Alberta

Alberta fiscal update: second quarter is outstanding, challenges ahead

Alberta maintains a balanced budget while ensuring pressures from population growth are being addressed.

Alberta faces rising risks, including ongoing resource volatility, geopolitical instability and rising pressures at home. With more than 450,000 people moving to Alberta in the last three years, the province has allocated hundreds of millions of dollars to address these pressures and ensure Albertans continue to be supported. Alberta’s government is determined to make every dollar go further with targeted and responsible spending on the priorities of Albertans.

The province is forecasting a $4.6 billion surplus at the end of 2024-25, up from the $2.9 billion first quarter forecast and $355 million from budget, due mainly to higher revenue from personal income taxes and non-renewable resources.

Given the current significant uncertainty in global geopolitics and energy markets, Alberta’s government must continue to make prudent choices to meet its responsibilities, including ongoing bargaining for thousands of public sector workers, fast-tracking school construction, cutting personal income taxes and ensuring Alberta’s surging population has access to high-quality health care, education and other public services.

“These are challenging times, but I believe Alberta is up to the challenge. By being intentional with every dollar, we can boost our prosperity and quality of life now and in the future.”

Midway through 2024-25, the province has stepped up to boost support to Albertans this fiscal year through key investments, including:

- $716 million to Health for physician compensation incentives and to help Alberta Health Services provide services to a growing and aging population.

- $125 million to address enrollment growth pressures in Alberta schools.

- $847 million for disaster and emergency assistance, including:

- $647 million to fight the Jasper wildfires

- $163 million for the Wildfire Disaster Recovery Program

- $5 million to support the municipality of Jasper (half to help with tourism recovery)

- $12 million to match donations to the Canadian Red Cross

- $20 million for emergency evacuation payments to evacuees in communities impacted by wildfires

- $240 million more for Seniors, Community and Social Services to support social support programs.

Looking forward, the province has adjusted its forecast for the price of oil to US$74 per barrel of West Texas Intermediate. It expects to earn more for its crude oil, with a narrowing of the light-heavy differential around US$14 per barrel, higher demand for heavier crude grades and a growing export capacity through the Trans Mountain pipeline. Despite these changes, Alberta still risks running a deficit in the coming fiscal year should oil prices continue to drop below $70 per barrel.

After a 4.4 per cent surge in the 2024 census year, Alberta’s population growth is expected to slow to 2.5 per cent in 2025, lower than the first quarter forecast of 3.2 per cent growth because of reduced immigration and non-permanent residents targets by the federal government.

Revenue

Revenue for 2024-25 is forecast at $77.9 billion, an increase of $4.4 billion from Budget 2024, including:

- $16.6 billion forecast from personal income taxes, up from $15.6 billion at budget.

- $20.3 billion forecast from non-renewable resource revenue, up from $17.3 billion at budget.

Expense

Expense for 2024-25 is forecast at $73.3 billion, an increase of $143 million from Budget 2024.

Surplus cash

After calculations and adjustments, $2.9 billion in surplus cash is forecast.

- $1.4 billion or half will pay debt coming due.

- The other half, or $1.4 billion, will be put into the Alberta Fund, which can be spent on further debt repayment, deposited into the Alberta Heritage Savings Trust Fund and/or spent on one-time initiatives.

Contingency

Of the $2 billion contingency included in Budget 2024, a preliminary allocation of $1.7 billion is forecast.

Alberta Heritage Savings Trust Fund

The Alberta Heritage Savings Trust Fund grew in the second quarter to a market value of $24.3 billion as of Sept. 30, 2024, up from $23.4 billion at the end of the first quarter.

- The fund earned a 3.7 per cent return from July to September with a net investment income of $616 million, up from the 2.1 per cent return during the first quarter.

Debt

Taxpayer-supported debt is forecast at $84 billion as of March 31, 2025, $3.8 billion less than estimated in the budget because the higher surplus has lowered borrowing requirements.

- Debt servicing costs are forecast at $3.2 billion, down $216 million from budget.

Related information

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

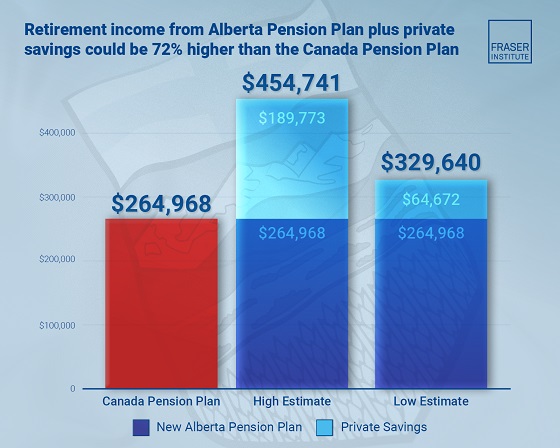

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Energy2 days ago

Energy2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

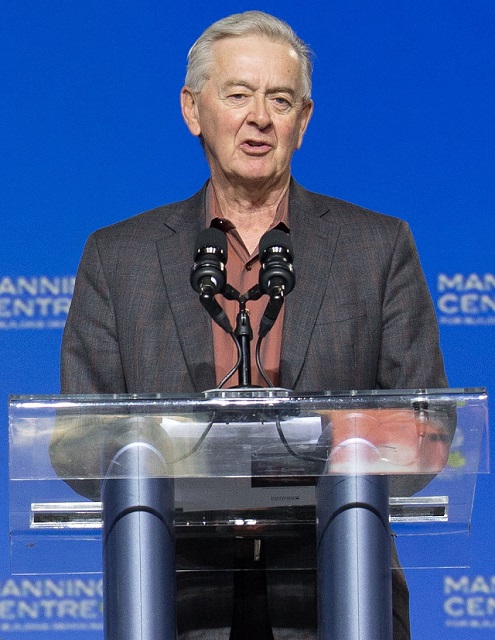

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Red Deer1 day ago

Red Deer1 day agoWesterner Days Attraction pass and New Experiences!