Opinion

City Hall continues to provoke the bear. “They don’t give council options they don’t support.”

The debate over masking is exposing city hall administration’s narcissistic attitude.

The administration did not offer city council any options they did not support. The administration is now provoking the bear. I predict that many candidates, especially incumbents, will campaign in the next municipal election (Oct. 2021) on shaking up city hall.

Perhaps our city councilors will take back the reins, and take control of the agenda. They give direction to the Mayor and administration not the other way around.

Remember a past blog;

The recent debate over the Molly Banister could be seen as democracy at work and possibly an expose of city hall dysfunction.

At first reading of the bylaw to remove the road alignment it seemed supported by the Mayor, by the council and by the administration. Comments from some elected officials about campaign promises made it appear inevitable.

The public reacted and it appeared that city hall was out of sync with today’s reality.

The local newspaper did an editorial on September 29, declaring in bold headline that the “Road extension must be kept”. Writing ;”It’s surprising that public workers paid to plan for the city’s growth would do the opposite; not plan for the responsible development of the region.” “ What is portrayed as an environmental concern is really just an interest in keeping neighbourhood traffic down to a minimum,”

Former city manager, Craig Curtis, waded into the debate, questioning the recommendation and reminding us of past decisions that were essential to our development that were similar.

Legal opinions on historical commitments and legal obligations.

Knowledgeable residents debunked many of the environmental issues.

The local church came out in favour of the extension.

The Mayor who championed removal, declared herself in conflict, as she lives in the area, removed herself from voting before each reading.

Councillor Wong started off questioning, after the public hearing, why the administration would bring up a 250 foot bridge when an old man like himself could hop the creek?

Councillor Lee questioned why the city would emphasize the road would cause several instances of ecological damage when the other option of building houses on the creek would have the same effect? Councillor Lee admitted that the majority wanted the extension and voted against the removal.

Councillor Hendley, questioned the city about the future changes. How, when the city administration repeated that there is no current connection to Springfield Avenue, countered, that when the neighbourhood plan is presented it could then be connected, initiating another public hearing. She didn’t claim to know what the future would bring and wanted to leave all options opened.

Councillor Buchanan mentioned that in his non-councillor life he has witnessed the short-cutting of drivers that were of concern to neighbouring communities.

Councillor Higham, took note of the less than complete information on traffic. Bringing her own detailed analyses of traffic to the table.

Together they formed the majority that paralleled the wishes of the majority.

On the face of it, democracy won, a fragile democracy but still a democracy.

2 of the opposition councillors credited the support of the administration in buoying their determined support to remove the alignment, another one used the “Green” umbrella to support her opposition to keeping the alignment.

Poll after poll showed majority support for the extension, so why did we need to go through this stressful and expensive process? Why did the same traffic study get 2 extremely different interpretations?

City hall has been put on notice. Do their jobs, leave the politics and biases out of the equation. You get paid the big bucks to give your political masters the untarnished truth, so do it.

Someone said; “The bear has been poked, do not provoke”.

The next municipal election is on the horizon, provocation could mean great change. Not just at the ballot box.

Is it time for a shake-up and renewal at city hall? Just asking.

Will city administration heed the people duly elected to represent the people?

Will city hall administration be the ballot box question? Just asking.

Business

Carney should rethink ‘carbon capture’ climate cure

From the Fraser Institute

In case you missed it amid the din of Trump’s trade war, Prime Minister Carney is a big believer in “carbon capture and storage.” And his energy minister, Tim Hodgson, who said it’s “critical to build carbon capture systems for the oilsands,” wants the Smith government and oilsands companies to get behind a proposed project (which hasn’t been unable to raise sufficient private investment) in Cold Lake, Alberta.

The term “carbon capture and storage” (or CCS) essentially refers to technology that separates carbon dioxide (CO2) from emissions and either stores it or uses it for other products. Proponents claim that CCS could replace other more ham-handed climate regulations such as carbon taxes, emission caps, etc. The problem is, like many (or most) proposed climate panaceas, CCS is oversold. While it’s a real technology currently in use around the world (primarily to produce more oil and gas from depleting reservoirs), jurisdictions will likely be unable to affordably scale up CCS enough to capture and store enough greenhouse gas to meaningfully reduce the risks of predicted climate change.

Why? Because while you get energy out of converting methane (natural gas) to CO2 by burning it in a power plant to generate electricity, you have to put quite a lot of energy into the process if you want to capture, compress, transport and store the attendant CO2 emissions. Again, carbon capture can be profitable (on net) for use in producing more oil and gas from depleting reservoirs, and it has a long and respected role in oil and gas production, but it’s unclear that the technology has utility outside of private for-profit use.

And in fact, according to the International Institute for Sustainable Development (IISD), most CCS happening in Canada is less about storing carbon to avert climate change and more about stimulating oil production from existing operations. While there are “seven CCS projects currently operating in Canada, mostly in the oil and gas sector, capturing about 0.5% of national emissions,” CCS in oil and gas production does not address emissions from “downstream uses of those fuels” and will, perversely, lead to more CO2 emissions on net. The IISD also notes that CCS is expensive, costing up to C$200 per tonne for current projects. (For reference, today’s government-set minimum carbon market price to emit a tonne of CO2 emissions is C$95.) IISD concludes CCS is “energy intensive, slow to implement, and unproven at scale, making it a poor strategy for decarbonizing oil and gas production.”

Another article in Scientific American observes that industrial carbon capture projects are “too small to matter” and that “today’s largest carbon capture projects only remove a few seconds’ worth of our yearly greenhouse gas emissions” and that this is “costing thousands of dollars for every ton of CO2 removed.” And as a way to capture massive volumes of CO2 (from industrial emission streams of out the air) and sequestering it to forestall atmospheric warming (climate change), the prospects are not good. Perhaps this is why the article’s author characterizes CCS as a “figleaf” for the fossil fuel industry (and now, apparently, the Carney government) to pretend they are reducing GHG emissions.

Prime Minister Carney should sharpen his thinking on CCS. While real and profitable when used in oil and gas production, it’s unlikely to be useful in combatting climate change. Best to avoid yet another costly climate change “solution” that is overpromised, overpriced and has historically underperformed.

Energy

Is Carney ‘All Hat And No Cattle’?

From the National Citizens Coalition

By National Citizens Coalition President Peter Coleman

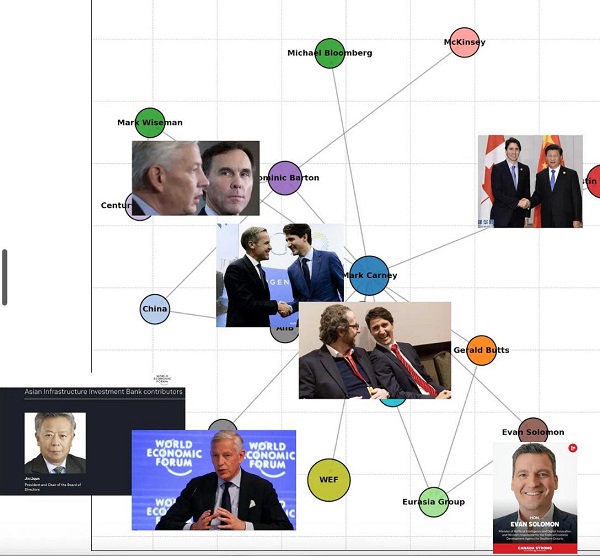

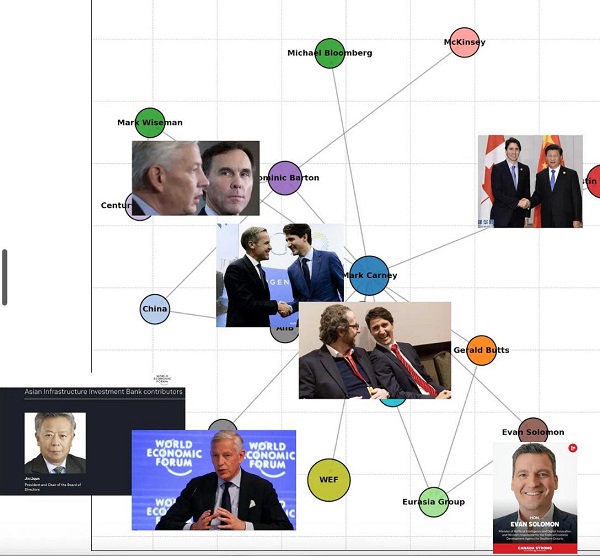

Mark Carney promised to lead Canada with bold vision and economic strength. But his latest stall tactics on removing red tape for Canadian oil and gas, his floundering in tariff negotiations despite lofty “elbows up” promises, and his refusal to address shocking interference allegations tied to his public safety minister so far show that he’s all hat and no cattle.

Today, Prime Minister Mark Carney held consultations and conversations with Indigenous groups on Bill C-5, which claims to fast-track “nation-building” energy projects. Yet he announced no major approvals on the horizon, and impressed no urgency or authority upon those in attendance who would seek to claim veto over vital projects.

Canada doesn’t need more endless talk or one bill to pick more losers than winners. We need action to remove anti-resource laws and regulatory roadblocks that choke our energy sector. Projects like pipelines and LNG facilities are critical for jobs, economic growth, and energy security, but they’re stalled by bureaucratic overreach and outdated policies. Hard-working Canadians deserve affordable energy. Our economy needs rescuing from tariff threat and a decade of Liberal sabotage. And Indigenous communities deserve real economic partnerships, not more delays and cowardly half-measures that often only placate anti-resource interests and insiders, not the real needs of the community.

Streamlined approvals with clear economic benefits will unlock prosperity for all Canadians. Carney’s stall tactics only hold back progress. It’s time to cut the red tape and get out of the way so that real Canadian leaders, and our great Canadian workers, can rebuild Canada after all that’s been broken.

Carney campaigned as the economic genius who could handle U.S. President Donald Trump’s tariff threats. Yet, with Trump’s August 1 deadline for a 35% tariff on Canadian goods approaching, Carney’s negotiations are going nowhere. His vague promises do nothing to protect Canadian jobs, industries, or families facing higher costs. Canadians deserve a leader who delivers results, not one who breaks campaign promises with empty rhetoric.

Meanwhile, he’s been shielding corruption and dodging accountability. Carney, now revealed to have 16 pages of conflicts that were kept from voters during the election, continues to protect Public Safety Minister Gary Anandasangaree, who faces serious allegations of lobbying for those with listed terrorist ties. Instead of demanding transparency, Carney is shielding his minister from scrutiny, doubling down on the Liberal tradition of dodging accountability. Canadians deserve a government that upholds integrity, not one that buries troubling connections to protect political allies. Is Carney just like Justin, who broke immigration and invited rampant foreign interference into government? Because this response is right out of his predecessor’s playbook.

Mark Carney’s leadership has been all talk and no action. Canada needs a government that unleashes our energy potential, lives up to its lofty campaign promises, and roots out corruption; not another Justin Trudeau.

We’re not falling for it. And neither are you. Demand action. Demand results.

–Peter Coleman, President, National Citizens Coalition

-

Education1 day ago

Education1 day agoWhy more parents are turning to Christian schools

-

Business2 days ago

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

Alberta1 day ago

Alberta1 day agoOPEC+ is playing a dangerous game with oil

-

Alberta1 day ago

Alberta1 day agoUpgrades at Port of Churchill spark ambitions for nation-building Arctic exports

-

Business1 day ago

Business1 day agoIs dirty Chinese money undermining Canada’s Arctic?

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections

-

COVID-191 day ago

COVID-191 day agoJapan disposes $1.6 billion worth of COVID drugs nobody used