CBDC Central Bank Digital Currency

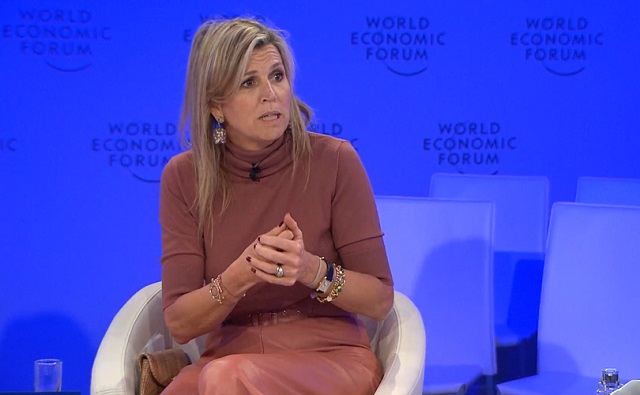

Davos 2024: Queen Maxima advocates global digital ID for financial services, vaccine verification

Queen Maxima of the Netherlands

From LifeSiteNews

Digital IDs are ‘good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government,’ Queen Maxima of the Netherlands stated at the 2024 Davos summit.

Queen Maxima of the Netherlands tells the World Economic Forum (WEF) in Davos that digital ID is good for knowing “who actually got a vaccination or not” and for financial inclusion.

On Thursday the Dutch queen continued her crusade to see universal adoption of digital ID because she believes it is good for everything from opening a bank account to enrolling in school and for providing proof of vaccination, aka “vaccine passports.”

It [digital ID] is also good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government.

Speaking at the WEF annual meeting panel entitled “Comparing Notes on Financial Inclusion,” Her Majesty said:

In order to open up an account, you need to have an ID. I have to say that when I started this job, there were actually very little countries in Africa or Latin America that had one ubiquitous type of ID, and certainly that was digital and certainly that was biometric.

We’ve really worked with all our partners to actually help grow this, and the interesting part of it is that yes, it is very necessary for financial services, but not only.

Queen Maxima of the Netherlands at WEF in Davos: [Digital ID] is very necessary for financial services, but not only – it is also good for school enrollment; it is also good for health — who actually got a vaccination or not" #DigitalID #WEF24 https://t.co/DJiO8nISih pic.twitter.com/RgYA2ahXS0

— Tim Hinchliffe (@TimHinchliffe) January 18, 2024

Beyond financial services, Queen Maxima said that digital ID was good for proving an individual’s vaccination status:

It is also good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government.

The Dutch queen also highlighted that for the past 10 years, she had been working on developing Digital Public Infrastructure (DPI), which is a digital stack consisting of digital ID, digital payments systems like Central Bank Digital Currencies (CBDCs), and massive data sharing.

“We’ve been working in the last 10 years on a notion that we call Digital Public Infrastructure. In our experiences in different countries, to actually have these sort of things that are actually very important,” the queen told the WEF panel.

“One of these is IDs, e-signature, digital ID, so that’s extremely important, even having a QR code legislation is very important,” she added.

Last November, the United Nations and the Bill and Melinda Gates Foundation launched their 50-in-5 campaign to get 50 countries to rollout at least one DPI component within the next five years:

Digital public infrastructure (DPI) – which refers to a secure and interoperable network of components that include digital payments, ID, and data exchange systems – is essential for participation in markets and society in a digital era.

Digital Public Infrastructure (DPI) is essential for countries to improve their economies & the well-being of people.

Join us for the launch of the #50in5 initiative to discuss how building inclusive DPI can foster strong economies & equitable societies: https://t.co/SB2QDNJp2I pic.twitter.com/S01Rpxq1VP

— UNDP Digital (@UNDPDigital) October 25, 2023

As the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development, Queen Maxima has been pushing the digital ID agenda for a number of years.

Wonderful to have @UNSGSA HM Queen Máxima of the Netherlands with us at #ID4D event today highlighting the critical role of #DigitalID in inclusive development: https://t.co/bNRaIulRc7 #GoodID #WBGMeetings pic.twitter.com/nNCO8qP50q

— World Bank Digital Development (@WBG_DigitalDev) April 12, 2019

#UNSGSA Queen Máxima delivered the keynote speech at today’s @WorldBank #ID4D event on inclusive digital ID for a resilient recovery from #COVID-19. Read it here → https://t.co/vD9uYPtA7P #financialinclusion pic.twitter.com/8W2tk2ImIY

— UN SG's Special Advocate Queen Máxima (@UNSGSA) October 21, 2020

Vaccine passports, by their very nature, serve as a form of digital identity, according to the WEF.

And the WEF envisions digital identity being linked to everything from financial services and healthcare records to travel, mobility, and digital governance.

A WEF report on “Reimagining Digital ID” published in June 2023, says:

- “Digital ID may weaken democracy and civil society.”

- “The greatest risks arising from digital ID are exclusion, marginalization and oppression.”

- Requiring any form of ID risks exacerbating fundamental social, political and economic challenges as conditional access of any kind always creates the possibility of discrimination and exclusion.”

This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us

Queen Maxima is also a staunch advocate for Central Bank Digital Currencies (CBDCs), which cannot operate without a digital ID.

According to the Bank for International Settlements (BIS) Annual Economic Report 2021:

The most promising way of providing central bank money in the digital age is an account-based CBDC built on digital ID with official sector involvement…

Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity.

#CBDCs can help overcome some barriers facing the unbanked, write Agustín Carstens and H.M. Queen Máxima of the Netherlands, the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development @UNSGSA @koninklijhuis @ProSyn https://t.co/C8VXHvDSZ2 pic.twitter.com/aTqJdeTCa2

— Bank for International Settlements (@BIS_org) April 18, 2022

At this very moment, governments and central banks all over the world are exploring how to implement Central Bank Digital Currencies that are inextricably linked with pegging every citizen to a digital identity.

A CBDC adds another layer to digital ID, in that it can program permissions on purchases.

Speaking at the WEF’s 14th Annual Meeting of the New Champions, aka “Summer Davos,” in Tianjing, China, last year, Cornell University professor Eswar Prasad explained that governments could program CBDCs to restrict undesirable purchases and set expiry dates.

You could have a potentially […] darker world where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort.

"You could have a potentially […] darker world where the government decides that [CBDC] can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort": Eswar Prasad, WEF #AMNC23 pic.twitter.com/KkWgaEWAR5

— Tim Hinchliffe (@TimHinchliffe) June 28, 2023

The theme of this year’s WEF Annual Meeting is “Rebuilding Trust.”

Kicking off the meeting this week in his welcome address, WEF founder Klaus Schwab appointed himself and the Davos crowd “trustees” over humanity’s future.

Reprinted with permission from The Sociable.

Banks

Top Canadian bank studies possible use of digital dollar for ‘basic’ online payments

From LifeSiteNews

A new report released by the Bank of Canada proposed a ‘promising architecture well-suited for basic payments’ through the use of a digital dollar, though most Canadians are wary of such an idea.

Canada’s central bank has been studying ways to introduce a central bank digital currency (CBDC) for use for online retailers, according to a new report, despite the fact that recent research suggests Canadians are wary of any type of digital dollar.

In a new 47-page report titled, “A Retail CBDC Design For Basic Payments Feasibility Study,” which was released on June 13, 2025, the Bank of Canada (BOC) identified a “promising architecture well-suited for basic payments” through the use of a digital dollar.

The report reads that CBDCs “can be fast and cheap for basic payments, with high privacy, although some areas such as integration with retail payments systems, performance of auditing and resilience of the core system state require further investigation.”

While the report authors stopped short of fully recommending a CBDC, they noted it is a decision that could happen “outside the scope of this analysis.”

“Our framing highlights other promising architectures for an online retail CBDC, whose analysis we leave as an area for further exploration,” reads the report.

When it comes to a digital Canadian dollar, the Bank of Canada last year found that Canadians are very wary of a government-backed digital currency, concluding that a “significant number” of citizens would resist the implementation of such a system.

Indeed, a 2023 study found that most Canadians, about 85 percent, do not want a digital dollar, as previously reported by LifeSiteNews.

The study found that a “significant number” of Canadians are suspicious of government overreach and would resist any measures by the government or central bank to create digital forms of official money.

The BOC has said that it would continue to look at other countries’ use and development of CBDCs and will work with other “central banks” to improve so-called cross border payments.

Last year, as reported by LifeSiteNews, the BOC has already said that plans to create a digital “dollar,” also known as a central bank digital currency (CBDC), have been shelved.

Digital currencies have been touted as the future by some government officials, but, as LifeSiteNews has reported before, many experts warn that such technology would restrict freedom and could be used as a “control tool” against citizens, similar to China’s pervasive social credit system.

The BOC last August admitted that the creation of a CBDC is not even necessary, as many people rely on cash to pay for things. The bank concluded that the introduction of a digital currency would only be feasible if consumers demanded its release.

Conservative Party leader Pierre Poilievre has promised, should he ever form the government, he would oppose the creation of a digital dollar.

Contrast this to Canada’s current Liberal Prime Minister Mark Carney. He has a history of supporting central bank digital currencies and in 2022 supported “choking off the money” donated to the Freedom Convoy protests against COVID mandates.

Banks

Legal group releases report warning Canadians about central bank digital currencies

From LifeSiteNews

By

“central bank digital currency could hand incredible power to the Government and Bank of Canada to monitor financial transactions, punish whatever behaviours the government deems undesirable, and penalize those on the wrong side of government ambitions”

The Justice Centre for Constitutional Freedoms released a new report examining how the adoption of a central bank digital currency in Canada could undermine the rights and freedoms of Canadians, including their privacy, autonomy, security, equality, and access to economic participation.

Financial transactions are increasingly conducted digitally. In 2023, a mere 11 percent of transactions were conducted with cash, according to Payments Canada.

This trend is not limited to individual consumers. Government entities, including government departments, agencies, and Crown Corporations, have rapidly digitized access to, and delivery of, their goods and services over the past decade.

READ: Mark Carney has history of supporting CBDCs, endorsed Freedom Convoy crackdown

Against this backdrop, in 2017, the Bank of Canada (a Crown Corporation) began exploring the possibility of implementing its own government-issued and government-controlled cashless currency – a central bank digital currency (CBDC).

In a 2023 Bank of Canada survey on CBDCs, however, 82 percent of 89,423 respondents strongly disagreed that the Bank of Canada should be researching or building the capability to issue a CBDC. Despite these results, the Bank of Canada continues to research a CBDC for Canada.

The Justice Centre’s report critically evaluates the impact a CBDC could have on Canadians’ fundamental rights and freedoms. Absent robust legislative protections and oversight, a CBDC could allow the Government and Bank of Canada to monitor Canadians’ purchases, donations, investments and other financial transactions.

A CBDC has the potential to empower government to reward and punish the behaviours and lifestyle choices of individual Canadians, as Communist China does with its “social credit” system. Allowing the government to peer into and influence Canadians’ purchasing behaviours could have a profoundly damaging impact on their privacy and autonomy, cautions the report.

READ: Financial expert warns all-digital monetary system would enable ‘complete control’ of citizens

Canada is not the first jurisdiction to explore a CBDC. This report evaluates the Bank of Canada’s exploration within a global context, applying lessons learned from jurisdictions like Nigeria, the Caribbean, and others.

After analyzing negative outcomes of “going cashless” in jurisdictions such as Australia, Sweden, Finland, and Norway, this report advocates for the value of cash and the need for robust institutional and legislative protections for the use of cash.

Ben Klassen, Education Programs Coordinator at the Justice Centre and lead author of the report, stated, “Many Canadian politicians and policy designers would have us participate in a frantic (and global) race to digitize goods and services, including our dollar. The finish line, we are told, promises heightened profitability, convenience, and security. While the pursuit of innovation and efficiency can deliver worthwhile rewards, we must always remember the values of privacy, autonomy, security, equality, and access to economic participation. Adopting a central bank digital currency risks excluding the homeless, the elderly, the ‘internetless,’ the technologically illiterate, and the conscientious objector.”

“Most seriously, a central bank digital currency could hand incredible power to the Government and Bank of Canada to monitor financial transactions, punish whatever behaviours the government deems undesirable, and penalize those on the wrong side of government ambitions,” continued Mr. Klassen. “This issue should be framed as a contrast between a ‘digital dollar’ and a ‘human dollar’ – our currency cannot be designed without regard for the humans and human values that will be profoundly impacted by its design.”

READ: RFK Jr. warns Americans ‘will be slaves’ if central bank digital currency is established

This report was produced in collaboration with Sharon Polsky – President of AMINAcorp.ca, President of the Privacy & Access Council of Canada, and a Privacy by Design Ambassador with more than 30 years’ experience in advising governments and policy designers on privacy and access matters.

Reprinted with permission from the Justice Centre for Constitutional Freedoms.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoEau Canada! Join Us In An Inclusive New National Anthem

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Business2 days ago

Business2 days agoCarney’s new agenda faces old Canadian problems

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta2 days ago

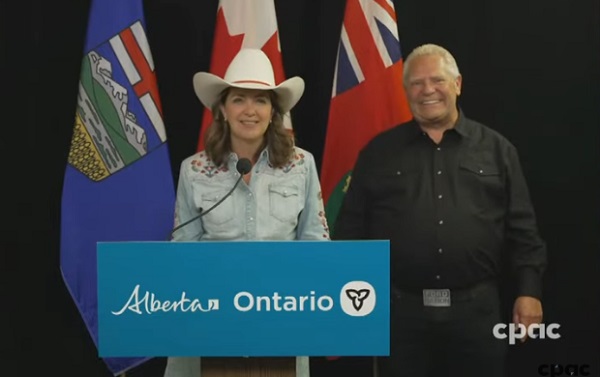

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Crime1 day ago

Crime1 day ago“This is a total fucking disaster”

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million annually