Opinion

Thunder Bay has twin railroads and an under-utilized port once used for grain. Why not oil?

This submission was submitted as an Opinion from Garfield Marks.

Thunder Bay, Ontario, the largest Canadian port of the St. Lawrence Seaway located on the west end of Lake Superior, 1850 kms. from Hardisty, Alberta. A forgotten jewel.

So what, you may ask.

They used to ship grain from Thunder Bay in huge tankers to ports all over the world. Why not oil?

We could run oil tankers to the Irving refinery in New Brunswick, bypassing the controversial pipeline running through eastern Ontario and Quebec.

The pipeline, if that was the transport model chosen, would only need to run through parts of Alberta, Saskatchewan, Manitoba and Ontario. Like, previously stated the pipeline would only be 1850 kms. long.

The other great thing about Thunder Bay is the abundance of rail lines. Transportation for such things as grain and forestry products from western Canada. If you can’t run pipeline from Hardisty, through to Thunder Bay, use the railroad.

Why Hardisty, you may ask.

Hardisty, according to Wikipedia, is mainly known as a pivotal petroleum industry hub where petroleum products such as Western Canada Select blended crude oil and Hardisty heavy oil are produced and traded

The Town of Hardisty owes its existence to the Canadian Pacific Railway. About 1904 the surveyors began to survey the railroad from the east and decided to locate a divisional point at Hardisty because of the good water supply from the river.

Hardisty, Alberta has the railroad and has the product, and the Alberta government is investing $3.7 billion in rail cars for hauling oil while Thunder Bay has the railroad and an under utilised port at the head of the St. Lawrence Seaway.

Economics are there along with opportunity, employment would be created and the east coast could end its’ dependency on imported oil.

Do we have the vision or willingness to consider another option. I am just asking for all avenues to be considered.

Crime

‘We’re Going To Lose’: Steve Bannon Warns Withholding Epstein Files Would Doom GOP

From the Daily Caller News Foundation

By Jason Cohen

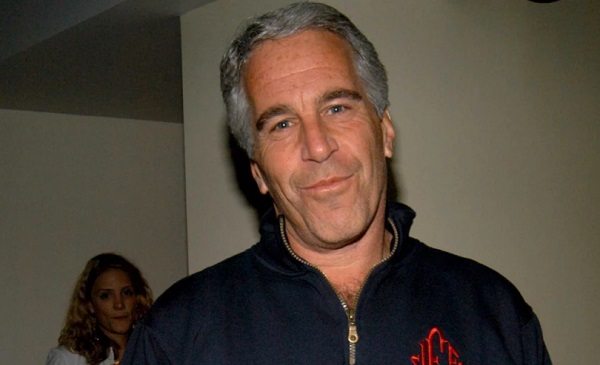

Former White House adviser Steve Bannon warned on Friday that Republicans would suffer major losses if President Donald Trump’s administration does not move to release documents related to deceased pedophile Jeffrey Epstein’s crimes and associations.

Axios reported on Sunday that a two-page memo showed the Department Of Justice (DOJ) and FBI found no evidence Epstein kept a “client list” or was murdered, but public doubts have continued. Bannon said on “Bannon’s War Room” that failure to release information would lead to the dissipation of one-tenth of the Make America Great Again (MAGA) movement and significant losses for the Republican Party in the 2026 midterms and the 2028 presidential election.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“It’s not about just a pedophile ring and all that, it’s about who governs us, right? And that’s why it’s not going to go away … For this to go away, you’re going to lose 10% of the MAGA movement,” Bannon said. “If we lose 10% of the MAGA movement right now, we’re going to lose 40 seats in ’26, we’re going to lose the [presidency]. They don’t even have to steal it, which they’re going to try to do in ’28, because they’re going to sit there and they go, ‘They’ve disheartened the hardest-core populist nationalists’ — that’s always been who governs us.”

Bannon also demanded the publication of all the Epstein documents on “Bannon’s War Room” Thursday. He called on the DOJ to go to court and push for the release of the documents or for Trump to appoint a special counsel to manage the publication.

Epstein was arrested in 2019 and charged with sex trafficking. Shortly after, he was found dead in his New York Metropolitan Correctional Center cell shortly after. Officials asserted that he hanged himself in his cell.

However, Epstein’s death has sparked years of theories because of the malfunctioning of prison cameras, along with guards admitting to falsifying documents about checking on the then-inmate. The DOJ inspector general later confirmed that multiple surveillance cameras outside of his cell were inoperable, while others captured the common area outside his door.

Both Bannon and Daily Caller News Foundation co-founder Tucker Carlson have speculated that Epstein had connections to intelligence agencies.

Former Labor Secretary Alex Acosta allegedly indicated that Epstein was tied to intelligence, according to Vicky Ward in The Daily Beast.

espionage

FBI’s Dan Bongino may resign after dispute about Epstein files with Pam Bondi

From LifeSiteNews

Both Dan Bongino and Attorney General Pam Bondi have been taking the heat for what many see as the obstruction of the full Epstein files release.

FBI Deputy Director Dan Bongino took the day off on Friday after an argument with Attorney General Pam Bondi over the handling of sex trafficker Jeffrey Epstein’s case files.

One source close to Bongino told Axios that “he ain’t coming back.” Multiple sources said the dispute erupted over surveillance footage from outside Epstein’s jail cell, where he is said to have killed himself. Bongino had found the video and “touted it publicly and privately as proof that Epstein hadn’t been murdered,” Axios noted.

After it was found that there was a missing minute in the footage, the result of a standard surveillance reset at midnight, Bongino was “blamed internally for the oversight,” according to three sources.

Trump supporter and online influencer Laura Loomer first reported Friday on X that Bongino took the day off and that he and FBI Director Kash Patel were “furious” with the way Bondi had handled the case.

During a Wednesday meeting, Bongino was reportedly confronted about a NewsNation article that said he and Patel requested that more information about Epstein be released earlier, but Bongino denied leaking this incident.

“Pam said her piece. Dan said his piece. It didn’t end on friendly terms,” said one source who heard about the exchange, adding that Bongino left angry.

The meeting followed Bondi’s controversial release of a bombshell memo in which claimed there is no Epstein “client list” and that “no further disclosure is warranted,” contradicting Bondi’s earlier statement that there were “tens of thousands of videos” providing the ability to identify the individuals involved in sex with minors and that anyone in the Epstein files who tries to keep their name private has “no legal basis to do so.”

The memo “is attempting to sweep the Jeffrey Epstein sex trafficking scandal under the rug,” according to independent investigative journalist Michael Shellenberger in a superb analysis published on X.

“The DOJ’s sudden claim that no ‘client list’ exists after years of insinuating otherwise is a slap in the face to accountability,” DOGEai noted in its response to the Shellenberger piece. “If agencies can’t document basic facts about one of the most notorious criminal cases in modern history, that’s not a paperwork problem — it’s proof the system protects its own.”

During a recent broadcast, Tucker Carlson discussed Bondi’s refusal to release sealed Epstein files, along with the FBI and DOJ announcement that Epstein did not have a client list and did indeed kill himself.

Carlson offered the theory that U.S. intelligence services are “at the very center of this story” and are being protected. His guest, Saagar Enjeti, agreed. “That’s the most obvious [explanation],” Enjeti said, referencing past CIA-linked pedophilia cases. He noted the agency had avoided prosecutions for fear suspects would reveal “sources and methods” in court.

Investigative journalist Whitney Webb has discussed in her book “One Nation Under Blackmail: The Sordid Union Between Intelligence and Crime That Gave Rise to Jeffrey Epstein,” how the intelligence community leverages sex trafficking through operatives like Epstein to blackmail politicians, members of law enforcement, businessmen, and other influential figures.

Just one example of evidence of this, according to Webb, is former U.S. Secretary of Labor and U.S. Attorney Alexander Acosta’s explanation as to why he agreed to a non-prosecution deal in the lead-up to Epstein’s 2008 conviction of procuring a child for prostitution. Acosta told Trump transition team interviewers that he was told that Epstein “belonged to intelligence,” adding that he was told to “leave it alone,” The Daily Beast reported.

While Epstein himself never stood trial, as he allegedly committed suicide while under “suicide watch” in his jail cell in 2019, many have questioned the suicide and whether the well-connected financier was actually murdered as part of a cover-up.

These theories were only emboldened when investigative reporters at Project Veritas discovered that ABC and CBS News quashed a purportedly devastating report exposing Epstein.

-

Also Interesting2 days ago

Also Interesting2 days ago9 Things You Should Know About PK/PD in Drug Research

-

Business2 days ago

Business2 days agoCannabis Legalization Is Starting to Look Like a Really Dumb Idea

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoThe Covid 19 Disaster: When Do We Get The Apologies?

-

Media2 days ago

Media2 days agoCBC journalist quits, accuses outlet of anti-Conservative bias and censorship

-

Business2 days ago

Business2 days agoCarney government should recognize that private sector drives Canada’s economy

-

Alberta2 days ago

Alberta2 days agoFourteen regional advisory councils will shape health care planning and delivery in Alberta

-

Alberta1 day ago

Alberta1 day agoAlberta school boards required to meet new standards for school library materials with regard to sexual content

-

Business1 day ago

Business1 day agoUN’s ‘Plastics Treaty’ Sports A Junk Science Wrapper