Alberta

Business, not as usual

Business, not as usual. Employer support of reservists in time of pandemic.

Submitted by: Canadian Forces Liaison Council/Alberta Chapter

In this challenging time of pandemic, it’s probably safe to say that business will not carry on as usual. Employers have much to be concerned about – employees’ health and welfare, revenue, and simply put – survival.

In many cases employers have reservist-employees who balance double duty with both the Reserve Force and their workplace. Reservists are prepared willing and able to answer the call to support pandemic response or other emergencies, either nationally or locally.

Preparations for pandemic support across Canada are underway, and this includes many reservists, army, navy, air force alike, who have been asked to mobilize. It is with thanks to many employers who support their reservist-employee as they volunteer for Operation LASER 20-01 – the Canadian Armed Forces’ response to the COVID-19 pandemic within Canada.

The Government of Canada has authorized reservists, who volunteer, to be placed on full-time Class C service to support the Operation. The Canadian Armed Forces is currently mobilizing 24,000 service members, both regular and reserve, to support provincial and municipal governments and agencies in their efforts to suppress the disease, to support vulnerable populations, and to provide logistical and general support to communities. In Alberta, there will be hundreds of reservists who will choose to deploy and serve to support our communities.

The impact of the COVID-19 pandemic on Canadians has been unprecedented, as is the scale of the Canadian Armed Forces mobilization under the Operation LASER response. Reservists’ dedication to duty in volunteering for Operation LASER is essential to support both provincial and municipal authorities during this crisis. Canada cannot meet its defence needs at home and abroad without the dedicated, motivated and highly skilled people who work tirelessly to defend Canada and promote Canadian values and interests. Op LASER is the immediate need, but reservists have been and will continue to be needed to support other domestic crisis, such as floods and fires, which are occurring on a more frequent basis.

In Alberta, Employment Standards Code, outlines a reservist-employee who has completed at least 26 consecutive weeks of employment with an employer is entitled to reservist leave without pay to take part in deployment to a Canadian Forces operation inside Canada. It also outlines that all leave provided to Reservists is leave without pay – as the Canadian Armed Forces will provide the Reservist with income for the duration of their contract. It’s good business sense to keep good employees and the employment code notes that employers cannot terminate, or lay off, an employee who has started reservist leave. Although these are the legislated minimums, organizations are encouraged to develop and implement military leave policies that support a reservist-employee even further.

There is great pride for reservists as they deploy domestically and equally for the employers who support them. Undoubtedly, business will not be as usual and if you have a reservist-employee there is support available for your organization. Employer support during this time of crisis is greatly appreciated by the Canadian Armed Forces and the Government of Canada. Indeed, when you employ a reservist, you in turn, are serving your country.

How can I find out more information for my business?

• Federal Compensation for Employers of Reservists Program (CERP) – Employers can apply and eligible applicants will receive a lump sum payment, in the form of a grant, following the deployment period of the reservist employee.

- Military Leave Policy information – if your organization does not already have a formal military leave policy, this may be a good opportunity to implement one that provides additional detail beyond what is in the job protection legislation.

- Canadian Forces Liaison Council – Employers Supporting Reservists

Info for military leave policies and federal support (CERP): https://www.canada.ca/en/department-national-defence/services/benefits-military/supporting-reservists-employers.html

- With Glowing Hearts – Reservist Support Program – a turnkey employer support program for reservists. The program provides information and tools for employers of reservists and is an asset for a business to attract and retain experienced and valued reservist/employees.

Info and/or to Register: https://www.surveymonkey.com/r/WithGlowingHearts

originally published April 9, 2020.

Alberta

The Canadian Energy Centre’s biggest stories of 2025

From the Canadian Energy Centre

Canada’s energy landscape changed significantly in 2025, with mounting U.S. economic pressures reinforcing the central role oil and gas can play in safeguarding the country’s independence.

Here are the Canadian Energy Centre’s top five most-viewed stories of the year.

5. Alberta’s massive oil and gas reserves keep growing – here’s why

The Northern Lights, aurora borealis, make an appearance over pumpjacks near Cremona, Alta., Thursday, Oct. 10, 2024. CP Images photo

Analysis commissioned this spring by the Alberta Energy Regulator increased the province’s natural gas reserves by more than 400 per cent, bumping Canada into the global top 10.

Even with record production, Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

According to McDaniel & Associates, which conducted the report, these reserves are likely to become increasingly important as global demand continues to rise and there is limited production growth from other sources, including the United States.

4. Canada’s pipeline builders ready to get to work

Canada could be on the cusp of a “golden age” for building major energy projects, said Kevin O’Donnell, executive director of the Mississauga, Ont.-based Pipe Line Contractors Association of Canada.

That eagerness is shared by the Edmonton-based Progressive Contractors Association of Canada (PCA), which launched a “Let’s Get Building” advocacy campaign urging all Canadian politicians to focus on getting major projects built.

“The sooner these nation-building projects get underway, the sooner Canadians reap the rewards through new trading partnerships, good jobs and a more stable economy,” said PCA chief executive Paul de Jong.

3. New Canadian oil and gas pipelines a $38 billion missed opportunity, says Montreal Economic Institute

Steel pipe in storage for the Trans Mountain Pipeline expansion in 2022. Photo courtesy Trans Mountain Corporation

In March, a report by the Montreal Economic Institute (MEI) underscored the economic opportunity of Canada building new pipeline export capacity.

MEI found that if the proposed Energy East and Gazoduq/GNL Quebec projects had been built, Canada would have been able to export $38 billion worth of oil and gas to non-U.S. destinations in 2024.

“We would be able to have more prosperity for Canada, more revenue for governments because they collect royalties that go to government programs,” said MEI senior policy analyst Gabriel Giguère.

“I believe everybody’s winning with these kinds of infrastructure projects.”

2. Keyera ‘Canadianizes’ natural gas liquids with $5.15 billion acquisition

Keyera Corp.’s natural gas liquids facilities in Fort Saskatchewan, Alta. Photo courtesy Keyera Corp.

In June, Keyera Corp. announced a $5.15 billion deal to acquire the majority of Plains American Pipelines LLP’s Canadian natural gas liquids (NGL) business, creating a cross-Canada NGL corridor that includes a storage hub in Sarnia, Ontario.

The acquisition will connect NGLs from the growing Montney and Duvernay plays in Alberta and B.C. to markets in central Canada and the eastern U.S. seaboard.

“Having a Canadian source for natural gas would be our preference,” said Sarnia mayor Mike Bradley.

“We see Keyera’s acquisition as strengthening our region as an energy hub.”

1. Explained: Why Canadian oil is so important to the United States

Enbridge’s Cheecham Terminal near Fort McMurray, Alberta is a key oil storage hub that moves light and heavy crude along the Enbridge network. Photo courtesy Enbridge

The United States has become the world’s largest oil producer, but its reliance on oil imports from Canada has never been higher.

Many refineries in the United States are specifically designed to process heavy oil, primarily in the U.S. Midwest and U.S. Gulf Coast.

According to the Alberta Petroleum Marketing Commission, the top five U.S. refineries running the most Alberta crude are:

- Marathon Petroleum, Robinson, Illinois (100% Alberta crude)

- Exxon Mobil, Joliet, Illinois (96% Alberta crude)

- CHS Inc., Laurel, Montana (95% Alberta crude)

- Phillips 66, Billings, Montana (92% Alberta crude)

- Citgo, Lemont, Illinois (78% Alberta crude)

Alberta

Alberta Next Panel calls for less Ottawa—and it could pay off

From the Fraser Institute

By Tegan Hill

Last Friday, less than a week before Christmas, the Smith government quietly released the final report from its Alberta Next Panel, which assessed Alberta’s role in Canada. Among other things, the panel recommends that the federal government transfer some of its tax revenue to provincial governments so they can assume more control over the delivery of provincial services. Based on Canada’s experience in the 1990s, this plan could deliver real benefits for Albertans and all Canadians.

Federations such as Canada typically work best when governments stick to their constitutional lanes. Indeed, one of the benefits of being a federalist country is that different levels of government assume responsibility for programs they’re best suited to deliver. For example, it’s logical that the federal government handle national defence, while provincial governments are typically best positioned to understand and address the unique health-care and education needs of their citizens.

But there’s currently a mismatch between the share of taxes the provinces collect and the cost of delivering provincial responsibilities (e.g. health care, education, childcare, and social services). As such, Ottawa uses transfers—including the Canada Health Transfer (CHT)—to financially support the provinces in their areas of responsibility. But these funds come with conditions.

Consider health care. To receive CHT payments from Ottawa, provinces must abide by the Canada Health Act, which effectively prevents the provinces from experimenting with new ways of delivering and financing health care—including policies that are successful in other universal health-care countries. Given Canada’s health-care system is one of the developed world’s most expensive universal systems, yet Canadians face some of the longest wait times for physicians and worst access to medical technology (e.g. MRIs) and hospital beds, these restrictions limit badly needed innovation and hurt patients.

To give the provinces more flexibility, the Alberta Next Panel suggests the federal government shift tax points (and transfer GST) to the provinces to better align provincial revenues with provincial responsibilities while eliminating “strings” attached to such federal transfers. In other words, Ottawa would transfer a portion of its tax revenues from the federal income tax and federal sales tax to the provincial government so they have funds to experiment with what works best for their citizens, without conditions on how that money can be used.

According to the Alberta Next Panel poll, at least in Alberta, a majority of citizens support this type of provincial autonomy in delivering provincial programs—and again, it’s paid off before.

In the 1990s, amid a fiscal crisis (greater in scale, but not dissimilar to the one Ottawa faces today), the federal government reduced welfare and social assistance transfers to the provinces while simultaneously removing most of the “strings” attached to these dollars. These reforms allowed the provinces to introduce work incentives, for example, which would have previously triggered a reduction in federal transfers. The change to federal transfers sparked a wave of reforms as the provinces experimented with new ways to improve their welfare programs, and ultimately led to significant innovation that reduced welfare dependency from a high of 3.1 million in 1994 to a low of 1.6 million in 2008, while also reducing government spending on social assistance.

The Smith government’s Alberta Next Panel wants the federal government to transfer some of its tax revenues to the provinces and reduce restrictions on provincial program delivery. As Canada’s experience in the 1990s shows, this could spur real innovation that ultimately improves services for Albertans and all Canadians.

-

Business8 hours ago

Business8 hours agoICYMI: Largest fraud in US history? Independent Journalist visits numerous daycare centres with no children, revealing massive scam

-

Daily Caller2 days ago

Daily Caller2 days agoWhile Western Nations Cling to Energy Transition, Pragmatic Nations Produce Energy and Wealth

-

Daily Caller1 day ago

Daily Caller1 day agoUS Halts Construction of Five Offshore Wind Projects Due To National Security

-

Alberta2 days ago

Alberta2 days agoAlberta Next Panel calls for less Ottawa—and it could pay off

-

Bruce Dowbiggin1 day ago

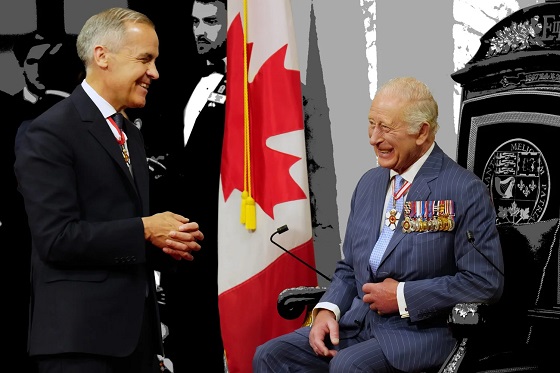

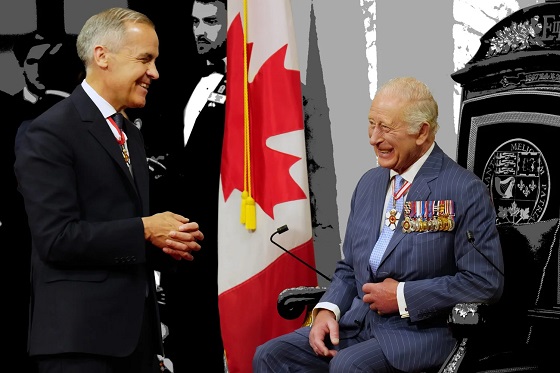

Bruce Dowbiggin1 day agoBe Careful What You Wish For In 2026: Mark Carney With A Majority

-

Energy2 days ago

Energy2 days agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoLand use will be British Columbia’s biggest issue in 2026

-

Business2 days ago

Business2 days agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud