Economy

Federal budget’s scale of spending and debt reveal a government lacking self-control

From the Fraser Institute

By Jake Fuss and Grady Munro

Had the government simply limited the growth in annual program spending to 0.3 per cent for two years, it could have balanced the budget by 2026/27 and avoided significant debt accumulation.

Instead, the government chose to increase annual program spending by an average of 4.4 per cent over the next two years and kick the debt problem down the road for another government to solve.

Time and time again, Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland have emphasized the importance of being fiscally responsible with federal finances. Unfortunately, this year’s federal budget ensures once again their rhetoric rings hollow due to their ongoing mismanagement of federal finances.

This mismanagement is rooted in the government’s insatiable appetite for new and expanded programs or services, which has endured for nine years and will continue for the foreseeable future. The budget introduces billions of dollars in additional spending for a national school food program, housing initiatives and artificial intelligence. As such, program spending (total spending minus debt interest costs) is now expected to be $77.2 billion higher over the next four years than the government forecasted last spring.

In 2024/25 alone, federal program spending will reach a projected $483.6 billion—an increase of $16.1 billion compared to the previous budget’s estimates. On a per-person inflation-adjusted basis, federal program spending is forecasted to reach $11,901, which is approximately 28.0 per cent higher than during the final full year of Stephen Harper’s tenure as prime minister (2014/15). The Trudeau government has already recorded the five (2018 to 2022) highest levels of federal program spending per person in Canadian history (inflation-adjusted), and budget projections suggest it’s now on track to possess the eight highest levels of per-person spending by the end of its term next autumn.

This is despite recent polling data that shows the majority of Canadians (59 per cent) think the Trudeau government is spending too much. Nearly two-thirds (64 per cent) of Canadians are also concerned about the size of the federal deficit.

As it has done nine times before, the Trudeau government will borrow to fund some of its spending spree, resulting in a projected budget deficit of $39.8 billion this year, which is $4.8 billion higher than previously forecasted. And it doesn’t intend to stop borrowing, with annual deficits exceeding $20 billion planned for the subsequent four years. This represents a notable increase in deficits compared to what was expected in the last year’s budget. Simply put, there’s no plan for a return to balanced budgets any time soon. As a result, federal debt (net debt minus non-financial assets) is expected to climb $156.2 billion from now until April 2029.

To make matters worse, the government is also increasing the capital gains inclusion tax rate from 50.0 per cent to 66.6 per cent for capital gains realized above $250,000. This will act as a huge disincentive for individuals and businesses to invest in Canada at a time when the country already struggles to attract the very investment we need to improve productivity, economic growth and living standards. Businesses and individuals will now simply invest their capital elsewhere.

There’s a large body of research that finds low or no capital gains taxes increase the supply and lower the cost of capital for new and growing firms, leading to higher levels of entrepreneurship, economic growth and job creation—precisely what Canada needs more of today and in the future.

While the government did boast about its ability to hold the 2023/24 deficit at $40.0 billion, this had little to do with responsible fiscal management. Instead, the government enjoyed higher-than-anticipated revenues of $8.3 billion, but repeated its all too frequent and ill-advised approach of spending that money and wiping out any chance to reduce the deficit.

Growing federal debt leads to higher debt interest costs, all else equal, which eat up taxpayer dollars that could otherwise have provided services or tax relief for Canadians. For context, the government now spends more ($54.1 billion) on debt interest as on health-care transfers to the provinces ($52.1 billion). Accumulating debt today also increases the tax burden on future generations of Canadians who are ultimately responsible for paying off this debt. Research suggests this effect could be disproportionate, with future generations needing to pay back a dollar borrowed today with more than one dollar in future taxes.

But again, it didn’t have to be this way. As we pointed out before the budget, had the government simply limited the growth in annual program spending to 0.3 per cent for two years, it could have balanced the budget by 2026/27 and avoided significant debt accumulation.

Instead, the government chose to increase annual program spending by an average of 4.4 per cent over the next two years and kick the debt problem down the road for another government to solve. Simply put, the government’s fiscal strategy is not all that different from an overzealous child that eats all their Halloween candy in one night even though they fully understand it won’t end well.

Yet for all this spending and debt, living standards have not improved for Canadians. In fact, inflation-adjusted GDP per person was actually lower at the end of 2023 than it was nine years prior in 2014. And going forward, the OECD predicts Canada will record the lowest growth rates in per-person GDP up to 2060 of any industrialized country—meaning countries such as New Zealand, Italy, Korea, Turkey and Estonia would all surpass Canada with higher living standards.

The combination of tax hikes and scale of spending and debt in this year’s federal budget demonstrate the Trudeau government has no interest in being fiscally responsible or improving living standards for Canadians. Instead of showing restraint, the government chose to repeat its mistakes and lead federal finances down an increasingly perilous path.

Authors:

Business

Canada’s loyalty to globalism is bleeding our economy dry

This article supplied by Troy Media.

Trump’s controversial trade policies are delivering results. Canada keeps playing by global rules and losing

U.S. President Donald Trump’s brash trade agenda, though widely condemned, is delivering short-term economic results for the U.S. It’s also revealing the high cost of Canada’s blind loyalty to globalism.

While our leaders scold Trump and posture on the world stage, our economy is faltering, especially in sectors like food and farming, which have been sacrificed to international agendas that don’t serve Canadian interests.

The uncomfortable truth is that Trump’s unapologetic nationalism is working. Canada needs to take note.

Despite near-universal criticism, the U.S. economy is outperforming expectations. The Federal Reserve Bank of Atlanta projects 3.8 per cent second-quarter GDP growth.

Inflation remains tame, job creation is ahead of forecasts, and the trade deficit is shrinking fast, cut nearly in half. These results suggest that, at least in the short term, Trump’s economic nationalism is doing more than just stirring headlines.

Canada, by contrast, is slipping behind. The economy is contracting, manufacturing is under pressure from shifting U.S. trade priorities, and food

inflation is running higher than general inflation. One of our most essential sectors—agriculture and food production—is being squeezed by rising costs, policy burdens and vanishing market access. The contrast with the U.S. is striking and damning.

Worse, Canada had been pushed to the periphery. The Trump administration had paused trade negotiations with Ottawa over Canada’s proposed digital services tax. Talks have since resumed after Ottawa backed away from implementing it, but the episode underscored how little strategic value

Washington currently places on its relationship with Canada, especially under a Carney-led government more focused on courting Europe than securing stable access to our largest export market. But Europe, with its own protectionist agricultural policies and slower growth, is no substitute for the scale and proximity of the U.S. market. This drift has real consequences, particularly for

Canadian farmers and food producers.

The problem isn’t a trade war; it’s a global realignment. And while Canada clings to old assumptions, Trump is redrawing the map. He’s pulling back from institutions like the World Health Organization, threatening to sever ties with NATO, and defunding UN agencies like the Food and Agriculture Organization (FAO), the global body responsible for coordinating efforts to improve food security and support agricultural development worldwide. The message is blunt: global institutions will no longer enjoy U.S. support without measurable benefit.

To some, this sounds reckless. But it’s forcing accountability. A senior FAO official recently admitted that donors are now asking hard questions: why fund these agencies at all? What do they deliver at home? That scrutiny is spreading. Countries are quietly realigning their own policies in response, reconsidering the cost-benefit of multilateralism. It’s a shift long in the making and long resisted in Canada.

Nowhere is this resistance more damaging than in agriculture. Canada’s food producers have become casualties of global climate symbolism. The carbon tax, pushed in the name of international leadership, penalizes food producers for feeding people. Policies that should support the food and farming sector instead frame it as a problem. This is globalism at work: a one-size-fits-all policy that punishes the local for the sake of the international.

Trump’s rhetoric may be provocative, but his core point stands: national interest matters. Countries have different economic structures, priorities and vulnerabilities.

Pretending that a uniform global policy can serve them all equally is not just naïve, it’s harmful. America First may grate on Canadian ears, but it reflects a reality: effective policy begins at home.

Canada doesn’t need to mimic Trump. But we do need to wake up. The globalist consensus we’ve followed for decades is eroding. Multilateralism is no longer a guarantee of prosperity, especially for sectors like food and farming. We must stop anchoring ourselves to frameworks we can’t influence and start defining what works for Canadians: secure trade access, competitive food production, and policy that recognizes agriculture not as a liability but as a national asset.

If this moment of disruption spurs us to rethink how we balance international cooperation with domestic priorities, we’ll emerge stronger. But if we continue down our current path, governed by symbolism, not strategy, we’ll have no one to blame for our decline but ourselves.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Business

Carney’s spending makes Trudeau look like a cheapskate

This article supplied by Troy Media.

By Gwyn Morgan

By Gwyn Morgan

The Carney government’s spending plans will push Canada’s debt higher, balloon the deficit, and drive us straight toward a credit downgrade

Prime Minister Mark Carney was sold to Canadians as the grown-up in the room, the one who’d restore order after Justin Trudeau’s reckless deficits. Instead, he’s spending even more and steering Canada deeper into trouble. His newly unveiled fiscal plan will balloon the deficit, drive up

interest costs and put Canada’s credit rating and economic future in jeopardy.

When Trudeau first ran for office, he promised “modest short-term deficits” of under $10 billion annually and a balanced budget by 2019. Instead, he ran nine consecutive deficits, peaking at $62 billion in 2023–24, and nearly doubled the national debt, from $650 billion to $1.236 trillion. That

reckless spending should have been a warning.

Yet Carney, presented for years as a safe, globally respected economic steward, is proving to be anything but. The recently released Main Estimates (the federal government’s official spending blueprint) project program spending will rise 8.4 per cent in 2025–26 to $488 billion. Add in at least $50 billion to service the national debt, and the federal tab balloons to $538 billion.

Even assuming tax revenues stay flat, we’re looking at a $40-billion deficit. But that’s optimistic. The ongoing tariff war with the United States, now hitting everything from autos to metals to consumer goods, is cutting deep into economic output. That means weaker revenues and a much larger shortfall. Carney’s response? Spend even more.

And the Canadian dollar is already paying the price. Since 2015, the loonie has slipped from 78 cents U.S. to 73. Carney’s spending spree is likely

to drive it even lower, eroding the value of Canadians’ wages, savings and retirement funds. Inflation? Buckle up.

Franco Terrazzano of the Canadian Taxpayers Federation nailed it in a recent Financial Post column: “Mark Carney was right: He’s not like Justin Trudeau, he spends more,” Terrazzano argues. “The government will spend $49 billion on interest this year and the Parliamentary Budget Officer projects interest charges will be blowing a $70-billion hole in the budget by 2029. That means our kids and grandkids will be making payments on Ottawa’s debt for the rest of their lives.”

Meanwhile, Canada’s credit rating is under real threat. An April 29 report by Fitch Ratings warned that “Canada has experienced rapid and steep fiscal deterioration, driven by a sharply weaker economic outlook and increased government spending during the electoral cycle. If the Liberal program is implemented, higher deficits are likely to increase federal, provincial and local debt to above 90 per cent of GDP.”

That’s not just a red flag; it’s a fire alarm. A downgraded credit rating means Ottawa will pay more to borrow, which trickles down to higher interest rates on everything from provincial debt to mortgages and business loans.

But this decline didn’t start with tariffs. The rot runs deeper. One of the clearest signs of a faltering economy is falling business investment per worker. According to the C.D. Howe Institute, investment has been shrinking since 2015. Canadian businesses now invest just 66 cents of new capital for every dollar invested by their OECD counterparts; only 55 cents compared to U.S. firms. That means less productivity, fewer wage gains and stagnating living standards.

Why is investment collapsing? Policy. Regulation. Taxes. Uncertainty.

The C.D. Howe report laid out a straightforward to-do list, one the federal government continues to ignore:

Reform corporate taxes to attract capital investment.

Introduce early-stage investment incentives.

Tear down regulatory barriers delaying resource and infrastructure projects, especially in energy (maybe then Alberta won’t feel like seceding).

Promote IP investment with targeted tax credits.

Bring stability and predictability back to the regulatory process.

Instead, what Canadians get is policy chaos and endless virtue-signalling. That’s no substitute for economic growth. And let’s talk about Carney’s much-touted past. Voters were bombarded with reminders that he led the Bank of Canada during the 2008–09 financial crisis. But it was Jim Flaherty, Stephen Harper’s finance minister, who made the hard fiscal decisions that got the country through it. Carney’s tenure at the Bank of England? A different story. As former U.K. Prime Minister Liz Truss put it: “Mark Carney did a terrible job” at the Bank of England. “He printed money to a huge extent, creating inflation.”

Fast-forward to today, and Canada’s performance is nothing short of dismal. Our GDP per capita sits at just $53,431, compared to America’s $82,769. That’s not just a bragging-rights statistic. It reflects real differences in productivity, competitiveness and national prosperity. Worse, over the past 10 years, Canada’s per capita GDP has grown just 1.1 per cent, second worst in the OECD, ahead of only Luxembourg.

We remain a great country filled with capable people, but our most significant fault may be how easily we fall for image over substance. First with Trudeau’s sunny ways. Now with Carney’s global banker persona. The reality? His plan risks stripping Canadians of their prosperity, downgrading our creditworthiness and deepening long-term decline.

It pains me to say it, but unless something changes fast, Canadians face continued erosion in their standard of living and inflation-driven losses in their savings. The numbers are grim. The direction is wrong. And the consequences are generational.

Trudeau fooled voters with promises of restraint. Carney’s now asking for the same trust, with an even bigger bill attached. Canadians can’t afford to make the same mistake twice.

Gwyn Morgan is a retired business leader who has been a director of five global corporations

-

International2 days ago

International2 days agoWoman wins settlement after YMCA banned her for complaining about man in girls’ locker room

-

Alberta1 day ago

Alberta1 day agoAlberta government records $8.3 billion surplus—but the good times may soon end

-

Opinion2 days ago

Opinion2 days agoBlind to the Left: Canada’s Counter-Extremism Failure Leaves Neo-Marxist and Islamist Threats Unchecked

-

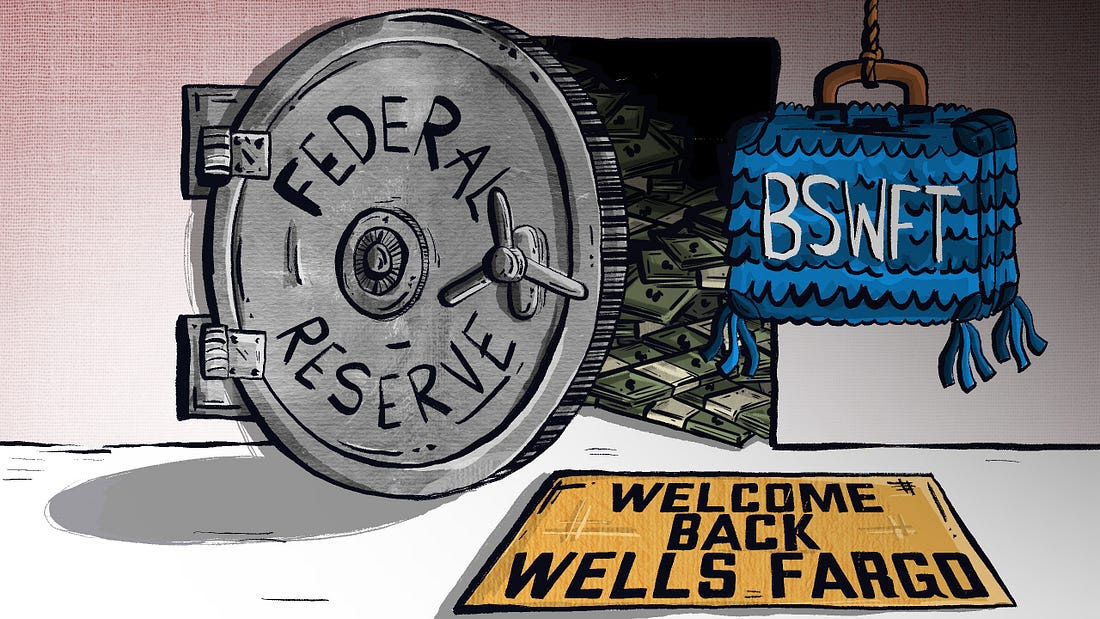

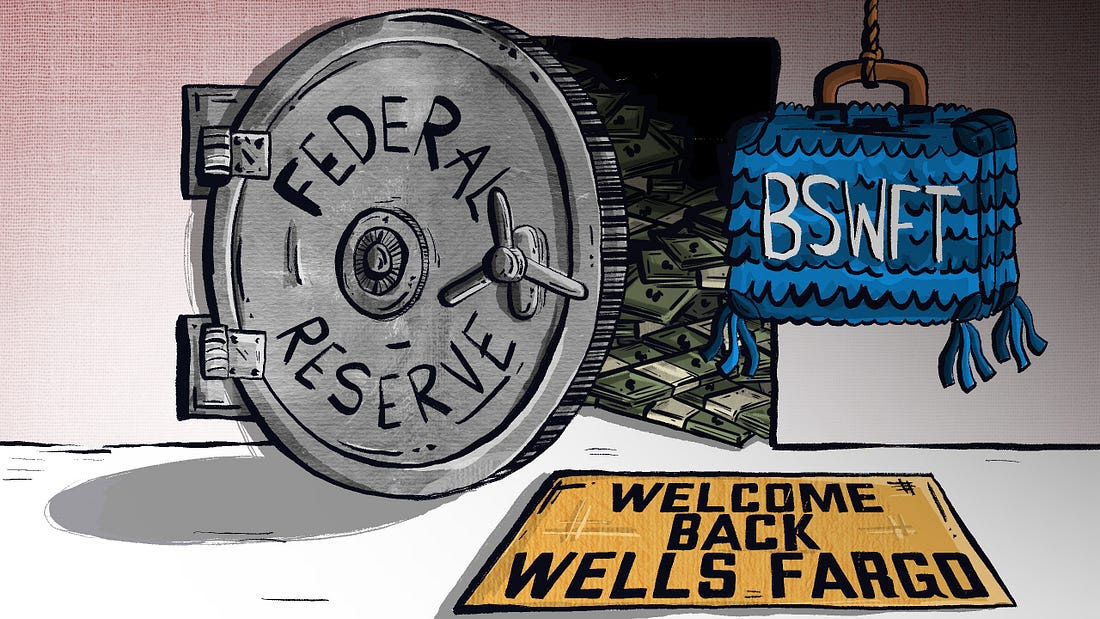

Banks2 days ago

Banks2 days agoWelcome Back, Wells Fargo!

-

MxM News1 day ago

MxM News1 day agoDiddy found not guilty of trafficking, faces prison on lesser charge

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCanada Day 2025: It’s Time For Boomers To Let The Kids Lead

-

Also Interesting1 day ago

Also Interesting1 day agoEndorphina Slots: High-Quality Games Now at Zoome Casino Canada

-

Business1 day ago

Business1 day agoPrairie provinces and Newfoundland and Labrador see largest increases in size of government