Business

The Great Wealth Transfer – Billions To Change Hands By 2026

Here comes the boom.

What is ‘The Great Wealth Transfer’?

This term has been coined by several major wealth managers across North America; referring to the tremendous amount of wealth that will be transferred to younger generations over the next decade. Wealth amassed by baby boomers will eventually be passed down to their families or beneficiaries, typically with the aid of a trusted wealth manager or financial advisor.

Similar in a way to climate change, when we visit some of the data that has been reported in both Canada and the US, this issue seems to be far more pressing than most people are aware. Depending on the publication, the exact amount of wealth that will be transferred is questionable. Cited in Forbes, a report done by the Coldwell Banker Global Luxury® program and WealthEngine claim that $68 Trillion will change hands in the US by 2030.

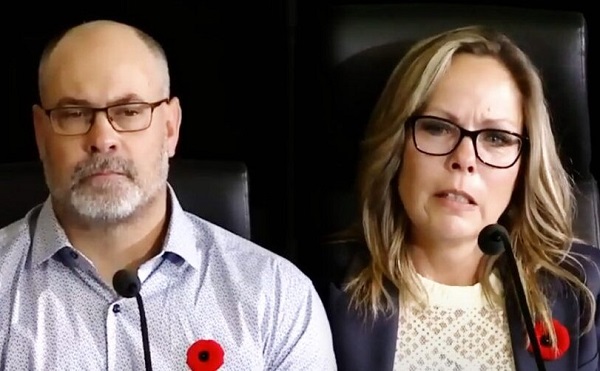

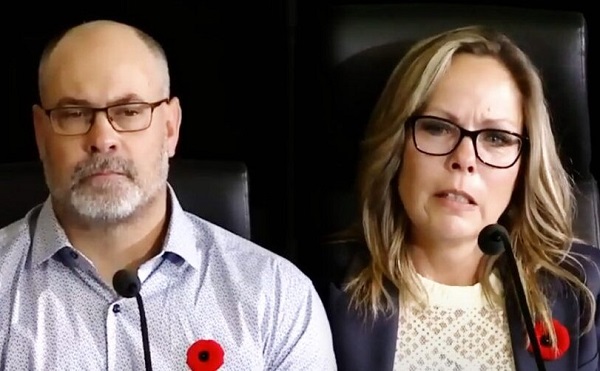

We spoke with Gwen Becker and Devin St. Louis, two VP’s, Portfolio Managers and Wealth Advisors for RBC Wealth Management, offering their expert insight into the industry and the vast amount of wealth that is changing hands in Canada.

According to RBC Wealth Management, their numbers in terms of the wealth transfer report $150 billion is set to change hands by 2026. The industry as a whole is at the forefront of this generational shift, whereas a trusted advisor can onboard younger family members to ensure the highest level of support through the process. Gwen offers her perspective:

“Certainly just around the corner; something that we are definitely paying attention to. My practice has always been very relationship-driven. It has been my privilege to advise many of my clients for decades. I have been intentional to welcome and include multiple generations of the same family. I advise grandparents who are now in their 90s, to which the majority of their children are my clients and even beginning to onboard grandchildren.”

This is an example of what is referred to as multi-generational estate planning. Being in the midst of the ‘great transfer of wealth’, this type of planning is crucial for advisors to implement early so they can continue to support the same family in the future. According to the Canadian Financial Capability Survey conducted in 2019, 51% of Canadians over the age of 65 will refer to a financial advisor to seek literacy and support. Contrary to that, Canadians aged 18-34 show that 51% are more likely to use online resources to aid in their financial literacy.

Devin offers his perspective on how the importance of family legacy plays a role when an advisor poses this question: What is your wealth for?

“If you sat down with a couple 10 years ago, they may say, when I pass away, whatever wealth is left can be distributed evenly amongst our children. That has changed quite a lot now because elder family members are now more concerned about how their wealth is passed on to the next generation. Onboarding grandchildren can ensure that a family legacy that receives their wealth, uses it to benefit their family and their community.”

An important question to consider. Clearly there is a shift in attitude towards having a family legacy live on through younger generations of a family. Evident that having the support of a financial advisor or wealth manager not only ensures the most efficient use of your money and assets but also ensures financial stability for your family in their future.

If we revisit the above study in how a younger demographic is more likely to utilize online resources, interesting how a more digitally inclined audience will be receptive to advisors. Boiling down to how millennials and younger age groups will perceive wealth management if those in that space fail to offer their services through online communication.

Devin agrees that RBC is uniquely positioned for this digital shift:

“interesting that everybody had to transform their processes online through this COVID-19 pandemic. Every company has been forced to step up their technology means, RBC has definitely risen to that occasion. RBC has adapted quickly, improving a great technology base that already existed. I don’t perceive it at this point to be a challenge. I believe we have the right focus. I think it’ll be a good transition for us.”

Gwen continues:

“I do agree that RBC is very well positioned. The younger generations below millennials that would eventually take over some of this wealth carries some challenges. How does that age demographic think, and what are their expectations of wealth management or financial advisors? It is difficult to understand what that generation will expect out of digital advisors. Estate planning matters, and it will always be tied to you knowing the family, it’s a relationship business”

Consider that RBC Wealth Management oversees $1.05 trillion globally under their administration, has over 4,800 professionals to serve their clients and was the recipient of the highest-ranking bank-owned investment brokerage by the 2020 Investment Executive Brokerage Report Card, safe to say their decades of professionalism, expertise and ‘get it done’ attitude speaks for itself.

So, what does this mean for younger members of families who may not understand the field of wealth management?

Starting the conversation early

Whether you are the elder family member who has their financial ‘quarterback’ preparing their estate to change hands or are younger family members who may be the beneficiary of wealth in the near future, starting the conversation amongst family members early is important for the process to be successful. Considering that some possessions have more than just monetary value, but an emotional tie to the family legacy can be a difficult asset to distribute evenly. Of course, it can be a tough conversation to have, it may involve discussing the passing away of a loved one or even setting a plan to cover future expenses. Gwen mentions:

“I encourage my clients to have open conversations with their children while they are alive so that their intentions are clear. Depending on the dynamics of the family, things such as an annual family meeting with a beneficiary can be effective once it’s put in place. If they are not comfortable leading that conversation, bring a trusted adviser to the table to be impartial and logical.”

There is no way to know what ramifications will come of this ‘great transfer of wealth’. It may be that we see the resurgence of a strong bull market in the near future, we may see new tech innovation that we cannot yet grasp or new business investments that continue to disrupt traditional processes. Only time will tell.

For more stories, visit Todayville Calgary

Automotive

Another sign Canada’s EV mandate is FAILING

By Dan McTeague

While other countries are moving away from EVs, the Carney government is doubling down.

Last week, it was reported that the feds are considering reimbursing car dealerships impacted by the sudden suspension of EV rebates. It’s becoming clear that Canada’s EV ambitions are failing as EV sales are plummeting and car manufacturers are backtracking on their EV plans.

It’s not too late for the Carney government to backdown from its EV mandate.

Dan McTeague explains.

Business

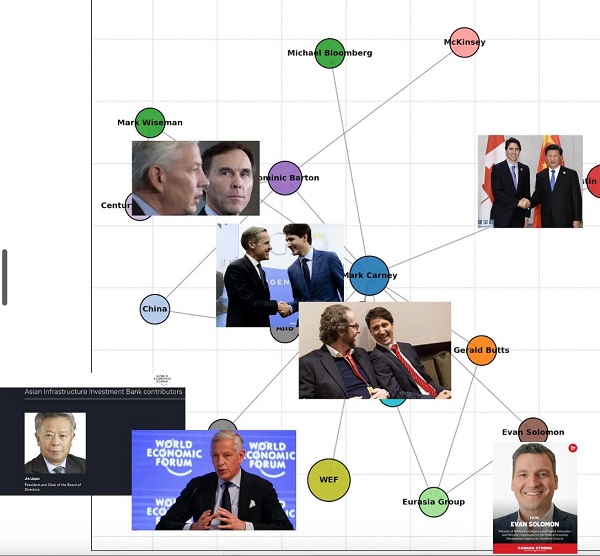

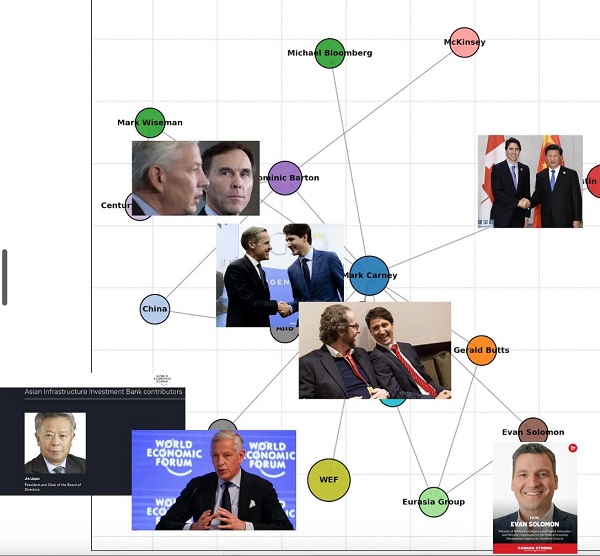

Is dirty Chinese money undermining Canada’s Arctic?

By Pauline Springer for Inside Policy

Pauline Springer warns that Canada’s lax rules on foreign investment are doing the dirty work for our geopolitical adversaries.

China’s interest in the Canadian Arctic is growing. The People’s Republic evidently views the Arctic as a strategic frontier rich in untapped resources and geopolitical leverage. China’s attempt to acquire stakes in mining operations such as the Izok Corridor and the Doris North gold mine in Nunavut indicate a broader strategy. China’s Arctic activity is a calculated bid to lock in influence under the friendly sounding banners of the Polar Silk Road and the Belt and Road Initiative, using investment and infrastructure to secure long-term influence.

Admittedly most Chinese investments in the Canadian Arctic to date have failed, are yet to be realized, or are relatively insignificant, but this should not lead Canadians to underestimate the threat or ignore the broader strategy behind China’s significant engagement across the Arctic. Some Canadian stakeholders view Chinese capital as a benign path to regional development and self-sufficiency but this is naïve and dangerous. The limited scale of successful, traceable Chinese investment to date should not be used as a justification for inaction against the clear threat to regional sovereignty.

National security threats arising from foreign investment led to the creation of the Investment Canada Act in early 2024, which requires disclosure of foreign investors and mandates transparency in the submission of investment information. With the passage of Bill C-34 in 2009, the Act was further strengthened to include specific timelines for security reviews and mechanisms for information-sharing with investigative bodies. These reforms were a late and incomplete admission that foreign capital is not just risky – it’s already rewriting the rules in sectors critical to national security.

Chinese state-linked and private entities have not only engaged in opaque investment practices but have also been implicated in large-scale money laundering operations across Canada. The money laundering schemes typically involve underground banking networks, convoluted ownership structures, and unregistered money service businesses, which funnel illicit capital into high-value assets such as real estate, infrastructure, and mining ventures. According to FINTRAC’s Laundering the Proceeds of Crime through Underground Banking Schemes, much of this money is moved through informal and untraceable financial channels, often linked to Chinese sources.

Money laundering typically unfolds in three stages: placement (introducing illicit funds into the financial system), layering (concealing the origin through complex transactions), and integration (reintroducing the money as seemingly legitimate income).

A particularly relevant mechanism in this context is trade-based money laundering (TBML) which enables illicit funds to be disguised as legitimate commerce through the manipulation of trade transactions.

In northern Canada, where oversight of mineral exports and industrial equipment imports is limited, the mining sector provides opportunities for trade based laundering of proceeds from transnational crime under the pretext of resource development. The Organized Crime and Corruption Reporting Project (OCCRP) reported that Chinese Triads and other transnational criminal organizations have laundered billions of dollars through Canadian financial and corporate systems, particularly in British Columbia.

This laundering activity is not a parallel issue to foreign investment – it is embedded within it. The same corporate tools used to facilitate transnational investments are often used to conceal the source of funds, mask ownership, and bypass national scrutiny. Shell companies and foreign actors can disguise themselves as Canadian or Indigenous-owned companies, while the actual control remains offshore.

One of the key enablers of this opacity is the phenomenon known as snow-washing: a term that refers to the use of Canada’s pristine international reputation to launder money through anonymous corporations. Canada’s corporate registration system still allows individuals to form companies without disclosing the true beneficial owner. As of late 2023, Canada ranked 70th in terms of ability to access information on companies, below Sri Lanka, El Salvador and Bahrain. Foreign actors can register companies, list local nominees as front directors, and then use these entities to invest in sensitive sectors with virtually no public oversight. Canada’s lax rules are doing the dirty work for our adversaries.

In early 2024, Canada introduced a requirement under the Canada Business Corporations Act (CBCA) to collect information on “individuals with significant control,” marking a step toward greater transparency. A federal public registry is in development. Crucially, publicly listed corporations are exempt from these disclosure requirements, and the system’s effectiveness hinges on alignment with provincial registries. Without full national coverage and seamless integration between federal and provincial systems, Canada’s transparency framework risks remaining fragmented, with loopholes that continue to benefit bad actors.

What might this look like operationally? The formation of such a shell company in Canada’s Arctic is relatively straightforward. A local entrepreneur registers a mining company in the High North, listing themselves as the owner. However, the actual financial backing originates from Chinese private or state-linked actors, who remain in the background. Due to the scale of their investment and the influence it affords, these individuals become de-facto beneficial owners. Yet, in the absence of effective monitoring mechanisms and a central, publicly accessible registry for beneficial ownership, the company continues to appear Canadian-owned. This poses a significant governance challenge: it is impossible to assess how many ostensibly local companies are, in fact, under foreign control and to what extent.

Bill C-34 aims to mitigate this risk by imposing minimum reporting requirements for foreign investment. Nonetheless, the challenge becomes even more acute when examined through the lens of money laundering. As previously discussed, there is substantial evidence that Chinese (including state-linked) entities have used Canada’s economy as a vehicle for laundering illicit funds. When those funds pass through complex corporate layers, where even identifying foreign ownership is already difficult, they can be easily embedded in the local economy. The profits, now “clean,” carry the appearance of legitimate origin, completing the cycle and reinforcing a system that is fundamentally opaque and unaccountable.

Crucially, the use of shell companies for money laundering in the Arctic is extraordinarily difficult to prove, as both the existence of shell structures and the laundering activities themselves are inherently opaque and challenging to detect. Canadian oversight bodies are playing catch-up while foreign actors exploit the shadows.

As a result, there is a serious lack of reliable data in the public domain on the actual extent of the problem. Investigative bodies face structural and legal obstacles in tracing ownership or financial flows, especially when they intersect with international jurisdictions or nominal Indigenous ownership structures that shield the real beneficiaries.

This lack of hard evidence makes it easy for policymakers to downplay or disregard the threat. However, the absence of precise numbers should not be misread as an absence of risk. On the contrary, the reasonable deduction that such structures are ripe for abuse – especially given China’s documented use of opaque financial networks and strategic investments – provides sufficient grounds to act. The deep concealment and the below-threshold tactics are precisely what make it dangerous.

The risks posed by unmonitored foreign investment stem, in part, from deeper domestic shortcomings. Chronic underfunding and a top-down governance model where decisions about the North are made in Ottawa, have left northern regions exposed. Canada’s northern provinces and territories, despite covering over 40 per cent of the national landmass, remain economically marginalized and structurally underdeveloped. This vacuum may invite external actors like China to step in where the federal government has long neglected to act. This further underscores the need for any policy response, whether from the RCMP, FINTRAC, or CSIS, to be coordinated with territorial and Indigenous governments, ensuring their meaningful involvement in the policymaking process and law enforcement actions.

Canada must act decisively on two fronts:

First, it must adopt robust transparency measures in corporate law and foreign investment screening, including following through with establishing a publicly accessible beneficial ownership registry on a national level, and closing loopholes that allow nominee directors or shell entities to hide foreign control.

Second, domestic investment must be scaled up dramatically. Canada needs to close the infrastructure and development gap in the Arctic by directly funding northern communities. Rather than simply increasing spending, policy should focus on making capital more accessible to northern and Indigenous-led projects through transparent, well-regulated mechanisms. This includes expanding grant and loan programs tailored to regional development, enhancing Indigenous financial institutions, and embedding anti-money laundering safeguards into all funding streams. These efforts would not only support reconciliation but also defend against covert financial influence.

Only strong domestic foundations and clear regulations can protect Canada from the corrosive threats of dirty foreign money. A threat exists where both intent and opportunity align; and the opportunity to launder money through shadow companies and foreign investment is undeniably present. The Canadian government must stop treating Arctic security as a seasonal concern, starting with the laws and loopholes that allow foreign money to buy silence, access, and influence in the Arctic.

Pauline Springer is a graduate researcher in International Relations specializing in Arctic security and Chinese influence.

-

International2 days ago

International2 days agoMatt Walsh slams Trump administration’s move to bury Epstein sex trafficking scandal

-

National2 days ago

National2 days agoDemocracy Watch Blows the Whistle on Carney’s Ethics Sham

-

Energy1 day ago

Energy1 day agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Immigration1 day ago

Immigration1 day agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business1 day ago

Business1 day agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Business1 day ago

Business1 day agoCompetition Bureau is right—Canada should open up competition in the air

-

Business1 day ago

Business1 day agoIt’s Time To End Canada’s Protectionist Supply Management Regime

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy leaders’ sentencing hearing to begin July 23 with verdict due in August