Energy

Opinion: A Kamala Harris Presidency Is The Stuff Of Nightmares

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By PETER MURPHY

Vice President Kamala Harris is one election away from winning the White House and accelerating America’s climate hysteria that is already well underway thanks to the outgoing President Joe Biden.

“There is no question I’m in favor of banning fracking,” then-Sen. Harris said during a CNN-sponsored town hall back in 2019, during her ill-fated run for president.

That same year, she threw her support behind the Green New Deal, proposed by New York Democratic Rep. Alexandria Ocasio-Cortez and Massachusetts Democratic Sen. Ed Markey. That is a plan that would spend trillions of taxpayer dollars to “transition” America from oil, gas and coal sources to so-called wind, solar and batteries–or, rather, to subjugate the nation to an all-powerful green state under the command of the federal government.

Harris later teamed with AOC to introduce the Climate Equity Act, which was a confusing, word-salad of a bill to address climate “injustice” in “front-line communities” using the familiar means of creating a massive new federal bureaucracy.

During Harris’ short-lived campaign for president, which crashed and burned months before the 2020 caucus and primary votes, she called for a climate pollution fee that would “make polluters pay for emitting greenhouse gases into our atmosphere.” Typical of so many climate falsehoods, Harris conflates carbon emissions with “pollution.”

In his letter to the nation last Sunday announcing he was dropping out of the presidential race, President Joe Biden boasted that he had overseen passage of the “most significant climate legislation in the history of the world” — an apparent reference to his misnamed Inflation Reduction Act. This “significant” legislation included hundreds of millions of dollars of corporate welfare for companies to build wind turbines, solar panels and electric vehicles and other climate-related projects.

Because, after all, the U.S. is “the world’s largest historical contributor to climate change – still the second largest today after China’ said a story posted by the climate-rabid media outlet, Yahoo News. Expect a President Harris to double down on such unscientific drivel.

In a modern historical anomaly, Harris is poised to become a major party’s presidential nominee without a single caucus or primary vote, which is a throwback to the old days of party bosses and smoke-filled rooms at convention time.

Still, Harris is among the most privileged Americans to ever become a presidential nominee of a major political party, though not without difficulties. Her parents were both college professors, but they divorced when she was young. Following law school, Harris became a prosecutor in the Alameda County attorney’s office. With the assistance of her politically powerful mentor and very close friend, the charismatic California State Assembly Speaker Willie Brown, she was appointed to several public jobs, elected as San Francisco district attorney, attorney general of California, and then U.S. senator.

After becoming a senator, Harris began running for president. Her 2020 presidential campaign helped reveal her radical positions on climate and a host of other issues and enabled her to get on the short list of vice presidential choices.

With Biden’s mental and physical decline now so obvious, Harris has become the beneficiary of a ninth-inning political coup d’état against the president, engineered by Democratic Party leaders, who pressured him to drop his re-election campaign on the eve of the party’s nominating convention.

Harris is no Scranton-born, working-class pretender, who rode Amtrak. She does not have any record of political centrism, moderation or bipartisanship, which Biden practiced off and on throughout his career and helped him win the presidency in 2020.

By contrast, Harris is a product of the one-party state of California, who supported destructive policies on climate change, energy, crime and welfare that helped spark in California high fuel costs, declining living standards and a population exodus.

The election of 2024 will have climate change on the ballot, as did the 2020 election. The big difference this time is that Americans have experienced more than ever the inflationary and detrimental effects of climate policies with no impact on climate change.

And, it is not a supposed moderate candidate making the climate sale to the public, but a true believer, Kamala Harris.

Peter Murphy is Senior Fellow at the Committee For A Constructive Tomorrow (CFACT), a Washington D.C.-based organization in support of free market, technological solutions to energy and environmental challenges.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Daily Caller

Trump Issues Order To End Green Energy Gravy Train, Cites National Security

From the Daily Caller News Foundation

By Audrey Streb

President Donald Trump issued an executive order calling for the end of green energy subsidies by strengthening provisions in the One Big Beautiful Bill Act on Monday night, citing national security concerns and unnecessary costs to taxpayers.

The order argues that a heavy reliance on green energy subsidies compromise the reliability of the power grid and undermines energy independence. Trump called for the U.S. to “rapidly eliminate” federal green energy subsidies and to “build upon and strengthen” the repeal of wind and solar tax credits remaining in the reconciliation law in the order, directing the Treasury Department to enforce the phase-out of tax credits.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the order states. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Former President Joe Biden established massive green energy subsidies under his signature 2022 Inflation Reduction Act (IRA), which did not receive a single Republican vote.

The reconciliation package did not immediately terminate Biden-era federal subsidies for green energy technology, phasing them out over time instead, though some policy experts argued that drawn-out timelines could lead to an indefinite continuation of subsidies. Trump’s executive order alludes to potential loopholes in the bill, calling for a review by Secretary of the Treasury Scott Bessent to ensure that green energy projects that have a “beginning of construction” tax credit deadline are not “circumvented.”

Additionally, the executive order directs the U.S. to end taxpayer support for green energy supply chains that are controlled by foreign adversaries, alluding to China’s supply chain dominance for solar and wind. Trump also specifically highlighted costs to taxpayers, market distortions and environmental impacts of subsidized green energy development in explaining the policy.

Ahead of the reconciliation bill becoming law, Trump told Republicans that “we’ve got all the cards, and we are going to use them.” Several House Republicans noted that the president said he would use executive authority to enhance the bill and strictly enforce phase-outs, which helped persuade some conservatives to back the bill.

-

Indigenous2 days ago

Indigenous2 days agoInternal emails show Canadian gov’t doubted ‘mass graves’ narrative but went along with it

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

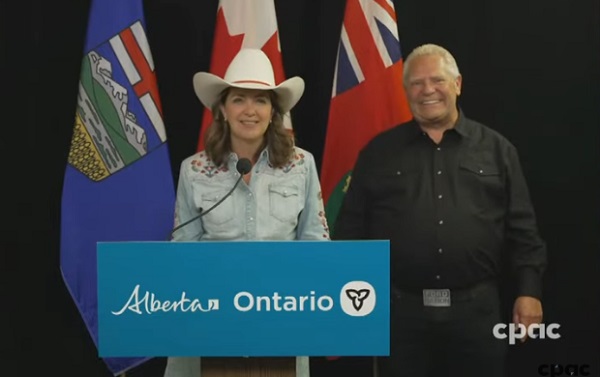

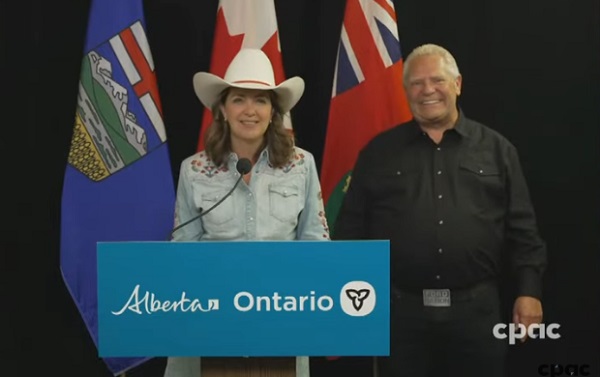

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV