Energy

Trudeau gives Quebec special treatment on carbon tax

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

The Canadian Taxpayers Federation is highlighting a fundamental unfairness about the federal carbon tax: Prime Minister Justin Trudeau is requiring taxpayers in other provinces to pay a higher carbon tax than in Quebec.

“Trudeau is giving Quebec a special deal on carbon taxes and giving other Canadians higher gas prices and heating bills,” said Franco Terrazzano, CTF Federal Director. “The solution is simple: Trudeau should scrap his carbon tax and lower gas prices and home heating bills across Canada.”

The federal government states all provinces are required to impose the carbon tax equally. “The federal government is committed to ensuring that carbon pricing is in place across Canada at a similar level of stringency,” states the government’s backgrounder.

Taxpayers in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, the Northwest Territories, Yukon and Nunavut are all required to pay a carbon tax of $80 per tonne of carbon dioxide equivalent.

However, Quebec’s cap-and-trade carbon tax is currently $57 per tonne.

By 2030, the federal carbon tax will cost $170 per tonne, while Quebec’s will cost an estimated $97 per tonne, as reported by La Presse. That means in 2030, Quebec’s carbon tax will cost about 14 cents per litre of gasoline less than in the rest of Canada.

“Trudeau’s special deal for Quebec shows the carbon tax was always about politics,” said Terrazzano. “Trudeau should make life more affordable for all Canadians and scrap his carbon tax.”

Current cost of carbon tax, Quebec vs. rest of Canada*

| Quebec ($57/tonne) | Rest of Canada ($80/tonne) | |

| Gasoline (per litre) |

$0.13 |

$0.17 |

| Diesel (per litre) |

$0.17 |

$0.21 |

| Natural gas (per cubic metre) |

$0.10 |

$0.15 |

* CTF estimates for Quebec based on cap-and-trade auction price. The rest of Canada is based on the cost of the carbon tax, according to the government of Canada.

Energy

The Carney Government is Hijacking the Phase “Energy Superpower” to Advance Their Agenda

From Energy Now

By Jim Warren

Lately, the spin doctors in the prime minister’s office (PMO) have been hijacking perfectly good words and altering their meaning in the service of the Liberal agenda.

For budgetary purposes “operating expenses” have become “investments.” Similarly, the term “energy superpower” no longer means what people typically think it means. Back in the day when the concept “energy superpower” was popularized, it was used to describe oil rich countries like Saudi Arabia, the other Gulf states and OPEC members.

Those countries are home to the oil sheiks—the leaders of OPEC who capitalized on their dominant position in global energy markets to affect the global oil supply and prices. They also used their control over oil as a source of leverage in the realm of geopolitics.

Wikipedia, the font of knowledge for lazy columnists, describes the traditional meaning of energy superpower as follows “…a country that supplies large amounts of energy resources (crude oil, natural gas, coal, etc.) to a significant number of other countries – and therefore has the potential to influence world markets for political or economic gains. Energy superpower status might be exercised, for example, by significantly influencing the price on global markets or by withholding supplies.”

During the 2025 election campaign Mark Carney’s notion of what constitutes an energy superpower was aligned with the conventional definition. A CTV news report the day after the federal election reminded viewers that on “April 8 at a campaign stop in Calgary, Carney pledged to position Canada as a ‘world energy superpower,’ calling for new [oil] pipelines, including one to Eastern Canada.”

By September of 2025, Carney and his Energy Minister Timothy Hodgson had obviously adopted a new definition. They still boast about making Canada an energy superpower but no longer referred to oil production and new export pipelines as things integral to that goal.

But wait, on Friday November 7 the prime minister told attendees at Canadian Club event in Toronto not to worry the long sought pipeline “was going to happen.”

Pardon me if I’m not convinced. Over the three months prior to Friday the Liberals had left us to assume becoming an energy superpower could happen without increasing oil production and exports.

We are still left with a riddle—what do the Carney Liberals actually mean when they promise Canadians we will achieve “energy superpower” status if crude oil, Canada’s single most valuable export commodity is no longer one of the key components of the strategy to get us there?

Actually, Canada was well on its way to achieving the status of a world class energy superpower until the Trudeau Liberals assumed office. Our budding superpower ambitions were foreclosed on by the Liberals’ growth killing BANANA* legislation which thwarted efforts to increase oil production and exports. The blue-eyed sheiks of Western Canada have been handcuffed and denounced as authors of the upcoming climate apocalypse.

(*BANANA – Build Absolutely Nothing Anywhere Near Anything)

The communications wizards in the PMO abandoned the traditional definition without actually telling anyone they were doing so. They have quietly adopted a fossil fuel-free version of what it means to be a supremely powerful purveyor of energy, but haven’t explained what that entails.

If they chose to be honest with Canadians they would say what they really mean is “green energy superpower.” But if they came clean, it would probably trigger a national unity crisis. Better to leave things loose until the budget has been approved.

Despite wishful thinking in Ottawa, Canada is a long way from winning the race for medals in the field of clean, green energy production. But, we’re so far behind the leaders that Mark Carney thinks he’s first.

Powering the dream of a net zero world will presumably rely heavily on the approximately 28 critical minerals and rare earths required for wind turbines, advanced electric motors and batteries. Canada makes it to the medals podium for just three of the 28. According to a 2024 report published by Our World in Data, Canada is in third place globally for uranium and aluminum production, and cobalt refining.

Australia, a Western-style capitalist democracy which punches close to our weight by many economic measures is far ahead of Canada when it comes to critical minerals production and proven reserves. China is in a class of its own—clearly the world leader in rare earth production and proven reserves, miles ahead of the rest of the world. When it comes to mining and refining of critical minerals Canada has a lot of catching up to do.

Canada is similarly a long way from superpower status when it comes to the manufacturing of polysilicon, the compound required to produce solar electricity, and wind turbines.

Canada does not have any commercial level producers of polysilicon. China has several firms that manufacture it, one of which GCL-Poly has a 22% share of the global market. Polysilicon is also produced by firms in the US, South Korea, Germany, Japan, Norway and Qatar. There once was a company in Canada which imported polysilicon from China which it then used to make solar panels. Apparently it has moved its operations to the US.

Globally, there are approximately 39 manufacturers of large, grid-scale wind turbines located in some 14 different countries. The world’s largest manufacturer, Vestas, is headquartered in Denmark. No large wind turbines are manufactured in Canada. Our role is limited to installation, operations and maintenance.

And, given recent events it is unlikely Canada is going to become a global superpower for the manufacturing of electric vehicles any time soon.

Canada is in third place globally for the production of hydroelectricity, although our 364.2 terawatt-hours (TWH) of electricity we generate pales in comparison with China’s 4,183.4 TWH of hydroelectric production. While the environmentally virtuous may find grounds for bragging rights with respect to our country’s hydro production, it means little in terms of leverage in a global market place. Sure Canadian producers sell electricity into the US power grid, but they are unable to sell it anywhere else. Ocean spanning transmission lines won’t work, too much power is lost when sending power long distances and selling electricity stored in batteries is not commercially viable—the batteries required are simply too big and insanely expensive.

For the foreseeable future the only way Canada can claim superpower status as a producer of clean energy is if the definition is radically changed. Apparently being identified as a clean green energy superpower can now mean that a country makes use of an impressive level of the stuff—the criteria required to be deemed an “impressive producer” is apparently one of those post-modern woke notions whereby each country is entitled to its own green energy truth.

This echoes the casual way social media mavens award superpower status to supposedly inspiring personal characteristics – my superpower is multi-tasking, or baking sourdough bread, or being an avid recycler. It makes about as much sense as claiming you are a hero because you held a guy’s mitts so he could dial 911 to report an accident.

It is sad, but true, that Canada was well on its way to energy superpower status prior to the federal Liberals coming to office in 2015. Crude oil was then and remains Canada’s single most valuable export product. We currently export approximately 4.2 million barrels per day which was worth 153 billion USD in 2024. Back in 2013 and early 2014 when world prices were good the oil industry was generating as much as three to four percent of Canada’s GDP.

Clearly Canada could be doing a whole lot better economically if the federal government got behind the oil industry and removed the barriers to growth in production and exports. Danielle Smith has been trying to alert the Canadian government and public to the reality that completion of a single million barrels per day oil pipeline from Alberta to Prince Rupert could contribute $20 to $30 billion in new revenues to Canada’s GDP, depending on world prices.

That would be a giant leap forward on the path to being a real energy superpower.

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

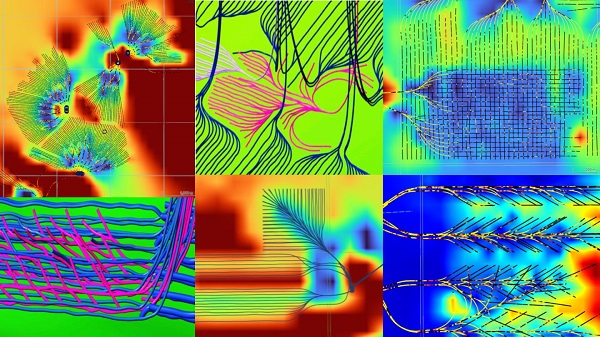

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

Alberta2 days ago

Alberta2 days agoAlbertans choose new licence plate design with the “Strong and Free” motto

-

Alberta2 days ago

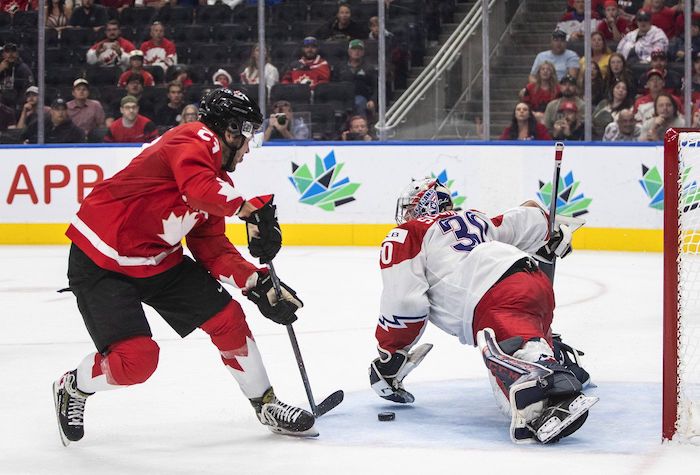

Alberta2 days agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Daily Caller1 day ago

Daily Caller1 day agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

Business2 days ago

Business2 days agoNearly One-Quarter of Consumer-Goods Firms Preparing to Exit Canada, Industry CEO Warns Parliament

-

Energy1 day ago

Energy1 day agoCarney bets on LNG, Alberta doubles down on oil

-

Indigenous1 day ago

Indigenous1 day agoTop constitutional lawyer slams Indigenous land ruling as threat to Canadian property rights

-

Alberta1 day ago

Alberta1 day agoAlberta on right path to better health care

-

Business2 days ago

Business2 days agoClimate Climbdown: Sacrificing the Canadian Economy for Net-Zero Goals Others Are Abandoning