future interviews with presidential candidates. The internal nickname for the new rule is reportedly the “Trump Rule.”

Trump initially sought $20 billion in damages, citing a Face the Nation preview that aired Harris’s rambling response to a question about Israeli Prime Minister Benjamin Netanyahu. That portion of the interview was widely mocked. A more polished answer was aired separately during a primetime 60 Minutes special, prompting allegations that CBS intentionally split Harris’s answer to minimize political fallout.

The FCC later ordered CBS to release the full transcript and raw footage after a complaint was filed. The materials confirmed that both versions came from the same response—cut in half across different broadcasts.

CBS denied wrongdoing but the fallout rocked the network. 60 Minutes executive producer Bill Owens resigned in April after losing control over editorial decisions. CBS News President Wendy McMahon also stepped down in May, saying the company’s direction no longer aligned with her own.

Several CBS veterans strongly opposed any settlement. “The unanimous view at 60 Minutes is that there should be no settlement, and no money paid, because the lawsuit is complete bulls***,” one producer told Fox News Digital. Correspondent Scott Pelley had warned that settling would be “very damaging” to the network’s reputation.

The final agreement includes no admission of guilt and no direct personal payment to Trump—but it locks in a substantial cash payout and forces a new standard for transparency in how networks handle presidential interviews.

International

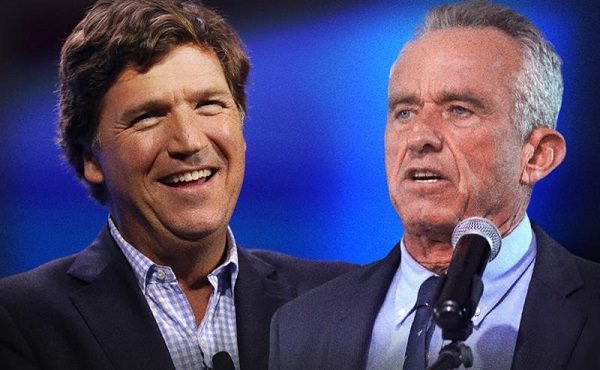

RFK Jr. tells Tucker how Big Pharma uses ‘perverse incentives’ to get vaccines approved

From LifeSiteNews

By Matt Lamb

Kennedy defended his decision to fire all 17 members of the Advisory Committee on Immunization Practices, which he decried as a tool used to “rubber stamp” vaccines.

The vaccine approval process is a “bundle of perverse incentives” since pharmaceutical companies stand to make billions of dollars in revenue from it, Secretary of Health and Human Services Robert F. Kennedy Jr. told Tucker Carlson recently.

Kennedy appeared on Carlson’s show yesterday to discuss a variety of issues, including the potential link between autism and vaccines and his overhauling of the vaccine advisory committee at the Centers for Disease Control and Prevention last month.

Twenty years ago, Bobby Kennedy was exiled from polite society for suggesting a link between autism and vaccines. Now he’s a cabinet secretary, and still saying it.

(0:00) The Organized Opposition to RFK’s Mission

(6:46) Uncovering the Reason for Skyrocketing Rates of Autism… pic.twitter.com/g8T8te3kNC— Tucker Carlson (@TuckerCarlson) June 30, 2025

Kennedy began by explaining that Big Pharma has been targeting academic journals to ensure its products receive favorable reviews.

“The journals won’t publish anything critical of vaccines … there’s so much pressure on them. They’re funded by pharmaceutical companies, and they’ll lose advertising and revenue from reprints,” Kennedy said.

Kennedy then noted that Big Pharma will “pay to get something published in these journals,” before accusing industry leaders of pushing drugs on doctors and of hiring “mercenary scientists” to manipulate data until their product is deemed safe and effective.

The entire complex is broken due to the “perverse incentives,” he lamented.

Later in the interview, Kennedy defended his decision to fire all 17 members of the Advisory Committee on Immunization Practices (ACIP) in June, which he decried as a mere tool to “rubber stamp” vaccines.

It served as “a sock puppet for the industry that it was supposed to regulate,” Kennedy exclaimed, citing conflicts of interest for the overwhelming majority of its board members.

This sort of “agency capture” explains the lucrative nature of vaccines, he added.

— Matt Lamb (@MattLamb22) July 1, 2025

Kennedy then summarized the “perverse” process as follows:

First of all, the federal government often times actually designs the vaccine, [the National Institutes of Health] would design it, would hand it over to the pharmaceutical company. The pharmaceutical company then runs it … first through [the] FDA, then through [the] ACIP, and gets it recommended.

If you can get that recommendation you now got a billion dollars in — at least — revenues by the end of the year, every year, forever. So, there was a gold rush to add new vaccines to the schedule and ACIP never turned away a single vaccine … that came to them they recommended, and a lot of these vaccines are for diseases that are not even casually contagious.

Kennedy further pointed to the Hepatitis B shot for newborns as an example of how the industry has been corrupted.

In 1999, the CDC “looked at children who had received the hepatitis vaccine within the first 30 days of life and compared those children to children who had received the vaccine later — or not at all. And they found an 1,135% elevated risk of autism among the vaccinated children. It shocked them. They kept the study secret and manipulated it through five different iterations to try to bury the link,” he said.

“We want to protect public health,” Kennedy explained, but “these vaccines … can cause chronic disease, chronic injuries that last a lifetime.”

-

COVID-192 days ago

COVID-192 days agoOntario man launches new challenge against province’s latest attempt to ban free expression on roadside billboards

-

COVID-191 day ago

COVID-191 day agoNew Peer-Reviewed Study Affirms COVID Vaccines Reduce Fertility

-

Business21 hours ago

Business21 hours agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

Alberta2 days ago

Alberta2 days agoAlberta Next Takes A Look At Alberta Provincial Police Force

-

Alberta24 hours ago

Alberta24 hours agoThe permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

-

MAiD23 hours ago

MAiD23 hours agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Alberta2 days ago

Alberta2 days agoCanadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

-

International2 days ago

International2 days agoPresident Xi Skips Key Summit, Adding Fuel to Ebbing Power Theories