Alberta

INDUSTRY-INDIGENOUS RELATIONS: A TREND TOWARD DEEPER ENGAGEMENT

INDUSTRY-INDIGENOUS RELATIONS: A TREND TOWARD DEEPER ENGAGEMENT

The Canadian oil and natural gas industry has a strong history of engagement with Indigenous peoples. Since its early initiatives, the petroleum sector has had many learnings and opportunities for growth with respect to its interactions with Indigenous communities. Consequently, these relationships have evolved towards ever-deepening forms of engagement including consultation and business partnerships. However, the nature of these relationships has been difficult to communicate with credibility; arrangements between companies and communities are often confidential, thus limiting the ability of industry to share positive stories of engagement.

The Canadian Association of Petroleum Producers (CAPP), an association that represents Canada’s oil and natural gas producers, has utilized multiple surveys of its members in order to better understand the relationship between industry and Indigenous peoples. One of these surveys, known as the Telling Our Story survey, was commissioned by CAPP and conducted by Dr. Ken Coates of the University of Saskatchewan. Additionally, CAPP developed its own survey focused on procurement, community investment and consultation capacity funding in the oil sands. These surveys provide data that demonstrate the value producers place on building long-term, sustainable relationships with Indigenous communities. In particular, economic engagement is viewed as a primary opportunity to establish good relations and support Indigenous self- determination.

Survey Methodology

The purpose of the Telling Our Story survey was to collect information about the oil and natural gas industry’s efforts to engage Indigenous communities. Research was conducted by Dr. Ken Coates, Canada Research Chair in Regional Innovation at the Johnson-Shoyama Graduate School of Public Policy, University of Saskatchewan. Dr. Coates used a comprehensive survey of industry representatives, in partnership with CAPP, plus CAPP’s member companies and partner associations including the Canadian Council for Aboriginal Business, the Petroleum Services Association of Canada, the Canadian Energy Pipeline Association, and the Canadian Association of Geophysical Contractors. A total of 122 companies participated in the study, representing a cross-section of the oil and natural gas industry in Canada. Data was collected in a confidential manner, anonymized and aggregated into a final report. The survey highlighted key themes related to industry’s engagement with Indigenous communities.

Consultation and Community Engagement

Companies within the oil and natural gas industry have developed long-term relationships with communities, and these relationships are multifaceted. Of course, a core aspect of relationship-building takes place through consultation processes. The trend toward consultation accelerated in 2004 with the Supreme Court of Canada decision on Haida Nation v. British Columbia, which determined the Crown has a duty to consult and accommodate Indigenous peoples when making a decision that could affect their constitutional rights. Procedural aspects of this duty can be delegated to industry, and now industry conducts the majority of project consultations. Survey respondents noted that today, companies are actively engaged in this process, seeking to ensure meaningful, two-way discussion in consultations. CAPP members indicated that they view these relationships formed through consultation as critically important to their business. Many companies have teams of staff dedicated to consulting and building relationships with communities, and funding is often provided to support community capacity to engage in consultations. A separate survey of CAPP’s oil sands members found that between 2015 and 2016, oil sands operators provided $40.79 million for consultation capacity funding to local Indigenous communities.

Associated with consultations are a variety of forms of engagement. CAPP’s members placed particular value on supporting various community activities, social and cultural priorities, and infrastructure needs. The aforementioned survey of oil sands members found that between 2015 and 2016 operators in the region spent $48.6 million on Indigenous community investment. According to companies, these focused investments positively impact relationships. Furthermore, there has been a trend toward the negotiation of long- term, collaborative agreements between project proponents and Indigenous communities in areas of operation that address community concerns and include clauses related to procurement, employment, community investment, dispute resolution, capacity funding and other topics of importance to the proponent and the community.

Economic Engagement

According to oil and natural gas producers, there is a strong emphasis on economic engagement as the priority in building relationships. In particular, procurement – the purchasing of goods and services from Indigenous businesses – presents a significant opportunity for mutual benefit. Both joint venture partnerships and preferential contracting arrangements with Indigenous-owned companies enable companies to build links and trust with communities. The focus on these arrangements is evidenced by substantial financial investment: in 2015 to 2016, oil sands producers spent $3.3 billion on procurement from 399 Indigenous owned- companies in 65 Alberta communities. While a sizable proportion of Indigenous businesses may be small or new, the data suggests their role in the sector will continue to increase.

This type of engagement allows Indigenous peoples to leverage their own expertise, build capacity, and ultimately establish pathways to prosperity. In this regard, industry can play an important role in supporting successful, self-determining communities. Although procurement was ranked most highly in terms of its benefit to the relationship between producers and communities, there are other forms of economic engagement; a number of companies have Indigenous recruitment strategies and support training programs intended to build the technical skillset of Indigenous employees and contractors.

Conclusion

The research commissioned by CAPP highlights the emphasis that oil and natural gas sector companies place on meaningful consultation, partnerships, and in particular, economic engagement. Industry has made strides in building deeper partnerships, and it is expected that the trend toward more meaningful engagement will continue. As an industry association, CAPP believes the oil and natural gas sector has an important role in tangibly advancing reconciliation together with Indigenous peoples in response to the Truth and Reconciliation Commission’s Call to Action 92. CAPP believes its role in reconciliation can be described as identifying and finding feasible ways to share economic opportunities arising from resource development, while continuing to learn, grow and improve strong relationships based on trust, respect, and open communication. Industry’s understanding will continue to develop, and the sector is open to further dialogue in order to inform its understanding of industry’s role in reconciliation.

Thanks to Todayville for helping us bring our members’ stories of collaboration and innovation to the public.

Click to read a foreward from JP Gladu, Chief Development and Relations Officer, Steel River Group; Former President and CEO, Canadian Council for Aboriginal Business.

JP Gladu, Chief Development and Relations Officer, Steel River Group; Former President & CEO, Canadian Council for Aboriginal Business

Click to read comments about this series from Jacob Irving, President of the Energy Council of Canada.

Jacob Irving, President of Energy Council of Canada

The Canadian Energy Compendium is an annual initiative by the Energy Council of Canada to provide an opportunity for cross-sectoral collaboration and discussion on current topics in Canada’s energy sector. The 2020 Canadian Energy Compendium: Innovations in Energy Efficiency is due to be released November 2020.

Click below to read more stories from Energy Council of Canada’s Compendium series.

PETER SUTHERLAND SR GENERATING STATION POWERS NORTHEAST ONTARIO

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

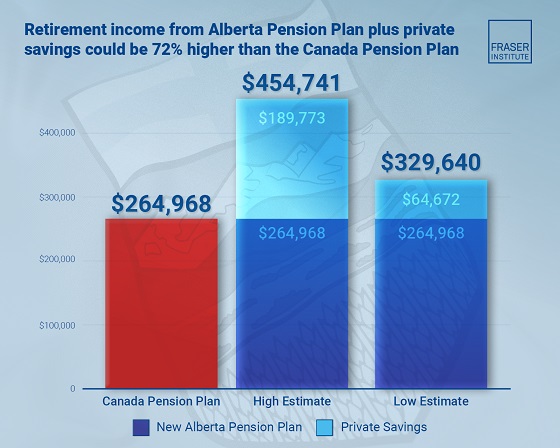

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Uncategorized1 day ago

Uncategorized1 day agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business20 hours ago

Business20 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

COVID-1920 hours ago

COVID-1920 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Alberta19 hours ago

Alberta19 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal