Environment

Bjorn Lomborg shows how social media censors forgot to include the facts in their fact check

From lomborg.com

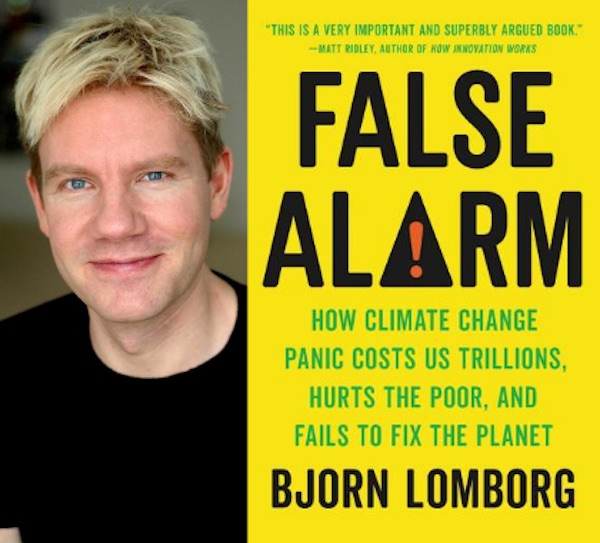

Dr. Bjorn Lomborg is president of the Copenhagen Consensus Center, and visiting fellow at the Hoover Institution, Stanford University. The Copenhagen Consensus Center is a think-tank that researches the smartest ways to do good. For this work, Lomborg was named one of TIME magazine’s 100 most influential people in the world. His numerous books include “False Alarm: How Climate Change Panic Costs Us Trillions, Hurts the Poor, and Fails to Fix the Planet”, “The Skeptical Environmentalist”, “Cool It”, “How to Spend $75 Billion to Make the World a Better Place”, “The Nobel Laureates’ Guide to the Smartest Targets for the World 2016-2030” and “Prioritizing Development: A Cost Benefit Analysis of the UN’s SDGs”.

The heresy of heat and cold deaths

A group of campaign researchers try hilariously, ineptly — and depressingly —to suppress facts

TL;DR. A blog, claiming to check facts, does not like that I cite this fact: the rising temperatures in the past two decades have caused more heat deaths, but at the same time avoided even more cold deaths. Since this inconvenient fact is true, they ignore to check it. Instead, they fabricate an absurd quote, which is contradicted in the very article they claim to ‘fact-check’.

166,000 avoided deaths

Cold deaths vastly outweigh heat deaths. This is common knowledge in the academic literature and for instance the Lancet finds that each year, almost 600,000 people die globally from heat but 4.5 million from cold.

Moreover, when the researchers include increasing temperatures of 0.26°C/decade (0.47°F/decade), they find heat deaths increase, but cold deaths decrease more than twice as much:

Or here from the article:

The total impact of more than 116,000 more heat deaths each year and almost 283,000 fewer cold deaths year is that by now, the temperature rise since 2000 means that for temperature-related mortality we are seeing 166,000 fewer deaths each year.

Climate Feedback

However, this is obviously heretical information, so the self-appointed blog, Climate Feedback, wants it purged. Now, if they were just green campaigning academics writing on the internet, that might not matter much. But unfortunately, this group has gained the opportunity to censor information on Facebook, so I have to spend some time showing you their inept, often hilarious, and mostly nefarious arguments. The group regularly makes these sorts of bad-faith arguments, and apparently appealing their Facebook inditements simply goes back to the same group. It is rarely swayed by any argument.

They never test the claim

Climate Feedback seemingly wants to test my central claim from the Lancet article that global warming now saves 166,000 people each year, from my oped in New York Post:

But notice what is happening right after the quote “Global warming saves 166,000 lives each year”. They append it with something that is not in the New York Post. You have to read much further to realize that they are actually trying — and failing — to paste in an entirely separate Facebook post, which addressed a different scientific article.

It turns out, Climate Feedback never addresses the 166,000 people saved in their main text. “166” only occurs three times in the article: twice stating my claim and once after their main text in a diatribe by an ocean-physics professor, complete with personal insults. In it, the professor doesn’t contest the 166,000 avoided deaths. Instead, he falsely claims that I am presenting the 166,000 as the overall mortality impact of climate change, which is absurd: anyone reading my piece understand that I’m talking about the impact of temperature-related mortality.

Perhaps most tellingly, Climate Feedback has asked one of the co-authors of the 166,000 Lancet study (as they also very proudly declare in their text). And this professor, Antonio Gasparrini, does not only not challenge but doesn’t even discuss my analysis of the 166,000 avoided deaths.

Climate Feedback not only doesn’t present any reasonable argument against the 166,000 avoided deaths. It has actually asked one of the main authors of the study to comment and they have nothing.

In conclusion, Climate Feedback simply has no good arguments against the 166,000 people saved, and yet they pillory my work publicly in an attempt to censor data they deem inconvenient. . That academics play along in this charade of an inquisition dressed up ‘fact-check’ is despicable.

Rest of Climate Feedback’s claim is ludicrously wrong

So, beyond the claim of 166,000, Climate Feedback is alleging that I say the following: “those claiming that climate change is causing heat-related deaths are wrong because they ignore that the population is growing and becoming older.”

This is a fabricated quote. I never say this. Climate Feedback has simply made up a false statement, dressing it as a quote of mine, even though I never claimed anything like this. This is incredibly deceptive: it is ludicrous to insist that I should argue that it is wrong to claim “climate change is causing heat-related deaths.” I simply do not argue that “climate change is not causing heat-related deaths”

Up above I exactly argued that climate change causes more heat deaths. My graph shows that climate change causes more heat deaths.

And I even point out exactly that the temperature increases cause heat deaths in my New York Post piece:

“As temperatures have increased over the past two decades, that has caused an extra 116,000 heat deaths each year.” Sorry, Climate Feedback, but the rest of your claim is straight-out, full-on stupid.

Evaluation of Climate Feedback’s review

So Climate Feedback is simply wrong in asserting that I somehow say climate change is not causing heat-related deaths — because I do say that, even in my New York Post article:

Climate Feedback doesn’t show anywhere in their main text how the 166,000 avoided deaths are wrong. They even ask one of the main authors of the study, and that professor says nothing.

Conclusion

Climate Feedback’s deceptive hit job is long on innuendo and bad arguments (see a few, further examples below). But the proof really is in the pudding.

They make two central arguments. First, that my claim of “Global warming saves 166,000 lives each year” is incorrect. Yet, they never address this in their main text. And while they get information from one of the main authors of the Lancet study that is the basis for the 166,000 lives saved, they get no criticism of the argument.

Second, they assert that I somehow say that it is wrong to claim climate change is causing more heat-related deaths, which is just ludicrous because I make that very point, even in my New York Post article:

Verdict: Climate Feedback is fundamentally wrong in both their two main claims.

Additional point: It really shouldn’t be necessary to say, but you can’t make a ‘fact-check’ page, write page after page of diatribe, ignore the first main point and bungle the other main point, and then hope at the end nobody notices, and call my arguments wrong. Or, at least, you shouldn’t be able to get away with such nonsense.

Two examples of the inadequate arguments in the rest of Climatefeedback

Lomborg doesn’t have a time machine

Climate Feedback asks professor Gasparrini, co-author of the Lancet study above. He doesn’t cover anything on the 166,000 deaths avoided. Instead, his text entirely discusses a 2016 WSJ article where I used his 2015-article but he criticizes me for not citing his 2017 article:

The reason I didn’t cite his 2017-article is of course that I didn’t have access to a time machine when I wrote my article in 2016.

Indeed, I have corresponded with Professor Gasparrini several times later about his 2017-article. And yes, his 2017-study indeed shows that at very high emissions, additional heat deaths will likely outweigh avoided cold deaths towards the end of the century. But his study also shows that all regions see additional heat deaths vastly exceeded by extra avoided cold deaths from the 1990s to the 2010s — the exact point I’ve made here.

Serious academics take into account population growth and aging

In a refreshing comment, Climate Feedback asks Philip Staddon, Principal Lecturer in Environment and Sustainability from the University of Gloucestershire to chime in. He says, that I’m wrong to criticize the lack of standardization from population growth and aging, because clearly “all serious academic research already takes account of population growth, demographics and ageing”:

I, of course, entirely agree with Staddon, that all serious academic research should do that. But the research that I have criticized has exactly not done so, resulting in unsupported claims. So, for instance, in the Facebook post that Climate Feedback discusses, I show how CNN believes that a study shows a 74% increase caused by the climate crisis:

This is based on not adjusting for population and age, and is actually from the press release of the paper (and in table S6 in the paper).

Likewise, Staddon might have noticed that a very high-profile editorial in the world’s top medical journals made that very amateurish mistake. They argue that temperature increases over the past 20 years have increased deaths among people 65 and older:

But they cite numbers that are not adjusted for age or population — indeed the world’s population of people above age 65 has increased almost as much:

I absolutely agree with Principal Lecturer Philip Staddon on the necessity of making sure that good arguments in the public sphere are adjusted for population and aging before blaming climate. Unfortunately, they often aren’t

Automotive

Politicians should be honest about environmental pros and cons of electric vehicles

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

According to Steven Guilbeault, former environment minister under Justin Trudeau and former member of Prime Minister Carney’s cabinet, “Switching to an electric vehicle is one of the most impactful things Canadians can do to help fight climate change.”

And the Carney government has only paused Trudeau’s electric vehicle (EV) sales mandate to conduct a “review” of the policy, despite industry pressure to scrap the policy altogether.

So clearly, according to policymakers in Ottawa, EVs are essentially “zero emission” and thus good for environment.

But is that true?

Clearly, EVs have some environmental advantages over traditional gasoline-powered vehicles. Unlike cars with engines that directly burn fossil fuels, EVs do not produce tailpipe emissions of pollutants such as nitrogen dioxide and carbon monoxide, and do not release greenhouse gases (GHGs) such as carbon dioxide. These benefits are real. But when you consider the entire lifecycle of an EV, the picture becomes much more complicated.

Unlike traditional gasoline-powered vehicles, battery-powered EVs and plug-in hybrids generate most of their GHG emissions before the vehicles roll off the assembly line. Compared with conventional gas-powered cars, EVs typically require more fossil fuel energy to manufacture, largely because to produce EVs batteries, producers require a variety of mined materials including cobalt, graphite, lithium, manganese and nickel, which all take lots of energy to extract and process. Once these raw materials are mined, processed and transported across often vast distances to manufacturing sites, they must be assembled into battery packs. Consequently, the manufacturing process of an EV—from the initial mining of materials to final assembly—produces twice the quantity of GHGs (on average) as the manufacturing process for a comparable gas-powered car.

Once an EV is on the road, its carbon footprint depends on how the electricity used to charge its battery is generated. According to a report from the Canada Energy Regulator (the federal agency responsible for overseeing oil, gas and electric utilities), in British Columbia, Manitoba, Quebec and Ontario, electricity is largely produced from low- or even zero-carbon sources such as hydro, so EVs in these provinces have a low level of “indirect” emissions.

However, in other provinces—particularly Alberta, Saskatchewan and Nova Scotia—electricity generation is more heavily reliant on fossil fuels such as coal and natural gas, so EVs produce much higher indirect emissions. And according to research from the University of Toronto, in coal-dependent U.S. states such as West Virginia, an EV can emit about 6 per cent more GHG emissions over its entire lifetime—from initial mining, manufacturing and charging to eventual disposal—than a gas-powered vehicle of the same size. This means that in regions with especially coal-dependent energy grids, EVs could impose more climate costs than benefits. Put simply, for an EV to help meaningfully reduce emissions while on the road, its electricity must come from low-carbon electricity sources—something that does not happen in certain areas of Canada and the United States.

Finally, even after an EV is off the road, it continues to produce emissions, mainly because of the battery. EV batteries contain components that are energy-intensive to extract but also notoriously challenging to recycle. While EV battery recycling technologies are still emerging, approximately 5 per cent of lithium-ion batteries, which are commonly used in EVs, are actually recycled worldwide. This means that most new EVs feature batteries with no recycled components—further weakening the environmental benefit of EVs.

So what’s the final analysis? The technology continues to evolve and therefore the calculations will continue to change. But right now, while electric vehicles clearly help reduce tailpipe emissions, they’re not necessarily “zero emission” vehicles. And after you consider the full lifecycle—manufacturing, charging, scrapping—a more accurate picture of their environmental impact comes into view.

Agriculture

Canada’s air quality among the best in the world

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

Canadians care about the environment and breathing clean air. In 2023, the share of Canadians concerned about the state of outdoor air quality was 7 in 10, according to survey results from Abacus Data. Yet Canada outperforms most comparable high-income countries on air quality, suggesting a gap between public perception and empirical reality. Overall, Canada ranks 8th for air quality among 31 high-income countries, according to our recent study published by the Fraser Institute.

A key determinant of air quality is the presence of tiny solid particles and liquid droplets floating in the air, known as particulates. The smallest of these particles, known as fine particulate matter, are especially hazardous, as they can penetrate deep into a person’s lungs, enter the blood stream and harm our health.

Exposure to fine particulate matter stems from both natural and human sources. Natural events such as wildfires, dust storms and volcanic eruptions can release particles into the air that can travel thousands of kilometres. Other sources of particulate pollution originate from human activities such as the combustion of fossil fuels in automobiles and during industrial processes.

The World Health Organization (WHO) and the Canadian Council of Ministers of the Environment (CCME) publish air quality guidelines related to health, which we used to measure and rank 31 high-income countries on air quality.

Using data from 2022 (the latest year of consistently available data), our study assessed air quality based on three measures related to particulate pollution: (1) average exposure, (2) share of the population at risk, and (3) estimated health impacts.

The first measure, average exposure, reflects the average level of outdoor particle pollution people are exposed to over a year. Among 31 high-income countries, Canadians had the 5th-lowest average exposure to particulate pollution.

Next, the study considered the proportion of each country’s population that experienced an annual average level of fine particle pollution greater than the WHO’s air quality guideline. Only 2 per cent of Canadians were exposed to fine particle pollution levels exceeding the WHO guideline for annual exposure, ranking 9th of 31 countries. In other words, 98 per cent of Canadians were not exposed to fine particulate pollution levels exceeding health guidelines.

Finally, the study reviewed estimates of illness and mortality associated with fine particle pollution in each country. Canada had the fifth-lowest estimated death and illness burden due to fine particle pollution.

Taken together, the results show that Canada stands out as a global leader on clean air, ranking 8th overall for air quality among high-income countries.

Canada’s record underscores both the progress made in achieving cleaner air and the quality of life our clean air supports.

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Daily Caller1 day ago

Daily Caller1 day agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Great Reset1 day ago

Great Reset1 day agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Automotive2 days ago

Automotive2 days agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Digital ID1 day ago

Digital ID1 day agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Community1 day ago

Community1 day agoCharitable giving on the decline in Canada

-

Alberta1 day ago

Alberta1 day agoSchools should go back to basics to mitigate effects of AI

-

Alberta4 hours ago

Alberta4 hours agoAlberta’s huge oil sands reserves dwarf U.S. shale