Politics

Poilievre chastises Trudeau for dealing with inflation like a ‘pyromaniac promising to fight a fire’

From LifeSiteNews

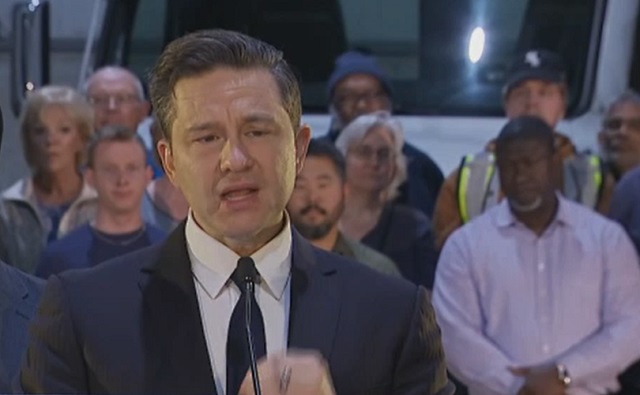

At a Fix the Budget rally, the Conservative Party leader made three demands ahead of the 2024 budget release.

Conservative Party of Canada (CPC) leader Pierre Poilievre criticized Prime Minister Justin Trudeau’s pledge to combat sky-high inflation in a strong rebuke of the handling of the nation’s economy.

“Justin Trudeau promising to fight inflation is like a pyromaniac promising to fight a fire,” Poilievre said Sunday during a “Fix the Budget” rally at a truck depot in Mississauga, Ontario.

“He’s the one that lit the fire with his taxes and his deficits.”

Poilievre noted that “every day” Trudeau is seen in planned “photo ops,” saying that many Canadians “know the money that he’s spitting out of his mouth is money that will come out of your pocket, just like it has for the last eight years.”

The CPC leader said during the rally that his party has three demands for Trudeau concerning his upcoming 2024 budget, which is set to be released on April 16.

“Ax the Trudeau tax on food and farmers; two, build homes, not bureaucracies; and three, cap the spending with a dollar-for-dollar law to bring down inflation and interest rates,” Poilievre said.

Poilievre also mentioned that he wants the Trudeau government to take away the tax on food and farmers via Bill C-234, which, if passed, would take away the carbon tax on farmers, their barns, and fuel they use to dry grain.

The bill would amend the current Greenhouse Gas Pollution Pricing Act to take the carbon tax off farmers, barns, and drying, which Poilievre said will provide food price relief to Canadians.

Poilievre also said he wants the federal government to bring in a “dollar-for-dollar” law that would help to lower high interest rates, which contributes to inflation.

He also promised that the CPC, should it form the next government, will “cut back office bureaucracy, botched procurements, and foreign aid to dictators, terrorists, and multinational bureaucracies.”

“We’ll bring that money home and invest it in our military,” he said.

Poilievre also accused Trudeau’s spending, which skyrocketed during the COVID crisis, of being a leading cause of inflation.

“When you double the national debt, you drive up demand, which builds up goods. You print $600 billion of cash, and that causes inflation just like it has everywhere and always over the last 5,000 years of economic history,” he said.

The Liberal federal government has faced backlash, notably from the CPC, that high inflation and immigration have led to soaring housing prices and interest rates.

The Bank of Canada, for the sixth straight time since July 2023, held the interest rate at 5 percent.

Protests against Trudeau have been increasing in recent months due to the unpopularity of higher carbon taxes and other governmental policies.

As reported by LifeSiteNews, Trudeau’s carbon tax is costing Canadians hundreds of dollars annually, as government rebates are not enough to compensate for high fuel costs.

Franco Terrazzano, federal director of the Canadian Taxpayers Federation, told LifeSiteNews in January that “If the government wanted to make all areas of life more affordable, the government should leave more money in people’s pockets and cut taxes.”

“Trudeau should completely scrap his carbon tax,” he added.

Recent polls show that the scandal-plagued government has sent the Liberals into a nosedive with no end in sight. Per a recent LifeSiteNews report, according to polls, in a federal election held today, Conservatives under Poilievre would win a majority in the House of Commons over Trudeau’s Liberals.

Opinion

Blind to the Left: Canada’s Counter-Extremism Failure Leaves Neo-Marxist and Islamist Threats Unchecked

By Ian Bradbury

Incidents like the 2022 Coastal GasLink attack, the December 2023 Ottawa plot against Jewish events and the January 2024 Edmonton City Hall attack underscore the stakes, yet they fade from public discourse without rigorous analysis. This is not mere oversight—it is a systemic failure of Canada’s counter-radicalization and extremism frameworks and media, exposing the nation to risks from under-assessed threats.

In June 2025, a former British Columbia civil liberties leader—forced to resign in 2021 for rhetoric deemed too extreme even by the province’s NDP government—re-emerged to lead a protest outside the Canada Border Services Agency offices in Vancouver. Her earlier praise of Hamas attackers’ hang-glider tactics as “beautiful” and her call to “burn it all down” amid the 2021 church arsons across Canada raise a critical question: Is this the sign of a deeper ideological current gaining momentum beneath the surface?

Canada faces a mounting crisis of radicalization and extremism, yet its citizens remain largely uninformed or, worse, misinformed.

Despite tens of millions invested in counter-radicalization over the past decade, threats from extremist elements within the Pro-Palestinian movement, the “Hands Off Iran” protests, and left-wing extremism receive insufficient scrutiny.

The “Hands Off Iran” demonstrations on June 22, 2025, which rallied hundreds in support of the Iranian regime—planned before U.S. strikes on Iranian nuclear facilities and organized by many of the same protest groups active since October 7, 2023—highlight this neglect.

The absence of detailed reporting obscures their scope and significance. Incidents like the January 2024 Edmonton City Hall attack and the December 2023 Ottawa plot against Jewish events underscore the stakes, yet they fade from public discourse without rigorous analysis.

This is not mere oversight—it is a systemic failure of Canada’s counter-radicalization and extremism frameworks and media, exposing the nation to risks from under-assessed threats.

Under-assessed Threats in Plain Sight

Pro-Palestinian rallies in Vancouver, Toronto, Ottawa, and Montreal reveal this gap. Flags of Hamas and Hezbollah—designated terrorist groups in Canada—have been displayed openly, and chants of “Death to Canada”, “Death to America”, and “Death to Israel, Death to Jews” have been reported, yet government-funded organizations offer no in-depth analysis of the radical networks or rhetoric tied to these events.

The “Hands Off Iran” protests face the same silence. Where are the detailed reports dissecting these movements? Where are the network maps or guides to their flags, symbols, and rhetoric, as seen for far-right groups?

Similarly, Left-wing accelerationism, an neo-marxist ideology advocating violent societal collapse, has fueled incidents like the 2022 Coastal GasLink attack, the 2021 church arsons, and anti-colonial criminal acts, yet it is overshadowed and downplayed by coverage of far-right threats, such as militant “right-wing accelerationism”. Two cases illustrate the broad urgency: the Edmonton attack, involving gunfire and a Molotov cocktail, included a video supporting Palestine and condemning Israel’s actions in Gaza, but was downplayed as “salad-bar extremism.”

The Ottawa plot, inspired by Islamic extremism and the Israel-Palestine conflict, vanished from headlines with alarming speed. These incidents demand thorough investigation, not dismissal.

A Counter-Radicalization Industry Misaligned

Canada’s counter-radicalization efforts fail to address the full spectrum of threats. Organizations such as the Canadian Centre for the Prevention of Radicalization Leading to Violence and the Canadian Anti-Hate Network (an organization linked to the extremist decentralized Antifa movement) focus heavily on far-right extremism and limited Islamic threats (e.g., ISIS and Al-Qaeda), while sidelining left-wing extremism, accelerationism, anarchist extremism, and broader Islamic extremism.

Despite Canada’s 2024 designations of the IRGC and Samidoun as terrorist entities, these threats receive minimal attention compared to the detailed profiling of far-right networks in Canada. Detailed radicalization or extremist assessment reports on Edmonton or Ottawa? Virtually nonexistent. Further compounding the challenge, Canada’s reliance on foreign groups like the UK’s ICSR, ISD, Moonshot, or Meta’s GIFCT—partly funded by Canadian taxpayers—skews focus away from nuanced, Canada centered, counter-radicalization and extremism priorities.

Certain initiatives, such as Moonshot’s redirect program, which was found to have directed individuals vulnerable to right-wing radicalization to curated content from an anarchist and convicted human trafficker with ties to Russian organized crime, likely exacerbated rather than mitigated the risks it intended to reduce. This prompts a critical question: Why does Canada entrust so much of its counter-radicalization and extremism initiatives to external entities that are unaccountable to its citizens?

Media coverage only compounds the problem.

The Edmonton attack’s Palestine-linked video was buried under vague labeling, and the Ottawa plot faded without follow-up. Extremist symbols at rallies are treated as backdrop, unlike the 2022 convoy protests, which prompted detailed government-funded analyses of symbols, rhetoric, and networks, that were amplified by media.

Exacerbating the challenges, Public Safety Canada’s Listed Terrorist Entities page lists groups but lacks guides to their symbols, terms, or networks, leaving Canadians ill-equipped to identify threats. This is not journalism or governance—it is a failure to connect evident and observable dots.

CSIS and the RCMP have raised alarms about Iranian- and Palestinian-linked threats, in addition to Israeli Deputy Foreign Minister Sharren Haskel’s claim of hundreds of IRGC operatives active in Canada. The 2024 designations of the IRGC, linked to Hamas, Hezbollah, and the Houthis, and Samidoun, tied to Palestinian extremism, confirm these risks. CSIS has flagged Iranian-backed influence networks, and the RCMP thwarted plots like the Ottawa conspiracy.

Yet, these warnings rarely translate into robust public understanding, leaving Canadians vulnerable to acknowledged and observable threats.

A Path Forward: Immediate Accountability

The U.S. bombardment of Iranian nuclear sites has heightened these risks, with reports of Iranian sleeper cells in North America adding urgency. Canada must act swiftly to address all threats—left-wing, Islamic, and far-right—with equal rigor.

Detailed, unclassified reports on incidents like Edmonton and Ottawa, alongside network analyses of domestic protest and disruption movements, must become standard. Furthermore, Public Safety Canada should enhance its Listed Terrorist Entities page with guides to symbols, flags, rhetoric, and networks, drawing on allied nations’ open-source models for rapid implementation. Federal funding for counter-radicalization groups must mandate balanced, actionable reporting across all threats, verified through regular audits.

Canada’s skewed approach to extremism is a profound national security vulnerability. Left-wing extremism and accelerationism, pervasive Islamic extremism, and attacks on Jewish institutions fester unaddressed, while rallies including support for listed terrorist groups evade scrutiny.

The counter-radicalization sector, media, and government share responsibility for this dangerous oversight. As global tensions rise and domestic risks evolve, the cost of inaction grows steeper, leaving Canada vulnerable to the next strike. What message does Canada send by prioritizing some threats while overlooking others that are active and evident?

And what will the reckoning be when a skilled attacker, emboldened by this neglect, slips through the cracks?

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Invite your friends and earn rewards

Energy

If Canada Wants to be the World’s Energy Partner, We Need to Act Like It

Photo by David Bloom / Postmedia file

From Energy Now

By Gary Mar

With the Trans Mountain Expansion online, we have new access to Pacific markets and Asia has responded, with China now a top buyer of Canadian crude.

The world is short on reliable energy and long on instability. Tankers edge through choke points like the Strait of Hormuz. Wars threaten pipelines and power grids. Markets flinch with every headline. As authoritarian regimes rattle sabres and weaponize supply chains, the global appetite for energy from stable, democratic, responsible producers has never been greater.

Canada checks every box: vast reserves, rigorous environmental standards, rule of law and a commitment to Indigenous partnership. We should be leading the race, but instead we’ve effectively tied our own shoelaces together.

In 2024, Canada set new records for oil production and exports. Alberta alone pumped nearly 1.5 billion barrels, a 4.5 per cent increase over 2023. With the Trans Mountain Expansion (TMX) online, we have new access to Pacific markets and Asia has responded, with China now a top buyer of Canadian crude.

The bad news is that we’re limiting where energy can leave the country. Bill C-48, the so-called tanker ban, prohibits tankers carrying over 12,500 tons of crude oil from stopping or unloading crude at ports or marine installations along B.C.’s northern coast. That includes Kitimat and Prince Rupert, two ports with strategic access to Indo-Pacific markets. Yes, we must do all we can to mitigate risks to Canada’s coastlines, but this should be balanced against a need to reduce our reliance on trade with the U.S. and increase our access to global markets.

Add to that the Impact Assessment Act (IAA) which was designed in part to shorten approval times and add certainty about how long the process would take. It has not had that effect and it’s scaring off investment. Business confidence in Canada has dropped to pandemic-era lows, due in part to unpredictable rules.

At a time when Canada is facing a modest recession and needs to attract private capital, we’ve made building trade infrastructure feel like trying to drive a snowplow through molasses.

What’s needed isn’t revolutionary, just practical. A start would be to maximize the amount of crude transported through the Trans Mountain Expansion pipeline, which ran at 77 per cent capacity in 2024. Under-utilization is attributed to a variety of factors, one of which is higher tolls being charged to producers.

Canada also needs to overhaul the IAA and create a review system that’s fast, clear and focused on accountability, not red tape. Investors need to know where the goalposts are. And, while we are making recommendations, strategic ports like Prince Rupert should be able to participate in global energy trade under the same high safety standards used elsewhere in Canada.

Canada needs a national approach to energy exporting. A 10-year projects and partnerships plan would give governments, Indigenous nations and industry a common direction. This could be coupled with the development of a category of “strategic export infrastructure” to prioritize trade-enabling projects and move them through approvals faster.

Of course, none of this can take place without bringing Indigenous partners into the planning process. A dedicated federal mechanism should be put in place to streamline and strengthen Indigenous consultation for major trade infrastructure, ensuring the process is both faster and fairer and that Indigenous equity options are built in from the start.

None of this is about blocking the energy transition. It’s about bridging it. Until we invent, build and scale the clean technologies of tomorrow, responsibly produced oil and gas will remain part of the mix. The only question is who will supply it.

Canada is the most stable of the world’s top oil producers, but we are a puzzle to the rest of the world, which doesn’t understand why we can’t get more of our oil and natural gas to market. In recent years, Norway and the U.S. have increased crude oil production. Notably, the U.S. also increased its natural gas exports through the construction of new LNG export terminals, which have helped supply European allies seeking to reduce their reliance on Russian natural gas.

Canada could be the bridge between demand and security, but if we want to be the world’s go-to energy partner, we need to act like it. That means building faster, regulating smarter and treating trade infrastructure like the strategic asset it is.

The world is watching. The opportunity is now. Let’s not waste it.

Gary Mar is president and CEO of the Canada West Foundation

-

Business2 days ago

Business2 days agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

COVID-192 days ago

COVID-192 days agoNew Peer-Reviewed Study Affirms COVID Vaccines Reduce Fertility

-

MAiD2 days ago

MAiD2 days agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Alberta2 days ago

Alberta2 days agoThe permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

-

Business1 day ago

Business1 day agoWorld Economic Forum Aims to Repair Relations with Schwab

-

Alberta1 day ago

Alberta1 day agoAlberta’s government is investing $5 million to help launch the world’s first direct air capture centre at Innisfail

-

Business2 days ago

Business2 days agoMunicipal government per-person spending in Canada hit near record levels

-

Business1 day ago

Business1 day agoA new federal bureaucracy will not deliver the affordable housing Canadians need