Opinion

Someone Needs Replacing at Red Deer Catholic Regional Schools

Once you put children safety at risk… I can’t be silent any longer.

From charitable tax receipts not being issued correctly… to having private information of your child’s educational performance being stored and “pushed” to you by foreign apps that you must agree to their terms saying that information is processed by foreign servers, to hearing wasteful spending radio ads, to leaving an entire bus route of elementary school children stranded for nearly an hour while their “bus status app” says “all buses on time”.

Yes, this is what the RDCRS has to offer you in just this past year alone.

I ran for trustee in 2013, so sure, some might try to spin this as sour grapes, but when you are tired of administrators that have stopped focusing on children and have become more focused on child recruitment, you have a problem. I ran for a trustee position to prevent this very type of thing going on, and here we sit.

Don’t get me wrong, I love the teachers, their assistants, and staff doing everything to help the children. But something needs to be done at the top.

Charitable Receipts

To be eligible for a charitable donation credit, all tax receipts must have the Registered Charity number on them. This is a 9-digit number followed by “RR” and then 4 more digits. Every single RDCRS receipt received by my accounting firm this past tax season was missing this number. This was raised by yours truly to their office on behalf of my clients. They did not reissue replacements until I pushed back repeatedly and individually per client. They said over the phone they would not be mailing out replacements for everyone. So, if you donated this past year, enjoy your reassessment.

Performance Reports

We all want to know how our child(ren) is(are) doing in school. This past year RDCRS decided to launch the use of PowerSchool LLC. They say all of your child’s information is held on Canadian servers. However, when you go to sign up for the app it says that the app uses foreign servers for you to access, view, and receive notifications on, your child’s performance. This is how a foreign app works.

While you may store information in Canada, it is being sent through other connections and servers in a foreign country like the United States. While I’m fine seeing pictures on social media or getting the quick note from a teacher about what “little Johnny” did today… when it comes to academic performance and review, privacy and security steps should be taken. When I raised this concern with the superintendent, his response is that commercial privacy laws do not apply to them.

In my request I stated:

“Further to my previous e-mail: although PIPEDA may not apply to RDCRS directly, by engaging a corporate entity, you are required under FOIP S.38 and 39(1) to have proper controls in place which would require our consent. The corporate entity PowerSchool LLC is to be bound by PIPEDA as well as the stricter Alberta version, PIPA, as it is not a government agency. The app from the Canadian version of the app store that you have instructed parents to use to access is warning us upon installation that the data is being routed via PowerSchool LLC’s US resident servers. This is not a violation of PIPEDA by PowerSchool LLC directly, as they are requesting our permission on installing the app. This warning does not exist unless you are in Canada. This is not a “default”, this is a requirement by PowerSchool for any notifications to Canadian resident users.

However, the letter sent to parents states that we are required to sign up, or we will not receive information. Requiring parents to use the app in order to access report cards and information on our children is not allowing for our consent, it is being forced. A government department forcing a parent to accept a foreign corporation’s “terms of service agreement” is in violation of FOIP.”

His response:

“In your message you reference Sec. 38 and 39(1) of the FOIP Act. Our school division is in compliance with these sections of this Act as we have proper controls in place because our student data is housed on our servers. We protect personal information by using reasonable security arrangements against risk of unauthorized access. As a result parent consent is not required.”

So parent consent is not required with the school division, but yet parent consent is required by the corporate entity, which then routes the data from Canada through their U.S. server. However, if you don’t consent, you don’t get updates other than a final report at the end of the “reporting term”. Sounds like forced consent to me. Why would I want to have my child’s personal and private information sent through a foreign country?

Radio Ads

Instead of focusing on children that they have, they would rather recruit more children instead. During the 2013 election, I was amazed how a former trustee chair stated, “if we convert just one child to Catholicism then it [advertising] is worth it.”

Apparently, conversion is more important than the education of the children already there.

I have asked how much was spent on advertising but the only response I received was “fill out a freedom of information request. There will be fees associated with it because it is not your personal information.”

How many textbooks could we have purchased for the amount they spend on advertising in a year? I’m sure many parents would like to know.

This brings me to today.

Transport

An entire bus route of elementary school children did not get picked up today. Instead, they were sitting outside for 45 minutes when my children contacted me in panic tears and said the bus didn’t come. Like any parent, at first, I was questioning my kids… then worried for other children… then mad.

Why did I get mad?

Well, you see the RDCRS has a wonderful “app” that is supposed to notify parents if a bus is canceled or running late. But the status for the route said “On time”.

So I asked my kids if they missed the bus, they said no, because the other kids at their stop were there too.

When I picked up my children (and one of the neighbour’s kids after getting permission from her parent) we continued along the route and saw many more children waiting along the route. We pulled over to tell them to contact their parents as it appears there is no bus.

When I arrived with my children at the school I informed them of the issues. Now, to the school’s staff credit, the school responded quickly and the vice principal drove the route to check the safety of the kids.

However, when I called the transport office, which is owned and run by RDCRS, they stated that they “had a no-show and only found out now.” They still did not update the bus status on the app and this was one hour after the route was to begin.

Every employer has some sort of attendance system. Couriers use radios and GPS to track vehicles and routes. But somehow the RDCRS transport office doesn’t have a way to track if a driver showed up to work or not? Or if a bus is on a route or not?

Then what is the point of an app to notify parents if you don’t use it?

I’ve been relatively quiet publicly on these things, but today, when you put children safety at risk, it was the last straw.

Business

Carney government should retire misleading ‘G7’ talking point on economic growth

From the Fraser Institute

By Ben Eisen and Milagros Palacios

If you use the more appropriate measure for measuring economic wellbeing and living standards—growth in per-person GDP—the happy narrative about Canada’s performance simply falls apart.

Tuesday, Nov. 4, the Carney government will table its long-awaited first budget. Don’t be surprised if it mentions Canada’s economic performance relative to peer countries in the G7.

In the past, this talking point was frequently used by prime ministers Stephen Harper and Justin Trudeau and their senior cabinet officials. And it’s apparently survived the transition to the Carney government, as the finance minister earlier this year triumphantly tweeted that Canada’s economic growth was “among the strongest in the G7.”

But here’s the problem. Canada’s rate of economic growth relative to the rest of the G7 is almost completely irrelevant as an indicator of economic strength because it’s heavily influenced by Canada’s much faster rate of population growth. In other words, Canada’s faster pace of overall economic growth (measured by GDP) compared to most other developed countries has not been due to Canadians becoming more productive and generating more income for their families, but rather primarily because there are more people in Canada working and producing things.

In reality, if you use the more appropriate measure for measuring economic wellbeing and living standards—growth in per-person GDP—the happy narrative about Canada’s performance simply falls apart.

According to a recent study published by the Fraser Institute, if you simply look at total economic growth in the G7 in recent years (2020-24) without reference to population, Canada does indeed look good. Canada’s economy has had the second-most total economic growth in the G7 behind only the United States.

However, if you make a simple adjustment for differences in population change over this same time, a completely different picture emerges. Canada’s per-person GDP actually declined by 2 per cent from 2020 to 2024. This is the worst five-year decline since the Great Depression nearly a century ago. And on this much more important measure of wellbeing, Canada goes from second in the G7 to dead last.

Due to Canada’s rapid population growth in recent years, fuelled by record-high levels of immigration, aggregate GDP growth is quite simply a misleading economic indicator for comparing our performance to other countries that aren’t experiencing similar increases in the size of their labour markets. As such, it’s long past time for politicians to retire misleading talking points about Canada’s “strong” growth performance in the G7.

After making a simple adjustment to account for Canada’s rapidly growing population, it becomes clear that the government has nothing to brag about. In fact, Canada is a growth laggard and has been for a long time, with living standards that have actually declined appreciably over the last half-decade.

International

Nigeria better stop killing Christians — or America’s coming “guns-a-blazing”

President Trump on Saturday warned that the United States military “may very well” launch an armed intervention in Nigeria if the government continues allowing the slaughter of Christians by radical Islamist groups — a stark escalation following his recent designation of the African nation as a “Country of Particular Concern.”

— Rapid Response 47 (@RapidResponse47) November 1, 2025

In a post on Truth Social, Trump directed the Department of War to “prepare for possible action,” warning Nigerian officials that Washington’s patience had run out. “If the Nigerian Government continues to allow the killing of Christians, the U.S.A. will immediately stop all aid and assistance to Nigeria and may very well go into that now disgraced country, guns-a-blazing, to completely wipe out the Islamic terrorists who are committing these horrible atrocities,” Trump wrote. He added that any American strike “will be fast, vicious, and sweet, just like the terrorist thugs attack our cherished Christians.”

The warning follows Trump’s declaration Friday that “Christianity is facing an existential threat in Nigeria,” where thousands have been massacred by Islamist militants. He said the numbers were staggering — citing roughly 3,100 Christian deaths in Nigeria compared with about 4,476 worldwide — and ordered Rep. Riley Moore (R-W.Va.) and House Appropriations Chairman Tom Cole (R-OK) to immediately investigate and report their findings. “Something must be done,” Trump wrote, calling the situation “a mass slaughter” and urging swift action.

Trump’s call to action has drawn praise from prominent voices. Rap mogul Nicki Minaj reposted Trump’s earlier remarks and said his attention to the plight of Nigerian Christians gave her a “deep sense of gratitude.” “We live in a country where we can freely worship God,” she wrote on X. “No group should ever be persecuted for practicing their religion.”

Trump’s increasingly forceful stance on Nigeria marks one of the clearest demonstrations yet of his promise to defend persecuted Christians worldwide — and to use America’s power, if necessary, to make that protection real.

-

Business1 day ago

Business1 day agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Economy2 days ago

Economy2 days agoIn his own words: Stunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

International1 day ago

International1 day agoBiden’s Autopen Orders declared “null and void”

-

Addictions2 days ago

Addictions2 days agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine

-

Business2 days ago

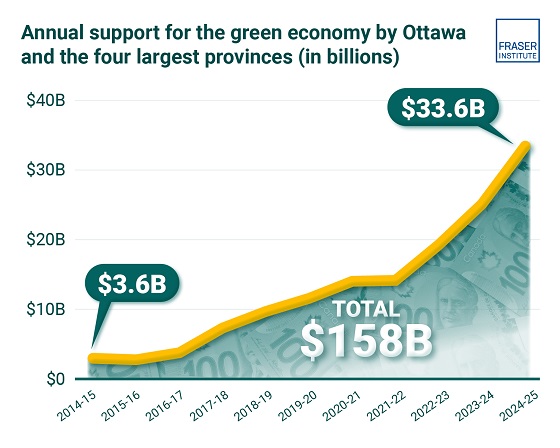

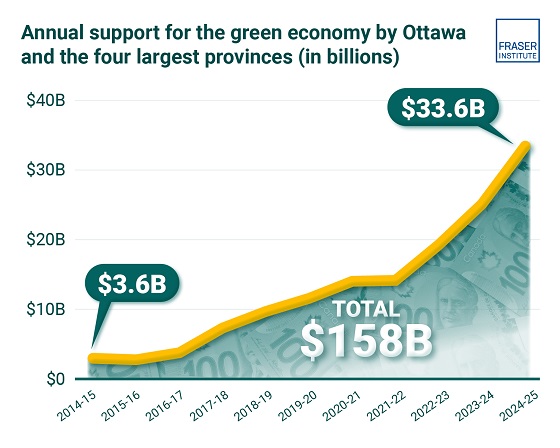

Business2 days agoClean energy transition price tag over $150 billion and climbing, with very little to show for it

-

Internet1 day ago

Internet1 day agoMusk launches Grokipedia to break Wikipedia’s information monopoly

-

MAiD1 day ago

MAiD1 day agoStudy promotes liver transplants from Canadian euthanasia victims

-

Business1 day ago

Business1 day agoCanada’s combative trade tactics are backfiring