Alberta

A battle over beer … between curlers?

Alberta’s Liquor Industry pushes back on Glenn Howard’s Ontario Beer ‘Facts’ in a new Social Media campaign.

Edmonton – Two Canadian curling stars are now battling off the rink in a war of ‘facts’ about provincial liquor laws that has broken out between Alberta and Ontario.

Brendan Bottcher, an Alberta curling champion, is starring in “Ontario Beer ‘Fake Facts’”, a social media campaign that launched today to counter misinformation being spread in Ontario about Alberta’s liquor laws and stores.

The Beer Store, a consortium of brewers that is fighting a move by the Doug Ford provincial government to sell beer and liquor in corner stores, has argued Alberta’s privatized system isn’t good for customers and allows for easier access to alcohol for minors. The Beer Store’s campaign is called “Ontario Beer Facts” and features Ontario curling champion Glenn Howard.

“[Howard]’s jealous. Our liquor stores are better and [so are] our curling teams,” Bottcher quips in one of the “Ontario Beer ‘Fake Facts’” ads being launched today.

Alberta Liquor Stores Association (ALSA) produced the campaign in an attempt to set the record straight about Alberta’s thriving and socially responsible private liquor industry.

“In Alberta, our liquor industry is open for business – literally from 10 a.m. to 2 a.m. We’re proud of the private liquor industry we’ve built here since 1993. Free enterprise doesn’t mean there is a free-for-all, Wild West system. But it does mean we have competitive prices and better service, hours and selection for our customers.”

Ivonne Martinez, President of Alberta Liquor Stores Association

Oh, and on that whole thing about the price of beer in Alberta – Martinez had this to say.

“…And what about The Beer Store’s claim that a 24 pack of Coors Light is more expensive in Alberta than in Ontario? The Beer Store is owned by Labatts and Molson (National Brewers). National Brewers, just like any manufacturer, sets the price for their products for each province. The price has nothing to do with the distribution model, the price is set by Molson themselves which set a higher price for their beer in Alberta…”

To view the Alberta campaign click here.

And to view the Ontario campaign click here.

Backgrounder About Alberta’s Liquor Industry:

- The $3-billion industry contributes approximately $866-million annually to provincial revenues

- 1,500+ private liquor stores operate in Alberta from 10 a.m. to 2 a.m. daily, including New Year’s Eve

- Since the industry was privatized in 1993, it has created approximately 12,000 new jobs for Albertans

- Alberta liquor stores offer more than 26,000 options, including 7,000 beer types; in Ontario, they sell less than 2,000 beer brands.

Alberta

Schools should go back to basics to mitigate effects of AI

From the Fraser Institute

Odds are, you can’t tell whether this sentence was written by AI. Schools across Canada face the same problem. And happily, some are finding simple solutions.

Manitoba’s Division Scolaire Franco-Manitobaine recently issued new guidelines for teachers, to only assign optional homework and reading in grades Kindergarten to six, and limit homework in grades seven to 12. The reason? The proliferation of generative artificial intelligence (AI) chatbots such as ChatGPT make it very difficult for teachers, juggling a heavy workload, to discern genuine student work from AI-generated text. In fact, according to Division superintendent Alain Laberge, “Most of the [after-school assignment] submissions, we find, are coming from AI, to be quite honest.”

This problem isn’t limited to Manitoba, of course.

Two provincial doors down, in Alberta, new data analysis revealed that high school report card grades are rising while scores on provincewide assessments are not—particularly since 2022, the year ChatGPT was released. Report cards account for take-home work, while standardized tests are written in person, in the presence of teaching staff.

Specifically, from 2016 to 2019, the average standardized test score in Alberta across a range of subjects was 64 while the report card grade was 73.3—or 9.3 percentage points higher). From 2022 and 2024, the gap increased to 12.5 percentage points. (Data for 2020 and 2021 are unavailable due to COVID school closures.)

In lieu of take-home work, the Division Scolaire Franco-Manitobaine recommends nightly reading for students, which is a great idea. Having students read nightly doesn’t cost schools a dime but it’s strongly associated with improving academic outcomes.

According to a Programme for International Student Assessment (PISA) analysis of 174,000 student scores across 32 countries, the connection between daily reading and literacy was “moderately strong and meaningful,” and reading engagement affects reading achievement more than the socioeconomic status, gender or family structure of students.

All of this points to an undeniable shift in education—that is, teachers are losing a once-valuable tool (homework) and shifting more work back into the classroom. And while new technologies will continue to change the education landscape in heretofore unknown ways, one time-tested winning strategy is to go back to basics.

And some of “the basics” have slipped rapidly away. Some college students in elite universities arrive on campus never having read an entire book. Many university professors bemoan the newfound inability of students to write essays or deconstruct basic story components. Canada’s average PISA scores—a test of 15-year-olds in math, reading and science—have plummeted. In math, student test scores have dropped 35 points—the PISA equivalent of nearly two years of lost learning—in the last two decades. In reading, students have fallen about one year behind while science scores dropped moderately.

The decline in Canadian student achievement predates the widespread access of generative AI, but AI complicates the problem. Again, the solution needn’t be costly or complicated. There’s a reason why many tech CEOs famously send their children to screen-free schools. If technology is too tempting, in or outside of class, students should write with a pencil and paper. If ChatGPT is too hard to detect (and we know it is, because even AI often can’t accurately detect AI), in-class essays and assignments make sense.

And crucially, standardized tests provide the most reliable equitable measure of student progress, and if properly monitored, they’re AI-proof. Yet standardized testing is on the wane in Canada, thanks to long-standing attacks from teacher unions and other opponents, and despite broad support from parents. Now more than ever, parents and educators require reliable data to access the ability of students. Standardized testing varies widely among the provinces, but parents in every province should demand a strong standardized testing regime.

AI may be here to stay and it may play a large role in the future of education. But if schools deprive students of the ability to read books, structure clear sentences, correspond organically with other humans and complete their own work, they will do students no favours. The best way to ensure kids are “future ready”—to borrow a phrase oft-used to justify seesawing educational tech trends—is to school them in the basics.

Alberta

Alberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

From the Fraser Institute

By Nadeem Esmail, Mackenzie Moir and Lauren Asaad

In October, Alberta’s provincial government announced forthcoming legislative changes that will allow patients to pay out-of-pocket for any diagnostic test they want, and without a physician referral. The policy, according to the Smith government, is designed to help improve the availability of preventative care and increase testing capacity by attracting additional private sector investment in diagnostic technology and facilities.

Unsurprisingly, the policy has attracted Ottawa’s attention, with discussions now taking place around the details of the proposed changes and whether this proposal is deemed to be in line with the Canada Health Act (CHA) and the federal government’s interpretations. A determination that it is not, will have both political consequences by being labeled “non-compliant” and financial consequences for the province through reductions to its Canada Health Transfer (CHT) in coming years.

This raises an interesting question: While the ultimate decision rests with Ottawa, does the Smith government’s new policy comply with the literal text of the CHA and the revised rules released in written federal interpretations?

According to the CHA, when a patient pays out of pocket for a medically necessary and insured physician or hospital (including diagnostic procedures) service, the federal health minister shall reduce the CHT on a dollar-for-dollar basis matching the amount charged to patients. In 2018, Ottawa introduced the Diagnostic Services Policy (DSP), which clarified that the insured status of a diagnostic service does not change when it’s offered inside a private clinic as opposed to a hospital. As a result, any levying of patient charges for medically necessary diagnostic tests are considered a violation of the CHA.

Ottawa has been no slouch in wielding this new policy, deducting some $76.5 million from transfers to seven provinces in 2023 and another $72.4 million in 2024. Deductions for Alberta, based on Health Canada’s estimates of patient charges, totaled some $34 million over those two years.

Alberta has been paid back some of those dollars under the new Reimbursement Program introduced in 2018, which created a pathway for provinces to be paid back some or all of the transfers previously withheld on a dollar-for-dollar basis by Ottawa for CHA infractions. The Reimbursement Program requires provinces to resolve the circumstances which led to patient charges for medically necessary services, including filing a Reimbursement Action Plan for doing so developed in concert with Health Canada. In total, Alberta was reimbursed $20.5 million after Health Canada determined the provincial government had “successfully” implemented elements of its approved plan.

Perhaps in response to the risk of further deductions, or taking a lesson from the Reimbursement Action Plan accepted by Health Canada, the province has gone out of its way to make clear that these new privately funded scans will be self-referred, that any patient paying for tests privately will be reimbursed if that test reveals a serious or life-threatening condition, and that physician referred tests will continue to be provided within the public system and be given priority in both public and private facilities.

Indeed, the provincial government has stated they do not expect to lose additional federal health care transfers under this new policy, based on their success in arguing back previous deductions.

This is where language matters: Health Canada in their latest CHA annual report specifically states the “medical necessity” of any diagnostic test is “determined when a patient receives a referral or requisition from a medical practitioner.” According to the logic of Ottawa’s own stated policy, an unreferred test should, in theory, be no longer considered one that is medically necessary or needs to be insured and thus could be paid for privately.

It would appear then that allowing private purchase of services not referred by physicians does pass the written standard for CHA compliance, including compliance with the latest federal interpretation for diagnostic services.

But of course, there is no actual certainty here. The federal government of the day maintains sole and final authority for interpretation of the CHA and is free to revise and adjust interpretations at any time it sees fit in response to provincial health policy innovations. So while the letter of the CHA appears to have been met, there is still a very real possibility that Alberta will be found to have violated the Act and its interpretations regardless.

In the end, no one really knows with any certainty if a policy change will be deemed by Ottawa to run afoul of the CHA. On the one hand, the provincial government seems to have set the rules around private purchase deliberately and narrowly to avoid a clear violation of federal requirements as they are currently written. On the other hand, Health Canada’s attention has been aroused and they are now “engaging” with officials from Alberta to “better understand” the new policy, leaving open the possibility that the rules of the game may change once again. And even then, a decision that the policy is permissible today is not permanent and can be reversed by the federal government tomorrow if its interpretive whims shift again.

The sad reality of the provincial-federal health-care relationship in Canada is that it has no fixed rules. Indeed, it may be pointless to ask whether a policy will be CHA compliant before Ottawa decides whether or not it is. But it can be said, at least for now, that the Smith government’s new privately paid diagnostic testing policy appears to have met the currently written standard for CHA compliance.

Lauren Asaad

Policy Analyst, Fraser Institute

-

Censorship Industrial Complex16 hours ago

Censorship Industrial Complex16 hours agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Automotive21 hours ago

Automotive21 hours agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Great Reset19 hours ago

Great Reset19 hours agoViral TikTok video shows 7-year-old cuddling great-grandfather before he’s euthanized

-

Daily Caller17 hours ago

Daily Caller17 hours agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Alberta18 hours ago

Alberta18 hours agoSchools should go back to basics to mitigate effects of AI

-

Daily Caller2 days ago

Daily Caller2 days ago‘Almost Sounds Made Up’: Jeffrey Epstein Was Bill Clinton Plus-One At Moroccan King’s Wedding, Per Report

-

Crime2 days ago

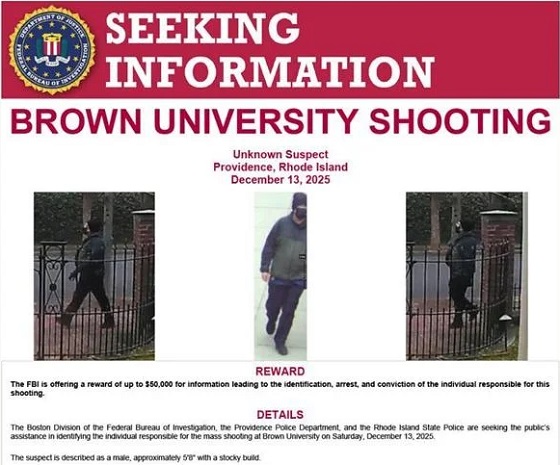

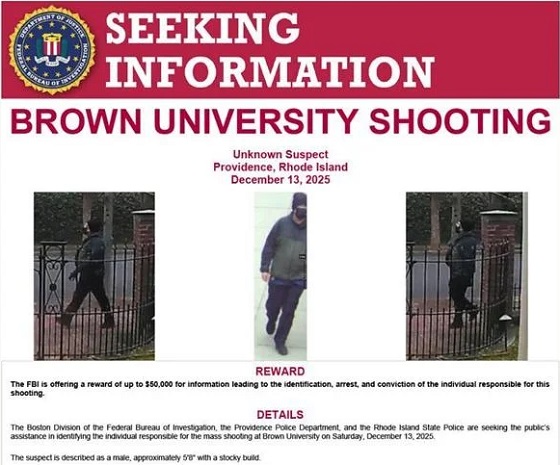

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoHunting Poilievre Covers For Upcoming Demographic Collapse After Boomers