Business

What is a Retirement Compensation Arrangement (“RCA”)?

An RCA is a plan that is funded by contributions from employers and employees to a custodian who manages the funds. RCAs are used to fund the retirement of an employee, their loss of employment or a substantial change in the services that they provide.

How it works?

Employers make annual tax deductible contributions to an RCA that are subject to a refundable 50% withholding tax. Since the payments are not made to the employee, they are not subject to any tax implications in the year the contributions are made. When payments are made from the plan to the employee, the refundable taxes paid are recovered at the same rate (e.g. $1 of every $2 paid). All income earned within the plan is subject to the refundable 50% tax and is recoverable at the same rate as above. The employee pays personal tax on distributions from the RCA in the year they are received.

Employees can also make tax deductible contributions to an RCA. The contributions are similarly considered deductible and subject to the 50% refundable withholding tax.

Types of plans

An RCA can be set up as either a Defined Benefit Plan (“DBP”) or a Defined Contribution Plan (“DCP”). As the title suggests, a DBP provides employees with a defined pension amount annually, upon retirement. Whereas employees on a DCP will receive only what was contributed to the plan, plus any income earned or less any losses incurred, a DBP will require the periodic involvement of an actuary to determine whether the plan is properly funded.

A DBP puts the risk of losses on investments in the hands of the employer and a DCP passes that risk to the employees as they will receive what is remaining in the plan.

Who will benefit from RCAs?

Employees

Employees who participate in an RCA will enjoy future pension benefits and peace of mind knowing that, if the employer were to close down and they lost their employment, the assets of the RCA would be protected against the creditors of the employer.

The 50% refundable withholding rate is currently less than the top tax bracket in a number of provinces. As such, the after-tax investment for the pension is no longer considered a disadvantage to RCAs for high-income earning employees as the plan will invest 50% of the amount they are paid as opposed to less than 50%, had they been paid as a salary.

Contributions to the RCA by an employer will not reduce the RRSP contribution room for the employee, which is not the case for contributions made to a Retirement Pension Plan (“RPP”).

Further tax savings can be obtained by paying the employees out of the RCA in future years when their income levels are lower and subject to lower marginal tax rates. When you consider the ability to include income in lower income earning years, employees living in provinces and territories not subject to >50% tax at the top rate can still benefit from an RCA.

Employers

Employers may wish to provide a retirement package for their employees but not pay the high costs of operating an RPP or an Individual Pension Plan (“IPP”). If the owner-manager of the company or someone already within the company completes the required remittance forms and bookkeeping for the plan, the costs associated with an RCA would include the preparation of the trust return, identified above, and investment advisor fees, if an advisor is used. Additional costs may be applicable for DPBs since possible periodic actuarial valuations may be needed to ensure the plan is properly funded.

Employers can also utilize RCAs for what’s referred to as “Golden Handcuffs,” meaning they can require an employee to meet certain length-of-employment requirements before the pension contributions vest. This will help employers retain key employees that are vital to their operations.

Tax benefits for employer

One group that may benefit most from these plans are companies involved in Scientific Research and Experimental Development (“SRED”) that must maintain low taxable income and taxable capital figures to retain their benefits from the enhanced investment tax credits. Since the taxable income and taxable capital figures exceed $500,000 and $10,000,000, respectively, the amount eligible for the enhanced tax credit decreases.

Federally, expenditures eligible for the enhanced tax credit are eligible for a 35% tax credit, whereas expenditures not eligible only provide for a 15% tax credit. When you also consider the provincial tax credit implications, it’s critical for these companies to maintain sufficient expenditure pool levels.

One common method for ensuring low income and taxable capital figures is to declare bonuses for the owner-managers and to pay those bonuses out of the company to reduce taxable capital. This is a good opportunity to use RCAs. The top tax rate in seven of Canada’s thirteen provinces or territories is over 50%. Given the RCA withholding rates are currently 50%, this can provide a deferral of up to 4% depending on your province. When you add the additional payroll costs, this can result in significant savings.

How much should be contributed?

An employer must be careful not to contribute an unreasonable amount to the plan on behalf of an employee as it could result in the plan being re-characterized as an SDA. The starting point for a reasonable DCP amount would be the 18% that is used to create RRSP deduction room annually. A higher rate would likely require a very strong argument as to why it’s reasonable.

A DBP requires a certain level of assets to be held within the plan to support the future pension obligations that an actuary has calculated. Given that the plan will require a certain amount, a reasonable contribution will be the amount that brings the assets of that plan to a sufficient level to fund that obligation. The pension benefit, however, must be considered a reasonable amount. Again, a reasonable amount will vary based on the facts of each situation.

The CRA has indicated that it will permit a deduction for recognition of an employee’s years of services even if it occurred prior to the establishment of the RCA.1 Since past years of service can be recognized, large contributions may be eligible when the RCA is initially established.

Careful planning is required to ensure that the plan meets the criteria of an RCA as adverse tax effects could result otherwise. You should seek professional advice if you are setting up an RCA.

Jesse Genereaux is a tax manager in the Durham office of Collins Barrow.

Want to get in touch with Jesse?

Connect with him by email at [email protected].

Business

The Truth Is Buried Under Sechelt’s Unproven Graves

From the Frontier Centre for Public Policy

Millions spent, no exhumations. What are we actually mourning?

From Aug. 15 to 17, 2025, the Canadian flag flew at half-mast above the British Columbia legislature. The stated reason: to honour the shíshálh Nation and mourn the alleged discovery of 81 unmarked graves of Indigenous children near the former St. Augustine’s Residential School in Sechelt.

But unlike genuine mourning, this display of grief lacked a body, a name or a single verifiable piece of evidence. As MLA Tara Armstrong rightly observed in her open letter to the Speaker, this symbolic act was “shameful”—a gesture unmoored from fact, driven by rumour, emotion and political inertia.

The flag was lowered in response to claims from University of Saskatchewan archaeologist Dr. Terry Clark. According to announcements from both 2023 and 2025, Dr. Clark “discovered” 81 unmarked graves using ground-penetrating radar—a tool that detects changes in soil, not bones. Its signals require interpretation—and in this case, the necessary context never arrived.

Even more concerning, there has been no release of names or records. Chief Lenora Joe of the shíshálh Nation said the names of the children are “well known” to Elders. Yet none have been made public: not a single missing child reported, no date of disappearance, no death certificate, not even a family willing to speak openly.

Instead, we’re being asked to accept deeply held recollections as conclusive proof—without corroborating evidence.

The original 40 anomalies—first announced in April 2023—appear to be located beneath the paved parking lot of the band’s administrative and cultural hub, the House of Hewhiwus complex. This land has been excavated before. At no point were any human remains discovered. As former Chief Warren Paull confirmed, “remains were never found” and the stories circulating then “don’t include burial at all.” The pattern of red dots in the band’s video—a tidy grid beneath the asphalt—looked less like sacred ground and more like a plumbing schematic.

The grief narrative, meanwhile, was presented with great care. Professionally produced videos showed solemn Elders, blurred radar images and mournful speeches—all designed to evoke emotion while discouraging inquiry. In one video, Chief Joe warned that asking questions would “cause trauma.”

But reconciliation doesn’t mean blind acceptance. Silencing questions isn’t healing—it risks turning reconciliation into a one-way narrative.

In a 2025 follow-up, Dr. Clark reported another 41 anomalies—this time likely in the community’s own cemetery on Sinku Drive. Brief footage confirms that GPR was conducted among existing gravesites, where decayed wooden markers would naturally result in “unmarked” burials. As Tara Armstrong noted, finding undocumented graves in or near a cemetery is about as surprising as spotting seagulls at a landfill.

Even so, political leaders continued to validate the narrative.

The B.C. government endorsed the claims with another round of symbolic mourning. In doing so, it lent the power of the state to what increasingly resembles collective fiction. Since 2021, similar claims across Canada have triggered government apologies, funding announcements and media headlines—often without physical evidence.

Residential schools were bureaucratic institutions. They kept meticulous enrolment and death logs. The Truth and Reconciliation Commission, with eight years of access to these archives, conducted more than 6,500 interviews and reviewed thousands of documents. It found no cases of children who disappeared without a trace. Despite this, $2.6 million in federal funds was spent in 2025 alone on the Sechelt investigation.

This isn’t reconciliation: it’s mythmaking dressed up as healing. Worse still, it undermines real tragedies by replacing verifiable history with folklore dressed up in government robes.

Governments should not promote unverified stories with ceremonial gestures. Flags lowered at half-mast should honour actual deaths, not narrative convenience. Public policy, especially around historical reckoning, must be rooted in fact, not feelings.

If reconciliation is to mean anything, it must be anchored in shared truth. And the truth is, we cannot mourn 81 phantom children because they almost certainly never existed.

Canadians must start insisting on evidence. The standard of proof should be no different here than in any serious allegation. The principle that underpins our justice system—innocent until proven guilty—must also guide our view of history.

State-sponsored guilt rituals disconnected from verifiable fact are not justice.

They are theatre.

And not even good theatre.

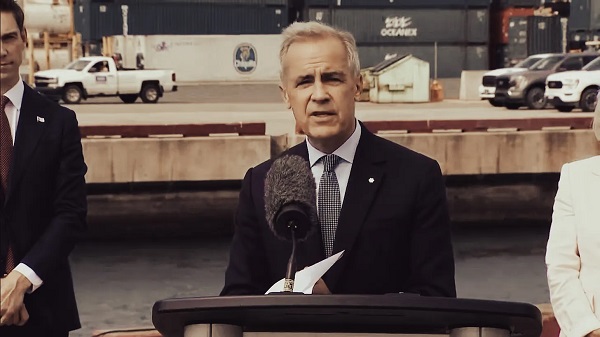

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023). With files from Nina Green.

Business

Ottawa’s so-called ‘Clean Fuel Standards’ cause more harm than good

From the Fraser Institute

To state the obvious, poorly-devised government policies can not only fail to provide benefits but can actually do more harm than good.

For example, the federal government’s so-called “Clean Fuel Regulations” (or CFRs) meant to promote the use of low-carbon emitting “biofuels” produced in Canada. The CFRs, which were enacted by the Trudeau government, went into effect in July 2023. The result? Higher domestic biofuel prices and increased dependence on the importation of biofuels from the United States.

Here’s how it works. The CFRs stipulate that commercial fuel producers (gasoline, diesel fuel) must use a certain share of “biofuels”—that is, ethanol, bio-diesel or similar non-fossil-fuel derived energetic chemicals in their final fuel product. Unfortunately, Canada’s biofuel producers are having trouble meeting this demand. According to a recent report, “Canada’s low carbon fuel industry is struggling,” which has led to an “influx of low-cost imports” into Canada, undermining the viability of domestic biofuel producers. As a result, “many biofuels projects—mostly renewable diesel and sustainable aviation fuel—have been paused or cancelled.”

Adding insult to injury, the CFRs are also economically costly to consumers. According to a 2023 report by the Parliamentary Budget Officer, “the cost to lower income households represents a larger share of their disposable income compared to higher income households. At the national level, in 2030, the cost of the Clean Fuel Regulations to households ranges from 0.62 per cent of disposable income (or $231) for lower income households to 0.35 per cent of disposable income (or $1,008) for higher income households.”

Moreover, “Relative to disposable income, the cost of the Clean Fuel Regulations to the average household in 2030 is the highest in Saskatchewan (0.87 per cent, or $1,117), Alberta (0.80 per cent, or $1,157) and Newfoundland and Labrador (0.80 per cent, or $850), reflecting the higher fossil fuel intensity of their economies. Meanwhile, relative to disposable income, the cost of the Clean Fuel Regulations to the average household in 2030 is the lowest in British Columbia (0.28 per cent, or $384).”

So, let’s review. A government mandate for the use of lower-carbon fuels has not only hurt fuel consumers, it has perversely driven sourcing of said lower-carbon fuels away from Canadian producers to lower-cost higher-volume U.S. producers. All this to the deficit of the Canadian economy, and the benefit of the American economy. That’s two perverse impacts in one piece of legislation.

Remember, the intended beneficiaries of most climate policies are usually portrayed as lower-income folks who will purportedly suffer the most from future climate change. The CFRs whack these people the hardest in their already-strained wallets. The CFRs were also—in theory—designed to stimulate Canada’s lower-carbon fuel industry to satisfy domestic demand by fuel producers. Instead, these producers are now looking to U.S. imports to comply with the CFRs, while Canadian lower-carbon fuel producers languish and fade away.

Poorly-devised government policies can do more harm than good. Clearly, Prime Minister Carney and his government should scrap these wrongheaded regulations and let gasoline and diesel producers produce fuel—responsibly, but as cheaply as possible—to meet market demand, for the benefit of Canadians and their families. A radical concept, I know.

-

Business2 days ago

Business2 days agoRed tape is killing Canadian housing affordability

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoUK Police Chief Hails Facial Recognition, Outlines Drone and AI Policing Plans

-

Health2 days ago

Health2 days agoMAiD should not be a response to depression

-

2025 Federal Election2 days ago

2025 Federal Election2 days agoPost election report indicates Canadian elections are becoming harder to secure

-

International2 days ago

International2 days agoTrump to Confront Starmer Over UK Free Speech Laws During State Visit

-

Duane Rolheiser2 days ago

Duane Rolheiser2 days agoUnite the Kingdom Rally: demonstrators take to the streets in historical numbers to demand end to mass migration in the UK

-

Crime2 days ago

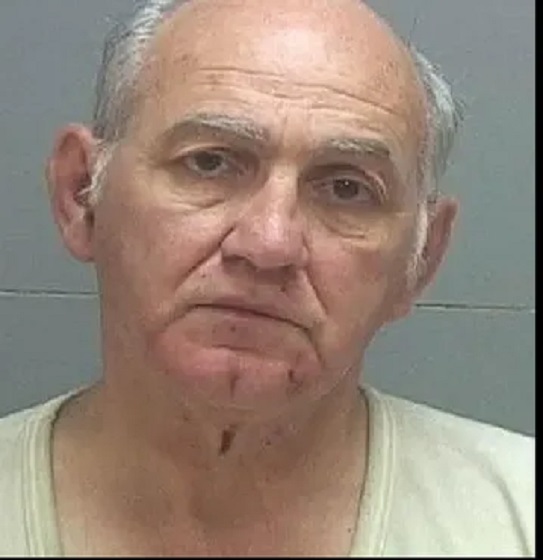

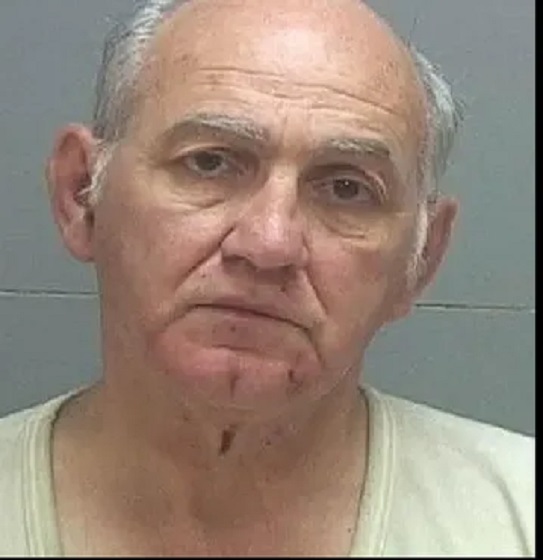

Crime2 days agoOlder man arrested at Kirk shooting admits to protecting real gunman

-

MAiD2 days ago

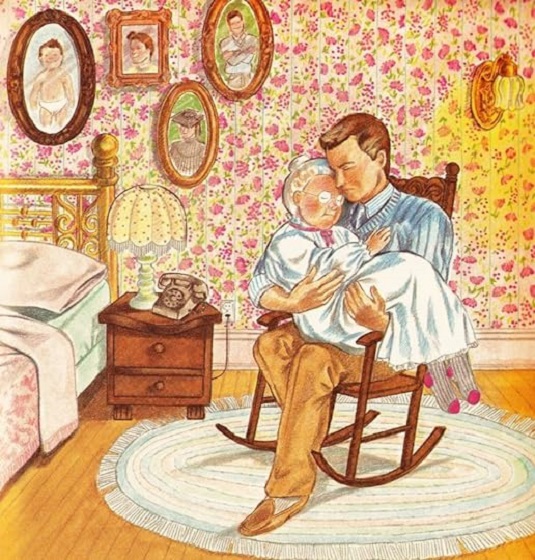

MAiD2 days agoFamous Canadian children’s author Robert Munsch says he plans to die by euthanasia