Business

Bank of Canada missteps helped fuel today’s inflation

The correlation between the quantity of money and inflation shown is not perfect but strong enough to justify the conclusion that Canada would have avoided the inflation starting in early 2021 had the Bank not increased the money supply so dramatically during the first year of the pandemic.

According to Statistics Canada’s latest consumer price index report, in February the annual inflation rate fell to 2.8 per cent, raising the prospect of interest rate cuts by the Bank of Canada sometime this year. “Inflation is caused by too many dollars chasing too few goods” used to be the traditional diagnosis of the cause of inflation, prompting central banks to fight it by slowing the growth of the money supply. This approach is based on what is known as the “monetarist” theory of inflation, which suggests that supply shocks such as those associated with the COVID pandemic do not cause inflation but only a temporary increase in the price level, which is reversed once the cause of the shock ends—unless the money supply has increased.

In recent decades, central banks have fought inflation using interest rates instead of monetary growth. This switch followed the postwar success of Keynesian theory, which blames inflation on excess aggregate demand, which higher interest rates are supposed to curtail.

Targeting interest rates can work if central banks simultaneously pay attention to money growth, but too often they’ve failed to do so. Equally, targeting the money supply can create inflation-fighting interest rates. However, interest rate targeting in practice has a serious shortcoming. Aggregate spending is influenced by real interest rates while central banks can set only nominal rates and real rates are beyond their control because they cannot change inflation by any direct policy.

This important problem arises because, for example, a nominal interest rate of 6 per cent turns into a real rate of minus 2 per cent if the expected inflation is 8 per cent. At that rate, investors can borrow $1 million at 6 per cent, use the money to buy real estate, sell it a year later after it has appreciated at the expected 8 per cent, repay the $1 million and take home a capital gain of $20,000. In other words, the high expected inflation rate incentivizes consumers and businesses to borrow more, which results in faster money growth and risks even higher inflation.

The expected rate of inflation exists only in peoples’ minds and is determined by many factors. The Bank of Canada collects as much information as it can, drawing on the results of public surveys, the information contained in the prices of so-called Real Return Yields, and sophisticated economic models produced by the Bank’s economists. But these efforts do not result in reliable information, as evidenced by the uncertain and speculative nature of economic forecasts found in its economic updates.

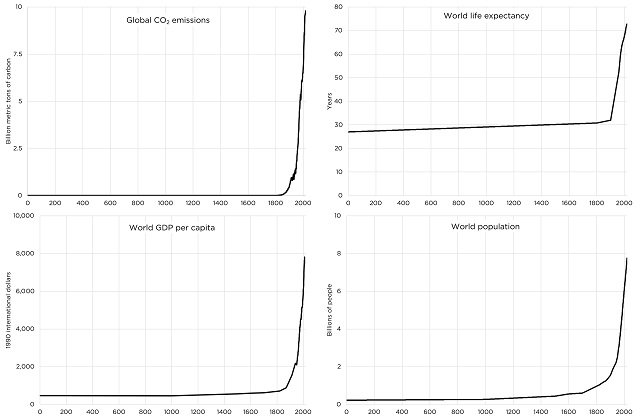

The problems associated with not knowing the real rate of interest have persuaded some economists, called “monetarists,” to urge central banks to target the money supply including famed economist Milton Friedman whose monumental study of the history of U.S. money supply and inflation inspired many including David Laidler, emeritus professor at the University of Western Ontario, and Britain’s John Greenwood who maintains a large database he used to create the accompanying graph.

This graph shows Canada’s annual rate of inflation (measured on the left axis) and the annual rate of growth of the money supply (M3) (measured on the right axis) for the years 2014 to 2024 using data published by the Bank of Canada and Statistics Canada, which require little manipulation. The annual percentage change in the money supply is averaged over 12-months, as is done widely to smooth data that fluctuate much over short periods; and the resultant time series is shifted forward 18 months, to achieve the best fit between changes in money growth and changes in inflation in the monetarist tradition, which has found the lag to have been variable historically between 12 and 18 months. (Thus, the peak smoothed money supply growth rate of more than 13 per cent occurred in February/March 2021, but is shown as occurring in August/September 2022, some 18 months later and close to the peak of inflation in June 2022.)

The correlation between the quantity of money and inflation shown is not perfect but strong enough to justify the conclusion that Canada would have avoided the inflation starting in early 2021 had the Bank not increased the money supply so dramatically during the first year of the pandemic.

In 1994, John Crow, then-governor of the Bank of Canada, presented to a parliamentary finance committee a report on the economic outlook. One of the authors of this op-ed (Grubel) was at this meeting. In response to his question, Crow said that the Bank’s econometric forecasting model did not include data on the money supply but that he always looked over his shoulders to ensure it does not get out of line. If his successors had followed his practice, perhaps Canada’s present inflation would have been avoided.

But then it would not be possible to test the usefulness of the model, which draws on money supply growth data over the last 18 months to predict that inflation should fall to 2 per cent near year-end 2024 or early 2025.

If the prediction is realized, however, Canadians should not expect the lower inflation rate to result in lower costs of living. That would happen only if the Bank made the money growth rate negative, something history suggests is unlikely because it usually resulted in recessions. How much better it would have been if the inflation genie had never been allowed out of the lamp.

Authors:

Automotive

The EV ‘Bloodbath’ Arrives Early

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By David Blackmon

Ever since March 16, when presidential candidate Donald Trump created a controversy by predicting President Joe Biden’s efforts to force Americans to convert their lives to electric-vehicle (EV) lifestyles would end in a “bloodbath” for the U.S. auto industry, the industry’s own disastrous results have consistently proven him accurate.

The latest example came this week when Ford Motor Company reported that it had somehow managed to lose $132,000 per unit sold during Q1 2024 in its Model e EV division. The disastrous first quarter results follow the equally disastrous results for 2023, when the company said it lost $4.7 billion in Model e for the full 12-month period.

While the company has remained profitable overall thanks to strong demand for its legacy internal combustion SUV, pickup, and heavy vehicle models, the string of major losses in its EV line led the company to announce a shift in strategic vision in early April. Ford CEO Jim Farley said then that the company would delay the introduction of additional planned all-electric models and scale back production of current models like the F-150 Lightning pickup while refocusing efforts on introducing new hybrid models across its business line.

General Motors reported it had good overall Q1 results, but they were based on strong sales of its gas-powered SUV and truck models, not its EVs. GM is so gun-shy about reporting EV-specific results that it doesn’t break them out in its quarterly reports, so there is no way of knowing what the real bottom line amounts to from that part of the business. This is possibly a practice Ford should consider adopting.

After reporting its own disappointing Q1 results in which adjusted earnings collapsed by 48% and deliveries dropped by 20% from the previous quarter, Tesla announced it is laying off 10 percent of its global workforce, including 2,688 employees at its Austin plant, where its vaunted Cybertruck is manufactured. Since its introduction in November, the Cybertruck has been beset by buyer complaints ranging from breakdowns within minutes after taking delivery, to its $3,000 camping tent feature failing to deploy, to an incident in which one buyer complained his vehicle shut down for 5 hours after he failed to put the truck in “carwash mode” before running it through a local car wash.

Meanwhile, international auto rental company Hertz is now fire selling its own fleet of Teslas and other EV models in its efforts to salvage a little final value from what is turning out to be a disastrous EV gamble. In a giant fit of green virtue-signaling, the company invested whole hog into the Biden subsidy program in 2021 with a mass purchase of as many as 100,000 Teslas and 50,000 Polestar models, only to find that customer demand for renting electric cars was as tepid as demand to buy them outright. For its troubles, Hertz reported it had lost $392 million during Q1, attributing $195 million of the loss to its EV struggles. Hertz’s share price plummeted by about 20% on April 25, and was down by 55% for the year.

If all this financial carnage does not yet constitute a “bloodbath” for the U.S. EV sector, it is difficult to imagine what would. But wait: It really isn’t all that hard to imagine at all, is it? When he used that term back in March, Trump was referring not just to the ruinous Biden subsidy program, but also to plans by China to establish an EV-manufacturing beachhead in Mexico, from which it would be able to flood the U.S. market with its cheap but high-quality electric models. That would definitely cause an already disastrous domestic EV market to get even worse, wouldn’t it?

The bottom line here is that it is becoming obvious even to ardent EV fans that US consumer demand for EVs has reached a peak long before the industry and government expected it would.

It’s a bit of a perfect storm, one that rent-seeking company executives and obliging policymakers brought upon themselves. Given that this outcome was highly predictable, with so many warning that it was in fact inevitable, a reckoning from investors and corporate boards and voters will soon come due. It could become a bloodbath of its own, and perhaps it should.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

UN plastics plans are unscientific and unrealistic

News release from the Coalition of Concerned Manufacturers and Businesses of Canada

“We must focus on practical solutions and upgrading our recycling infrastructure, not ridiculous restrictions that will harm our health care system, sanitary food supply, increase costs and endanger Canadians’ safety, among other downsides.”

This week Ottawa welcomes 4,000 delegates from the United Nations to discuss how they will oversee a reduction and even possible elimination of plastics from our lives. The key problem is no one has ever figured out how they will replace this essential component of our modern economy and society. The Coalition of Concerned Manufacturers and Businesses of Canada (CCMBC) has launched an information campaign to discuss the realities of plastic, how it contributes massively to our society and the foolishness of those who think plastics can be eliminated or greatly reduced without creating serious problems for key industries such as health care, sanitary food provision, many essential consumer products and safety/protective equipment, among others. CCMBC President Catherine Swift said “The key goal should be to keep plastics in the economy and out of the environment, not eliminate many valuable and irreplaceable plastic items. The plastics and petrochemical industries represent about 300,000 jobs and tens of billions contribution to GDP in Canada, and are on a growth trend.”

The UN campaign to ban plastics to date has been thwarted by reality and facts. UN efforts to eliminate plastics began in 2017, motivated by such terrible images as rivers with massive amounts of floating plastic and animals suffering from negative effects of plastic materials. Although these images were dramatic and disturbing, they do not represent the big picture of what is really happening and do not take into account the many ways plastics are hugely positive elements of modern society. Swift added “Furthermore, Canada is not one of the problem countries with respect to plastics waste. Developing countries are the main culprits and any solution must involve helping the leading plastics polluters find workable solutions and better recycling technology and practices.”

The main goal of plastic is to preserve and protect. Can you imagine health care without sanitary, flexible, irreplaceable and recyclable plastic products? How would we keep our food fresh, clean and healthy without plastic wraps and packaging? Plastic replaces many heavier and less durable materials in so many consumer products too numerous to count. Plastics help the environment by reducing food waste, replacing heavier materials in automobiles and other products that make them more energy-efficient. Many plastics are infinitely recyclable and innovations are taking place to improve them constantly. What is also less known is that most of the replacements for plastics are more expensive and actually worse for the environment.

Swift stated “Environment Minister Steven Guilbeault has been convinced by the superficial arguments that plastics are always bad despite the facts. He has pursued a campaign against all plastics as a result, without factoring in the reality of the immense value of plastic products and that nothing can replace their many attributes. Fortunately, the Canadian Federal court overturned his absurd ban on a number of plastic products on the basis that it was unscientific, impractical and impinged upon provincial jurisdiction.” Sadly, Guilbeault and his Liberal cohorts plan to appeal this legal decision despite its common-sense conclusions. Opinion polls of Canadians show that a strong majority would prefer this government abandon its plastics crusade at this point, but history shows these Liberals prefer pursuing their unrealistic and costly ideologies instead of policies that Canadians support.

The bottom line is that plastics are an essential part of our modern society and opposition has been based on erroneous premises and ill-informed environmentalist claims. Swift concluded “Canada’s record on plastics is one of the best in the world. This doesn’t mean the status quo is sufficient, but we must focus on practical solutions and upgrading our recycling infrastructure, not ridiculous restrictions that will harm our health care system, sanitary food supply, increase costs and endanger Canadians’ safety, among other downsides.” The current Liberal government approach is one that has no basis in fact or science and emphasizes virtue-signaling over tangible and measurable results. Swift noted “The UN’s original founding purpose after World War II was to prevent another world war. Given our fractious international climate, they should stick to their original goal instead of promoting social justice warrior causes that are unhelpful and expensive.”

The CCMBC was formed in 2016 with a mandate to advocate for proactive and innovative policies that are conducive to manufacturing and business retention and safeguarding job growth in Canada.

SOURCE Coalition of Concerned Manufacturers and Businesses of Canada

-

Energy2 days ago

Energy2 days agoAnti-LNG activists have decided that they now actually care for LNG investors after years of calling to divest

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoDesperate Liberals move to stop MPs from calling Trudeau ‘corrupt’

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoIs the Overton Window Real, Imagined, or Constructed?

-

conflict2 days ago

conflict2 days agoCol. Douglas Macgregor torches Trump over support for bill funding wars in Ukraine and Israel

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoThe end of Canada: The shift from democracy to totalitarian behavior in the ‘pandemic era’

-

Energy1 day ago

Energy1 day agoReflections on Earth Day

-

Alberta17 hours ago

Alberta17 hours agoAlberta rejects unconstitutional cap on plastic production

-

Great Reset2 days ago

Great Reset2 days agoTerrorists Welcome: Chronic counterterrorism lapses at the border demand investigation