Alberta

How the Railroads Shaped Red Deer

A crowd gathered at the Red Deer train station to provide a sendoff for members of “C” Squadron of the 12th Canadian Mounted Rifles Regiment. Heading off to join WWI in May 1915. Photo courtesy City of Red Deer Archives. P2603

Rivers, creeks and streams have shaped the land for eons, slowly carving away earth to reveal the terrain we know today. Much of the same can be said for the impact and influence that railways had in shaping the size and shape and even the very location of what is now the City of Red Deer.

Prior to the construction of the Calgary and Edmonton railway, which started heading north from Calgary in 1890, what we now recognize as the bustling city of Red Deer was unbroken and forested land. The nearest significant settlement was the crossing for the C&E Trail of the Red Deer River, very close to where the historic Fort Normandeau replica stands today.

Small town of Red Deer from along the Calgary and Edmonton Railway line looking north circa 1900. The Arlington Hotel and the CPR station can be seen. Photo courtesy City of Red Deer Archives. P4410

Above left: The Canadian Northern Railway excavating grade along the side of North Hill of Red Deer, AB in 1911. Using the steam shovel Bucyrus and trains. Photo P782. Above right: Workers building the Canadian National Railway trestle bridge at Burbank siding near Red Deer, AB, 1924. P7028. Photos courtesy City of Red Deer Archives.

Reverend Leonard Gaetz whose land formed the townsite for Red Deer. Photo courtesy City of Red Deer Archives. P2706

Navigating how to handle crossing the Red Deer River would be a significant challenge for construction of the railway route. Initially, the route was planned to take the tried-and-true path that had served animals, first nations people and fur traders for centuries, past the Red Deer River settlement. Yet just as the mighty river powerfully shaped the contours and dimensions of the land, the future site of Red Deer would be singlehandedly determined by Reverend Leonard Gaetz.

Rev. Gaetz offered James Ross, President of the Calgary and Edmonton Railway company, land from his personal farmlands for the river crossing and the townsite for Red Deer. Ross accepted and history was forever shaped by the decision, as what is now home to more than 100,000 people grew steadily outward starting at the C&E Railway train station.

A steam engine pulling a passenger train, likely near Penhold, AB, sometime between 1938 and 1944. Photo courtesy City of Red Deer Archives. Photo P3595.

The rails finally reached the Red Deer area in November of 1890 and trains soon began running south to Calgary. By 1891, the Calgary and Edmonton railway was completed north to Strathcona. Alberta gained one of its most vital transportation corridors and the province would thrive from this ribbon of steel rails.

CPR Station in 1910

Over time, the C&E railyards grew and expanded to accommodate the demand for moving more and more commodities like grain, coal, lumber and business and household items along with passengers. Those passengers were the pioneer settlers who would make Red Deer the commercial hub that it remains to this day.

Alberta-Pacific Elevator Co. Ltd. No. 67 elevator and feed mill, circa 1910. Photo courtesy City of Red Deer Archives Photo P3884.

For nearly 100 years, the downtown was intimately connected with the railway in the form of hotels built to welcome travelers, grain elevators, warehouses, factories and the facilities required to service the locomotives and equipment that operated the trains. Tracks and spurs dominated the downtown area, especially after the advent of the Alberta Central Railway and the arrival of the Canadian Northern Western Railway (later absorbed into Canadian National railways).

Left: Aerial view of downtown and the railyards in1938. Note old CPR bridge over the Red Deer River along with the old CNR bridge that was demolished in 1941. P2228 Centre: CPR Track at south end of Red Deer, circa 1904 or 1905. P8060 Right: CPR depot water tower and round house in 1912. P3907. Photos courtesy City of Red Deer Archives.

Left: CPR downtown railyards in 1983. Photo S490. Right: Southbound morning Chinook train at the CPR station in the summer of 1939. P13391. Photos courtesy City of Red Deer Archives.

By the 1980s, the ever-present tracks and downtown railyard were seen as an industrial blight in the heart of the city that the railway created so funding was sought and plans were made to relocate the now Canadian Pacific rails from their historical home to a new modern yard northwest of the city.

This was actually the second relocation of tracks from downtown as the Canadian National railway tracks were removed in 1960 which permitted the development along 47th Avenue south of the Red Deer River.

This massive project opened up the Riverlands district downtown to new developments which included condominiums, grocery stores, restaurants and professional buildings. Taylor Drive was built following the old rail line corridor and removal of the tracks in Lower Fairview meant residents wouldn’t hear the rumble of trains in their community anymore.

Just as the waters gradually shaped the places we know now, the railways definitely forged Red Deer into the vibrant economic hub of central Alberta that it remains today.

The 45th Street overpass across the CPR tracks. This was demolished in 1992. Photo courtesy City of Red Deer Archives. Photo S8479.

We hope you enjoyed this story about our local history. Click here to read more history stories on Todayville.

Visit the City of Red Deer Archives to browse through the written, photographic and audio history of Red Deer. Read about the city and surrounding community and learn about the people who make Red Deer special.

My name is Ken Meintzer. I’m a storyteller with a love of aviation and local history. In the 1990’s I hosted a popular kids series in Alberta called Toon Crew.

Agriculture

Lacombe meat processor scores $1.2 million dollar provincial tax credit to help expansion

Alberta’s government continues to attract investment and grow the provincial economy.

The province’s inviting and tax-friendly business environment, and abundant agricultural resources, make it one of North America’s best places to do business. In addition, the Agri-Processing Investment Tax Credit helps attract investment that will further diversify Alberta’s agriculture industry.

Beretta Farms is the most recent company to qualify for the tax credit by expanding its existing facility with the potential to significantly increase production capacity. It invested more than $10.9 million in the project that is expected to increase the plant’s processing capacity from 29,583 to 44,688 head of cattle per year. Eleven new employees were hired after the expansion and the company plans to hire ten more. Through the Agri-Processing Investment Tax Credit, Alberta’s government has issued Beretta Farms a tax credit of $1,228,735.

“The Agri-Processing Investment Tax Credit is building on Alberta’s existing competitive advantages for agri-food companies and the primary producers that supply them. This facility expansion will allow Beretta Farms to increase production capacity, which means more Alberta beef across the country, and around the world.”

“This expansion by Beretta Farms is great news for Lacombe and central Alberta. It not only supports local job creation and economic growth but also strengthens Alberta’s global reputation for producing high-quality meat products. I’m proud to see our government supporting agricultural innovation and investment right here in our community.”

The tax credit provides a 12 per cent non-refundable, non-transferable tax credit when businesses invest $10 million or more in a project to build or expand a value-added agri-processing facility in Alberta. The program is open to any food manufacturers and bio processors that add value to commodities like grains or meat or turn agricultural byproducts into new consumer or industrial goods.

Beretta Farms’ facility in Lacombe is a federally registered, European Union-approved harvesting and meat processing facility specializing in the slaughter, processing, packaging and distribution of Canadian and United States cattle and bison meat products to 87 countries worldwide.

“Our recent plant expansion project at our facility in Lacombe has allowed us to increase our processing capacities and add more job opportunities in the central Alberta area. With the support and recognition from the Government of Alberta’s tax credit program, we feel we are in a better position to continue our success and have the confidence to grow our meat brands into the future.”

Alberta’s agri-processing sector is the second-largest manufacturing industry in the province and meat processing plays an important role in the sector, generating millions in annual economic impact and creating thousands of jobs. Alberta continues to be an attractive place for agricultural investment due to its agricultural resources, one of the lowest tax rates in North America, a business-friendly environment and a robust transportation network to connect with international markets.

Quick facts

- Since 2023, there are 16 applicants to the Agri-Processing Investment Tax Credit for projects worth about $1.6 billion total in new investment in Alberta’s agri-processing sector.

- To date, 13 projects have received conditional approval under the program.

- Each applicant must submit progress reports, then apply for a tax credit certificate when the project is complete.

- Beretta Farms has expanded the Lacombe facility by 10,000 square feet to include new warehousing, cooler space and an office building.

- This project has the potential to increase production capacity by 50 per cent, thereby facilitating entry into more European markets.

Related information

Alberta

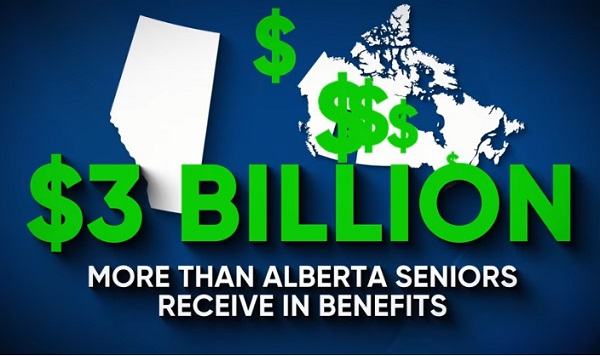

Alberta Next: Alberta Pension Plan

From Premier Danielle Smith and Alberta.ca/Next

Let’s talk about an Alberta Pension Plan for a minute.

With our young Alberta workforce paying billions more into the CPP each year than our seniors get back in benefits, it’s time to ask whether we stay with the status quo or create our own Alberta Pension Plan that would guarantee as good or better benefits for seniors and lower premiums for workers.

I want to hear your perspective on this idea and please check out the video. Get the facts. Join the conversation.

Visit Alberta.ca/next

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Economy2 days ago

Economy2 days agoTrump opens door to Iranian oil exports

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

armed forces23 hours ago

armed forces23 hours agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Crime1 day ago

Crime1 day agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

Alberta1 day ago

Alberta1 day agoAlberta uncorks new rules for liquor and cannabis

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate