Health

Dr. Cheba explains “What is Orthodontics”?

Dr. Vivek Cheba (Dr. Vick) is a certified specialist in orthodontics and the owner of Red Deer Orthodontics.

In this first of a series of short interviews with Dr. Cheba, we ask the question:

What is orthodontics?

Orthodontics (also referred to as dentofacial orthopedics) is a specialized form of dentistry that focuses on the diagnosis, prevention, and treatment of dental and facial abnormalities.

Dr. Cheba grew up in Calgary and attended the University of Calgary for his Bachelor of Science, so he is no stranger to Alberta. Dr. Cheba was accepted into the dental program at the University of Manitoba, and after graduation remained in Winnipeg to practice general dentistry in a large group practice for five years. In 2009, Dr. Cheba returned to the University of Manitoba for his postgraduate program in orthodontics.

Business

RFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

From LifeSiteNews

By Matt Lamb

They got rid of all the older children essentially and just had younger children who were too young to be diagnosed and they stratified that, stratified the data

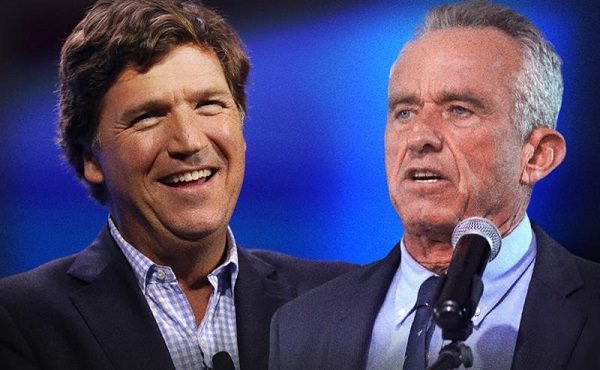

The Centers for Disease Control and Prevention (CDC) found newborn babies who received the Hepatitis B vaccine had 1,135-percent higher autism rates than those who did not or received it later in life, Robert F. Kennedy Jr. told Tucker Carlson recently. However, the CDC practiced “trickery” in its studies on autism so as not to implicate vaccines, Kennedy said.

RFK Jr., who is the current Secretary of Health and Human Services, said the CDC buried the results by manipulating the data. Kennedy has pledged to find the causes of autism, with a particular focus on the role vaccines may play in the rise in rates in the past decades.

The Hepatitis B shot is required by nearly every state in the U.S. for children to attend school, day care, or both. The CDC recommends the jab for all babies at birth, regardless of whether their mother has Hep B, which is easily diagnosable and commonly spread through sexual activity, piercings, and tattoos.

“They kept the study secret and then they manipulated it through five different iterations to try to bury the link and we know how they did it – they got rid of all the older children essentially and just had younger children who were too young to be diagnosed and they stratified that, stratified the data,” Kennedy told Carlson for an episode of the commentator’s podcast. “And they did a lot of other tricks and all of those studies were the subject of those kind of that kind of trickery.”

But now, Kennedy said, the CDC will be conducting real and honest scientific research that follows the highest standards of evidence.

“We’re going to do real science,” Kennedy said. “We’re going to make the databases public for the first time.”

He said the CDC will be compiling records from variety of sources to allow researchers to do better studies on vaccines.

“We’re going to make this data available for independent scientists so everybody can look at it,” the HHS secretary said.

— Matt Lamb (@MattLamb22) July 1, 2025

Health and Human Services also said it has put out grant requests for scientists who want to study the issue further.

Kennedy reiterated that by September there will be some initial insights and further information will come within the next six months.

Carlson asked if the answers would “differ from status quo kind of thinking.”

“I think they will,” Kennedy said. He continued on to say that people “need to stop trusting the experts.”

“We were told at the beginning of COVID ‘don’t look at any data yourself, don’t do any investigation yourself, just trust the experts,”‘ he said.

In a democracy, Kennedy said, we have the “obligation” to “do our own research.”

“That’s the way it should be done,” Kennedy said.

He also reiterated that HHS will return to “gold standard science” and publish the results so everyone can review them.

International

RFK Jr. tells Tucker how Big Pharma uses ‘perverse incentives’ to get vaccines approved

From LifeSiteNews

By Matt Lamb

Kennedy defended his decision to fire all 17 members of the Advisory Committee on Immunization Practices, which he decried as a tool used to “rubber stamp” vaccines.

The vaccine approval process is a “bundle of perverse incentives” since pharmaceutical companies stand to make billions of dollars in revenue from it, Secretary of Health and Human Services Robert F. Kennedy Jr. told Tucker Carlson recently.

Kennedy appeared on Carlson’s show yesterday to discuss a variety of issues, including the potential link between autism and vaccines and his overhauling of the vaccine advisory committee at the Centers for Disease Control and Prevention last month.

Twenty years ago, Bobby Kennedy was exiled from polite society for suggesting a link between autism and vaccines. Now he’s a cabinet secretary, and still saying it.

(0:00) The Organized Opposition to RFK’s Mission

(6:46) Uncovering the Reason for Skyrocketing Rates of Autism… pic.twitter.com/g8T8te3kNC— Tucker Carlson (@TuckerCarlson) June 30, 2025

Kennedy began by explaining that Big Pharma has been targeting academic journals to ensure its products receive favorable reviews.

“The journals won’t publish anything critical of vaccines … there’s so much pressure on them. They’re funded by pharmaceutical companies, and they’ll lose advertising and revenue from reprints,” Kennedy said.

Kennedy then noted that Big Pharma will “pay to get something published in these journals,” before accusing industry leaders of pushing drugs on doctors and of hiring “mercenary scientists” to manipulate data until their product is deemed safe and effective.

The entire complex is broken due to the “perverse incentives,” he lamented.

Later in the interview, Kennedy defended his decision to fire all 17 members of the Advisory Committee on Immunization Practices (ACIP) in June, which he decried as a mere tool to “rubber stamp” vaccines.

It served as “a sock puppet for the industry that it was supposed to regulate,” Kennedy exclaimed, citing conflicts of interest for the overwhelming majority of its board members.

This sort of “agency capture” explains the lucrative nature of vaccines, he added.

— Matt Lamb (@MattLamb22) July 1, 2025

Kennedy then summarized the “perverse” process as follows:

First of all, the federal government often times actually designs the vaccine, [the National Institutes of Health] would design it, would hand it over to the pharmaceutical company. The pharmaceutical company then runs it … first through [the] FDA, then through [the] ACIP, and gets it recommended.

If you can get that recommendation you now got a billion dollars in — at least — revenues by the end of the year, every year, forever. So, there was a gold rush to add new vaccines to the schedule and ACIP never turned away a single vaccine … that came to them they recommended, and a lot of these vaccines are for diseases that are not even casually contagious.

Kennedy further pointed to the Hepatitis B shot for newborns as an example of how the industry has been corrupted.

In 1999, the CDC “looked at children who had received the hepatitis vaccine within the first 30 days of life and compared those children to children who had received the vaccine later — or not at all. And they found an 1,135% elevated risk of autism among the vaccinated children. It shocked them. They kept the study secret and manipulated it through five different iterations to try to bury the link,” he said.

“We want to protect public health,” Kennedy explained, but “these vaccines … can cause chronic disease, chronic injuries that last a lifetime.”

-

COVID-191 day ago

COVID-191 day agoOntario man launches new challenge against province’s latest attempt to ban free expression on roadside billboards

-

Energy2 days ago

Energy2 days agoThis Canada Day, Celebrate Energy Renewal

-

COVID-1914 hours ago

COVID-1914 hours agoNew Peer-Reviewed Study Affirms COVID Vaccines Reduce Fertility

-

Business10 hours ago

Business10 hours agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

Alberta1 day ago

Alberta1 day agoAlberta Next Takes A Look At Alberta Provincial Police Force

-

MAiD12 hours ago

MAiD12 hours agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Alberta1 day ago

Alberta1 day agoCanadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

-

International2 days ago

International2 days agoPresident Xi Skips Key Summit, Adding Fuel to Ebbing Power Theories